Medicare levy adjustment weekly tax table

advertisement

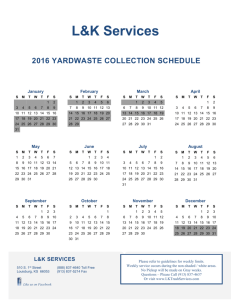

Schedule 6 Pay as you go (PAYG) withholding NAT 1010 Medicare levy adjustment weekly tax table This table should be read with the Weekly tax table – including instructions for calculating monthly and quarterly withholding (NAT 1005) and the Medicare levy variation declaration (NAT 0929) FOR PAYMENTS MADE ON OR AFTER 1 JULY 2012 From 1 July 2012, the temporary flood and cyclone reconstruction levy (flood levy) will no longer apply. For a full list of tax tables, visit our website at www.ato.gov.au/taxtables Alternatively, we have a calculator to help work out the correct amount of tax to withhold from payments to most payees. To access the calculator, visit our website at www.ato.gov.au/taxwithheldcalculator WHO SHOULD USE THIS TABLE? You should use this table if you make payments to your payee on a weekly basis and they are entitled to a Medicare levy adjustment. This tax table includes instructions for calculating the Medicare levy adjustment for monthly payments. For more information, see page 3. NAT 1010-05.2012 This document is a withholding schedule made by the Commissioner of Taxation in accordance with sections 15‑25 and 15‑30 of schedule 1 to the Taxation Administration Act 1953. It applies to withholding payments covered by Subdivisions 12‑B (except sections 12‑50 and 12‑55), and 12‑D of schedule 1. IS YOUR PAYEE ENTITLED TO A MEDICARE LEVY ADJUSTMENT? Your payee is entitled to an adjustment if they meet all of the following requirements: nthey have provided you with a Medicare levy variation declaration in which they – claimed dependents –answered yes to question 10 ‘Is the combined weekly income of you and your spouse, or your income as a sole parent, less than the relevant amount in table A on page 1?’ nthey have weekly earnings of $395 or more, but less than the corresponding amount in column A of table 1 on this page – for example, a payee who claims two dependent children must have weekly earnings of less than $876 to be entitled to a Medicare levy adjustment. No Medicare levy is payable on weekly earnings of less than $395. If your payee claims more than 10 children, the column A amount is $1,421, plus $68 for each child claimed in excess of 10. Column B shows the values used in calculating adjustments for payees with more than five dependent children. If your payee claims more than 10 dependent children, the column B amount is $1,207.94 plus $57.82 for each child in excess of 10. For information about how to use table 1, see ‘How to work out the Medicare levy adjustment’ on this page. Spouse only Column B $740 — 1 $808 — 2 $876 — 3 $944 — 4 $1,012 — 5 $1,080 — 6 $1,148 $976.63 7 $1,217 $1,034.46 8 $1,285 $1,092.29 9 $1,353 $1,150.12 10 $1,421 $1,207.94 Number of children 2 The Medicare levy adjustments shown in this table can be expressed in a mathematical form. If you have developed your own payroll software package, you will need to use the Statement of formulas for calculating amounts to be withheld (NAT 1004) available on our website at www.ato.gov.au/taxtables HOW TO WORK OUT THE WITHHOLDING AMOUNT To workout the amount you need to withhold, you must: 1Use the Weekly tax table – including instructions for calculating monthly and quarterly withholding (NAT 1005) to find the weekly amount to withhold from your payee’s earnings, allowing for any tax offsets claimed. 2Reduce this amount by the amount of the Medicare levy adjustment, worked out as detailed below. Where the adjustment equals or exceeds the amount obtained in step 1, the amount to be withheld is nil. HOW TO WORK OUT THE MEDICARE LEVY ADJUSTMENT How you work out the Medicare levy adjustment varies depending on the number of dependent children your payee is claiming, see either: n‘Payee claiming spouse and/or one to five dependent children’ below n‘Payee with more than five dependent children’ on page 3. Payee claiming spouse and/or one to five dependent children TABLE 1: Medicare levy adjustments Column A Can you use a formula? Round the weekly earnings down to the nearest dollar amount. Use the table on page 4 to find the payee’s weekly earnings in the ‘Weekly earnings’ column and the corresponding amount of Medicare levy adjustment in the appropriate column. EXAMPLE The payee has weekly earnings of $454.70 and is claiming four dependent children on the Medicare levy variation declaration. Find $454 in the ‘Weekly earnings’ column and find the corresponding Medicare levy adjustment of $6.00 from the ‘4 children’ column. Schedule 6 Medicare levy adjustment weekly tax table Payee with more than five dependent children How you work out the Medicare levy adjustment for a payee with more than five dependent children varies depending on the weekly earnings of the payee, see: n‘Weekly earnings less than $919’ below n‘Weekly earnings of $919 or more but less than the column B amount that corresponds to the number of dependent children claimed’ below n‘Weekly earnings of $919 or more and greater than the column B amount but less than the column A amount that corresponds to the number of dependent children claimed’ below. Weekly earnings less than $919 Use the ‘5 children’ column. Round the weekly earnings down to the nearest dollar. Use the table beginning on page 4 to find the payee’s earnings in the ‘Weekly earnings’ column and find the corresponding amount of Medicare levy adjustment in the ‘5 children’ column. EXAMPLE The payee has weekly earnings of $410.65 and is claiming six dependent children. Find $410 in the ‘Weekly earnings’ column and find the corresponding Medicare levy adjustment of $2.00 from the ‘5 children’ column. Weekly earnings of $919 or more but less than the column B amount that corresponds to the number of dependent children claimed Round the weekly earnings down to the nearest dollar and add 99 cents. Take 1.5% of that amount and round to the nearest dollar. EXAMPLE The payee has weekly earnings of $950.45 and is claiming seven dependent children. Take 1.5% of $950.99 (weekly earnings of $950, rounded down to the nearest dollar, plus 99 cents), this equals $14.26. The Medicare levy adjustment is $14, rounded to the nearest dollar. Weekly earnings of $919 or more and greater than the column B amount but less than the column A amount that corresponds to the number of dependent children claimed Complete steps 1–4 below: 1Take 1.5% of the relevant column B amount. Round the result to the nearest cent. 2Take 8.5% of the difference between the weekly earnings (round down to the nearest dollar plus 99 cents) and the column B amount. Round the result to the nearest cent. 3Subtract the result of step 2 from step 1. 4Round the result to the nearest dollar. EXAMPLE The payee has weekly earnings of $1,200.70 and is claiming eight dependent children. 11.5% × $1,092.29 (column B amount for eight children) = $16.38 28.5% × ($1,200.99 – $1,092.29) = 8.5% × $108.70 = $9.24 3$16.38 – $9.24 = $7.14 4$7.00 ($7.14 rounded to the nearest dollar). The Medicare levy adjustment is $7. What if you pay monthly? To work out the Medicare levy adjustment for monthly payments, you must: 1Work out the monthly gross earnings. Where this amount ends in 33 cents add one cent. 2Multiply the monthly gross earnings by 12. 3Divide this figure by 52 to obtain the weekly gross amount (ignore any cents) 4Use the table to find the payee’s weekly earnings in the ‘Weekly earnings’ column and the corresponding amount of Medicare levy adjustment in the appropriate column. 5Multiply this amount by 52 and then divide by 12 to obtain the monthly Medicare levy adjustment. EXAMPLE A payee has monthly earnings of $2,250.39 and is claiming three dependent children on the Medicare levy variation declaration. 1Gross monthly earnings are $2,250.39 2$2,250.39 × 12 = $27,004.68 3$27,004.68 ÷ 52 = $519.32 ($519 ignoring cents) 4Medicare levy adjustment amount using column 5 for $519 is $8.00 5$8 × 52 = $416.00 $416 ÷ 12 = $35.00 is the Medicare levy adjustment for the month. The Medicare levy adjustment monthly withholding table (NAT 1012) is available on our website at www.ato.gov.au/taxtables PAYG WITHHOLDING PUBLICATIONS You can access all PAYG withholding tax tables and other PAYG withholding publications quickly and easily from our website at www.ato.gov.au/paygw Copies of weekly and fortnightly tax tables are available from most newsagents. Newsagents also hold copies of the following: nTax file number declaration (NAT 3092) nWithholding declaration (NAT 3093). Schedule 6 Medicare levy adjustment weekly tax table3 MEDICARE LEVY ADJUSTMENT WEEKLY TAX TABLE Weekly earnings $ 394 395 396 397 398 399 400 401 402 403 404 405 406 407 408 409 410 411 412 413 414 415 416 417 418 419 420 421 422 423 424 425 426 427 428 429 430 431 432 433 434 435 436 437 438 439 440 441 442 443 444 445 446 447 448 449 450 451 452 453 454 455 456 457 458 459 460 461 462 463 464 465 466 467 468 469 470 471 472 473 474 475 476 477 478 4 Spouse only $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 1 child $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 2 child $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 3 child $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 4 child $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 5 child $ — — — — — — 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 Weekly earnings $ 479 480 481 482 483 484 485 486 487 488 489 490 491 492 493 494 495 496 497 498 499 500 501 502 503 504 505 506 507 508 509 510 511 512 513 514 515 516 517 518 519 520 521 522 523 524 525 526 527 528 529 530 531 532 533 534 535 536 537 538 539 540 541 542 543 544 545 546 547 548 549 550 551 552 553 554 555 556 557 558 559 560 561 562 563 Spouse only $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 1 child $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 2 child $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 3 child $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 4 child $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 5 child $ 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 Schedule 6 Medicare levy adjustment weekly tax table MEDICARE LEVY ADJUSTMENT WEEKLY TAX TABLE Weekly earnings $ 564 565 566 567 568 569 570 571 572 573 574 575 576 577 578 579 580 581 582 583 584 585 586 587 588 589 590 591 592 593 594 595 596 597 598 599 600 601 602 603 604 605 606 607 608 609 610 611 612 613 614 615 616 617 618 619 620 621 622 623 624 625 626 627 628 629 630 631 632 633 634 635 636 637 638 639 640 641 642 643 644 645 646 647 648 Spouse only $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 1 child $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 2 child $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 3 child $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 4 child $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 5 child $ 8.00 8.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 Weekly earnings $ 649 650 651 652 653 654 655 656 657 658 659 660 661 662 663 664 665 666 667 668 669 670 671 672 673 674 675 676 677 678 679 680 681 682 683 684 685 686 687 688 689 690 691 692 693 694 695 696 697 698 699 700 701 702 703 704 705 706 707 708 709 710 711 712 713 714 715 716 717 718 719 720 721 722 723 724 725 726 727 728 729 730 731 732 733 Spouse only $ 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1 child $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 2 child $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 3 child $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 4 child $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 5 child $ 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 Schedule 6 Medicare levy adjustment weekly tax table5 MEDICARE LEVY ADJUSTMENT WEEKLY TAX TABLE Weekly earnings $ 734 735 736 737 738 739 740 741 742 743 744 745 746 747 748 749 750 751 752 753 754 755 756 757 758 759 760 761 762 763 764 765 766 767 768 769 770 771 772 773 774 775 776 777 778 779 780 781 782 783 784 785 786 787 788 789 790 791 792 793 794 795 796 797 798 799 800 801 802 803 804 805 806 807 808 809 810 811 812 813 814 815 816 817 818 6 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 — — — — — — — — — — — — — — — — — 2 child $ 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 3 child $ 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 4 child $ 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 5 child $ 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 Weekly earnings $ 819 820 821 822 823 824 825 826 827 828 829 830 831 832 833 834 835 836 837 838 839 840 841 842 843 844 845 846 847 848 849 850 851 852 853 854 855 856 857 858 859 860 861 862 863 864 865 866 867 868 869 870 871 872 873 874 875 876 877 878 879 880 881 882 883 884 885 886 887 888 889 890 891 892 893 894 895 896 897 898 899 900 901 902 903 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 2 child $ 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 3 child $ 11.00 11.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 4 child $ 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 9.00 9.00 9.00 5 child $ 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 14.00 14.00 14.00 14.00 Schedule 6 Medicare levy adjustment weekly tax table MEDICARE LEVY ADJUSTMENT WEEKLY TAX TABLE Weekly earnings $ 904 905 906 907 908 909 910 911 912 913 914 915 916 917 918 919 920 921 922 923 924 925 926 927 928 929 930 931 932 933 934 935 936 937 938 939 940 941 942 943 944 945 946 947 948 949 950 951 952 953 954 955 956 957 958 959 960 961 962 963 964 965 966 967 968 969 970 971 972 973 974 975 976 977 978 979 980 981 982 983 984 985 986 987 988 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 2 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 3 child $ 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 4 child $ 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 5 child $ 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 14.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 13.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 11.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 9.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 8.00 Weekly earnings $ 989 990 991 992 993 994 995 996 997 998 999 1000 1001 1002 1003 1004 1005 1006 1007 1008 1009 1010 1011 1012 1013 1014 1015 1016 1017 1018 1019 1020 1021 1022 1023 1024 1025 1026 1027 1028 1029 1030 1031 1032 1033 1034 1035 1036 1037 1038 1039 1040 1041 1042 1043 1044 1045 1046 1047 1048 1049 1050 1051 1052 1053 1054 1055 1056 1057 1058 1059 1060 1061 1062 1063 1064 1065 1066 1067 1068 1069 1070 1071 1072 1073 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 2 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 3 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 4 child $ 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 5 child $ 8.00 8.00 8.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 7.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 6.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Schedule 6 Medicare levy adjustment weekly tax table7 MEDICARE LEVY ADJUSTMENT WEEKLY TAX TABLE Weekly earnings $ 1074 1075 1076 1077 1078 1079 1080 1081 1082 1083 1084 1085 1086 1087 1088 1089 1090 1091 1092 1093 1094 1095 1096 1097 1098 1099 1100 1101 1102 1103 1104 1105 1106 1107 1108 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 2 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 3 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 4 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 5 child $ 1.00 — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — Weekly earnings $ 1109 1110 1111 1112 1113 1114 1115 1116 1117 1118 1119 1120 1121 1122 1123 1124 1125 1126 1127 1128 1129 1130 1131 1132 1133 1134 1135 1136 1137 1138 1139 1140 1141 1142 1143 Spouse only $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 1 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 2 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 3 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 4 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — 5 child $ — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — © AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA, 2012 You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products). OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. If you feel that this publication does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us. PUBLISHED BY Australian Taxation Office, Canberra, May 2012 JS 22928 We regularly revise our publications to take account of any changes to the law, so make sure that you have the latest information. If you are unsure, you can check for more recent information on our website at www.ato.gov.au or contact us. This publication was current at May 2012. 8 Schedule 6 Medicare levy adjustment weekly tax table