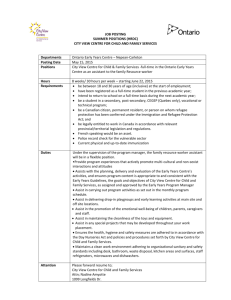

ontario tax credits and benefits you should know about

advertisement

ONTARIO TAX CREDITS AND BENEFITS YOU SHOULD KNOW ABOUT Ontario Child Care Supplement for Working Families The Ontario Child Care Supplement for Working Families (OCCS) is a tax-free monthly payment for lowto moderate-income working families with children under seven years of age, born prior to July 1, 2009. Your child does not have to be in daycare for you to apply for the OCCS. Children’s Activity Tax Credit This credit helps parents with the cost to register their child(ren) in organized activities. For 2014 you can claim up to $541 in eligible expenses and get up to $54.10 back for each child under 16. You can get up to $108.20 back for a child with a disability who is under 18. You may qualify for the credit for a taxation year if you were a resident of Ontario on the last day of that year and you or your spouse or common-law partner paid fees in that year to register your child, or your spouse or common-law partner's child, in an eligible activity. Ontario Child Benefit The Ontario Child Benefit is financial support that low and moderate income families – whether they are working or not – may receive to help provide for their children. The Ontario Child Benefit will reach about one million children each month. Beginning July 2013, the maximum payment increased to just over $100 per month for each child, up to $1,210 per year for each child. Ontario Senior Homeowners' Property Tax Grant This grant helps seniors with the cost of their property taxes, worth up to $500 each year. You may qualify for the grant if you or your spouse/common-law partner paid Ontario property tax in the previous year, you meet the income requirements and as of as of December 31 of the previous year, you: were 64 years of age or older, were a resident of Ontario and/or owned and occupied your principal residence (or your spouse/common-law partner did). Ontario Trillium Benefit The Ontario Trillium Benefit helps people pay for energy costs, and provides relief for sales and property tax. The Ontario Trillium Benefit combines the Ontario Sales Tax Credit and Ontario Energy and Property Tax Credit. You need to be eligible for at least one of the Ontario Sales Tax Credit or Ontario Energy and Property Tax Credit, to receive the Ontario Trillium Benefit. Ontario Guaranteed Annual Income System (GAINS) GAINS ensures a guaranteed minimum income for Ontario seniors by providing monthly payments to qualifying pensioners. The monthly GAINS payments are on top of the federal Old Age Security (OAS) pension and the Guaranteed Income Supplement (GIS) payments you may receive. Healthy Homes Renovation Tax Credit The Healthy Homes Renovation Tax Credit is a permanent, refundable personal income tax credit for seniors and family members who live with them. If you qualify, you can claim up to $10,000 worth of eligible home improvements on your tax return. The amount of money you get back for these expenses is calculated as 15 per cent of the eligible expenses you claim. For example, if you spend and then claim $10,000 worth of eligible expenses, you could get $1,500 back. Ontario Tax Reduction Program The Ontario Tax Reduction program reduces Ontario income tax for lower income taxpayers. The program also provides additional tax relief for eligible individuals with dependent children or disabled/infirm dependants of any age. You are eligible if you filed your income tax return, were resident in Canada at the beginning of the year and an Ontario resident on December 31 of the year. If you had a spouse or commonlaw partner on December 31 of the year, only the spouse or common-law partner with the higher net income can claim the Ontario Tax Reduction for dependent children and disabled/infirm dependants. You are not eligible if you paid Ontario Minimum Tax as calculated on Ontario form ON428. Community Small Business Investment Fund Program The Community Small Business Investment Fund (CSBIF) program provides Ontario small businesses with greater access to capital, by encouraging the formation of community sponsored venture capital pools, and by providing eligible investors with incentives for purchasing shares of registered CSBIFs. To find about your eligibility for these and other credits, visit www.fin.gov.on.ca/en/credit/ Or contact my office: 416-243-7984 lalbanese.mpp.co@liberal.ola.org 99A Ingram Drive