SAP-FICO-Interview-Questions

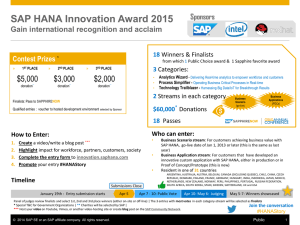

advertisement