>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

SELL-SIDE EXECUTION &

ORDER MANAGEMENT SOLUTIONS (SSEOMS)

A Bloomberg Trading Solutions Offering

BE

AGILE

EXPAND

YOUR

REACH

Bloomberg Trading Solutions delivers front-end

portfolio, inventory, sales and trading and middle and

back office operations solutions. With these solutions,

buy-side and sell-side firms gain unrivaled agility to

respond to their changing business needs, and market

regulations and innovations. Fully integrated with the

Bloomberg Professional® service, Bloomberg Trading

Solutions provides access to unmatched analytics, data,

news and the largest financial network, supported by

Bloomberg global customer service at the local level.

CONTENTS

02 SELL-SIDE EXECUTION & ORDER MANAGEMENT SOLUTIONS

04 OPTIMIZE YOUR WORKFLOW

05 INCREASE DIRECT MARKET ACCESS

06 MANAGE RISK AND COMPLIANCE

07 IMPROVE OPERATIONAL EFFICIENCY

BUY-SIDE AND

SELL-SIDE FIRMS

GAIN UNRIVALED

AGILITY TO

CHANGING

BUSINESS NEEDS,

AND MARKET

REGULATIONS

& INNOVATIONS

SELL-SIDE

EXECUTION

& ORDER

MANAGEMENT

SOLUTIONS

GLOBAL SOLUTIONS FOR SELL-SIDE EQUITY FIRMS

Whether you’re a trader, compliance manager, or IT

manager, you face the challenge of doing your job in

the most efficient way possible. You need sell-side

solutions that help you generate revenue, attain best

execution, manage risk and compliance and deliver

the best technology solution. Bloomberg provides

global trading solutions to meet those needs.

Bloomberg Sell-Side Execution and Order Management

Solutions (SSEOMS) deliver global order and execution

management solutions for front-end sales and trading and

middle and back office operations. SSEOMS offers an

integrated suite of solutions including: idea generation,

liquidity management and electronic order flow; market

execution, positions and P&L and risk management;

compliance and middle and back office operations. With

SSEOMS, you can optimize your workflow, increase

direct market access, manage risk and compliance,

and improve operational efficiency.

Bloomberg delivers SSEOMS on a hosted platform

for flexibility and scalability because markets evolve

and your needs change. It eliminates the need to have

dedicated workstations or servers on your premises, so

you can lower your total cost of ownership. We take on

the burden of keeping up with the costs of development

inherent with changing markets, such as infrastructure

build-outs, version upgrades, data sourcing, continual

tuning and system maintenance.

°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°

Leverage the largest financial

network in the world

°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°

°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°

SSEOMS is fully integrated with the

Bloomberg Professional service, so

you can take greater advantage of easy

access to Bloomberg business and

financial news, data and analytics

°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°

SELL-SIDE EXECUTION & ORDER MANAGEMENT SOLUTIONS (SSEOMS) 02 // 03

OPTIMIZE

YOUR

WORKFLOW

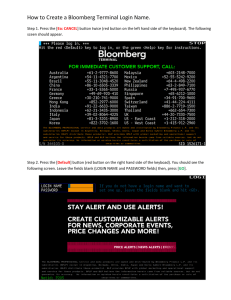

TOOLS FOR SALES, TRADING AND OPERATIONS

Bloomberg recognizes that traders, salespeople, middle-office and back-office professionals all have

very different needs. SSEOMS provides users intuitive navigation, customizable views and advanced

trading tools to optimize workflow.

SSEOMS FOR TRADERS

• Build custom views, columns and alerts to display key

data elements that are most critical to your workflows

• Create strategies and view historical performance

• Gain better transparency into the market with

multi-market trading across liquidity pools

SSEOMS FOR SALES

• Shop trade ideas and strategies to customers

• View real-time and historical commission reports

• Search internal order inventory

• Receive news and corporate action alerts on

customer focus lists

SSEOMS WORKFLOW

SSEOMS FOR MIDDLE OFFICE

• Access a central blotter with trades, summary views

and ticket matching features

• Confirm and allocate customer block trades with

post-trade processing tools

• Quickly open new customer accounts on a custom

middle office dashboard

SSEOMS FOR BACK OFFICE

• Automate the trade reporting process with a rules

based engine for timely execution reports.

• Real-time alerts to manage trading breaches

• Real-time alerts audit reports to display full

order lifecycle

INCREASE

DIRECT MARKET

ACCESS

CONNECT TO EXCHANGES AND

DIVERSE LIQUIDITY POOLS

SSEOMS provides a complete market access solution connecting to exchanges and diverse liquidity pools

for any given market. SSEOMS also provides the solutions to fulfill your market making obligations and work

customer orders directly from the market depth and trade proprietarily.

• Gain instant access to thousands of electronic

counterparties, third-party FIX networks, buy-side

order management systems, global exchanges,

MTFs, ECNs, brokers, dark pools and algorithmic

trading destinations

• Target institutional holders, the Bloomberg IOI network

and buy-side OMS systems, or take advantage of

capabilities to deliver IOIs via personalized email,

or anonymous instant messaging

• Manage Care or DMA client orders with automatic

routing rules with true “no touch” capabilities,

including custom route buttons to send orders to

whichever market you want with the parameters you

need. Leverage algorithmic and smart order routing

technology for execution or send orders to a

third-party algorithmic destination

SSEOMS CONNECTIVITY

TRADE REPORTING

VENUES

SSEOMS

EXCHANGE

CONNECTIVITY

BROKER

DEALERS

ALGORITHMIC

TRADING

BUY-SIDE

OMSs

BACK

OFFICES

SELL-SIDE EXECUTION & ORDER MANAGEMENT SOLUTIONS (SSEOMS) 04 // 05

MANAGE

RISK AND

COMPLIANCE

TRACK FIRM-WIDE POSITIONS AND ORDER HISTORY

SSEOMS provides a full range of real-time solutions to manage risk and compliance.

• Increase visibility throughout your firm with easy

access to real-time positions and P&Ls individually

and across the firm

• Integrate the position monitor with the Bloomberg

Professional service enabling employees to view

real-time news, data and analytics while tracking

firm-wide positions and risk

• Meet global regulatory obligations and receive

firm-wide transparency

• Set trading limits, thresholds and receive real-time

alerts on trading breaches

• Maintain accurate order history for trade reporting

with time stamping

• Utilize industry standard, real-time supervisory reports

SSEOMS REGULATORY REPORTING

REG SHO

REG NMS

MIFID

REGULATORY

REPORTING

SSEOMS

TRADE

REPORTING

RISK

CONTROLS

IMPROVE

OPERATIONAL

EFFICIENCY

SEAMLESS WORKFLOW FOR

STRAIGHT THROUGH PROCESSING

SSEOMS INTEGRATION

THIRDPARTY

PROVIDERS

OMS TARGETED

IOI INTEGRATION

SSEOMS

BACK OFFICE

INTEGRATION

OMGEO

ALLOCATION

PRODUCTS

SSEOMS improves firm-wide operational efficiency through seamless workflow and pre-integration with the

Bloomberg Professional service and third-party providers to achieve straight through processing.

• Onboard buy-side connectivity with existing

Bloomberg routers or utilize third-party network firms

• Limit dual entry to third-party systems with real-time

integration with back office providers

• Manage the allocation process with full integration to

Omgeo’s suite of products and direct FIX connectivity

with your clients’ OMS

SELL-SIDE EXECUTION & ORDER MANAGEMENT SOLUTIONS (SSEOMS) 06 // 07

ABOUT

BLOOMBERG

Bloomberg is the world’s most trusted source of information

for financial professionals and businesses. Combining

innovative technology with unmatched analytics, data,

news and tools, Bloomberg delivers critical information

via the Bloomberg Professional service and multimedia

platforms. Bloomberg Enterprise Solutions provides leaders

in corporations, finance and government with a dynamic

network that allows them to access, integrate, distribute and

manage information and technology across organizations

more efficiently and effectively.

08 // 09

SELL-SIDE EXECUTION & ORDER MANAGEMENT SOLUTIONS (SSEOMS)

////////////////////////////////////////////////////

Bloomberg Trading Solutions and SSEOMS

not only help address the needs you have

today, but also prepare you for those to

come. To learn more email our SSEOMS

team at sseomsb@bloomberg.net

////////////////////////////////////////////////////

BEIJING

+86 10 6649 7500

DUBAI

+971 4 364 1000

FRANKFURT

+49 69 9204 1210

HONG KONG

+852 2977 6000

LONDON

+44 20 7330 7500

MUMBAI

+91 22 6120 3600

NEW YORK

+1 212 318 2000

SAN FRANCISCO

+1 415 912 2960

SÃO PAULO

+55 11 3048 4500

SINGAPORE

+65 6212 1000

SYDNEY

+61 2 9777 8600

TOKYO

+81 3 3201 8900

©2013 Bloomberg L.P. All rights reserved. 53816936 0613