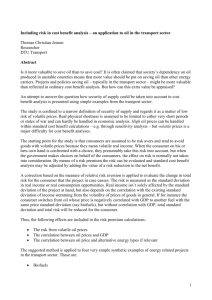

The Loss Aversion/Narrow Framing Approach to

advertisement