Competitive Density and the Customer Acquisition

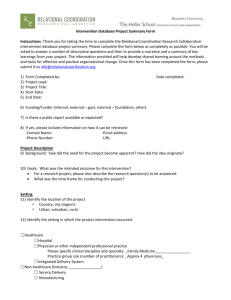

advertisement