Electrical Contracting Industry WA Award Summary

advertisement

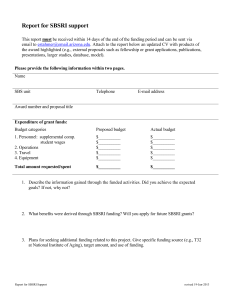

Electrical Contracting Industry WA Award Summary Things to check as an employee or employer include: Pay rates Employment of children Allowances Overtime rates Public holidays Meal breaks Leave entitlements Dismissal laws and entitlements due on termination Time and wages record keeping Laws relating to taxation, superannuation, workers compensation, discrimination and occupational health and safety This WA award summary outlines only the most common entitlements within the Western Australian state system of industrial relations under the Electrical Contracting Industry Award R 22 of 1978. It applies only to sole traders and partnerships. If the business is a Pty Ltd company, it does not apply. If you are unsure contact Wageline on 1300 655 266. To access the full version of the WA award, which details all entitlements and obligations, visit www.wairc.wa.gov.au. Adult wages – apply as of the first pay period on or after 1 July 2015 Level 1 Electronics Tradesman Level 2 Instrument Fitter/Electrical Grade 2 Electrician - Special Class Level 3 Instrument Fitter/Electrical Grade 1 Electrical Installer / Mechanic Electrical Fitter Cable Jointer Linesperson Grade 1 Level 4 Linesperson Grade 2 Level 5 Electrical Assistant 1 Weekly Hourly Casual 20% loading $917.00 $24.13 $28.96 $863.50 $855.30 $22.72 $22.51 $27.26 $27.01 $848.30 $829.80 $829.80 $829.80 $829.80 $22.32 $21.84 $21.84 $21.84 $21.84 $26.78 $26.21 $26.21 $26.21 $26.21 $812.80 $21.39 $25.67 $753.10 $19.82 $23.78 Apprentice wages – apply as of the first pay period on or after 1 July 2015 Weekly Hourly Tool Allowance* Weekly Grievance Allowance* 39% 51% 67% $323.60 $423.20 $556.00 $8.52 $11.14 $14.63 $6.55 $8.57 $11.26 $13.53 $17.70 $23.25 79% $655.50 $17.25 $13.27 $27.41 4 Year Term % of Electrical Installer 1st Year 2nd Year 3rd Year 4th Year *Allowances in the table above apply as of the first pay period on or after 5 November 2015. Adult apprentices Apprentices aged 21 and above receive the minimum adult wage of $584.20 per week or the prescribed apprenticeship rate, whichever is the higher, for ordinary hours of work. Junior wages Juniors working in the electrical contracting industry must be paid at adult rates. Employment of children Under the Children and Community Services Act 2004, it is illegal to employ children under the age of 15 in this industry. Exemptions may apply to children working in a family business where the business is carried out by a parent or relative of the child, in a not-for-profit organisation or when they are participating in a school program. School aged children must not be employed during school hours, unless they are participating in a school program or have received an exemption from the Department of Education. A child under 18 must not be employed in a job that jeopardises their wellbeing. Please contact Wageline on 1300 655 266 or visit the Commerce website at When Can Children Work? for employers, or Young Workers for employees for more information. Allowances Grievance allowance – increased as of the first pay period on or after 5 November 2015 A special allowance of $34.70 per week shall be paid as a flat amount each week except where direct action takes place. Apprentices shall receive a percentage of this allowance, as shown in the wages table above. Tool allowance – increased as of the first pay period on or after 5 November 2015 If a tradesperson or an apprentice is not supplied with the tools ordinarily required by that tradesperson or apprentice in the performance of their work, the employer shall pay an allowance for the purpose of such tradesperson or apprentice supplying and maintaining the tools required. This allowance shall be $16.80 per week to such tradespersons, or in the case of an apprentice a percentage of $16.80 being the percentage which appears against the apprentice's year of apprenticeship, as seen in the wages table above. 2 Travel allowance An employee who is required to work away from their usual workshop or depot shall be paid for time spent in travelling between their home and the job (to the extent that it exceeds normal time spent in travel) and shall be reimbursed for any fares incurred in such travelling (to the extent that the fares exceed normal fares incurred). An employee using their own vehicle for travel to or from outside jobs shall be paid the amount of excess fares and travelling time which the employee would have incurred in using public transport unless the employee has an arrangement with their employer for a regular allowance. Other employees engaged on construction work may be entitled to alternative allowances for travel. Please contact Wageline on 1300 655 266 or see the full version of the WA award at www.wairc.wa.gov.au for details. Car allowance – increased as of the first pay period on or after 9 December 2014 Where an employee is required and authorised to use their own vehicle in the course of their duties the employee shall be paid an allowance of 80.2 cents per kilometre travelled. Provided that the employer and the employee may make any other arrangement as to car allowance not less favourable to the employee. Meal allowance – increased as of the first pay period on or after 5 November 2015 An employee required to work overtime for more than two hours without being notified on the previous day or earlier that they will be so required to work overtime shall be supplied with a meal by the employer or be paid $13.70 for such meal and for a second or subsequent meal if so required. Leading hand allowance – increased as of the first pay period on or after 5 November 2015 In addition to the total weekly wage, a leading hand must be paid the additional allowance as below: If placed in charge of at least 3 but no more than 10 other employees If placed in charge of more than 10 but no more than 20 other employees If placed in charge of more than 20 other employees $29.20 $44.90 $57.90 Construction allowance – increased as of the first pay period on or after 5 November 2015 If an employee is employed on particular types of construction, they must receive the following weekly allowance: If working on the construction of a multi-storey building which will have less than 5 storeys on completion If working on the construction of a building which will have at 5 or more storeys on completion, but only until the exterior walls have been erected and the windows completed and a lift made available to carry the employee between the ground floor and the floor upon which the employee is required to work If working on the construction of a large undertaking or large civil engineering project $27.80 $46.90 $52.20 Licence Allowance – increased as of the first pay period on or after 5 November 2015 A tradesperson who holds and in the course of his/her employment may be required to use a current "A" Grade or "B" Grade licence issued pursuant to the relevant regulation in force at the date of this WA award under the Electricity Act 1945, shall be paid $24.80 per week. Location allowance An employee working in a specified regional area is entitled to a weekly location allowance. Please contact Wageline on 1300 655 266 or see the full version of the WA award at www.wairc.wa.gov.au for details. Hours and overtime The ordinary hours of work shall be an average of 38 hours per week to be worked on one of the bases prescribed in the WA award. Ordinary hours shall be worked Monday to Friday inclusive, and, except in the case of shift employees, between the hours of 6:00am and 6:00pm. Provided that the spread of hours may be altered by agreement between the employer and the majority of employees in the plant or section or sections concerned. 3 The ordinary hours of work shall not exceed 10 hours on any day. Provided that in any arrangement of ordinary working hours, where such ordinary hours are to exceed 8 hours on any day, the arrangement shall be subject to the agreement between the employer and the majority of employees in the plant or section or sections concerned. All work done beyond the ordinary working hours on any day, Monday to Friday, inclusive, shall be paid for at the rate of time and one-half for the first two hours and double time after that. Weekend work Work done on Saturday prior to 12:00 noon shall be paid for at the rate of time and one half for the first two hours and double time thereafter. All work performed after 12:00 noon on Saturday or on Sundays shall be paid for at the rate of double time. Different hours and overtime provisions apply to shift employees. Please contact Wageline on 1300 655 266 for more information relating to shift work. Meal breaks An employee shall not be required to work for more than five hours without a meal break of not more than one hour. If the meal break is postponed for more then half an hour the employee shall receive overtime rates until they are provided with a meal. A paid rest break of 10 minutes shall also be allowed each morning at a time that is convenient for the employer. Additional breaks apply when an employee works overtime. For more information please contact Wageline on 1300 655 266 or see the full version of the WA award at www.wairc.wa.gov.au. Public holidays Full-time employees are entitled to public holidays (or days substituted for public holidays) without deduction of pay. Part-time employees are entitled to public holidays (or days substituted for public holidays) without deduction of pay if they would ordinarily be required to work on that day. If a public holiday falls on a Saturday or Sunday, the following Monday will be considered to be the public holiday. However, if Boxing Day falls on a Sunday or Monday, the following Tuesday will be considered to be the public holiday. When a public holiday is substituted with another day, the public holiday itself is no longer considered a public holiday for the purposes of the WA award. If an employee works on a public holiday or substituted public holiday, they must receive at least three hours’ payment at the appropriate overtime rate. All hours worked on a public holiday shall be paid for at the rate of double time and a half. To view public holiday dates visit our website www.commerce.wa.gov.au/labourrelations. Leave entitlements The table below outlines the basic leave entitlements for employees covered by this WA award. For more information relating to leave entitlements, please contact Wageline on 1300 655 266 or see the full version of the WA award at www.wairc.wa.gov.au. Type of leave Annual leave Sick leave Personal leave Entitlement Full-time employees accrue 2.923 hours weekly; this amounts to four weeks per year (pro rata for part-time) which is allowed annually after a period of 12 months’ continuous service. Leave accumulates year to year. In addition, a loading of 17.5% applies. For the annual leave information page visit www.commerce.wa.gov.au/labourrelations. Full-time employees accrue 1.583 hours weekly (pro-rata for part-time). Leave accumulates from year to year. Full-time employees accrue 1.461 hours weekly; this amounts to 10 days a year (pro rata for part-time). This can be used for sick leave or 4 Bereavement leave Parental leave Long service leave Portable long service leave carer’s leave and accumulates year to year. For the personal leave information page visit www.commerce.wa.gov.au/labourrelations. Two days per occasion for any employee (including casuals), applies on the death of a partner, parent, step-parent, grandparent, child, stepchild, grandchild, sibling or any other member of the employee’s household. See the parental leave information on the Commerce website or contact Wageline on 1300 655 266 for details. In accordance with the Long Service Leave Act 1958, 8.667 weeks after 10 years’ continuous employment for any employee (including casuals), and a further 4.333 weeks every subsequent 5 years, with pro-rata payments due on termination any time after 7 years’ continuous employment. For the long service leave information sheet please visit www.commerce.wa.gov.au/labourrelations. If engaged in construction work please contact the My Leave on 1800 198 136. Time and wages recordkeeping Employers must keep time and wages records which demonstrate that employees have been paid all entitlements under the relevant WA award or legislation. For information about time and wages record keeping, contact Wageline on 1300 655 266 or visit Record Keeping Requirements on the Commerce website. Termination It is recommended that an employer contact Wageline on 1300 655 266 before any termination, to receive information about dismissal laws. Termination by an employer Full-time and part-time employees, except in the case of misconduct justifying instant dismissal, may be terminated with the following period of notice (or payment in lieu): Period of continuous service Applicable notice During the first month 1 week* 2 months or more but less than 1 year 1 week 1 year or more but less than 3 years 2 weeks 3 years or more but less than 5 years 3 weeks 5 years or more 4 weeks Employees over 45 years of age with two or more years’ continuous service at the time of termination shall receive an additional week’s notice. *The entitlement to one week of notice on termination during the first month of employment is provided by the Fair Work Act 2009. Employers must read the notice provisions of the WA award in conjunction with the Fair Work Act 2009, as a greater entitlement may be applicable. Termination of a casual employee Casual employees may terminate or be terminated by one hour’s notice (on either side). Termination by an employee Full-time and part-time employees may terminate their employment by providing the following period of notice: Period of continuous service During the first month More than 1 month but less than 1 year More than 1 year but less than 3 years More than 3 years but less than 5 years 5 years or more Applicable notice 1 day 1 week 2 weeks 3 weeks 4 weeks 5 Employees who do not provide the required notice as prescribed above, may be liable to forfeit certain entitlements. Please contact Wageline on 1300 655 266 for more information. Termination of an apprentice To terminate an apprentice or trainee an employer must apply in writing to the Department of Training and Workforce Development Apprenticeship Office (formerly the Apprenticentre) on 13 19 54. For information relating to notice periods for apprentices, please contact Wageline on 1300 655 266. Redundancy** If an employee ceases to be employed for any reason other than misconduct, the following redundancy/severance payments apply: Period of continuous service with an employer Redundancy/severance pay 1 year or more but 2.4 weeks' pay plus, for all less than 2 years service in excess of 1 year, 1.75 hours' pay per completed week of service up to a maximum of 4.8 weeks' pay. 2 years or more but 4.8 weeks' pay plus, for all less than 3 years service in excess of 2 years, 1.6 hours' pay per completed week of service up to a maximum of 7 weeks' pay. 3 years or more but 7 weeks' pay plus, for all less than 4 years service in excess of 3 years, 0.73 hours' pay per completed week of service up to a maximum of 8 weeks' pay. 4 years or more 8 weeks' pay. Provided that an employee employed for less than 12 months shall be entitled to payment of 1.75 hours per week of service if, and only if, redundancy is occasioned otherwise than by the employee. **Service as an apprentice will entitle an employee to accumulate credits towards the payment of a redundancy benefit in accordance with this clause if the employee completes an apprenticeship and remains in employment with that employer for a further 12 months. Additional redundancy payments may apply if the employer has made a definite decision that the employer no longer wishes the job the employee has been doing done by anyone. Please call Wageline on 1300 655 266 for more information about redundancy. Other entitlements The WA Award also includes: Safety footwear Shift work Payment of wages Posting of awards and union notices Special rates and provisions Adverse weather Travelling and employment in construction work Distant work 6 This WA award summary has only included the most common employee entitlements. To minimise the risk of non-compliance with State employment laws, please contact Wageline on 1300 655 266 to clarify your understanding of this WA award summary. Wageline offers advice and publications to assist employees and employers better understand their rights and obligations in the workplace. To keep informed and receive practical information on employment issues, please subscribe to Wageline’s email newsletters at www.commerce.wa.gov.au/labourrelations. Disclaimer: The Department of Commerce has prepared this state award summary to provide information on pay rates and major award provisions. It is provided as a general guide only and is not designed to be comprehensive or to provide legal advice. The Department of Commerce does not accept liability for any claim which may arise from any person acting on, or refraining from acting on, this information. 7