Stop harassing taxpayers, Chong tells IRB

advertisement

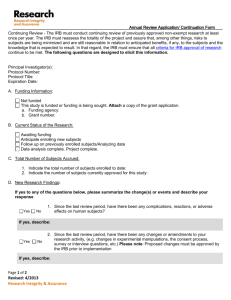

Headline MediaTitle Date Section Page No Language Journalist Frequency Stop harassing taxpayers, Chong tells IRB Borneo Post (Kuching) 15 Oct 2015 Home 10 English N/A Daily (EM) Color Circulation Readership ArticleSize AdValue PR Value Black/white 89,224 267,672 348 cm² RM 2,373 RM 7,119 Stop harassing taxpayers, Chong tells IRB « "It is a duty of the people to pay tax KUCHING: Anoppositionlawmakerhere wants the Inland Revenue Board (IRB) to but there should be a limit on how IRB stop 'tax harassment' of taxpayers for collect taxes. In this case, you can't expect a taxpayer to keep receipts up to 10 to 20 backdated claims of over six years. Bandar Kuching MP Chong Chieng years. Even the bank has a limitation of Jen believed the Limitation Act 1953 six years. It's unfair for creditors to ask and Sabah and Sarawak Limitation debtors for receipts. Ordinances should be amended so that "In Ho's case, she did not receive any agencies such as IRB stopped making inheritance. Under the Limitation Act, backdated claims. if you don't ask for money within the He said he planned to raise this matter time limit, you lose those rights. What in Parliament. Inland Revenue did is inhuman and Recently, a widow, who wished to be unethical," Chongtoldapress conference known as Ho, received a letter from IRB here yesterday. demanding her late husband, Pui Kim Following a meeting with Ho, who is a Hong, pay outstanding tax of RM5.613.20 petty trader, Chong said he had written for assessment years from 1989 to 1993. The letter, dated March 26, 2015, a letter to the IRB, enclosed with a copy demanded the deceased to make of Pui's death certificate. Chong claimed that of late, IRBhasbeen arrangements to settle his alleged tax. issuing letters demanding taxpayers to IRB stated it was prepared to discuss payment proposal from the late Pui to pay alleged outstanding taxpayable some lessen his financial burden. The letter also mentioned that if the 10 to 20 years ago. Such letters included threats that if no payments were made, agency did not receive any response by legal action and restriction of travel order would be issued. April 9,2015, court action could be taken He hoped IRB would have more respect against the deceased, who passed away for the law and basic principles offairness. on Aug 6,1997. and justice in the collection of debt. The law of limitations in Malaysia is In addition, it stated the late Pui could be barred from travelling outside the contained in the Limitation Act 1953 country under Section 104 of the Income (Act 254) which declares itself to be an Tax Act 1967. According to state DAP chairman Chong, Ho had met with IRB officers only to be told that the family must pay the alleged outstanding debt. Chong, who is also Kota Sentosa assemblyman, believed Ho should not be held for any outstanding tax, considering that she did not inherit anything from her husband, who passed away 18 years ago. Act to provide for limitation of actions and arbitrations that applies only in Peninsular Malaysia. Sabah and Sarawak have their own respective Limitation Ordinances, which share a similar format, except for some differences. The scheme of the Act generally allows a per iod of six years ­12 years in the case of land ­ to bring an action for the relief that is sought. Chong (right) with Ho on his right, holds a letter from IRB demanding the deceased to pay his alleged tax outstanding from over 20 years ago.