Ties that bind: Professional connections and sell

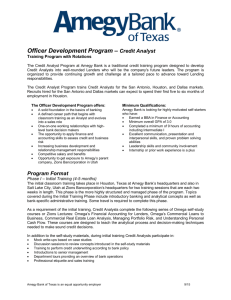

advertisement