Shared Parenting in Tools One Software

advertisement

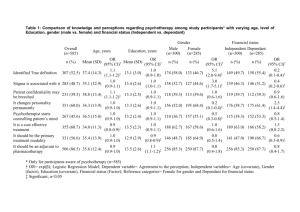

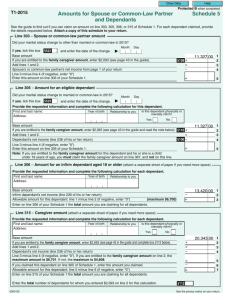

Shared Parenting in Tools One Software Prepared by S. Christine Montgomery, B.A., LL.B., For DivorceMate Software Inc., updated April, 2015 Child Support Guidelines, Section 9 Where a parent has access or physical custody of the child(ren) not less than 40% of the time, section 9 of the Child Support Guidelines (“CSG”) says that child support is determined having regard to the applicable Table amount for each parent (s.9(a)), the increased costs of the shared parenting arrangement (s.9(b)), and the condition, means, needs and other circumstances of the parties and the children (s.9(c)). The methodology for a shared parenting arrangement as set out in the CSG must consider a number of factors, but in the final analysis, the offset of the Table amounts is the starting point, and thereafter judicial discretion is required. “Not less than 40% of the time” Threshold In shared parenting situations, there is no universally accepted method for determining when the 40% threshold has been met, which can be extremely problematic. Many courts avoid “rigid calculations” (see Froom v. Froom (2005), 11 R.F.L. (6th) 254 (Ont. C.A.)) or “tight accounting” (see Berry v. Hart (2003), 233 D.L.R. (4th) 1 (B.C.C.A.)). In the case of Froom v. Froom, supra, the Ontario Court of Appeal in a 2-1 decision declined to find that the trial judge had erred in counting days, rather than hours, and noted that many courts “seek to avoid rigid calculations and, instead, look at whether physical custody of the children is truly shared.” It is interesting to note that had the court counted hours rather than days (a more accurate calculation according to the minority), the children would have been in the father’s care for only 36.7% and 32.09% of the time for 2003 and 2004 respectively. In Maultsaid v. Blair, 2009 CarswellBC 607, the British Columbia Court of Appeal found that the tenor of the order or agreement setting out the right of access will determine how time is to be calculated. For example, if access is defined precisely, a calculation of hours may be more appropriate. If, however, access is more broadly described with reference to numbers of days or blocks of time, the broader method of calculation of days may be more appropriate. The Manitoba Court of Appeal in Mehling v. Mehling, 2008 MBCA 66, urged a flexible approach in the calculation of time, stating that while necessarily including a mathematical component, the calculation of time should not be a strictly mathematical calculation. An evaluation of days or weeks (or portions thereof) may be more realistic than an hourly accounting. It is also worth noting that the courts do not have the discretion to round the time calculation up or down (see Gauthier v. Hart, 2011 ONSC 815; Maultsaid v. Blair, supra), nor simply “deem” a parent to have 40% parenting time without regard for the evidence (L.C. v. R.O.C., 2007 ABCA 158). Notwithstanding the flexible approach urged by the various Court of Appeal decisions, many lower court decisions, particularly in Ontario, tend to favour the hourly accounting of time (see L.L v. M.C., 2013 ONSC 1801; Gauthier v. Hart, supra). The onus of proving that the 40% threshold is met falls on the spouse seeking to rely on s. 9 (Meloche v. Kales, 1997 CanLII 12292 (Ont. SCJ); Huntley v. Huntley, 2009 BCSC 1020). Joint parenting does not automatically qualify as shared parenting because joint parenting arrangements vary greatly and may mean no more than the right to make decisions concerning the child. Contino – Quantum of Child Support under Section 9 The courts have applied different “formulas” to calculate quantum of support in shared parenting situations. In its long awaited decision, Contino v. Leonelli-Contino, 2005 SCC 63, the Supreme Court of Canada examined the application of section 9 of the Child Support Guidelines, namely the shared custody provision. In reviewing section 9, the Supreme Court held that this section expressly provides a particular regime for shared custody, quite distinct from the presumptive rule of section 3 requiring support according to the Tables. The S.C.C. further found that all three factors listed in subsections (a), (b) and (c) of section 9 must be considered equally; none prevail. Nor is there a presumption in favour of awarding more or less than the Guidelines amount. Under section 9(a), the court must consider the financial situations of both parties. The simple set-off of the parties’ respective Table amounts is a starting point that must then be followed by an examination of the continuing ability of the recipient parent to meet the needs of the child, given that many costs are fixed. Courts must be especially careful in variation applications where a rigid application of a set-off would result in a drastic change in support. Each party’s actual contributions must be compared to the Table amount he/she would be required to contribute, to determine whether adjustments to the simple set-off amount are necessary. The court retains discretion to vary the set-off amount where it would lead to a significant variation in the household standards of living. Section 9(b) recognizes that the total cost of raising children may be greater in shared custody situations than in sole custody situations. The court must therefore look at the payor parent’s increased costs and the actual spending patterns of both parents to determine whether shared custody has resulted in increased costs globally. These expenses will be apportioned between the parties in accordance with their respective incomes. Finally, section 9(c) requires the court to analyze the resources and needs of both parents and the children (which includes a comparison of the parties’ respective net worth). The court will consider the standard of living of the child in each household and the ability of each parent to absorb the costs required to maintain an appropriate standard of living. It is important to note that the analysis in sections 9(b) and (c) requires actual evidence to be led on increased costs by way of financial statements and/or children’s expense budgets. The court should demand this information from the parties when it is lacking or deficient. The court should not make “common sense” assumptions about the payor parent’s costs, nor apply a multiplier to account for the fixed costs of the recipient parent, as has been done in previous cases. Tax Considerations of Shared Parenting Canada Child Tax Benefit, Universal Child Care Benefit and Children’s GST/HST Credits As far as the Canada Child Tax Benefit (“CCTB”) (including the National Child Benefit Supplement and the Child Disability Benefit), the Universal Child Care Benefit (“UCCB”) and the refundable children’s GST/HST credits (“GST/HST credits”) are concerned, a policy of the CRA requires these benefits to be shared between the parents in a “shared eligibility situation”. Therefore each parent’s entitlement to these benefits/credits will be determined based on their respective incomes, and each will receive one half of his/her annual entitlement, paid out on a monthly basis, with the exception of the GST/HST credits which will be paid out quarterly. Eligible Dependant Credit A party may claim the eligible dependant credit (formerly, the equivalent-to-spouse credit) if a party is single, divorced, separated and not supporting his/her spouse, or widowed and has a dependant person (child under age 19 years old, infirm child, parent or grandparent who is living with him/her) whom the party is supporting. If the dependant is a child, the child must be related to the party claiming the credit by blood, marriage, common-law partnership or adoption. Historically, in cases of shared parenting, the Canada Revenue Agency (“CRA”) allowed neither party or only the recipient parent to claim the eligible dependant credit. In recent years, however, the CRA has indicated that where the child resides with both parents throughout the year and where both parties are paying support, the parties can agree on the allocation of the eligible dependant credit. See the General Income Tax and Benefit Guide 2014 (http://www.cra-arc.gc.ca/E/pub/tg/5000-g/5000g-14e.pdf - see Schedule “A” attached) and the CRA Guide P102, Support Payments 2014, specifically the section on “Shared custody and the amount for an eligible dependant” (http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncmtx/spprtpymnts/shrdcstdy-eng.html - see Schedule “B” attached). If the parties cannot agree on the allocation of the credit, neither gets it. Therefore, if the intention is for the higher income payor (ie. the one who could most benefit from the credit from a tax perspective) to claim the credit, then it is critical that any order or agreement for child support provide that both parties are paying support, even if ultimately a “setoff” payment from one to the other is made for convenience. Note that the allocation of this credit will not affect child support but may affect spousal support under the Spousal Support Advisory Guidelines. If more than one child is in a shared parenting situation, again, as long as both parties are paying support, it would appear that both parties can claim the credit. See the CRA Guide P102, Support Payments 2014, specifically Example 2 in the section on “Shared custody and the amount for an eligible dependant” (http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/spprtpymnts/shrdcstdy-eng.html - see Schedule “B” attached). It is important to keep in mind, however, that the General Income Tax and Benefit Guide is just that – a guide – and CRA retains the ultimate decision-making power with respect to these credits. Please also note that the credit cannot be claimed by more than one individual in the year for the same child, nor can the credit be claimed if the party is remarried, has a new common law spouse or is claiming a spousal credit. With respect to the eligible dependant credit, the default setting in Date’s Tools One software is “automatic”, which will allocate the credit to the net recipient of child support (ie. generally the lower income earner). If the parties agree to allocate the credit otherwise, this default can be changed by selecting the appropriate party from the “Dependant credit claimed by:” dropdown list under the “Children” blue link. Child Care Deduction With respect to child care expenses, a party with custody of the child(ren) may deduct his/her child care expenses for tax purposes, up to the allowed maximum deduction ($8,000/child for children under 7 years of age for 2015 on, and $7,000 for 2014 and prior; $5,000/child for children 7 to 16 years of age for 2015 on, and $4,000/child for 2014 and prior), so long as the child care was incurred to enable the party to work or attend school. Separated parties who share custody and support obligations both appear to have a potential claim for child care expenses incurred by each of them in respect of the same children. In other words, it would appear that both parents can claim the maximum deduction provided they make the payment for child care while the children are in their care to enable the parent to work or attend school. See CRA’s Income Tax Folio S1-F3-C1: Child Care Expense Deduction, specifically Clauses 1.33 – 1.36 (http://www.craarc.gc.ca/tx/tchncl/ncmtx/fls/s1/f3/s1-f3-c1-eng.html– see Schedule “C” attached). In the event that one parent pays the entire cost of the child care and is then reimbursed for a portion of the cost from the other parent, a receipt should be issued by the first parent to the other for the amount reimbursed, so that each party can claim his/her respective applicable child care costs. Note that the ability of each parent to deduct the child care expenses assumes that neither one is living with a new supporting person. In other words, if the party has remarried or is living in a new common law relationship with a new supporting person, that new person may be the one entitled to deduct the child care expenses if ultimately he/she is the one actually paying the expenses. Steps when using DivorceMate’s Tools One software in Shared Parenting Situation 1) Click on the blue link marked “Children”: a. Indicate with whom each child primarily resides from the drop down list under “Lives with:”. For every child in a shared parenting situation, select the “Shared” option. b. Indicate who will claim various miscellaneous benefits/credits for children under 18 (such as certain provincial low income tax reduction schemes, the Ontario Trillium Benefit, etc.) from the drop down list under “Claimed on tax return by:” Note: This does not refer to the CCTB, UCCB or GST/HST credits for the children which are determined based on the party with whom the children live. c. Indicate who will claim the eligible dependant credit from the drop down list beside “Dependant credit claimed by:”. If the child is in a shared parenting situation and both parties are paying support, the parties may agree which party will claim this credit. If there is no agreement, neither party may claim it. If there is more than one child in a shared parenting situation, both parties may be able to claim the credit (see notes above). If you set this drop down list to “Automatic”, the program will assign the credit to the net recipient of child support. The software will determine each party’s respective child support obligation, and will then calculate the set off amount under s.9(a) of the CSG to be paid by the higher income earner. 2) Next, consider if there is to be an adjustment to the straight offset figure as a result of ss. 9(b) and (c) of the CSG. If so, click on the blue link marked “Options” under the “Child Support Guidelines (CSG)” section, and make the appropriate adjustment under the section marked “Shared Custody Considerations”: a. CSG, s. 9(b): 1) Input any adjustment necessary to either party’s child support obligation because of any increased costs of shared custody arrangements (ie. disproportionate spending on the children), in accordance with s.9(b) of the CSG. In other words, if one party is spending disproportionately more on the children than the other party given their respective incomes, then that party must contribute less or the other party must contribute more child support. For example, if the Recipient is disproportionately spending on the children (eg. buying all of the children’s clothing), adjust the CSG Table Amount Offset by either: increasing the Payor’s child support obligation by the applicable amount (by inputting a number under the Payor’s column); or decreasing the Recipient’s child support obligation by the applicable amount (by inputting a minus sign before the number under the Recipient’s column). Or, if the Payor is disproportionately spending on the children (eg. paying for all of the children’s incidental schooling costs such as lunches, field trips, after school programs, supplies, photos, uniforms etc.), adjust the CSG Table Amount Offset by either: increasing the Recipient’s child support obligation by the applicable amount (by inputting a number under the Recipient’s column); or decreasing the Payor’s child support obligation by the applicable amount (by inputting a minus sign before the number under the Payor’s column). Note that if the child support is adjusted because of disproportionate spending (ie. according to s.9(b)), this adjustment is not reflected in INDI in the SSAG calculation and the spousal support range does not change. The adjustment is merely to compensate the party for an expense already incurred on behalf of the children, and so does not increase the party’s INDI for spousal support purposes. b. CSG, s. 9(c): 1) Input any adjustment necessary to either party’s child support obligation because of the conditions, means, needs and other circumstances of each party and of any child for whom support is sought (ie. disparate standards of living), in accordance with s.9(c) of the CSG. In other words, if one party has a significantly lower standard of living warranting adjustment, then that party must contribute less or the other party must contribute more child support to equalize the standards of living of both households. For example, if the Recipient has a lower standard of living warranting adjustment, adjust the CSG Table Amount Offset by either: increasing the Payor’s child support obligation by the applicable amount (by inputting a number under the Payor’s column); or decreasing the Recipient’s child support obligation by the applicable amount (by inputting a minus sign before the number under the Recipient’s column). Or, if the Payor has a lower standard of living warranting adjustment, adjust the CSG Table Amount Offset by either: increasing the Recipient’s child support obligation by the applicable amount (by inputting a number under the Recipient’s column); or decreasing the Payor’s child support obligation by the applicable amount (by inputting a minus sign before the number under the Payor’s column). decreasing the Payor’s child support obligation by the applicable amount (by inputting a minus sign before the number under the Payor’s column). Note that if the child support is adjusted because of disparate standards of living (ie. according to s.9(c)), this adjustment is reflected in INDI in the SSAG calculation and the spousal support range does change. The adjustment affects the parties’ relative standards of living, and so does impact on the parties’ respective INDIs for spousal support purposes. So for example, if the Payor is required to pay increased child support to improve the Recipient’s standard of living, then this increased child support must be reflected in the SSAG formula: the Payor’s INDI decreases, the Recipient’s INDI increases, and the SSAG range consequently goes down. 3) Other areas of the software to keep in mind in shared parenting situations: a. The S.C.C. in Contino held that a claim for special or extraordinary expenses can be examined directly in section 9(c), which is conspicuously broader than section 7. Given this comment, it may be that no expenses should be input as special expenses, and that instead only section 9(c) should be used to increase/decrease the Table amounts offset to account for special or extraordinary expenses. However, until such time as the courts are comfortable using their discretion to vary the Table amounts offset under sections 9(b) and (c), it is likely prudent to continue to delineate and proportionately share section 7 expenses. b. You may view the parties’ respective benefits and credits by checking the box at the very top of your screen marked “Calculation Details”. c. Given the S.C.C.’s comments in Contino requiring actual evidence to be led on increased costs of shared parenting by way of financial statements and/or children’s expense budgets, be aware that our “Forms One” software allows the parties in Ontario to create a children’s budget and a proposed budget from the Financial Statement (Form 13 or 13.1). Schedule “A” CRA General Income Tax and Benefit Guide 2014 http://www.cra-arc.gc.ca/E/pub/tg/5000-g/5000g-14e.pdf Enter your date of birth in the “Information about you” area on page 1 of your return. corporations, you may be able to reduce your tax if you report all of your spouse’s or common-law partner’s dividends. See line 120. Tax Tip You may be able to transfer all or part of your age amount to your spouse or common-law partner or to claim all or part of his or her age amount. See line 326. Line 303 – Spouse or common-law partner amount Line 305 – Amount for an eligible dependant ▼ Claim this amount if, at any time in the year, you supported your spouse or common-law partner (see the definition on page 10) and his or her net income (line 236 of his or her return, or the amount it would be if he or she filed a return) was less than $11,138 ($13,196 if he or she is eligible for the family caregiver amount – see page 35). Complete the appropriate part of Schedule 5 to calculate your claim and attach a copy to your return. Enter the information about your spouse or common-law partner in the “Identification” area on page 1 of your return if you were married or living common-law on December 31, 2014. In certain situations, your spouse’s or common-law partner’s net income must be stated even if your marital status has changed. See “Net income of spouse or common-law partner” in the next section. Both of you cannot claim this amount for each other for the same year. You may be able to claim this amount if, at any time in the year, you met all the following conditions at once: ■ You did not have a spouse or common-law partner or, if you did, you were not living with, supporting, or being supported by that person. ■ You supported a dependant in 2014. ■ You lived with the dependant (in most cases in Canada) in a home you maintained. You cannot claim this amount for a person who was only visiting you. In addition, at the time you met the above conditions, the dependant must also have been either: ■ your parent or grandparent by blood, marriage, common-law partnership, or adoption; or ■ your child, grandchild, brother, or sister, by blood, marriage, common-law partnership, or adoption and under 18 years of age or had an impairment in physical or mental functions. If you had to make support payments to your current or former spouse or common-law partner, and you were separated for only part of 2014 because of a breakdown in your relationship, you have a choice. You can claim the deductible support amounts paid in the year to your spouse or common-law partner on line 220 or an amount on line 303 for your spouse or common-law partner, whichever is better for you. If you reconciled with your spouse or common-law partner before the end of 2014, you can claim an amount on line 303 and any allowable amounts on line 326. Net income of spouse or common-law partner This is the amount on line 236 of your spouse’s or common-law partner’s return, or the amount it would be if he or she filed a return. If you were living with your spouse or common-law partner on December 31, 2014, use his or her net income for the whole year. This applies even if you got married or got back together with your spouse in 2014 or you became a common-law partner or started to live with your common-law partner again (see the definition on page 10). If you separated in 2014 because of a breakdown in your relationship and were not back together on December 31, 2014, reduce your claim only by your spouse’s or common-law partner’s net income before the separation. In all cases, enter, in the “Information about your spouse or common-law partner” area on page 1 of your return, the amount you use to calculate your claim, even if it is zero. Tax Tip If you cannot claim the amount on line 303 (or you have to reduce your claim) because of dividends your spouse or common-law partner received from taxable Canadian 36 Notes Your dependant may live away from home while attending school. If the dependant ordinarily lived with you when not in school, we consider that dependant to live with you for the purposes of this amount. For the purposes of this claim, your child is not required to have lived in Canada but still must have lived with you. This would be possible, for example, if you were a deemed resident (as defined under E and F on page 9) living in another country with your child. Even if all the preceding conditions have been met, you cannot claim this amount if any of the following apply: ■ You or someone else is claiming a spouse or common-law partner amount (line 303) for this dependant. ■ The person for whom you want to claim this amount is your common-law partner. However, you may be able to claim the amount on line 303. ■ Someone else in your household is making this claim. Each household is allowed only one claim for this amount, even if there is more than one dependant in the household. ■ The claim is for a child for whom you had to make support payments for 2014. However, if you were separated from your spouse or common-law partner for only part of 2014 because of a breakdown in your relationship, you may be able to claim an amount for that child on line 305 (plus any allowable amounts on lines 315 and 318) if you do not claim any support amounts paid to your spouse or common-law partner on line 220. You can claim whichever is better for you. www.cra.gc.ca Note If you and another person had to make support payments for the child for 2014 and, as a result, no one would be entitled to claim the amount for an eligible dependant for the child, you can claim this amount if you and the other person(s) paying support agree you will be the one making the claim. If you cannot agree who will claim this amount for the child, neither of you can make the claim. For more information, see Pamphlet P102, Support Payments. throughout the year but cannot agree who will claim the amount, neither of you can make this claim. If the child did not live with both parents throughout the year, the parent or the spouse or common-law partner who claims the amount for an eligible dependant (see line 305) for that child can make the claim. Notes You can claim this amount for the child if you were unable to claim the amount for an eligible dependant because: How to claim You can claim this amount if your dependant’s net income (line 236 of his or her return, or the amount it would be if he or she filed a return) was less than $11,138 ($13,196 if he or she is eligible for the family caregiver amount – see page 35). Complete the appropriate part of Schedule 5 to calculate your claim and give certain details about your dependant. Attach a copy of this schedule to your paper return. Notes If you were a single parent on December 31, 2014, and you choose to include all universal child care benefit (UCCB) amounts you received in 2014 in the income of your dependant, include this amount in the calculation of his or her net income. You cannot split this amount with another person. Once you claim this amount for a dependant, no one else can claim this amount or an amount on line 306 for that dependant. If you and another person can both claim this amount for the same dependant (such as shared custody of a child) but cannot agree who will claim the amount, neither of you can make the claim. Line 367 – Amount for children born in 1997 or later Either you or your spouse or common-law partner can claim an amount for each of your or your spouse’s or common-law partner’s children who are under 18 years of age at the end of the year if the child lived with both of you throughout the year. You may be eligible to claim the family caregiver amount for each child with an impairment in physical or mental functions (see page 35). The full amount can be claimed in the year of the child’s birth, death, or adoption. Notes If you are making this claim for more than one child, either you or your spouse or common-law partner must make the claim for all children under 18 years of age at the end of the year who lived with both of you throughout the year. If you have shared custody of the child throughout the year, the parent who claims the amount for an eligible dependant (see line 305) for that child can make the claim on line 367. If you have shared custody of the child ■ the child’s net income was more than $11,138 ($13,196 if he or she is eligible for the family caregiver amount – see page 35); ■ you are already claiming the amount for an eligible dependant for another child; or ■ another person in your household has already claimed the amount for an eligible dependant (other than the child). If you and another person had to make support payments for the child in 2014 and, as a result, no one would be entitled to claim this amount or the amount for an eligible dependant for the child, you can claim this amount if you and the other person(s) paying support agree you will be the one making the claim. If you cannot agree who will claim this amount for the child, no one can make the claim for that child. How to claim Enter the number of children for whom you are not claiming the family caregiver amount (FCA) in box 366 (above and to the left of line 367 on Schedule 1). For children for whom you are claiming the FCA, enter the number of children in box 352 (beside and to the left of line 367). Claim the result of the calculation on line 367. Tax Tip You may be able to transfer all or part of this amount to your spouse or common-law partner or to claim all or part of his or her amount. See line 326. Line 306 – Amount for infirm dependants age 18 or older You can claim an amount up to a maximum of $6,589 which includes the $2,058 family caregiver amount (see page 35) for each of your or your spouse’s or common-law partner’s dependent children or grandchildren only if that person had an impairment in physical or mental functions and was born in 1996 or earlier. You can also claim an amount for more than one person if each one meets all the following conditions. The person must have been: ■ your or your spouse’s or common-law partner’s parent, grandparent, brother, sister, aunt, uncle, niece, or nephew; ■ born in 1996 or earlier and had an impairment in physical or mental functions; www.cra.gc.ca 37 Schedule “B” CRA Guide P102, Support Payments 2014 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/spprtpymnts/shrdcstdyeng.html Shared custody and the amount for an eligible dependant If you and another person were required to make support payments for a child and, as a result, no one would be entitled to claim the amount for an eligible dependant for the child, you can still claim that amount as long as you and the other person(s) paying support agree that you will make the claim. If you cannot agree who will claim this amount for the child, neither of you can make the claim. For more information about your eligibility to claim the amount for an eligible dependant, see line 305. Example 1 Ryan and Chloe share the custody of their child Faith. Faith spends 50% of her time with Ryan and 50% of her time with Chloe. The court order states that Ryan has to pay Chloe $200 a month and that Chloe has to pay Ryan $100 a month. For convenience, Ryan agrees that Chloe does not have to write him a monthly cheque and that he will simply pay her $100 a month, which will fulfill both their support obligations. Ryan and Chloe agree that Ryan will claim the amount for an eligible dependant on line 305 of his income tax and benefit return. If they did not agree, neither of them could claim the amount on line 305 for Faith. Example 2 Nicholas and Christine share the custody of their children Sam and Amy. Sam and Amy spend 50% of their time with Nicholas and 50% of their time with Christine. The written agreement states that Nicholas has to pay Christine $300 a month and that Christine has to pay Nicholas $400 a month. For convenience, Christine agrees that Nicholas does not have to write her a monthly cheque and that she will simply pay him $100 a month, which will fulfill both their support obligations. Nicholas will claim the amount for an eligible dependant on line 305 of his income tax and benefit return for Sam. Christine will claim the amount for an eligible dependant on line 305 of her income tax and benefit return for Amy. A payment based on a court order or written agreement that calculates child support obligations with reference to a statutory scheme (such as The Federal Child Support Guidelines) does not legally obligate both parents to pay child support. Under these types of agreement only the payer is considered to have made support payments, since there is no legal obligation for the recipient to pay an amount. Example William and Julie share custody of their children, Emily and Eric. Emily and Eric spend 50% of their time with William and 50% of their time with Julie. Based on William's and Julie's incomes, the court order states that William has to pay Julie $250 a month according to The Federal Child Support Guidelines. The amount William pays is considered a support payment because he has a legal obligation to pay the amount to Julie. Therefore, William is not entitled to a claim on line 305 for either Emily or Eric. However, Julie can claim an amount for an eligible dependant on line 305 of her income tax and benefit return for Emily or Eric, as Julie has no legal obligation to pay an amount to William for Emily or Eric. Schedule “C” CRA Income Tax Folio S1-F3-C1 Child Care Expense Deduction Clauses 1.33 – 1.36 http://www.cra-arc.gc.ca/tx/tchncl/ncmtx/fls/s1/f3/s1-f3-c1-eng.html Separation and shared custody 1.33 The situations in which a higher income spouse or common–law partner may be able to claim child care expenses in the year of separation, where there has been a breakdown in the marriage or common-law partnership and there has been a reconciliation within 60 days after the end of the year, are discussed at ¶1.31. If, in the year of separation, reconciliation does not occur within 60 days after the end of the year, there will not be a supporting person for the year. In this case, child care expenses will be allowed only to the individual who resided with the eligible child and only to the extent that the expenses were paid by that individual to enable the individual to engage in one of the activities listed in ¶ 1.9. 1.34 In situations where there is no supporting person of the eligible child for the year, and the child lived with each parent at different times in a year (for example, in shared custody situations), both parents may claim a deduction for the year as provided in ¶1.38 - 1.42. Each parent may only claim child care expenses incurred for a period during the year that the eligible child resided with the parent and only to the extent that the expenses were paid by that parent to enable that parent to engage in the activities listed in ¶1.9. In these cases, the CRA will generally consider each parent to reside with a child while the child is in their custody. 1.35 In shared custody situations, one parent (the first parent) may pay the child care provider and be reimbursed for a portion of the child care costs by the other parent (the second parent). In these cases, the child care provider should issue a receipt to the first parent for the full amount of the payment for child care expenses. The first parent should issue a receipt to the second parent for the amount of the reimbursement. The first parent is generally considered to have paid child care expenses in the amount they paid the child care provider, net of the reimbursement received from the second parent. The second parent is generally considered to have paid child care expenses in the amount of the reimbursement they paid to the first parent. This will not be the case however, where the reimbursement is a support payment that must be included in the income of the first parent and that is deductible in computing the taxable income of the second parent. A reimbursement that must be included in the first parent’s income will not reduce the amount of the child care expenses that can be claimed by that parent. Where the amount of the payment made by the second parent to the first parent is a support payment that is deductible in computing the second parent’s income, the payment would not be considered a child care expense paid by the second parent. For assistance in determining whether a payment is considered a support payment and whether it is taxable to the recipient and deductible to payer, please refer to Income Tax Folio S1-F3-C3 . 1.36 The comments in ¶1.33 - 1.35 assume that neither parent is residing with a new supporting person during the year. If a parent remarries or enters into a new common-law relationship with another person in circumstances such that the other person is a supporting person, the new supporting person may be the one entitled to deduct child care expenses.