annual report 2012

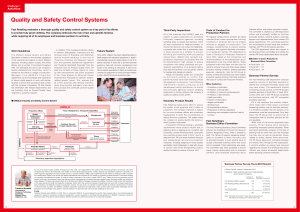

advertisement