QGBOTA Business Plan 2015 - Queensland Greyhound Breeders

advertisement

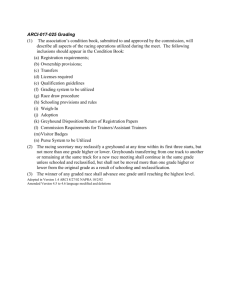

2015 Strategic Business Plan Queensland Greyhounds 2015 -2035 Q.G.B.O.T.A QUEENSLAND GREYHOUNDS BREEDERS, OWNERS & TRAINERS ASSOCIATION BRENTON WILSON - PRESIDENT QGBOTA – PO BOX 567 – CAPALABA – QLD - 4157 Table of Contents 1 Table of Contents 2 QGBOTA Mission Statement 3 QGBOTA Code of Ethics 5 Introduction 6 Infrastructure Policy 9 Strategic Vision 10 Population Growth 15 Business Plan 17 Environment 18 Wagering 21 Compliance & Integrity 22 Sponsorship & Branding 25 Working with Breeders, Owners & Trainers 26 Canine Athlete Welfare 28 Methodology 37 Future of Greyhound Racing 1|Page Mission Statement The QGBOTA’s mission is to deliver fair and equitable treatment for all participants and their greyhounds. By supporting a holistic and sustainable well-regulated Greyhound Racing and Breeding Industry, while engaging with customers, stakeholders and the greater public to meet our social and legislative requirements. 2|Page QGBOTA Code of Ethics The QGBOTA’s primary role is to take a holistic approach to the growth, development and achievement of Canine Athletic potential. This role accepts the canines’ long term interests as of greater importance than short term monetary considerations. To fulfil this role all members must behave in an ethical manner, and setting the highest integrity possible to Canine Athlete welfare. By becoming a member of the QGBOTA, the person agrees to be held accountable for any breach of the following points: 1. Members must ensure the highest animal welfare management possible. 2. Members must respect the dignity and recognise the life of each greyhound. 3. Members must ensure that practical training environments are safe and appropriate. This appropriateness must take into consideration the age and maturity of the canine athlete. 4. Members must acknowledge and respect the Rules of Racing. This respect should extend to the spirit as well as to the letter of the rules, in both training and competition, to ensure fairness of competitive opportunity between all greyhounds. 5. Members must exhibit an active respect for stewards and officials, by accepting the role of those in providing judgement to ensure that meetings are conducted fairly and according to the established rules of racing. 6. Members must accept final responsibility for the performance and conduct of their greyhounds they train or own, while at the same time accept responsibility for their own decisions, conduct and performance. 7. Members must assert a positive and active leadership role to prevent any use of prohibited drugs or other disallowed performance enhancing substances or practices including live baiting. This leadership by members includes notifying RQL of any evidence or knowledge of the use of prohibited substances or illegal practices. 8. The member must acknowledge that all members have an equal right to desire the success of the greyhounds they train or own - competing within the rules. Observations, recommendations and criticism should be directed to the appropriate person outside the view or hearing of the public domain. 9. Members should hold recognised training qualifications. Members should respect that the gaining of training qualifications is an ongoing commitment, achieved through the upgrading of their knowledge by attendance of accredited courses and through practical training experience. Members also have a responsibility to share the knowledge and practical experience they gain. 10. Members must respect the image of the sport and the reputation of the Association and continuously maintain the highest standards of personal conduct, reflected in both the manner of appearance and behaviour, so that they do not bring Greyhound Racing or the QGBOTA into disrepute. 11. Members must respect that on race day we are representing the sport to the general public. We should dress professionally, but minimise the use of alcohol while having race 3|Page commitments. Members are responsible for the image of the sport, and must respect that responsibility at all times. 4|Page Introduction This Strategic Plan will provide the Greyhound Industry in Queensland a blue print for the future of the Industry. Any future plans for Greyhound Racing in Queensland have to be determined around its core stakeholders the family. Our Social Licence lies with the general public, and dogs have a special affinity with families. We believe families are our core stakeholder and our Industry has a unique needs that can be set up around a community and multi-use sport and recreation facilities. It is the QGBOTA’s vision that future Stadia are built around green field sites with new and growing communities, where sport and leisure infrastructure can be incorporated with a Greyhound Stadia, restaurant, sporting club and activities that support a healthy lifestyle in these new communities. With these Stadia/clubs would have approximately 100-120 poker machines, which will allow these sport and leisure facilities to have a long term sustainable income stream for future growth and community support. These sport and leisure Stadia would be self-funding, which will also mean that Greyhounds would have several income streams, and will not need Government support moving forward. The Greyhound Industry is the only Racing Code that continues to increase its turnover, and market share. In Queensland this has not been supported, nor has RQL created policies to take benefit from this increased turnover. To take advantage of this strategy 3 tracks need to be developed in South East Queensland, two one turn tracks and one City Class Track. The money we believe needs to come from these five key areas: • Greyhounds 50% share in Albion Park, worth approx. $40m to $45m; • Greyhounds $10m compensation from the Gold Coast Track; • • Approximately $12m from the Gov’t infrastructure fund Cronulla Park land valued at $10m This equates to approximately, $72-77m. 5|Page Infrastructure Policy Currently in Queensland all of its greyhound tracks are aged and falling apart with high maintenance costs. They do not attract people looking for entertainment, nor do they have the facilities to support ongoing racing. Albion Park is a prime example of a track that does not meet the QGBOTA’s Strategic requirements. Even with a well-known pub restaurant across the street, it does not attract patrons/customers to the track. The Greyhound Industry can no longer support a track being so close to the CBD. Our potential customers live a minimum of 15-20 km outside the CBD, and don’t travel these distances, when more accessible entertainment venues are close by. This combined with the Ipswich Greyhound Club possibly having to move in the next few years, leads us to our first policy. Although Cronulla Park was a sound option, it was the best of limited options available to the industry in 2008. We do not believe that it meets the strategic requirements for greyhound racing in Queensland over the next 20 years. Strategic Policy 1 – Start 2016 – Finish Mid 2017 A green field’s site in Ipswich i.e. Springfield’s, working closely with Ipswich City Council and hypothetically the Springfield Management team/developer, this potentially can be the new City Class venue for Greyhound Racing in Queensland. This would also involve the amalgamation of the Ipswich and Brisbane Clubs. It also makes business and commercial sense in the fact that most greyhound participants live in the Ipswich catchment area. They will have a dual Track surface, one turn track and circle track, which can hold a minimum of 4 meetings per week. • $25-28m to build. • Potential TAB turnover of $24m per annum on Ubet. (based on 4 meetings) • It is estimated that within the first 12 months of development, Queensland Greyhound Racing would see an increase of 14% in betting turnover, rising 5% to 19% in year 2, and a further 6% to 25% by 2021. This track will have an onsite veterinarian clinic, with sports injury rehabilitation equipment including water walkers, as well as an industry discounted vet/chiropractor. It is also envisaged that the area will be the future home to a number of local sporting clubs in the area, with the development of restaurants, poker machines and various entertainment for the local community. This venue has the ability to create up to 250 full & part-time jobs, but also jobs created through the building of the stadia (800 jobs), ongoing development and jobs created in local community. 6|Page Strategy Policy 2 – Start Immediate Business cases developed, with the assistance of RQL, for redesign and development of Capalaba, Bundaberg, Rockhampton, Cairns and Townsville Clubs. It is the QGBOTA’s policy for all clubs to be redeveloped to one turn tracks, including Capalaba which would be converted to loam. All tracks determined for redevelopment to be given TAB status, with potential to increase dates, determined by success. The Townsville Club would be sourced a new racing venue. In these regional areas, it may be difficult financially to undertake the full QGBOTA strategy, however success of these clubs long term, will allow them to grow their business’ into the future. • $20m to redevelop these clubs Strategy Policy 3 - 2020 The second track another one turn track will be sourced for the growing northern corridor area between Pine Rivers and Caboolture. It will have two TAB Meetings per week, and will cost approx. $16m to build. We would like one turn tracks developed, as this will reduce injuries and help satisfy animal welfare issues, as well as increase betting turnover of meetings by up to 25%. One turn tracks will encourage punter confidence, which will grow the wagering product. Strategy Policy 4 – Immediate OR 2021 The Tweed Heads Club is considered to be given a TAB date once their development is approved at their current Tweed Heads site. This will be a cost neutral exercise and creates another TAB venue in South-East Queensland. Will also cater for Northern Rivers greyhound participants. Alternative to this is finding a site on the Gold Coast that meets the QGBOTA’s Strategic Plan, and for a joint venture between Queensland Greyhounds to buy the land, working with Gold Coast City Council, and developers, while the Tweed Club build a new facility. The Tweed Heads club will not hand over their assets. This avenue if supported will need significant negotiation and agreement between all parties. But with the potential of being cost neutral to Queensland Greyhounds, and a new facility delivered, it is a win/win for all stakeholders. NSW Greyhounds Strategic Plan is to downsize their current stadia to make it more economical. The Tweed Club will probably have its support severed from NSW Greyhounds within 18 months. This is a unique opportunity. If agreement can’t be reached, a new Gold Coast Track to be considered in 2023. The Gold Coast Club policy: 7|Page 1. New Gold Coast green fields site; With State Gov’t and Gold Coast Council backing; Qld Greyhounds purchase the land and build Stadia in line with Business Plan; In return License the club to two Queensland TAB Meetings per week on a one turn track. This will have the ability to grow potential wagering turnover of approximately $12.0m per annum. Has the potential to create up to 50-75 full and part time jobs. This does not include the hundreds of jobs created to build the stadia, nor the knock on effect to local suppliers to help grow their business and more jobs created. With the remaining money banked for ongoing capital expenditure works from the 2015-2035 year strategic plan. 8|Page STRATEGIC VISION The Greyhound Industry is looking at the potential growth of Queensland over the next 20 years. We believe in South-East Queensland that there are three major growth corridors, North of Brisbane to the Sunshine Coast, West of Brisbane to Ipswich and Toowoomba, and the Gold Coast. The QGBOTA believes its future lies with families, and young families are the driving force behind these growth corridors in South East Queensland. These area require long term planning, infrastructure, sporting and recreation facilities and jobs. We believe it makes commercial sense to target these growing communities, as it will create jobs for a diverse economy. It is the plan for the Industry to work with developers and Local Government to provide Sport & Recreation hubs for these communities. The size of the average Greyhound Racing facility is not too dissimilar to a football or cricket field. We envisage multi-purpose Sport and Recreation facilities, with a Greyhound Track and Club similar to Kedron Wavell. The advantages of these facilities are the following: • Restaurants and eateries, discounted for members; • Multi-sport use; • Children play areas; • Child care facilities; • Entertainment; • Financial support to local sporting organisations; • Shops; • • Fetes; local farmers markets; Ten pen bowling (Strike Bowl); Putt Putt; Outdoor water entertainment etc. The facility would not only be a sport & recreational facility, but also an entertainment precinct which these new growth corridors will require over time. These clubs will be in a position to provide these services over time as the community grows. The industry will be providing an entertainment and racing hub that will connect and galvanise communities, as they come together to celebrate, be entertained, and support racing. Further to this, Queensland has always had close ties with South East Asia, and especially China. The State Government continues to grow its business ties with China in projects to develop jobs, but also tourism. China is the fastest growing greyhound racing community in the world at present. They have approximately 5million participants, interested in breeding, racing and betting on greyhounds. Queensland Greyhounds can tap into this community through tourism and business to grow strong ties moving forward. This will increase tourism, create jobs, and increased betting turnover for the Queensland Government. This can potentially bring over $100Million dollars to Queensland in tourism and business, over the next 5-10 years. 9|Page POPULATION GROWTH SEQ is expected to continue to dominate the state’s future growth figures because of its large population. The region’s population is projected to grow from 2.8 million people to 4.6 million in 2031, a figure greater than the current Queensland population. The population of SEQ Region is projected to grow by almost 1.8 million extra people from 2006 to 2031, approximately 70,600 people each year. This represents an average annual growth rate of approximately 2.0 per cent in the decade to 2021, declining to 1.7 per cent average annual growth for the decade to 2031. It is projected the region will continue to gain people faster than the state average, and therefore will increase its proportion of the state’s population. The medium series projections indicate SEQ Region will be home to 70 per cent of all Queenslanders by 2031, an increase from 69 per cent in 2006. The coastal LGAs of Brisbane (C), Gold Coast (C), Moreton Bay (R) and Sunshine Coast (R) are the four largest LGAs in Australia by population. Together they account for almost three-quarters of SEQ Region’s population and they are expected to absorb much of the region’s future population growth. But growth rates are projected to decline in each of these large LGAs over the projection period. Brisbane (C) alone contained 35 per cent of the region’s people in 2006 but this is projected to drop to 31 per cent by 2021 and to 28 per cent by 2031. While the population of Brisbane (C) increased by 166,800 in the 10 years to 2006, its future population increases are projected to be smaller – an extra 124,500 people in the 10 years to 2021 and an extra 62,200 in the 10 years to 2031. Its average annual rate of growth, which was 1.9 per cent from 1996 to 2006, is expected to fall to 1.1 per cent from 2011 to 2021 and fall further to 0.5 per cent from 2021 to 2031. It is anticipated that much of the population growth in Brisbane (C) will be accommodated by way of infill and redevelopment, rather than new green-field developments. 10 | P a g e 11 | P a g e 12 | P a g e 13 | P a g e Population and share of region, local government areas in South East Queensland Region, June 2006 to June 2031. Northern Corridor (Moreton Bay & Sunshine Coast) +414,000 Western Corridor (Ipswich, Lockyer Valley, Scenic Rim, Somerset, Toowoomba District) +490,000 Southern Corridor (Gold Coast) +330,000 Logan +192,000 Brisbane +281,000 In line with the QGBOTA’s Strategic Plan, The Queensland Governments population projections for the 25 year period from June 2006 to June 2031, highlights the growth within the three major corridors in South East Queensland. Over this period, young families will be moving into these areas, and away from the urban sprawl for cheaper housing, but also potential jobs. Singles and young couples will dominate the Brisbane region moving forward, and is not the target market for the Greyhound Industry. Along with the Governments SEQ Infrastructure Plan which has attributed $184m to investment in Sport & Recreation projects, the Greyhound Industry believes it can play an instrumental part in this planning, with support, and by creating jobs and tourism in these growth areas. The potential growth of these facilities will create approximately 1200 jobs in each region, which doesn’t include greyhound trainers and breeders becoming professional and creating further employment. 14 | P a g e BUSINESS PLAN This strategy is a blueprint for developing Queensland Greyhound Racing into a nationally competitive and sustainable industry. The potential for product growth for Queensland Greyhounds significantly improves greyhound’s financial position for the next 20 years notwithstanding the current public perception difficulties. Queensland Greyhound Racing has the potential to be the best in Australia, but will not achieve this while working under restrictive policies. Queensland Greyhounds need modern facilities which ensure that this potential can be achieved. We have a passionate and motivated population of breeders, owners and trainers all wanting to see the industry grow and prosper. We also have the significant potential partnership of the Chinese Greyhound Community moving forward, with the jobs, tourism and betting turnover. This strategy will result in having a stronger regulatory and compliance environment. Which will ensure that all races in Queensland continue to be competitive, attractive and encourage innovative wagering and betting platforms. It will grow and support the many new jobs required for the industry and the benefits associated with the breeding and racing of greyhounds which contribute greatly to the Queensland economy. It will enable greyhound races to be streamed and bet on in most countries of the world where betting is allowed, and increased returns to the greyhound industry and State Government through taxation on those returns. The potential of Queensland Greyhound Stadiums generated by a full crowd experiencing competitive racing and good entertainment, which will engage local communities to the fact that Greyhound Racing offers a great evening out for all age groups. The execution of this strategy will result in Queensland Greyhound Racing enjoying a positive future and support of the community. Over time this will be achieved by improved commercial operations, and by supporting the local community in their local activities. Training should be available for club management, and ongoing updating of skills for club staff. The QGBOTA believes these initiatives will lead to additional increases in wagering turnover in the vicinity of $141 million per annum on completion of the new Stadia by 2019. This will enable Queensland Greyhound Racing to be a national flagship for greyhound racing. We believe by 2030 that Queensland Greyhound Racing will be a Billion dollar industry. Creating close to 15,000 to 20,000 jobs during this period. Greyhound Industry moving forward must educate non-greyhound customers attending greyhound events at all levels of the sport. It has to be done on a personal, direct level. This includes the holistic approach of training, feeding and welfare of the greyhounds. Encouraging customers how to own a racing greyhound or join a greyhound syndicate, and life after retirement. We believe that the future of greyhound racing in Queensland is built around sport and recreational facilities. The model is based on the modern RSL e.g. Kedron Wavell, where local communities have 15 | P a g e a venue to get a meal, be entertained, poker machines, sport and recreational facilities and greyhound racing. The strategy is built on a number of existing strengths: • Queensland Greyhound Racing has some of the best greyhounds and Queensland bred greyhounds account for some of the population of greyhounds racing interstate • The commitment, passion and in-depth knowledge of breeders, owners and trainers • There is a strong organisational cost culture evidenced by the ability to manage the finances of the organisation compared to actual turnover. Current stadiums are old and poorly developed, which don’t provide the necessary entertainment and electric atmosphere that can be created. The QGBOTA is committed to the future of the industry and prepared to take the actions necessary to make it a national leader in racing entertainment. The restructure of racing and group events is required to get public support and value led entertainment of Queensland Greyhound Racing. There is a deep social, community and family connection based on a long tradition of greyhound racing in Australia This strategy is a culmination of several years’ work undertaken by the QGBOTA. The process involved an in-depth analysis of the industry including online petitions over 400 replies, survey’s that received over 300 replies, meetings and interviews with a cross section of stakeholders including Queensland Greyhound Breeders and Owners Association & other participants such as owners, breeders, trainers, stud keepers, customers, bookmakers, suppliers, the general public and industry experts. The QGBOTA has developed this strategic business plan, with the aim to develop a plan that will enable the Queensland Greyhounds to move towards becoming financially self-sufficient, and nonreliant on Government support, while retaining the traditions and cultural importance of the Queensland Greyhound Racing product. 16 | P a g e ENVIRONMENT The environment In Queensland for the industry has been challenged for a number of years. Fewer people are attending races in Queensland generally they are spending less and are looking for value for their entertainment dollar. The age profile of the core attendance is becoming older and it will take sustained effort to attract the younger generation to regularly attend greyhound events. However this does not mean that the sport is on the decline. In fact, the Greyhound Industry in Australia has grown its turnover by over a billion dollars in the past 5 years, unfortunately Queensland Greyhound Racing has not been positioned to take advantage of this increased exposure and popularity. The rest of the greyhound industry in Australia, where several jurisdictions have been supported to take advantage of the increase in popularity have seen a significant increase in turnover. Part of the advantages taken have been the building of new stadia, or upgrades to infrastructure to present a professional modern environment. These stadia have also taken into account the needs of the younger generation, who are happy to spend their money in modern facilities, with good food, alternative attractions and entertainment. The emergence of ‘sports’ wagering as opposed to traditional race wagering that is persuading the QGBOTA to develop policies that attract these people to greyhound venues. Your typical pub or RSL has sports entertainment areas, where people can grab a meal and or drink and watch their favourite sport. Queensland Greyhounds need to provide these type of areas as a sports and recreational precinct. The Queensland greyhound industry has not had a capital development program for over 30 years. Its facilities are poor and there is no program of planned investment to revive them. As a result audiences have declined with the state of the facilities. Yet greyhounds continue to be the second biggest sport by betting turnover in Queensland. The impact on Queensland Greyhound Racing over the past 20 years due to no support, has been the following: • A reduction in the number of greyhound bred; • Number of stadia reduced due to the withholding of industry funds from TAB turnover, estimated at $6m per annum; ($40m+ over the past 10 years) • The Queensland Greyhound Racing needs to replicate the Victorian, Western Australian and NSW Industries. The stadiums are modern and attractive, classic races are becoming larger entertainment events with music groups, good catering facilities and an exciting atmosphere being provided. This makes it possible to attract new customers to the sport of greyhound racing. • Queensland Greyhounds should be in very strong position to sell its overall wagering package to international betting operators. In this regard being able to sell live pictures coupled with a Tote pool, race card and data customization to suit new international customers will give Queensland Greyhounds a competitive advantage. 17 | P a g e WAGERING Within the overall continued popularity of greyhound racing in Australia there could be the opportunity to create Queensland Greyhound Racing as a leading wagering and entertainment attraction. It is in this environment that the QGBOTA seeks a strategy that will increase revenues and return on wagering with the long term goal of improving Greyhounds Queensland financial return from the sport and also increasing the Governments return from the industry. The strategy is mindful that it must comply with the highest standards of greyhound welfare and be consistent with the Greyhound Acts, the Code of Practice for the Governance of Queensland and Government Policy. It reflects the need for Queensland to operate in the most cost effective manner possible and deliver value for money in return for self- sufficiency. Throughout the strategy there is an emphasis on becoming self- sufficient while maintaining the tradition of the sport. The ultimate aim of the strategy is to build Queensland Greyhound Racing into one of the premier racing and wagering entertainment attractions in Australia. While achieving that aim it will result in zero borrowings and no ongoing financial Government support. The strategy comprises a number of interlinked threads that are further developed within the report. Increasing revenue initiatives includes: 1. Establish Queensland Greyhound Racing has having the most rigorous and effective Regulatory code in the wagering industry 2. With this new improved Regulatory code in place increase revenue earned from development of new stadia, including one turn tracks 3. Stream racing events to selected international locations 4. Continue to develop the group race meetings into major entertainment events with top music groups, excellent catering, celebrity attendance and promotional packages. This approach has shown to Victoria, NSW and Western Australia to increase attendance at major events 5. Negotiate greater media coverage 6. Obtain greater income from sponsorship for group and local meetings 7. Build higher attendance through improved marketing including the use of social media 8. Increase income from the TAB through new and more aggressive offers Provide a caring animal welfare program to manage the post racing lives of greyhounds and ensure this message is understood by those inside and outside of the industry Communicate the new animal welfare proposition so it is accepted by the general public, Government and Industry as best practice. Improving the Financial Return from the Queensland Greyhound Racing Wagering Product Based on QGBOTA experience a high level of attendance at greyhound stadia helps to promote a stronger bookmaking and Tote wagering market. High attendance with improved racing regulations will attract more bookmakers at the stadia. More bookmakers at a stadium will lead to more vibrant and attractive betting options at the stadium. 18 | P a g e The QGBOTA believes a proper website that specifically promotes greyhound racing in Queensland, will attract approximately 500,000 individual visitors annually. Betting on the Tote via a link to this website will generate extra turnover. As a percentage of overall business an online portal has the potential to promote an extra 2% of Tote turnover. With a new improved wagering website coupled with updated Tote products the net financial return from the online business will improve dramatically. There is a potential that up to 5,000 people could download an app from the new website. With the new wagering app along with the upgrade of the existing website the number betting on the Tote will significantly increase. Because of the existing user base the new wagering app will start with a strong captive base. As part of the program to stream Queensland Greyhound Racing to bookmakers a number of procedural changes will be implemented so that a small number of daytime meetings can be provided at regional stadia. Whilst the financial return from on-track Tote operations is relatively weak, more effort needs to go into staff training, incentive programs and defined procedures to drive higher returns and increased betting. Increased innovation around betting choices will be implemented in order to grow the on-track Tote financial contribution. It is a realistic expectation that increased levels of TV and radio coverage as well as improved PR to increase attendance at meetings whilst making betting simpler to new customers will help to drive revenue. Betting and Wagering Vision • • • • • • Queensland Greyhound Racing Global leader for online and retail wagering content ‘Group 1’ events streamed to major Australian bookmakers Queensland Greyhound Racing streamed into other international wagering entities All major meetings streamed throughout Australian & New Zealand Mobile integrated betting application available (iPad, iPhone, Android) Wagering revenue enables Greyhounds Queensland to become self-sufficient The first step is to negotiate the broadcast of Queensland Greyhound races onto the online portals of the major betting chains in Australia, to make available increased opportunities. Queensland Greyhounds will launch a betting app to cater for the growing mobile channels and identify the best partners to work with that can expose greyhound racing and wagering to a significant number of end user customers in Australia, New Zealand and around the world. We will work with these Partners to promote the product through marketing initiatives to drive more end-user adoption of the Queensland Greyhounds wagering app, and develop an approach that integrates bet placement and account management functionality to leverage third party expertise. And to also develop the opportunity that exists to market the betting app and streaming products into end-users outside of Australia. The potential to expand the Queensland wagering operation globally creates the opportunity to generate significant revenue and surpluses. The differentiator for Queensland Greyhound Racing is the excellence of the greyhounds, its global reputation and the electric atmosphere at stadium created by large crowds. 19 | P a g e Actions: • • • • • • Evaluate promotional partners Review opportunity with Australian Online Bookmakers Explore streaming opportunities for Europe, US and Asia Develop and implement a marketing plan for the mobile integrated betting app Review legislation around exporting the betting product Evaluate Tote & Wagering organisation structure with a view to strengthening it for its expanded role Goals: • • • To manage the implementation of new Tote and wagering IT systems To build an on-line Tote streaming income of $2.5 million by 2021 To develop new concepts and platforms to enable the Tote to grow Accountability: RQL & Tatts Outcomes: • • • • On and off track wagering turnover and income to achieve the targets in the Strategic Plan Operational efficiency of the Tote Track operations is faultless End users in Australia and New Zealand adopt the Queensland wagering app The betting app and streaming products are marketed and sold in the USA, Europe and Asia Performance Indicators: • • • • • Introduction of new wagering products at Queensland stadia and increased wagering revenue per person attending a meeting Number of wagering outlets taking on-line streaming in Australia and New Zealand Number of wagering and gaming outlets taking on-line streaming in Europe, UK, Ireland & Asia and North America Number of downloads of the Queensland wagering app and average monthly value of bet per app downloaded Number of new Tote products and platforms introduced that increase revenue 20 | P a g e COMPLIANCE & INTEGRITY Integrity is critical to the stabilisation and future growth of Queensland Greyhound Racing. It must strive to have the highest integrity and be capable of responding appropriately to new integrity risks. There is the need to develop best practice Regulations and reinforce those Regulations so they will not be flaunted by anyone without severe penalties resulting from a deliberate breach. The quality of the betting product is directly related to having and implementing a best practice Regulatory code. Compliance with a reputation for consistency is required to build strong relationships with bookmakers and commercial betting outlets, so that a greater demand for the Queensland Greyhound content is supported. A kennel system in Queensland with a strong regulatory compliance benefit will be very attractive to the RSPCA and animal welfare organisations. This will assist in ensuring we are meeting our welfare initiatives and goals. We believe it is also important that Greyhounds have the best Stewards. Training should be available to continually update their skills, but also investigative training courses held by experienced Police detectives, to enhance their skills. The approach to having industry best practice integrity is having a constant evolving Regulatory code, and detailed in that it has to work throughout the industry, at every meeting at every stadium. It must be effectively implemented at all Queensland Greyhound stadia. Goal: To have industry best practice regulatory arm of any organisation managing a racing industry Accountability: Director of Integrity Services RQL Outcome: Effective regulatory system in place underpinning the highest standards of integrity Performance Indicators: • The current Regulatory code is fully complied with and that performance values show significant improvement. • A new, best practice, Regulatory code is developed that will be recognised as having the highest integrity in the Australian sport and wagering industry. This should be ready for implementation in 2016 • The new Regulatory code is implemented and there is compliance at every greyhound racing meeting in Queensland • • The new Regulatory code is maintained through a program of annual updating for all RQL employees, greyhound owners and trainers Queensland Greyhounds partnering with a laboratories in its drive to improve testing for the latest banned substances. This should be developed for improving Regulatory compliance • New testing procedures to be introduced where greyhounds are tested before racing 21 | P a g e SPONSORSHIP & BRANDING Over the past few years RQL has undertaken no investigation to seek sponsorship of Greyhound Racing in Queensland, this has been left to individual clubs to source. RQL need to actively seek partnerships for Greyhound Racing in Queensland that support its short and long term strategic goals. The key to large sponsorship deals is media, especially radio. Sponsors want to be on in the media. Being in the media multiplies the value of sponsorship, for the advertising hoardings round the side of stadia and for corporate entertainment. Many stadia, large and small, could benefit from having a sales person who markets the stadium and events throughout the surrounding area. They will help to identify and work with supporters clubs to hold fund raising and benefit events at the stadium. They will be paid a basic salary plus commission. Well planned and managed, Greyhound Racing sponsorship gives a high return on investment to local businesses. The clubs will continue to build relationships with local sponsors working with them to maximise the return on the sponsorship. This will offer small and medium sized business the opportunity to have direct access to high quality marketing and branding opportunities, normally well out of their reach. Queensland Greyhounds is uniquely placed with its state of the art facilities and entertainment packages to bring business networking to a new level. Goals: • To increase media coverage of Queensland Greyhound Racing • To increase revenue from sponsorship by an average of 20% year on year to a total of $5 million in 2020 • To increase the revenue from branding and advertising to $1,200,000 in 2020 Accountability: Director of Sponsorship Outcomes: • Increased, entertaining media coverage of Queensland Greyhound Racing • Revenue from sponsorship increasing. Performance Indicators: • Development of a 3 year plan and budget for increasing sponsorship income and media coverage of Queensland Greyhound Racing. This will include identifying targets that have the potential to sponsor major Queensland Greyhound events and the approach to increasing media coverage. Once agreed by the RQL Board and Executive team this will define the performance standards for the next 3 years • Agree and sign contracts with companies to sponsor major Queensland Greyhounds events in line with the agreed budget 22 | P a g e • Negotiate a media contract that will professionally broadcast Queensland Greyhound race meetings to a significant audience • Achieve high satisfaction from sponsors that they achieve their marketing goals and they and their guests are well entertained when attending meetings • Develop and implement a sales and marketing program that will attract local sponsorship and advertising to Queensland Greyhound owned and private stadia Increasing Stadium Attendance Queensland Greyhound Racing has a tradition that is embedded in the culture of the country. The success of Group 1 events in attracting full stadia interstate with all age groups represented is proof that there is interest in going greyhound racing for well promoted events. The strategy aims to steadily increase attendance over the lifetime of the plan. This increase will occur at all events, from the local stadium to Group 1 events. The belief that stadium attendance can be increased with the skilful promotion of greyhound racing events is reinforced by the ongoing patronage in Victoria, NSW and Western which shows an annual increase in restaurant receipts and patronage. To begin, the focus will be on ‘Group’ events: • • • • • • These races to be shown on SKY channel and potentially major TV networks They will be entertainment events, with music groups, promotions and attendance of celebrities There will be an excitement generated in communities with local and online promotions. There are opportunities for simultaneous benefit nights to be delivered in conjunction with the Group events The major stadia have a sales person who markets the stadium and events throughout the surrounding area. They help to identify and persuade supporters clubs for other sports or other interest groups, such as cricket, soccer, rugby league, schools, community groups and charities to hold fund raising events at the Stadium These nights have shown to be a success and that a supporters fund raiser helps swell the crowd An approximate estimate of the number of people passing through the turnstiles at Group greyhound races is that those who are ‘greyhound people’ and regularly attend greyhound racing is, perhaps, 30% of the total who attend the these major events. The 70% are those who are attracted to attend because it is an entertainment event with the actual greyhound racing only being a part, albeit a focal part, but only a part of the overall attraction. A well-managed online strategy for social media can be powerful in projecting messages, especially to younger audiences. The QGBOTA plan to develop a social media program including a presence on Facebook, LinkedIn and Twitter. This program will be continually enhanced and developed. Broadcasting events on television will also increase stadium attendance numbers. In theory broadcasting an event should make it less attractive to actually attend the event. In practice with other sports such as, football, rugby league, golf, tennis and snooker exactly the opposite has 23 | P a g e occurred. An event being advertised on television increases attendance at the event. This particularly applies to the 70% who want an entertainment attraction. The plan is to market to this customer segment to come not just to the major events but to ‘Go Greyhound Racing’ five or six or more times a year. There needs to be more than one entertainment offering at an event such as music, or children’s fun activities etc. to bring in this group and a followup program to keep them coming back a number of times each year. With the younger members of this group social media campaigns are very effective. The proof of this approach is exemplified by the Melbourne Cup at Sandown Park which was stronger in 2014 than previous years due to the marketing effort and additional entertainment organized at the event. An important element of the strategy is to maintain and increase attendance during the period September to April when there are fewer alternative sporting attractions. Goals: • • To increase gate receipts, net program sales and catering income to $6 million by 2021 To increase the annual revenue from UBET to $ 27 million by 2021 Accountability: RQL Outcome: Increased annual revenue and profitability of all Queensland Greyhound Stadia in line with budget Performance Indicators: • • • • • Increased attendances at all Greyhound Stadia including working with the local voluntary supporter organizations Increased the revenue from the Tote Greater profits from the stadium facilities together with higher customer satisfaction Increase job growth within the greyhound industry by 20% Implementation of a comprehensive program that assists business development 24 | P a g e WORKING WITH BREEDERS, OWNERS & TRAINERS Queensland Greyhound breeding and racing has a strong tradition in Queensland, especially in the rural areas of the State. It is a major source of work and contributor to the economy. There is also a ‘pride’ among Queensland Greyhound people and this has to be recognized and encouraged at all levels of the sport. For most owners greyhound racing is a sport and a hobby. They are involved because of their love of the greyhound, their athletic prowess and their enjoyment of the social and sporting aspects of ownership. For the sport to grow and thrive it has to be nurtured. This means very focused investment in the sport at grass roots level, including education of participants, but also the general public. A media campaign needs to be introduced to educate the general public on the greyhound canine athlete, the sport of greyhound racing, and the holistic life approach to each greyhound. Investment in the sport should be channelled into support initiatives including welfare and the holistic life approach to greyhounds. It shows the Queensland Greyhound Industry is listening even in very difficult times. The budget projections when realised over the next 5 years will make it possible to increase funding of existing welfare initiatives. It will certainly have the effect of increasing general public support for the industry and owners of greyhounds. 25 | P a g e CANINE ATHLETE WELFARE Welfare should be at the centre of everything that the greyhound industry in Queensland does. It is recommended that a memorandum of understanding is adopted with and in consultation with the RSPCA. The QGBOTA also recommends that a Chief Veterinary Officer should be appointed to Racing Queensland and oversee the Greyhound Code specifically. They should be an independent person, not involved in the racing code previously, but has a background specialising in Canine welfare. They should conduct random kennel checks with Stewards, as well as oversee race day veterinarian staff. We believe that all current tracks are poorly designed and contribute to significant injuries annually. The industry needs to undertake a 5 year infrastructure program, which highlights latest track design initiatives for safe racing. From the time pups are born right through to the start of their racing career, greyhounds bred for racing are looked after and treated very well. They are given an excellent diet, a balanced exercise routine and good living conditions. This high standard of care continues right throughout their racing life and on into retirement with many owners keeping their greyhounds as a pet after their racing career is over. It is a fallacy to believe that because the Greyhound Adoption program does not home a significant amount of greyhound’s, that these greyhounds are then put down. This is a convenient excuse used by Animal Liberationists to make their argument, because they are anti-gambling. Any person who believes this argument, is naïve, and does not know anything about the greyhound industry. One hundred QGBOTA members were interviewed for this strategy, they were asked if they had retired greyhounds at home, the answer was a total of 216 greyhounds. This is in stark contrast to comments made by the MacSporran report and the State Government regarding the life cycle of retired greyhounds. It suggests that unless you are prepared to undertake proper due diligence on the greyhound industry, you shouldn’t be making unsubstantiated claims to the media, from groups whose sole purpose is anti-gambling. Greyhound welfare is a serious issue and needs a Holistic approach. Legislation is welcome in providing legal status, penalties and sanctions to those who fail to treat greyhounds to accepted community standards. These standards are to be at industry leading level in the treatment, care and experience with the finely tuned high performance canine athletes in greyhound racing. Queensland Greyhounds must pride itself in having a world class greyhound welfare program which is now supported through a holistic industry leading practices. The expenditure on the first 15 months of a racing greyhound’s life is between $3,000 and $4,000. This is spent on rearing including veterinary, food, consumables, and general looking after. Throughout a greyhound’s racing life the highest levels of care is taken to ensure the safety and wellbeing of each racing greyhound. It is recommended that a high standard of equipment and facilities for greyhounds be installed at all Queensland Greyhounds licensed stadia. A veterinary surgeon is 26 | P a g e always in attendance at Australian race meetings, but also an on-site vet practicing out of the stadia, which is subsidised by the industry. Over $40m+ has been lost to the Queensland Greyhound Industry over the past 10 years due to the previous Product Co agreement. If the State Government is serious about wanting improvements to welfare within the industry, then the sport must receive its full share of TAB turnover. This would ensure that the Queensland Greyhounds Welfare program is fully funded and the industry leader across Australia. The QGBOTA’s goal is to re-home as many greyhounds necessary, which aren’t retired to existing greyhound owners. Realistically it has to be acknowledged that it is not possible to re-home all greyhounds, as it is with normal dogs and the RSPCA. Although our goal will be to find a home for as many retired greyhounds as possible, we cannot be held to a higher standard than the community, although we will endeavour as policy to do so. Some greyhounds are not suitable to be pets in a private home. The first initiative is to maintain the current grant to the re-homing groups and work with the RSPCA and other groups to ensure that as many greyhounds as possible are re-homed and cared for. It is important that the public are made aware of the care given to racing greyhounds from birth to the end of their racing life and also the extent of the re-homing program. We do not believe this has been adequately communicated and a program to inform the public of these activities should be organized as a key part of the overall welfare communication strategy. Actions: Work with the RSPCA and Greyhound Adoption Program to increase the number of representatives seeking to re-home retired greyhound Assist accredited re-homing organisations to increase the number of greyhounds that are rehomed Prepare and distribute brochures explaining process and attractions of adopting a greyhound Place advertisements at stadia and meetings Implement improved greyhound adoption programmes on race nights Organise appearances on television morning shows – ‘adopt a greyhound’ Continue to develop with the QGBOTA and RNA retired greyhound shows and retired greyhound gatherings • • • • • • • The QGBOTA also believes that the following points should also be considered and enacted as policy; • • • • • Owner of the greyhound has 100% responsibility for the life of the animal Owner to pay fee or percentage of prizemoney, should they place the greyhound in the adoption program Restrictions on owners who continually try to have greyhounds put down after racing RQL to approve re-homing of greyhounds if not placed in adoption program Life/Welfare checks on all re-homed greyhounds 27 | P a g e METHODOLOGY Other Revenue Generating Options Queensland Greyhound stadiums could become venues for a number of other events. This might include: Food Markets, Festivals, Concerts, Disco’s, Weddings, and Conferences, Meetings, Bingo and Specialist events. They could generate reasonable additional revenue. Joint ventures for promotions - There are a large number of organisations in Queensland who would consider partnering with the Greyhounds Queensland on joint activities Results and Initiatives Following Completion of the Draft Strategy Since the commencement of the strategic planning process a number of initiatives have either been implemented or are in the process of being developed. These include: • Wagering app • New wagering opportunities have been identified • New Tote wagering options to be introduced, which can generate more Tote revenue. • New sponsors • A significant sponsor for new stadia Financial Implications of Strategy This strategy forecasts total income will increase from $17.8m in 2015 to $28m by 2021. This with other initiatives will double the return of taxation income by the State Government by 2021. The QGBOTA believe this plan over the next 5-10 years will generate around an additional 5000 new jobs directly and indirectly in these proposed growth areas. The projected turnover is seen as wholly achievable. Queensland Greyhounds have not been supported to enact policies that will increase its turnover due to the popularity of the sport. The overall thrust of the financial strategy is for Queensland Greyhounds to become self-sufficient, and not require State Government support. The plan envisages a capital development program with the development of West Moreton Stadium in Ipswich. This will be financed through sale or part of the greyhound industries 50% ownership of Albion Park, $10m compensation from the closure of the Gold Coast Track, and $12m from the infrastructure fund. West Moreton Stadium will be the new city class venue for Queensland Greyhounds. The western corridor of Brisbane will have a large influx of new residents over the next 25 years, and with the high volume of industry participants living in this area, makes sense. 28 | P a g e The Greyhound Industries future does not lay at Albion Park, the venue is past its used by date, we see the Brisbane Club amalgamating with the Ipswich Club for a super club to be built. This will also remove the need to relocate the Ipswich Club when the Show Society decide to sell the land. The Ipswich City Council is highly supportive of a new greyhound stadia in the Ipswich region. Logan does not have the infrastructure, nor the population growth that meets the needs of the greyhound industry in Queensland for the next 25 years, and should not be entertained. About engaging and aligning stakeholders Capturing the hearts and minds of racing participants, clubs, members and key influencers is a key outcome. Through open consultation and subsequent communication, the support and passion of these stakeholders can be fully engaged. “The Australian Racing Fact Book’, recently released figures for total turnover of Racing in 2013 2014. The following turnover was reported: Thoroughbreds $16.529 Billion; UP on previous year Greyhounds $3.110 Billion; UP on previous year Harness $2.363 Billion; DOWN on previous year These figures clearly show the changing face of Racing in Australia, and why State Governments have to acknowledge the growth of Greyhounds. Greyhounds turnover has increased by over $1Billion over the past 5 years, and highlights the need to make policy’s that reflect its ever growing upward trend. Contrary to these results however are the poor results in Queensland compared to the other States in Australia. The Queensland Greyhound Industry has significant growth to achieve when compared to the Key Performance Indicators of the other States Greyhound Industries. These can only be improved with the development of Best Practice Policies which will benefit all Racing Codes in Queensland and the general public through increases to wagering turnover, and the taxes derived from this increased turnover. The biggest issue however is that a leading Greyhound State like Queensland now sits fourth on Total TAB turnover, behind New South Wales $1.058Billion, Victoria $825Million, Western Australia $632Million & Queensland $292Million. (Australian Racing Facts 2013/14) Queensland has driven away most of its elite breeders, owners and trainers to interstate localities due to the lack of leadership and support by stakeholders. Western Australia Greyhounds is a second tier level, they have a strong breeding and training industry, but attract a lot of dogs that aren’t up to the eastern States. However, due to Government support of new stadia, marketing and welfare initiatives, its TAB turnover is now 200% of Queensland’s. This can be changed, but the Queensland Greyhound Industry needs support from the Queensland Government as a stakeholder in the industry. 29 | P a g e Understanding the Racing and Community Environment “The essence of formulating competitive strategy is relating an organisation to its environment.” Racing Organisations do not exist in isolation but operate in a dynamic and constantly changing environment. Changes in social attitudes, family patterns, and ethnic make-ups have had a major impact on participation and perception, and will continue to do so. Most environmental factors cannot be controlled by the Racing Organisations, but can be anticipated, understood, responded to and managed. Ignoring the impact of these factors will over time undermine the future of any organisation. This phase in the past has been challenging for Racing Organisations and has often been done poorly or not at all. Understanding the challenges presented by the environmental and community change requires a thorough assessment. The assessment should also include competitive activity and the needs of the customers. The general racing environment External factors (excluding competition) influencing the success of Racing Organisations can be grouped into four areas using the PEST analysis: • Political environment: political priorities, proposed legislation • Economic environment: wealth, work type and economic trends • Social environment: lifestyle patterns and attitudes, animal welfare and demographics • Technological environment: communications, information management, transport, entertainment For each environment category the following questions should be asked: • What are the major changes currently occurring? 30 | P a g e Answer: Corporate Bookmakers are slowly eroding the income of the racing industry, as they pay little in return for their use of racings intellectual property. The general public has various other avenues for entertainment. Stakeholders changing strategies to meet market demand. There is a growing need to meet community standards with regards to training practices, animal welfare and integrity services. • What impact are these changes having on our organisation? Answer: Impact on revenue to racing clubs, prize money, and little patronage from non-racing participants. Calls for sport to be stopped, similar to some states in America. Stakeholders reducing support and coverage. • What further changes are likely to occur in the future? Answer: Community standards imposed on the greyhound industry. Even less patronage due to age and state of clubs, industry participants leaving the sport, as they can’t make a living, or losing money. Reduction in wagering. • Which of these impacts represent threats to be managed or opportunities to be exploited? Answer: Linking racing with community sport & recreational activities that the general public will support. Improving racing revenue with changes to acts that improve revenue streams, and prize money. Animal welfare and misinformation of these groups and the RSPCA on the greyhound industry. Stakeholders taking their responsibility seriously and with integrity. It is the responsibilities of all Racing Organisations to identify these key environmental areas, both the threats and advantages, and identify solutions, so that the industry is on the front foot and setting their Key Performance Indicator’s on these factors. There are many threats surfacing for the greyhound industry and we need to be diligent with policy, procedures and licensing moving forward as an industry. There are many sources including the internet, similar organisations, universities, relevant management, magazines, advertising and media organizations, which can help assist in identifying the threats posed as highlighted above by the environment, but also identify what type of entertainment the potential customer is looking for. 31 | P a g e Understanding customers and competitive activity DEFINING YOUR MARKET This requires racing to consider and identify what market the racing industry is operating in and who your competitors are. When considering participation in a sport or activity it must be remembered that people have a choice as to how they spend their time and money. Understanding how they make those decisions and the options they consider is a good way to understand what benefits your club must deliver and to identify competitors. Historically, Greyhound Racing has had a negative perception in some parts of the community. A lot of this is through misinformation, old wives tales and past practices of participants 30-40 years ago. Times have changed, so has the Greyhound Industry, we need to ensure that our Integrity practices are unequaled and of the highest level. Our industry must be the leaders in integrity services and educating participants of their responsibilities. Changes need to be made and actioned, this is the only way to win support of the consumer and greater community moving forward, that old practices are dead. With this needs to come the recognition of the State Gov’t that this level costs money, and no longer can industry funds be withheld to distribute to the other two codes. Your target markets can be defined in many ways, such as: • age • gender • income • behavior • geographic location • attitudes • type of user • a mix of these & time 32 | P a g e Typically Racing Organisations do not define their target markets this way or even think in terms of target markets. However, good market definitions encourage an organisation to be more focused and to think more strategically about how it can grow participation. CUSTOMER FOCUS Ultimately the success or failure of any Racing Organisation depends on their ability to attract and retain participants (customers). Successful Racing Organisations offer products and services that add value and meet the needs of their target markets. This requires a close understanding of needs and continual monitoring of how they change. Some questions to ask that can help Racing Organisations ‘think like a customer’ are: • What do your customers want from your racing/greyhound organisations? • How satisfied are your customers with what you are currently providing? • What are the future requirements of your current and potential customers? • What services do they deliver? • Could our products and services be easily copied or substituted by a competitor? • What are the key strengths and weaknesses of our competitors? • Are there any partnership or joint venture opportunities? Racing Clubs need to look at the modeling of successful racing clubs interstate and overseas to see the future. Below are opportunities that reflect the needs of participants, stakeholders and existing and potential customers: • Multiple entertainment opportunities for the customer i.e. racing, dining, live music, children’s play area/minding, pokies, bowling alley etc. • Free admission to members of other clubs, or sporting activities • Professional atmosphere • Special dining nights • Competitions • Other avenues for entertainment • Alternate revenues streams • Positive marketing of industry, and animal welfare practices 33 | P a g e Since the year 2000, there has been a significant loss (approx. 43%) of Greyhound Participants, who have either moved Inter-State or left the Industry. In addition, generational change will be a major factor in the future of the sport in Queensland, due to the majority of greyhound participants being over the age of 55. There are less young participants involved in the sport today than 20 years ago. This is due to the state of the Greyhound Industry in Queensland, and the inability to forge a long term career. If the current policies and ideas are allowed to continue, there will be no generational change in Greyhounds in Queensland, but we also expose the industry to the threat of animal welfare lobbies and the wider community. This will be directly linked to successive Queensland State Governments placing impediments on Greyhound Racing, and the inability to implement fair and reasonable policy’s that allow the sport to grow and prosper. With the current trends of Racing and where the community wants to spend it’s time and money, long term it makes no sense to continue to have Greyhounds financially supporting both Thoroughbreds and Harness. The Greyhound Industry is under threat and needs it fair share of turnover to in act policy change for the betterment of a holistic industry. Common sense dictates that a healthy and prosperous Greyhound Industry is of greater benefit to the State Government and wider community long-term. The Greyhound Industry throughout Australia is the only Industry which has continually increased its turnover and revenue over the past five years, and all indications reflect that this will continue over the short and medium terms being the next 5 to 10 years. Government Planning – Identifying Financial Risks The following is a list of major areas future State Governments need to plan for when identifying the Financial Threats to the Racing Industry: • Threat of Corporate Bookmakers • Sports Wagering • Tatts Bet Fixed Betting – Racing Industry receives less revenue from this type of betting • Achieving a fairer and more equitable distribution of funds from wagering • Identifying alternative revenue streams 34 | P a g e ASSISTANCE TO ATTRACT MORE PATRONS RACING CODES POLICY Any Future State Government will need to consider the following: • Allocate all state taxes on on-course totalisator (TAB) bets to the racing industries to be used to promote on-course attendance. • For each racing code establish, by agreement of all key Stakeholders within that code, a committee to manage these funds. The three racing codes, thoroughbred, harness and greyhounds, are all facing challenges with declining attendances except at major feature meetings; for example, Winter Carnival, Country Cups, feature greyhound and harness events. While off-course betting is critical to the financial success of our racing industries, it is also essential to maintain and grow on-course attendance, betting volumes and atmosphere. There has continued to be moderate growth in off-course wagering despite the challenges of extra competition. However all three codes agree that declining on-course attendance, outside feature events, is of concern to the industry. The State Government would need to allocate all state taxes collected from on-course totalisator (TAB) bets to the racing industries for them to develop and implement innovative and exciting ideas to increase on course attendances. It is estimated that between $3 and 4 million will be available each year for these programs, however the exact amount will depend on the volume of on course totalisator turnover each year. A special committee should be established for each racing code to identify and implement these plans and programs to improve on-course attendances. Among the ideas which may be considered are: • Buy one, get one free entry tickets. • Free race books on entry. • Winter saver tickets; for example entry to 10 meetings for the price of five. • Free entry for AFL/League/Soccer club members at Saturday race meetings when none of these matches are in Brisbane. • ‘Fat’ on-course dividend for targeted bet types. • Free betting vouchers. • Broader on-course entertainment. • ‘Owner for a day’ privileges for lucky patrons. 35 | P a g e RACING INFRASTRUCTURE RACING CODES POLICY GREYHOUNDS The future challenges for Greyhound Racing in Queensland include the following: • Growing its share of off-course wagering to reflect previous years prior to the closure of the Gold Coast Club where 18% of wagering turnover was achieved. • Achieving a fairer and more equitable distribution of funds from wagering Post-2015. • Increased patronage to greyhound clubs. • Continuing to improve animal welfare for greyhounds. • Upgrade Country Tracks 36 | P a g e FUTURE OF GREYHOUND RACING The QGBOTA recognises that the Queensland Greyhound Industry has a lot of challenges moving forward. A significant amount of questions stand over the industry at present. We strongly believe most are unsubstantiated accusations, without proper investigation, or a proven methodology. The people of Queensland cannot form an opinion on greyhound racing, if they have not been delivered all the facts. It has been shown that in places like North America where they rehome 96% of retired greyhounds and Ireland where 84% are rehomed, that change can be made if the right policies are adopted, and that you bring the industry along with you. The people who raise these concerns are anti-gambling. They will exaggerate basic information to make their arguments. The issue is that their arguments are not tested. Greyhound participants are responsible for their actions, but the industry is being damaged due to the poor record keeping of administrators, who can’t supply basic information. This has allowed anti-gambling individuals to twist information to suit their purposes. Yes, we have challenges as an industry, but should we not define what those challenges are? The QGBOTA has undertaken its own investigation by contacting one hundred greyhound participants. We found 217 retired greyhounds being cared for by participants, or friends and relatives of those participants. What hasn’t been taken into account is that most trainers, breeders and owners keep retired greyhounds, not only as pets, but to help educate puppies. These greyhounds were considered deceased by the MacSporran Report, not because the evidence was there to support the theory, but because of poor record keeping by administrators. There are also challenges with breeding, but the numbers being quoted outstrip supply. You cannot put down more greyhounds than what are actually born each year, there would be no greyhounds racing. What doesn’t get acknowledged is that puppies can be lost during birth, they can be lost to diseases like parvo or a tick etc. before 12 weeks of age. Greyhounds can be lost because of injury through paddock incidents, snake, spider bites etc. None of this evidence is being taken into account, when individuals are making statements about the greyhound industry. The anti-gambling organisations aren’t interested in the facts, because it will mute their argument. There are many instances throughout history where individuals want to shut down a certain industry. History also tells us that mistakes can be made if all the information is not investigated thoroughly, and that the industry is not given an opportunity to reform and educate the community on the facts. 37 | P a g e The Greyhound Industry in Queensland has a great history. Change has to be made, and that is never easy, but the Industry is ready to make that change. We need the State Government to back our initiatives, that will deliver a strong future greyhound history, that has a holistic and sustainable plan, and meets it social, moral and legislative requirements. Brenton Wilson President QGBOTA 38 | P a g e