Bok1_050044 - Ahima - American Health Information Management

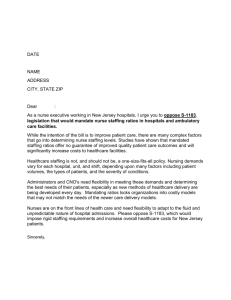

advertisement