(Un?)stable Dynamics, and Fundamental Uncertainty

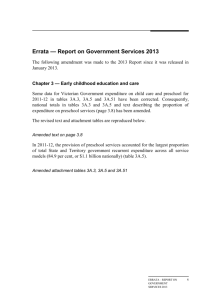

advertisement

Accounting, Distribution, (Un?)stable Dynamics, and Fundamental Uncertainty Lance Taylor New School for Social Research Simple SAM Current Outlays Output Costs Output Uses Incomes Wages Profits Taxes Flow of funds Macro balance Totals Wages Profits Fiscal Cap. form Totals Much More Complicated SAM (2009) 2009 (Annual) Sources of income Output HOUSEHOLDS Labor compensation Proprietors' income and rental income Consumption of fixed capital by households and NPOs Personal interest and dividend income Business transfer payments to HOU (net) Government social benefits to persons NONFINANCIAL BUSINESS Consumption of fixed capital Statistical discrepancy Net operating surplus Wage accruals less disbursements GOVERNMENT Taxes on production and imports Subsidies Government consumption of fixed capital Current surplus of government enterprises Taxes on corporate income from BUS Business transfer payments to GOV (net) Personal current taxes Taxes from the ROW Contributions for government social insurance Current transfer receipts from persons Government interest and misc asset receipts Government dividends receipts REST OF THE WORLD US Imports of goods and services US income paid to ROW Taxes on corporate income paid to the ROW Business transfer payments to ROW (net) Personal current transfer payments to ROW (net) Government current transfer payments to ROW FINANCIAL BUSINESS Personal interest payments US income receipts from ROW Government interest payments Business dividends paid HOUSEHOLDS NONFINANCIAL BUSINESS GOVERNMENT REST OF THE WORLD FINANCIAL BUSINESS Total 9,361.20 7,799.40 HHS 9,845.90 - Current expenditures GOV ROW 2,460.20 1,587.40 39.60 2,100.50 - BUS FIN HHS 354.10 Capital expenditures BUS GOV ROW 1,195.10 506.90 FIN Total 15,949.60 13,127.80 1,626.50 GDP 13,973.4 1,269.10 292.70 13,127.8 1,626.50 39.60 3,340.90 1,250.00 118.30 1,972.60 1,271.40 5.00 5.00 2,016.40 - 341.90 2,100.50 - - - 14.80 3,345.90 143.10 3,787.60 122.20 20.90 498.90 2,631.90 1,023.20 (59.70) 323.50 (15.60) 245.90 96.00 963.10 14.80 968.10 85.20 1,976.20 66.10 21.20 69.50 - 1,976.20 498.90 23.50 (2.30) 66.10 - 217.10 217.10 554.10 69.50 357.90 642.40 - 1,771.50 642.40 357.90 554.10 977.30 354.10 2,389.10 1,195.10 (1,200.50) 506.90 387.30 (497.00) 15,949.70 SUMMARY OF CURRENT ACCOUNT Total current expenditure Total current income Current surplus 13,127.80 3,345.90 3,787.60 2,631.90 1,771.50 HHS 12,150.50 13,127.80 977.30 BUS 956.80 3,345.90 2,389.10 GOV 4,988.10 3,787.60 (1,200.50) ROW 2,244.60 2,631.90 387.30 FIN 2,268.50 1,771.50 (497.00) Row total => Column total => Discrepancy=> Total 22,608.50 24,664.70 2,056.20 HOU NET LENDING BUS NET LENDING GOV NET LENDING ROW NET LENDING 623.20 1,194.00 (1,707.40) 387.30 (497.00) 24,664.70 24,664.80 0.10 623.20 697.00 (1,707.40) 387.30 Income and Expenditure Flows for Non‐Household Sectors (2009) Levels ($ Trillions) BUSINESS (Incomes) BUSINESS (Outlays) GOVERNMENT (Incomes) GOVERNMENT ROW (Incomes) ROW (Outlays) (Outlays) FINANCE (Incomes) FINANCE (Outlays) 6.00 5.00 4.00 3.00 2.00 1.00 (1.00) (2.00) HH (INCOME) BUS (INCOME) GOV (INCOME) ROW(INCOME) FIN (INCOME) BUS(EXPENDITURES) GOV(EXPENDITURE) ROW(EXPENDITURE) FIN(EXPENDITURES) SAVINGS HH (EXPENDITURES) US Income Size Distribution Adjusted to the NIPA (2009) Current 2009 US Income Size Distribution Adjusted to the National Income and Product Accounts Totals in US$ Billions Adjusted to NIPA Income Sources Wages Transfers Finance Proprietor's Income and CCA Total Income Outlays Consumption Contributions to Social Insurance Taxes Interest paid Saving Total Income Totals in US $ Thousands (Adjusted to NIPA) Mean Income (Before Taxes) Mean Income (After Taxes) Savings Rate (on after tax income) Mean Rate of Contributions to Social Insurance Mean Rate of Taxes Mean Overall Tax Rate First Quintile Second Quintile Third Quintile Fourth Quintile 81-90% 91-99% Top 1% Totals for Top Quintile Total 345.0 273.8 25.0 673.5 490.5 71.7 1100.3 517.3 170.7 1737.2 459.5 295.0 1317.6 184.9 221.1 1935.1 157.5 397.2 690.7 16.9 445.9 7799.4 2100.5 1626.5 3943.4 359.3 1064.1 48.6 692.4 73.6 1309.3 139.8 1928.0 229.9 2721.7 173.4 1897.0 398.9 2888.6 537.2 1690.8 1601.4 13127.8 1109.5 6476.4 1274.4 1360.9 1584.4 1957.4 1229.1 1637.1 802.5 9845.9 3668.8 44.0 (35.5) 23.3 (613.9) 692.4 93.9 (12.5) 26.5 (159.4) 1309.3 152.0 44.5 44.3 102.8 1928.0 234.6 139.4 64.2 326.1 2721.7 175.5 151.9 14.5 325.9 1897.0 226.6 365.9 26.4 632.6 2888.6 41.5 394.5 17.9 434.4 1690.8 968.1 1048.3 217.1 1048.4 13127.8 443.6 912.3 58.8 1392.9 6476.4 30.44 55.57 81.29 116.59 161.29 269.94 1485.73 111.62 274.26 30.06 52.11 73.00 100.57 133.46 214.57 1102.61 94.47 216.84 (0.90) (0.13) 0.06 0.14 0.21 0.28 0.35 0.09 0.27 0.06 0.07 0.08 0.09 0.09 0.08 0.02 0.07 0.07 (0.05) (0.01) 0.02 0.05 0.08 0.13 0.23 0.08 0.14 0.01 0.06 0.10 0.14 0.17 0.21 0.26 0.15 0.21 Levels ($Trillions) First Quintile First Quintile (Income) (Expenditure) Second Quintile (Income) Second Quintile Third Quintile Third Quintile Fourth Quintile Fourth Quintile (Expenditure) (Income) (Expenditure) (Income) (Expenditure) 81-90% (Income) 81-90% (Expenditure) 91-99% (Income) 91-99% (Expenditure) Top 1% (Income) Top 1% (Expenditure) 3.5 Average Incomes ($ Thousands) Figure 2: Current (2009) Income and Expenditure Flows by “Household” and Household Mean Income Levels 1200 3 1000 2.5 2 800 1.5 600 1 0.5 400 0 200 -0.5 -1 0 Wages (Incomes) Transfers (Incomes) Finance (Incomes) Proprietor's Income and CCA (Incomes) Consumption (Expenditure) Contributions to Social Insurance (Expenditure) Taxes (Expenditure) Interest paid (Expenditure) Saving (Expenditure) Average Income (Post Tax) Approximate fiscal position in “fiscal units” of account (U1 = $400 billion) Note: The “middle class” comprises households between the 41st and 90th percentiles of the size distribution of income. Goodwin Cycle • Wage • share • • • Stable share Stable demand Output gap Long-run trends in the Barbosa-Taylor model based on a panel data estimation of the (OECD ) Source: Kiefer and Rada (2012), work in progress Sectoral net borrowing flows normalized by GDP and NBER reference cycles. 0.12 0.12 0.07 0.07 0.02 0.02 -0.03 -0.03 -0.08 -0.08 Recessions Household Recessions 0.12 0.12 0.07 0.07 0.02 0.02 -0.03 -0.03 -0.08 -0.08 Recessions Government Recessions Business Foreign Real US housing price index vs. real consumer debt 180 2006-I 160 Real Housing Prices (2000-I=100) 2007-I 2005-I 140 2008-I 2004-I 2003-I 2002-I 120 2001-I 2009-I 2000-I 1999-I 1990-I 1989-I 1988-I 1998-I 1987-I 1994-I 1996-I 1986-I 1985-I 80 1980-I 100 60 40 20 0 35 55 75 95 115 Real Debt 135 155 175 Possible greenhouse gas vs. capital dynamics GHG/capital • • • • • • • • • • S B Z Stable capital S A C Stable GHG Capital per capita Uncertainty • • • • Knight Hayek Keynes Wittgenstein… • Clausewitz, Rumsfeld, Jared Diamond And thanks to…. • • • • • • • • • Rudi von Arnim Nelson Barbosa Laura de Carvalho Duncan Foley Ben Mitra-Khan Rishabh Kumar Codrina Rada Armon Rezai Luca Zamparelli ….. and SCEPA (New School) and INET