Mortgage Sales Manager - Originator

advertisement

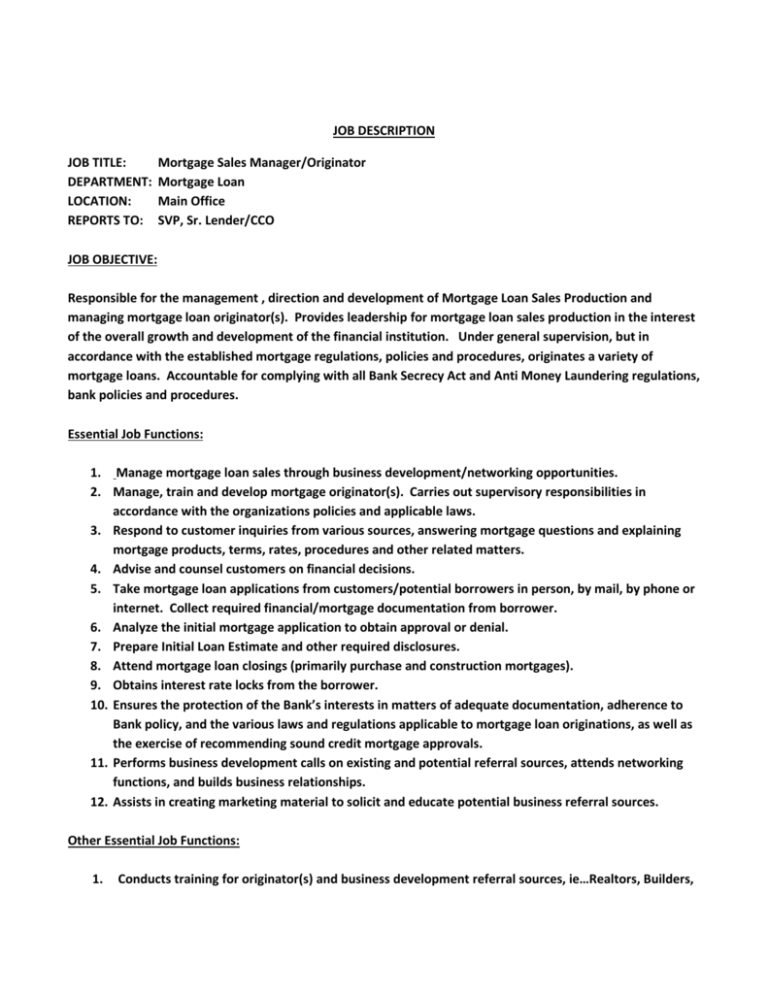

JOB DESCRIPTION JOB TITLE: DEPARTMENT: LOCATION: REPORTS TO: Mortgage Sales Manager/Originator Mortgage Loan Main Office SVP, Sr. Lender/CCO JOB OBJECTIVE: Responsible for the management , direction and development of Mortgage Loan Sales Production and managing mortgage loan originator(s). Provides leadership for mortgage loan sales production in the interest of the overall growth and development of the financial institution. Under general supervision, but in accordance with the established mortgage regulations, policies and procedures, originates a variety of mortgage loans. Accountable for complying with all Bank Secrecy Act and Anti Money Laundering regulations, bank policies and procedures. Essential Job Functions: 1. Manage mortgage loan sales through business development/networking opportunities. 2. Manage, train and develop mortgage originator(s). Carries out supervisory responsibilities in accordance with the organizations policies and applicable laws. 3. Respond to customer inquiries from various sources, answering mortgage questions and explaining mortgage products, terms, rates, procedures and other related matters. 4. Advise and counsel customers on financial decisions. 5. Take mortgage loan applications from customers/potential borrowers in person, by mail, by phone or internet. Collect required financial/mortgage documentation from borrower. 6. Analyze the initial mortgage application to obtain approval or denial. 7. Prepare Initial Loan Estimate and other required disclosures. 8. Attend mortgage loan closings (primarily purchase and construction mortgages). 9. Obtains interest rate locks from the borrower. 10. Ensures the protection of the Bank’s interests in matters of adequate documentation, adherence to Bank policy, and the various laws and regulations applicable to mortgage loan originations, as well as the exercise of recommending sound credit mortgage approvals. 11. Performs business development calls on existing and potential referral sources, attends networking functions, and builds business relationships. 12. Assists in creating marketing material to solicit and educate potential business referral sources. Other Essential Job Functions: 1. Conducts training for originator(s) and business development referral sources, ie…Realtors, Builders, Networking groups, etc. 2. Monitor budget goals of mortgage sales department. 3. Cross sell bank products to enhance bank performance and customer relationship. Skills and Abilities required: 1. 2. 3. 4. 5. 6. 7. 8. The analytical ability to conduct an analysis of an applicant’s credit status and recommend alternatives where the analysis reveals an insufficient financial posture. The ability to manage employees effectively. The ability to speak, read and write English and to perform complex loan calculations. The ability to prepare a detailed summary loan approval recommendation to the appropriate lending authority. The ability to proficiently operate a loan origination system. Good personal computer skills required including familiarity with Excel and Word. The ability to establish excellent customer relationships with a variety of customers and referral sources. Understanding/knowledge of mortgage lending regulations. Minimum Level Preparation and Training Normally Required by the Job: 1. A bachelor’s degree in a business field is preferred, however, an equivalent training history and work history of at least five years, preferably ten years, will be considered. 2. Five years experience in various types of mortgage lending. 3. Three years, preferably five years, supervisory experience. Working Conditions: 1. Generally good. Some exposure to adverse conditions when making business development calls or traveling to meet customers. 2. Must possess a valid Indiana driver’s license as local travel is required in and around the central Indiana area when meeting clients and/or making business development calls.