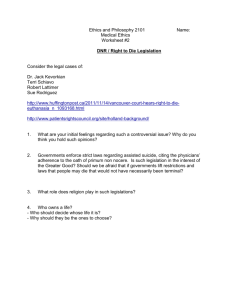

Brochure - Compliance and Ethics Institute

advertisement