Audit Memo - CPA Ontario

2006 SOA Final Examination Question 3

Suggested Solution

Page 1 of 6

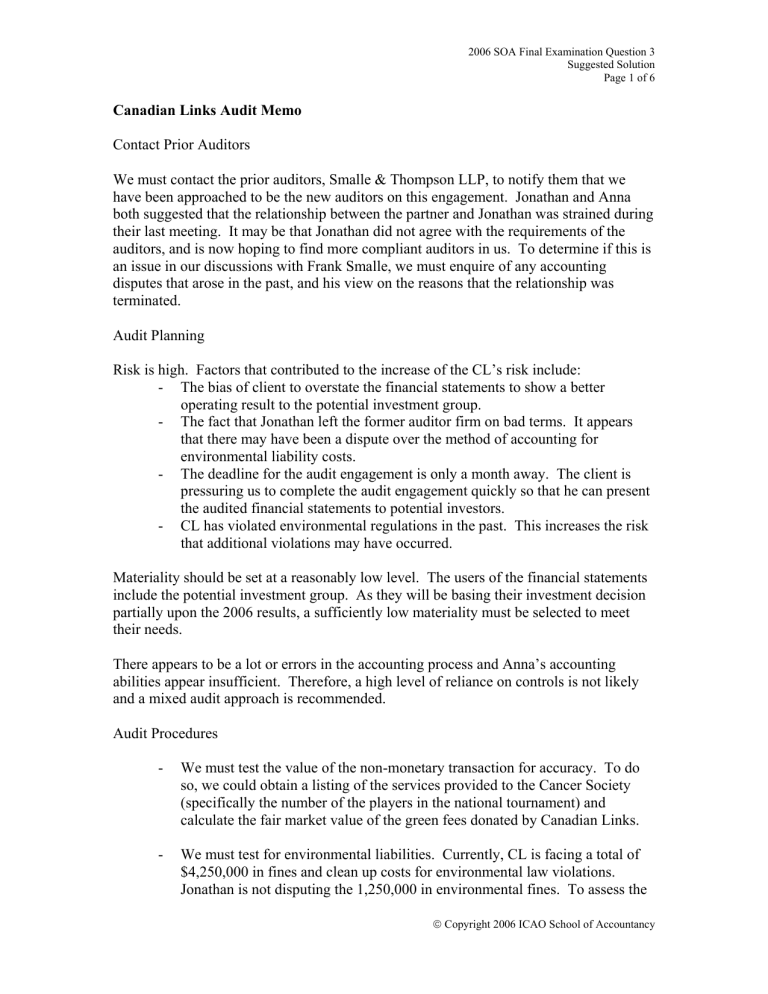

Canadian Links Audit Memo

Contact Prior Auditors

We must contact the prior auditors, Smalle & Thompson LLP, to notify them that we have been approached to be the new auditors on this engagement. Jonathan and Anna both suggested that the relationship between the partner and Jonathan was strained during their last meeting. It may be that Jonathan did not agree with the requirements of the auditors, and is now hoping to find more compliant auditors in us. To determine if this is an issue in our discussions with Frank Smalle, we must enquire of any accounting disputes that arose in the past, and his view on the reasons that the relationship was terminated.

Audit Planning

Risk is high. Factors that contributed to the increase of the CL’s risk include:

- The bias of client to overstate the financial statements to show a better operating result to the potential investment group.

- The fact that Jonathan left the former auditor firm on bad terms. It appears that there may have been a dispute over the method of accounting for environmental liability costs.

- The deadline for the audit engagement is only a month away. The client is pressuring us to complete the audit engagement quickly so that he can present the audited financial statements to potential investors.

- CL has violated environmental regulations in the past. This increases the risk that additional violations may have occurred.

Materiality should be set at a reasonably low level. The users of the financial statements include the potential investment group. As they will be basing their investment decision partially upon the 2006 results, a sufficiently low materiality must be selected to meet their needs.

There appears to be a lot or errors in the accounting process and Anna’s accounting abilities appear insufficient. Therefore, a high level of reliance on controls is not likely and a mixed audit approach is recommended.

Audit Procedures

- We must test the value of the non-monetary transaction for accuracy. To do so, we could obtain a listing of the services provided to the Cancer Society

(specifically the number of the players in the national tournament) and calculate the fair market value of the green fees donated by Canadian Links.

- We must test for environmental liabilities. Currently, CL is facing a total of

$4,250,000 in fines and clean up costs for environmental law violations.

Jonathan is not disputing the 1,250,000 in environmental fines. To assess the

©

Copyright 2006 ICAO School of Accountancy

2006 SOA Final Examination Question 3

Suggested Solution

Page 2 of 6 likelihood that the total balance will be payable (and thus should be accrued) we must obtain a legal letter from CL’s lawyers. Further, we must ensure that

CL does not currently have any other liabilities or contingencies related to environmental matters. As part of the audit, we must obtain written representation from management that all matters have been disclosed.

- We must examine the reasonableness of the estimated costs for the Maple

Leaf Golf Course remediation. To do so, we should confirm the client’s cost prediction with externally obtained prices for labour and equipment. Further, we must obtain a copy of the purchase agreement to confirm the details of the remediation requirements.

- We must test the information used in the estimated fair value calculation of the Sleeping Bear Golf Course. We must obtain confirmation that the cash flows of $100,000 from the course are reasonable for the next five years. In addition, we must assess the reasonableness of the expected sale price of the golf course in five years time.

Accounting Issues

Non-Monetary Transactions

CL did not charge the Cancer Society for the green fees on any of the five courses for the national golf tournament held in September of 2005. CL capitalized the balance of

$2,500,000. This was actually a non-monetary, non-reciprocal transfer that should be valued at the fair value of the transaction. In essence, this transaction was a donation to the Cancer Society, and does not have any future benefit to CL. Therefore, this balance should have been expensed as a donation in 2005. Jonathan likely did not want to do so, as this entry would have negatively impacted the financial statements of CL, and not met his bias of providing strong financial statements to the potential investors.

CL also engaged in a non-monetary transaction with the Cancer Society. In exchange for golf apparel, the Cancer Society included the Canadian Links name and logo in all their advertising promoting the tournament. The fair value of the goods given up, $750,000, should be the valued assigned to the advertising expense. This balance should be expensed in the current year. As with the donated services, Jonathan likely attempted to capitalize these costs in an attempt to maximize the 2006 net income, and impress the potential investors. This would be considered a current year transaction for tax purposes and would therefore be deductible in 2006.

Environmental Liabilities and Contingencies

Currently, CL has not accrued for any of the clean up costs from incorrect pesticide use.

Depending on the likelihood that CL will incur these costs, the $3,000,000 clean up costs should either be accrued for in the financial statements or disclosed in the financial statement notes. The omission of this balance from the financial statements erroneously

©

Copyright 2006 ICAO School of Accountancy

2006 SOA Final Examination Question 3

Suggested Solution

Page 3 of 6 increases the net income, and improves the reporting results, thereby meeting Jonathan’s bias to maximize results to look good in front of the potential investors.

The accrual is a reserve for tax purposes. Until a legal liability is established it is not tax deductible. The amount would be deductible when a liability is established for the cleanup costs incurred. The $1,250,000 fine is not tax deductible [5.67.6].

Asset Retirement Obligation

CL expensed the future cost of $650,000 in the current period. This is not in accordance with GAAP. This asset retirement obligation should be recognized as a liability and an annual accretion expense should be recognized over the next 15 years.

As calculated below, $234,000 (the present value of the future costs) should have been recognized as an ARO liability. Adjusted for the partial year, the straight-line depreciation expense related to the asset retirement cost ($7,800) and the accretion expense of the ARO liability ($8,190) should be recognized in the 2006 income statement.

Expected Future Cash Flows

PV (15 years, 7%)

$ 650,000

0.36

Present Value of Future Cash Flows

Depreciation Expense (Asset Retirement Cost)

$ 234,000

($234,000 / 15 years) * 6/12 months $ 7,800

Accretion Expense

$234,000 * 0.07 * 6/12 months $ 8,190

The above adjustment meets the objective of our client, to show strong financial statements to the potential investors. The adjustments mentioned above increase net income by $634,010 ($650,000 – 7,800 – $8,190).

©

Copyright 2006 ICAO School of Accountancy

2006 SOA Final Examination Question 3

Suggested Solution

Page 4 of 6

Impairment of Long Lived Assets

The Sleeping Bear Golf Course appears to be overvalued and an impairment loss should be recognized in the current year. Based on the following calculation the current carrying value of $2,000,000 exceeds the sum of the undiscounted cash flows from operations and expected disposition in 5 years time.

Annual Cash Flows $ 100,000

Estimated Time Remaining 5 years

500,000

Cash from Disposition 425,000

Fair Value

Carrying Amount

925,000

2,000,000

Impairment Loss $ (1,075,000)

Therefore, a loss of $1,075,000 should be recognized in the 2006 financial statements.

This adjustment goes against Jonathan’s objective to show positive financial statements to the investor group.

This loss would not be recognized for tax purposes until it is actually realized.

Other

Expansion into the U.S. will cause CL to cease to be a small business corporation. If he has not otherwise done so, Jonathan and his father should consider crystallizing their capital gains exemption now.

Considerations – Assumes Cdn. Links has at least 90% of its assets used in an active business carried on in Canada. Jonathan and his father do not have prior capital losses in

CNIL balances that could affect their ability to claim CGE.

AMT should be considered.

Alternatively, the U.S. operations could be set up in a sister corporation, owned by the shareholders of Cdn. Links, to keep Cdn. Links as a QSBC.

©

Copyright 2006 ICAO School of Accountancy

2006 SOA Final Examination Question 3

Suggested Solution

Page 5 of 6

Memo to Suzanne

Make or Buy Decision

One of the issues you asked me to address is the best method to produce the new line of

Golf-Her-Way gloves. Currently you have two options: either to make the product in house, or to out-source the production to a company in Ottawa. I have conducted a quantitative analysis of the costs associated with each option below.

Leather

Fabric

Elastic

Snap

$4.00

3.00

0.40

0.20

Logo

Packaging

0.20 0.20

1.00 1.00

Total Variable Cost $8.80 $8.40

Based on my analysis above, it appears that outsourcing the glove production will be less expensive.

However, there are some qualitative issues that you may also wish to consider. o CL requires a minimum order of 2000 units. Therefore, production of your entire season’s product will occur upfront. Although you estimate that sales of 2000 units is reasonable, it is hard to predict the success of a new product. If sales are not as anticipated, you will be stuck with the costs of production for this large order. If you were to produce the gloves in house, you could produce on an asneeded basis, and tailor your production schedule to the actual demand for the gloves. This would eliminate the wasted production and storage costs of the necessary large order in an outsourcing situation. o If you outsource the production of your gloves, you lose control of the production process,as you are relying on an external supplier to provide you with your product on time, and to the level of quality that you desire. Although the product is cheaper, you may decide that the extra cost is worth having control of the production process.

©

Copyright 2006 ICAO School of Accountancy

2006 SOA Final Examination Question 3

Suggested Solution

Page 6 of 6

New Product Line

You asked me if I thought the new golf glove line was worth pursuing. To determine if this line is going to profitable for your company, I have performed a break-even analysis.

To be conservative, the analysis uses the in-house production costs, as they are more expensive than the outsourcing costs. Should you decide to go ahead with the outsourcing contract; the breakeven point will decrease.

Fixed Costs $30,000

Sales Price

Variable Costs

$25.00

$16.80

Break Even = $30,000 / ($25 – $16.80) = 1,829 units

According to the calculation above, CL must sell 1,829 gloves to breakeven. This is below your estimated sales level of 4,000 units. Therefore, based on the predicted sales levels, I believe that you should go ahead with the production.

Transfer Pricing

Currently you are evaluating your production department as a profitability centre, and your sales/distribution department as a cost centre. The current transfer pricing structure disfavours the profitability centre. The production division is currently at capacity, and has the ability to sell to outside customers. When this division makes an intercompany sale, an external sale is foregone. However, the since the intercompany sale price is set at variable costs, an intercompany sale would not contribute to the profitability of the

Production division, while an external sale (presumably earning a profitable price) contributes to the profit of the division. With the current pricing and evaluation structure, the production department would be motivated to sell to external suppliers to increase profitability, and thus employee bonuses. This goes against your preference that intercompany sales would receive priority amongst the divisions. To address this issue, you should change the transfer price assigned to goods to market value. This way, the production department would become indifferent between an intercompany an external sale. Also, to prevent a negative impact on the sales/distribution division you must ensure that the budget of the sales/distribution centre is adjusted to include the market value prices.

Association

Jonathan and his father control Canadian Links. A related person, Linda, controls Golf-

Her-Way Company. Jonathan owns more that 25% of each company. The companies are associated and must share small business deduction business limit of $300,000.

Consider having Jonathan sell his shares to Linda to disassociate the companies.

©

Copyright 2006 ICAO School of Accountancy