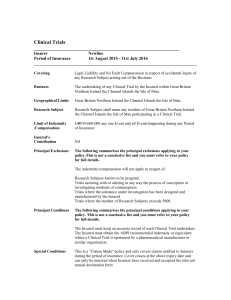

Industrial Special Risks Schedule

advertisement