Maruti Suzuki India Ltd.

advertisement

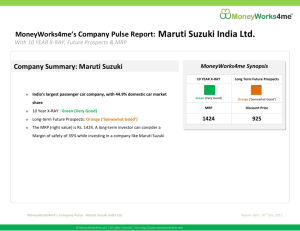

Maruti Suzuki India Ltd. Result Update: Q1 FY 12 C.M.P: Target Price: Date: Rs. 1058.00 Rs. 1216.00 Sep. 14th 2011 BUY SYNOPSIS Stock Data: Automobile 5.00 1599.90/1045.00 57000.00 532500 305677.36 Sector: Face Value Rs. 52 wk. High/Low (Rs.) Volume (2 wk. Avg.) BSE Code Market Cap (Rs in mn) Share Holding Pattern Maruti Suzuki India Limited (MSIL), a subsidiary of Suzuki Motor Corp. of Japan, is India's largest passenger car company, accounting for over 50 per cent of the domestic car market. During the quarter ended, the robust growth of Net Profit is increased by 18.02% Rs. 5492.30 million. Maruti Suzuki India Limited and investors have invested over Rs. 550 Crore to make the new Swift more vibrant and sportier. Suzuki Motor plans to set up new passenger car factory for Rs 6,235 crore ($1.3 billion) in Gujarat. 1 Year Comparative Graph Maruti Suzuki India Limited sold a total of 75,300 vehicles in July 2011 where 91442 vehicles in August 2011. Maruti Suzuki Net Sales and PAT of the company are expected to grow at a CAGR of 14% and 5% over 2010 to 2013E respectively. BSE SENSEX Years Net sales EBITDA Net Profit EPS P/E FY 11 370400.90 41466.60 22886.40 79.21 13.36 FY 12E 407440.99 45958.09 25900.22 89.64 11.80 FY 13E 444110.68 50719.30 28803.11 99.69 10.61 1 Peer Group Comparison Name of the company CMP(Rs.) Market Cap. (Rs.mn.) EPS(Rs.) P/E(x) P/Bv(x) Dividend (%) Maruti Suzuki 1058.00 305677.36 79.21 13.36 2.20 150.00 Mahindra & Mahindra 787.50 48424.20 44.05 17.90 4.70 230.00 SML Isuzu 380.00 549.92 28.58 13.30 2.58 80.00 Force Motors 696.90 915.68 34.94 19.89 2.68 30.00 Investment Highlights Q1 FY12 Results Update Maruti Suzuki India Ltd. has reported net profit of Rs 5492.30 million for the quarter ended on June 30, 2011 as against Rs. 4653.6 million in the same quarter last year, an increase of 18.02%. It has reported net sales of Rs 85293.00 million for the quarter ended on June 30, 2011 as against Rs 82315.30 million in the same quarter last year, a rise of 3.62%. Total income grew by 4.53% to Rs 87093.70 million from Rs.83317.30 million in the same quarter last year. During the quarter, it reported earnings of Rs 19.01 a share. Quarterly Results - Standalone (Rs in mn) As At June-11 June-10 %change Net sales 85293.00 82315.30 3.62% 5492.30 4653.60 18.02% 19.01 16.11 18.02% PAT Basic EPS 2 Break up of Expenditure Maruti Suzuki unveils the next generation all New Swift Maruti Suzuki India Limited, India's largest car manufacturer unveiled its much awaited sportier and stylish car, the all new 'Swift' which offers best in class acceleration, high power to weight ratio and much improved fuel efficiency with over 140 new features. The Company has introduced the VVT engine technology and DDiS engine powers in all petrol and diesel variants respectively of the new Swift. Maruti Suzuki and its suppliers have invested over Rs. 550 Crore to make the new Swift more vibrant and sportier. It entered the Indian car market and became a segment reference point by selling over 600,000 units in 6 years making it by far the highest selling car in the premium compact segment. Suzuki picks Gujarat for new Rs 6,235 cr plant Suzuki Motor plans to set up new passenger car factory for Rs 6,235 crore ($1.3 billion) in Gujarat. It wanted to end its alliance with Volkswagen, a tie-up that had been expected to help Europe's biggest carmaker expand on the Indian subcontinent. It will announce the location of the plant by the end of October. 3 Sales in July and August Car market leader Maruti Suzuki India Limited sold a total of 75,300 vehicles in July 2011 where 91442 vehicles in August in 2011. This includes 8,796 and 104791 units for export in July and August respectively. Company Profile Maruti Suzuki India Limited (MSIL), formerly known as Maruti Udyog Limited, a subsidiary of Suzuki Motor Corporation of Japan, is India's largest passenger car company, accounting for over 50 per cent of the domestic car market. Maruti Udyog Limited was incorporated in 1981 under the provisions of Indian Companies Act 1956 and the government of India selected Suzuki Motor Corporation as the joint venture partner for the company. In 1982 a JV was signed between Government of India and Suzuki Motor Corporation. The company has two manufacturing facilities located at Gurgaon and Manesar, south of New Delhi, India. Both the facilities have a combined capability to produce over a 1.2 million vehicles annually. The company plans to expand its manufacturing capacity to 1.75 million by 2013. The Manesar facility has been made to suit Suzuki Motor Corporation (SMC) and Maruti Suzuki India Limited's (MSIL) global ambitions. At present this plant rolls out World Strategic Models: Swift, A-star & SX4 and DZire. The plant has several in-built systems and mechanisms. Suzuki Powertrain India Limited, the diesel engine plant at Manesar is SMC's & Maruti's first and perhaps the only plant designed to produce world class diesel engine and transmissions for cars. The plant is under a joint venture company, called Suzuki Powertrain India Limited (SPIL) in which SMC holds 70 per cent equity the rest is held by MSIL. This facility has an initial capacity to manufacture 100,000 diesel engines a year. This has been scaled up to 300,000 engines per annum by 2010. 4 MSIL’s parent company, Suzuki Motor Corporation has been a global leader in mini and compact cars for three decades. Suzuki's technical superiority lies in its ability to pack power and performance into a compact, lightweight engine that is clean and fuel efficient. Product quality, safety and cost consciousness are embedded into their manufacturing process, which they have inherited from their parent company. Maruti Suzuki exports entry-level models across the globe to over 100 countries and the focus has been to identify new markets. Some important markets include Latin America, Africa and South East Asia. Product range includes It offers cars from entry level Maruti 800 & Alto to stylish hatchback Ritz, A star, Swift, Wagon R, Estillo and sedans DZire, SX4 and Sports Utility vehicle Grand Vitara. • Maruti 800 • Alto • Alto K10 • Omni • Gypsy • Zen Estilo • Wagon R • Versa • A-star • Ritz • SX4 • Swift • Dzire • Eeco • Grand Vitara 5 Financial Results 12 Months Ended Profit & Loss Account (Standalone) Value(Rs.in.mn) FY10 FY11 FY12E FY13E Description 12m 12m 12m 12m Net Sales 296230.10 370400.90 407440.99 444110.68 Other Income 4967.60 4823.10 6028.88 6752.34 Total Income 301197.70 375224.00 413469.87 450863.02 Expenditure -256687.20 -333757.40 -367511.77 -400143.72 Operating Profit 44510.50 41466.60 45958.09 50719.30 Interest -335.00 -244.10 -200.16 -204.17 Gross profit 44175.50 41222.50 45757.93 50515.13 Depreciation -8250.20 -10135.00 -10945.80 -11930.92 Profit Before Tax 35925.30 31087.50 34812.13 38584.21 Tax -10949.10 -8201.10 -8911.91 -9781.10 Profit After Tax 24976.20 22886.40 25900.22 28803.11 Equity capital 1444.60 1444.60 1444.60 1444.60 Reserves 116906.00 137230.20 163130.42 191933.54 Face value 5.00 5.00 5.00 5.00 EPS 86.45 79.21 89.64 99.69 6 Quarterly Ended Profit & Loss Account (Standalone) Value(Rs.in.mn) 31-Dec-10 31-Mar-11 31-Jun-11 30-Sep-11E Description 3m 3m 3m 3m Net sales 94944.50 100921.80 85293.00 92116.44 Other income 1282.70 1198.70 1800.70 1908.74 Total Income 96227.20 102120.50 87093.70 94025.18 Expenditure -85926.60 -90824.60 -77149.00 -82996.91 Operating profit 10300.60 11295.90 9944.70 11028.27 Interest -3.60 -63.50 -57.50 -55.78 Gross profit 10297.00 11232.40 9887.20 10972.49 Depreciation -2369.40 -2966.70 -2424.70 -2521.69 Profit Before Tax 7927.60 8265.70 7462.50 8450.81 Tax -2275.90 -1667.10 -1970.20 -2281.72 Profit After Tax 5651.70 6598.60 5492.30 6169.09 Equity capital 1444.60 1444.60 1444.60 1444.60 Face value 5.00 5.00 5.00 5.00 EPS 19.56 22.84 19.01 21.35 7 Key Ratios Particulars FY10 FY11 FY12E FY13E EBITDA Margin (%) 15.03% 11.20% 11.28% 11.42% PBT Margin (%) 12.13% 8.39% 8.54% 8.69% PAT Margin (%) 8.43% 6.18% 6.36% 6.49% P/E Ratio (x) 12.24 13.36 11.80 10.61 ROE (%) 21.10% 16.50% 15.74% 14.89% ROCE (%) 41.69% 36.40% 33.91% 31.84% Debt Equity Ratio 0.07 0.02 0.02 0.02 EV/EBITDA (x) 6.87 7.37 6.65 6.03 409.63 479.98 569.62 669.31 2.58 2.20 1.86 1.58 Book Value (Rs.) P/BV Charts: Net Sales & PAT 8 P/E Ratio(x) Debt Equity Ratio 9 EV/EBITDA P/BV 10 Outlook and Conclusion At the current market price of Rs.1058.00, the stock is trading at 11.80 x FY12E and 10.61 x FY13E respectively. Earning per share (EPS) of the company for the earnings for FY12E and FY13E is seen at Rs.89.64 and Rs.99.69 respectively. Net Sales and PAT of the company are expected to grow at a CAGR of 14% and 5% over 2010 to 2013E respectively. On the basis of EV/EBITDA, the stock trades at 6.65 x for FY12E and 6.03 x for FY13E. Price to Book Value of the stock is expected to be at 1.86 x and 1.58 x respectively for FY12E and FY13E. We expect that the company will keep its growth story in the coming quarters also. We recommend ‘BUY’ in this particular scrip with a target price of Rs.1216.00 for Medium to Long term investment. Industry Overview The Indian automobile industry, the seventh largest in the world, has demonstrated a phenomenal growth. The industry has grown significantly over the last ten years, during which industry volumes have increased by 3.2 times, from a level of 4.7 million numbers to 14.9 million numbers, according to Vishnu Mathur, Director General, Society of Indian Automobile Manufacturers (SIAM). The industry, by virtue of its deep connects with several key segments of the economy, occupies a prominent place in the country’s growth canvas. It exhibits a strong multiplier effect and has the ability to be the key driver of economic growth. A robust transportation system plays a key role in a country's rapid economic and industrial development, and the well-developed Indian automotive industry justifies this catalytic role by producing a wide variety of vehicles, which include passenger cars, light, medium and heavy commercial vehicles, multi-utility vehicles such as jeeps, scooters, motorcycles, mopeds, three wheelers, tractors etc. 11 Auto Industry in India – Growth Drivers The automobile sector in India has been experiencing significant growth in the last few years on the back of factors that include: • Favorable demographic distribution with rising working population and middle class Urbanisation • Rising affluence of the average consumer as per capita income rises - According to McKinsey, the middle class in India will grow from 50 million to 550 million by 2025. With a tremendous growth in wealth as the economy grows, there will be significant increases in spending on discretionary items and consumer durables • Increasing disposable incomes in rural agri-sector • Overall GDP growth, with a rise in industrial and agricultural output • Introduction of ultra-low-cost cars • Increasing maturity of Indian original equipment manufacturers (OEMs) • Availability of a variety of vehicle models meeting diverse needs and preferences – robust production • Greater affordability of vehicles • Easy finance schemes • Favorable government policies Indian Automobile market – Key statistics India's automobile industry, currently estimated to have a turnover of US$ 73 billion, accounts for 6 per cent of its GDP, and is expected to hit a turnover of US$ 145 billion by 2016. The automobile industry currently contributes 22 per cent to the manufacturing GDP and 21 per cent of the total excise collection in the country, according to Mr Praful Patel, Minister, Heavy Industries and Public Enterprises. In 2010-11, the total turnover and export of the automotive Industry in India reached a new high of US$ 73 billion and US$ 11 billion respectively. The cumulative announced investments 12 reached US$ 30 billion during this period. He also said that the forecasted size of the Indian Passenger Vehicle Segment is nearly 9 million units and that of 2 wheelers, close to 30 million units – by 2020. India achieved the position of the top growing passenger car market in the world during the January-June period in 2011, overtaking the US, which grew at 14.40 per cent, according to SIAM. In passenger vehicles, India was the fastest growing market at 18.20 per cent during the six month period. India's automobile industry is expected to grow by 11 to 13 per cent in the fiscal year ending March 2012, according to Pawan Goenka, President, SIAM. The industry body said that Indian automakers sold 143,370 cars in June 2011. The four-wheel passenger vehicle market has grown impressively at the hands of the new middle class, and there is huge opportunity, as market penetration remains low. Domestic market share for 2010-11 India’s automobile industry is growing fast, but two wheelers remain a dominant category. More than 78 percent of motor vehicles on the road are two-wheelers, their popularity driven by low price, high fuel mileage, and an ability to drive efficiently through dense traffic. The share of different types of vehicles during 2010-11 was passenger vehicles (16.25), commercial vehicles (4.36), three wheelers (3.39), and two wheelers (76.00). Recent Investments/ Trends The auto industry has made huge investments in the country. As per 2008-09, the total investment of auto industry in India was Rs 60,952 crore (US$ 13.89 billion). Another Rs 78,000 crore (US$ 17.78 billion) of new investments have been announced by the auto industry out of which some have already been made and the rest will come up over the next 2-3 years. The industry, therefore, is keeping pace with the growing demand for vehicles in all segments. The Karnataka government has cleared investment proposals amounting to more than Rs 8,662 crore (US$ 19.74 billion), which include the plans of Honda Motorcycle India 13 plans for a manufacturing unit in the State. Mr Murugesh Nirani, Karnataka Industries Minister, has said that Honda Motorcycles and Scooter India would be investing Rs 1,350 crore (US$ 307.7 million) in Narsapur Industrial area of Kolar district of the State. Demand for two-wheelers from six of the eight domestic mobike manufacturers rose 16 per cent in June to more than 880,000 units, compared to 761,000 units in June 2010. Australia is looking at possibilities of building better relations between its world-class firms and rapidly growing Indian automotive industries with an objective to create new export opportunities. Pune-based Force Motors has signed an agreement with Daimler AG, under which Daimler will supply technology for the development of a multi-purpose vehicle (MPV) by Force Motors Swedish automobile manufacturer Volvo Cars Corp is looking at introducing corporate editions of its luxury sedans S60 and S80 to shore up volumes in the Indian automobile market. French car maker PSA Peugeot Citroen has selected a site near Sriperumbudur, to the west of Chennai, in Tamil Nadu for setting up its car plant. The company is planning to invest Rs 4,000 crore (US$ 911.72 million) in an integrated automobile project. Toyota has launched its first made-for-India small car, the Etios, Liva, in the intensely competitive hatchback segment. The car, priced between Rs 399,000 and 599,000 (US$9,094 and 13,653), will compete with Maruti Suzuki Swift, Hyundai i20, Volkswagen Polo and Ford Figo. Auto industry in India – Government Initiatives With the gradual liberalization of the automobile sector since 1991, the number of manufacturing units in India has grown progressively. 14 Currently, 100 per cent Foreign Direct Investment (FDI) is permissible under automatic route in this sector including passenger car segment. The import of technology/technological upgradation on the royalty payment of 5 per cent without any duration limit and lump sum payment of US$ 2 million is also allowed under automatic route in this sector. The automobile industry is delicensed, and import of components is freely allowed. With an objective of accelerating and sustaining growth in the automotive sector and to steer,co-ordinate and synergise the efforts of all stakeholders, the Automotive Mission Plan (AMP) 2006-2016 was prepared. The plan aims at making India global automotive hub.The AMP 2006-2016 aims at doubling the contribution of automotive sector in GDP by taking the turnover to US$ 145 billion and providing additional employment to 25 million people by 2016. In the long term, the government has expressed plans to follow a two pronged strategy for spurring automotive Research &Development (R&D). The first is aimed at addressing the existing infrastructure gap in the field domain of automotive testing and homologation through the Department’s flagship National Automotive Testing and R&D Infrastructure Project(NATRiP), which is being implemented at a cost of Rs 2,288 crores (US$ 521.5 million), and is expected to be completed by the end of 2012. The second part of the strategy is aimed at leveraging the investments being made in NATRiP facilities for collaborative R&D with the industry, especially for the small and medium enterprises (SMEs) in the auto component space. Further, with the recent announcement of the launch of the National Mission for Electric Mobility and the setting up of the National Council and Board for Electric Mobility, Mr Patel emphasized on the commitment of the government for early adoption of electric vehicles, including hybrid vehicles, and the manufacturing of these vehicles and their components. The government is considering setting up two automotive manufacturing hubs spread over 10,000 acres each in central and eastern India. The new hubs, aimed at consolidating India's position as an important destination for low-cost automotive 15 production, will be in addition to the three existing zones — Haryana, Maharashtra and Tamil Nadu. Auto Industry in India – Road Ahead The automotive industry is at the core of India’s manufacturing economy - India is all set to become one of the world’s most attractive automotive markets for both manufacturers and consumers. The resulting benefits to society, such as economic growth, increased jobs, and stability for families employed by the automotive industry, are significant. The long-term potential for growth of the auto industry is very favorable, on account of low vehicle penetration in the country. As income levels rise and easy finance is available, the industry will continue to see a healthy growth rate. SIAM estimates that the growth of the auto industry in FY12 will be in the region of 12-15 per cent. ______________ ____ _________________________ Disclaimer: This document prepared by our research analysts does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable but do not represent that it is accurate or complete and it should not be relied on as such. Firstcall India Equity Advisors Pvt. Ltd. or any of it’s affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provide for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. 16 Firstcall India Equity Research: Email – info@firstcallindia.com C.V.S.L.Kameswari Pharma U. Janaki Rao Capital Goods D. Ashakirankumar Automobile A. Rajesh Babu FMCG H.Lavanya Oil & Gas Dheeraj Bhatia Diversified Manoj kotian Diversified Nimesh Gada Diversified Firstcall India also provides Firstcall India Equity Advisors Pvt.Ltd focuses on, IPO’s, QIP’s, F.P.O’s,Takeover Offers, Offer for Sale and Buy Back Offerings. Corporate Finance Offerings include Foreign Currency Loan Syndications, Placement of Equity / Debt with multilateral organizations, Short Term Funds Management Debt & Equity, Working Capital Limits, Equity & Debt Syndications and Structured Deals. Corporate Advisory Offerings include Mergers & Acquisitions(domestic and cross-border), divestitures, spin-offs, valuation of business, corporate restructuring-Capital and Debt, Turnkey Corporate Revival – Planning & Execution, Project Financing, Venture capital, Private Equity and Financial Joint Ventures Firstcall India also provides Financial Advisory services with respect to raising of capital through FCCBs, GDRs, ADRs and listing of the same on International Stock Exchanges namely AIMs, Luxembourg, Singapore Stock Exchanges and other international stock exchanges. For Further Details Contact: 3rd Floor,Sankalp,The Bureau,Dr.R.C.Marg,Chembur,Mumbai 400 071 Tel. : 022-2527 2510/2527 6077/25276089 Telefax : 022-25276089 E-mail: info@firstcallindiaequity.com www.firstcallindiaequity.com 17