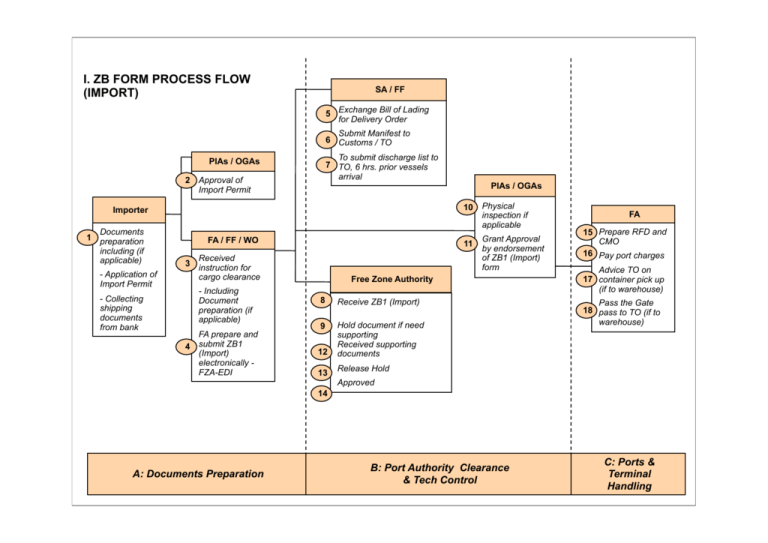

I. ZB FORM PROCESS FLOW (IMPORT)

advertisement