Processed Food and Food Processing Machinery and Equipment

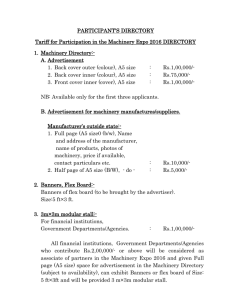

advertisement