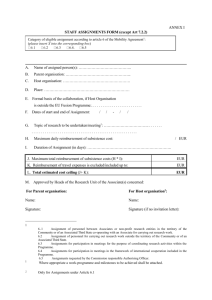

Financial statements 31.12.2013

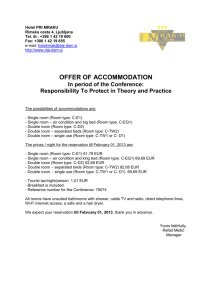

advertisement