August 2010

CRISIL Reaffirms Ratings on Hero Group Entities following

Family Arrangement among Munjal Family Members

CRISIL had issued an update in May 2010 relating to the proposed family arrangement among

members of the Munjal family. The update note indicated that CRISIL would hold discussions with

members of the Munjal family to assess the impact of the family arrangement on the ratings of

entities in the Hero group, whose debt programmes and bank facilities have been rated by CRISIL.

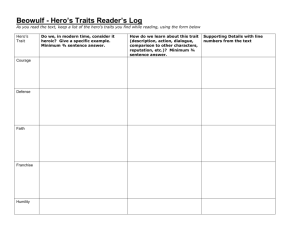

CRISIL has completed its assessment of the ratings on entities in the Hero group, and reaffirmed all

ratings as indicated in Table 1. The reaffirmation factors in the contours of the family arrangement,

the performance of each group entity, and its business and growth strategies, and management

structure.

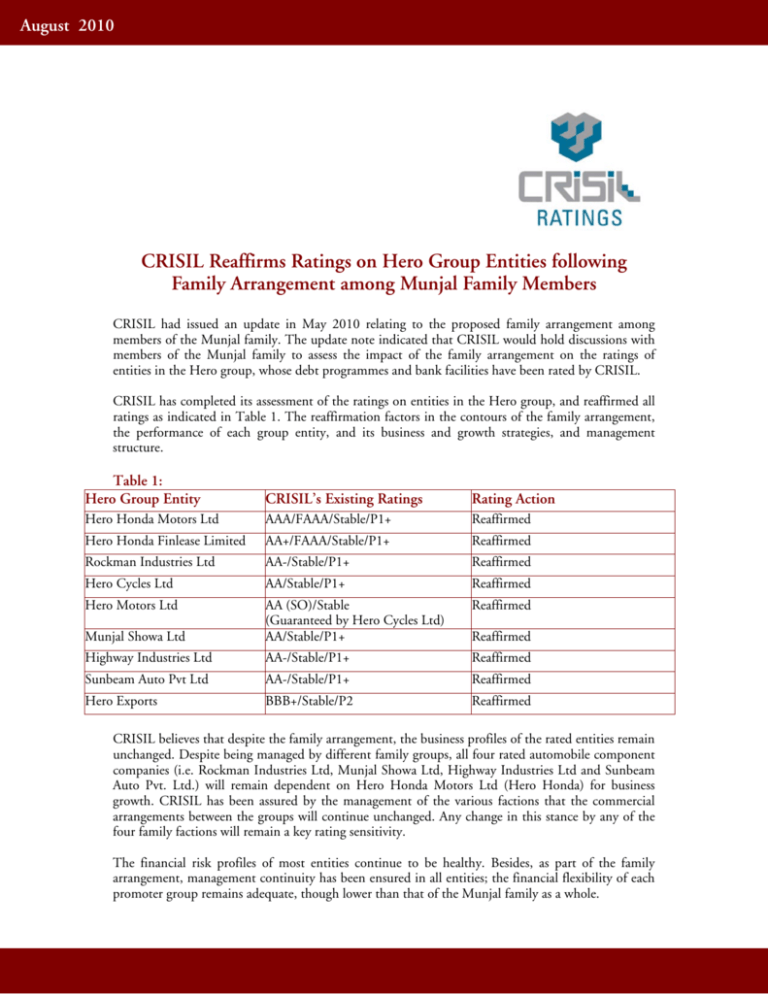

Table 1:

Hero Group Entity

CRISIL’s Existing Ratings

Rating Action

Hero Honda Motors Ltd

AAA/FAAA/Stable/P1+

Reaffirmed

Hero Honda Finlease Limited

AA+/FAAA/Stable/P1+

Reaffirmed

Rockman Industries Ltd

AA-/Stable/P1+

Reaffirmed

Hero Cycles Ltd

AA/Stable/P1+

Reaffirmed

Hero Motors Ltd

Reaffirmed

Munjal Showa Ltd

AA (SO)/Stable

(Guaranteed by Hero Cycles Ltd)

AA/Stable/P1+

Highway Industries Ltd

AA-/Stable/P1+

Reaffirmed

Sunbeam Auto Pvt Ltd

AA-/Stable/P1+

Reaffirmed

Hero Exports

BBB+/Stable/P2

Reaffirmed

Reaffirmed

CRISIL believes that despite the family arrangement, the business profiles of the rated entities remain

unchanged. Despite being managed by different family groups, all four rated automobile component

companies (i.e. Rockman Industries Ltd, Munjal Showa Ltd, Highway Industries Ltd and Sunbeam

Auto Pvt. Ltd.) will remain dependent on Hero Honda Motors Ltd (Hero Honda) for business

growth. CRISIL has been assured by the management of the various factions that the commercial

arrangements between the groups will continue unchanged. Any change in this stance by any of the

four family factions will remain a key rating sensitivity.

The financial risk profiles of most entities continue to be healthy. Besides, as part of the family

arrangement, management continuity has been ensured in all entities; the financial flexibility of each

promoter group remains adequate, though lower than that of the Munjal family as a whole.

CRISIL believes that the family arrangement will enhance the flexibility of family members to

diversify into new product segments, commence supplies to new customers, and venture into new

geographies. CRISIL will continue to monitor the new initiatives of each rated entity, and factor in

the impact of such initiatives on the rated entity’s credit risk profile.

The rating rationales for each of the rated entities is enclosed. Also are annexed frequently asked

questions (FAQs) on the family arrangement. This is a part of CRISIL’s initiative to explain to

investors and the lending community, the details of the Munjal family’s arrangement, and its impact

on the credit profile of the rated entities.

Frequently Asked Questions: Ratings of Hero Group Entities

following Family Arrangement among Munjal Family Members

What are the key features of the arrangement among members of the Munjal family?

•

•

•

•

•

•

•

•

•

•

The businesses and assets held by the Munjal family have been realigned among members of

the four founding promoters of the Munjal family — Mr. Brij Mohan Lall Munjal, Mr.

Satyanand Munjal, Mr. Om Prakash Munjal, and late Mr. Dayanand Munjal (represented

by his eldest son, Mr. Vijay Munjal).

The family arrangement has been done to avoid any future disputes and maintain peace and

harmony amongst the family groups.

All cross-holdings have been realigned such that each of the families managing the operations

have ownership of the respective entities.

The assets have been consolidated in the name of the members/entities of relevant family.

Existing management and control structures in various entities have been retained to ensure

there is continuity in business as before.

All previous formal and informal pacts by family members and their businesses not to

compete with each other directly will no longer apply.

The employees, suppliers, clients of different entities will remain unchanged.

As a part of realignment process under the family arrangement, Hero Cycles Ltd (Hero

Cycles) will restructure its cold-rolled (CR) division, to a new company, to be held by the

Brij Mohan Lall Munjal group.

As a part of the family arrangement, Hero Cycles will also restructure its Mangli unit, where

specialty cycles are made, and e-bikes are manufactured from imported kits on behalf of

Hero Exports, to a new company, Hero EcoTech Ltd, to be headed by Mr. Vijay Munjal.

Of the 29 per cent stake held by the Munjals in Hero Honda through different entities, 26

per cent stake will be held by the Brij Mohan Lall Munjal group, while the various family

members may choose to continue to hold or dispose off the remaining approximately 3 per

cent held by them or the entities belonging to them

How have the companies been distributed among members of the Munjal family?

A key feature of the family arrangement includes ensuring that existing businesses continue to operate

as before. Family members who were in charge of operations and of managing the different

businesses, will continue to do so; accordingly, operating entities in the group have been divided as

follows:

Mr. Brij Mohan Lall Munjal group (comprising Mr. Brij Mohan Lall Munjal, Mrs. Renu Munjal

(wife of eldest son Late Mr Raman Kant Munjal), his sons, Mr. Suman Kant Munjal, Mr. Pawan

Munjal, Mr. Sunil Kant Munjal)

•

Rockman Industries Ltd

•

Hero Honda Motors Ltd

•

Hero Honda Finlease Ltd

•

Arrow Infra Ltd

•

Hero Corporate Service Ltd

•

Hero Mindmine Institute Ltd

•

Hero Management Service Ltd

•

Easy Bill Ltd

•

Cold-Rolled (CR) division of Hero Cycles Ltd (To be restructured)

The late Mr. Dayanand Munjal group (comprising sons, Mr. Vijay Munjal, Mr. Ashish Munjal

and Mr. Ashok Munjal)

•

Sunbeam Auto Ltd

•

Munjal Castings

•

Hero Exports

•

Hero EcoTech Ltd

•

Hero Electric

•

Hero Eco Vehicles (P) Ltd

•

Munjal Steels

Mr. Om Prakash Munjal Group (comprising Mr. Om Prakash Munjal and his son, Mr. Pankaj

Munjal)

•

Hero Cycles Ltd (Cycles – GT Road, and Auto Rim Division, Ludhiana)

•

Hero Motors Ltd

•

Munjal Sales Corporation

•

Hero Global Design Ltd

Mr. Satyanand Munjal group (comprising Mr. Satyanand Munjal and his sons, Mr. Yogesh

Chander Munjal, Mr. Suresh Chandra Munjal, Mr. Sudhir Munjal, Mr. Umesh Munjal and Mr.

Mahesh Munjal)

•

Munjal Showa Ltd

•

Shivam Autotech Ltd

•

Highway Industries Ltd

•

Majestic Auto Ltd

•

Munjal Auto Components

•

Munjal Auto Industries Ltd

•

Satyam Auto Components Ltd

As part of the family arrangement, family members and the various entities have realigned the

holding of shares of companies in favour of respective family groups through internal and stock

market transactions.

What factors drive CRISIL’s reaffirmation of its outstanding ratings on Munjal family

owned entities?

•

•

•

The business risk profiles of all companies remain unaffected by the family arrangement; also

management, employees, suppliers, and clients of all entities remain unchanged.

The four family-owned, CRISIL-rated entities in the automotive component space will

continue to derive the bulk of their revenues from Hero Honda; large investments have been

made by these entities to set up facilities to supply components to Hero Honda, and these

entities have established themselves as suppliers of top-quality components. It is in Hero

Honda’s interest to ensure that supplies are not disrupted. Despite initiatives to expand

customer and geographical spread, most Munjal family owned auto component suppliers will

continue to depend on Hero Honda, given its dominant position in the domestic motorcycle

industry.

Management continuity has been ensured in order that business operations are not

disrupted.

•

•

•

The financial risk profiles of the various entities have improved over time; CRISIL expects

the same to continue.

Most rated entities belonging to the Munjal family are unlikely to undertake significant

capital spending in the near term; hence their requirements for funds may be met largely

from internal accruals.

The financial flexibility of members of the Munjal family is adequate; support from

respective promoter groups is expected to be forthcoming in the event of financial exigencies

in companies belonging to their respective groups.

Individual ‘Rating Rationales’ relating to the above companies are enclosed:

Rating Rationale

Hero Honda Motors Limited

Rs.1.25 Billion Cash Credit Limit *

AAA/Stable (Reaffirmed)

Rs.150.00 Million Non-Convertible Debenture

AAA/Stable (Reaffirmed)

Programme

Fixed Deposit Programme

FAAA/Stable (Reaffirmed)

Rs.160.00 Million Commercial Paper

P1+ (Reaffirmed)

Programme

Rs.4.00 Billion Letter of Credit Limit **

P1+ (Reaffirmed)

*Interchangeable with other fund-based facilities.

**Interchangeable with other non-fund-based facilities.

CRISIL’s ratings on the debt programmes and bank facilities of Hero Honda Motors Ltd (Hero

Honda) continue to reflect Hero Honda’s strong business risk profile, marked by leadership in the

motorcycles market in India, and robust financial risk profile, supported by large net worth,

negligible debt, and liquid surpluses. The ratings also factor in the restricted growth opportunities for

Hero Honda in the export market, and the company’s moderate presence in the economy segment of

motorcycles.

Hero Honda continues to be the market leader in motorcycles with a market share of 58.5 per cent in

2009-10 (refers to financial year, April 1 to March 31) The company’s strong brand appeal, wide

distribution and service network, and technical support from Honda Motor Co Ltd (HMC, rated

‘A+/Stable/A-1’ by Standard & Poor’s) strengthen its longstanding leadership position. Hero

Honda’s financial position remains buoyant on the back of its nearly debt-free status, robust cash

accruals, and large portfolio of liquid investments (more than Rs.52 billion as on March 31, 2010).

The strong financial position allows the company to meet competitive challenges, in terms of pricing

and fresh investments.

However, the company has only a moderate market share in the ‘economy’ segment of motorcycles.

This segment, with its relatively low-priced offerings, remains partially insulated from any slowdown.

Also, Hero Honda’s growth in the export markets is restricted by the presence of its technology

partner, HMC, in all key markets world-wide.

Outlook: Stable

CRISIL believes that Hero Honda will retain its market leadership and highly favourable financial

risk profile over the medium term.

About the Company

Hero Honda was jointly promoted by the Ludhiana-based Munjal family and HMC in 1984. The

company began production of motorcycles in 1985. At present, the company has three plants: at

Dharuhera and Gurgaon (both in Haryana), and at Haridwar (Uttaranchal) with a combined

manufacturing capacity of 5.2 million units per annum. Following the recent family arrangement

among the Munjals, 26 per cent stake held in Hero Honda by the various Munjal family members,

has been transferred to the Brij Mohan Lall Munjal group. As at June 30, 2010, both promoter

groups held 26 per cent each in Hero Honda, banks, financial institutions and mutual funds held 37

per cent and the balance was spread among the general public, bodies corporate etc.

For 2009-10, Hero Honda reported a profit after tax (PAT) of Rs.22.32 billion (Rs.12.81 billion in

the previous year) on net sales of Rs.157.58 billion (Rs.123.19 billion).

Rating Rationale

Hero Honda Finlease Limited

Rs.920 Million Long-Term Bank Facility

Rs.50 Million Non-Convertible Debenture Programme

Fixed Deposit Programme

Rs.1250 Million Short-Term Debt Programme

Rs.1500 Million Short-Term Bank Facility

AA+/Stable (Reaffirmed)

AA+/Stable (Reaffirmed)

FAAA/Stable (Reaffirmed)

P1+ (Reaffirmed)

P1+ (Reaffirmed)

CRISIL’s ratings on the bank facilities and debt instruments of Hero Honda Finlease Ltd (HHFL)

continue to reflect the strong support HHFL receives from Hero Honda Motors Ltd (HHML, rated

‘AAA/FAAA/Stable/P1+’ by CRISIL) in particular. The ratings also continue to factor in HHFL’s

healthy asset quality, and comfortable capitalisation. These rating strengths are partially offset by

HHFL’s significant dependence on HHML for revenues, and its limited size and growth prospects.

HHFL receives operational, financial, and management support (including senior management) from

HHML. HHFL and HHML have five common directors. HHML also provides financial support to

HHFL through inter-corporate deposits (ICDs); as on March 31, 2010, HHFL had access to ICDs

of up to Rs.1.25 billion from HHML. On the operational front, HHML identifies dealers, vendors,

and vendors’ suppliers for financing by HHFL.

HHFL’s asset quality is healthy; as on March 31, 2010, the company did not have any nonperforming assets (NPAs) in its loan book. HHFL is also comfortably capitalised, reflected in its Tier

I capital adequacy ratio of 30.3 per cent of risk-weighted assets as on March 31, 2010. The company

operated at a moderate gearing in 2009-10 (refers to financial year, April 1 to March 31); as on

March 31, 2010, it had a gearing of around 3.5 times.

However, HHFL remains heavily dependent on HHML for revenues. HHFL lends to entities that

form a part of HHML’s supply chain. The performance of these entities is directly linked to

HHML’s performance. In addition, HHFL’s asset base, of Rs.2.93 billion as on March 31, 2010, is

small. At present, the entire business of HHFL comes from HHML and its related entities, and

HHFL does not intend to pursue direct retail lending or finance other asset classes. This restricts its

growth prospects.

Outlook: Stable

CRISIL believes that HHFL will continue to benefit from operational, financial, and managerial

support, from HHML. The outlook may be revised to ‘Positive’ in case of increase in HHFL’s

importance to HHML. Conversely, the outlook could be revised to ‘Negative’ in case of a decline in

the support that HHFL receives from HHML. An adverse change in the ownership structure of

HHFL, or, in CRISIL’s view, deterioration in HHML’s credit risk profile, could also lead to a

revision in the outlook to ‘Negative’.

About the Company

HHFL finances HHML’s dealers, vendors, vendors’ suppliers, and associates through hire-purchase

financing, leasing, loans, and bill discounting. HHML, its associate companies, and members of the

Munjal family hold a 64.8 per cent equity stake in HHFL, while HHML’s dealers, employees, and

associates hold the remainder.

Following the recent family arrangement among the Munjal Family (promoters of the Hero group),

HHFL will continue to be managed by Mrs. Renu Munjal, and will be part of the Hero group led by

Mr. Brij Mohan Lall Munjal.

HHFL reported a profit after tax (PAT) of Rs.156 million on a total income of Rs.475 million for

2009-10, against a PAT of Rs.114 million on a total income of Rs.452 million for 2008-09.

Rating Rationale

Rockman Industries Limited

Rs.610.0 Million Long-Term Loans

Rs.300.0 Million Cash Credit

Rs.250.0 Million Buyer’s Credit

Rs.150.0 Million Letter of Credit*

* Interchangeable with bank guarantee.

AA-/Stable (Reaffirmed)

AA-/Stable (Reaffirmed)

P1+ (Reaffirmed)

P1+ (Reaffirmed)

CRISIL’s ratings on the bank facilities of Rockman Industries Ltd (Rockman) continue to reflect the

company’s healthy operating capabilities and its adequate and improving financial risk profile. The

ratings also continue to be driven by the support provided to Rockman by the Hero group, and the

strong business linkages with the group’s flagship, Hero Honda Motors Ltd (Hero Honda; rated

‘AAA/FAAA/Stable/P1+’ by CRISIL), India’s largest motorcycle manufacturer with nearly 54 per

cent share (as on June 30, 2010) in the domestic market. These rating strengths are partially offset by

the limited segmental, customer, and geographical diversity in Rockman’s revenues.

Outlook: Stable

CRISIL believes that Rockman’s credit profile will continue to benefit from steady offtake by Hero

Honda, and addition of new products to its portfolio. The outlook could be revised to ‘Negative’ in

case of deterioration in financial risk profile on account of a slowdown in revenue growth or

significant debt-funded capital expenditure. Conversely, better than expected revenue growth and

profitability, could result in the outlook being revised to ‘Positive’.

About the Company

Established in 1961 as a partnership firm, Rockman initially manufactured and supplied components

and chains to the bicycle sector. In 1999, it diversified into the manufacture of high-pressure

aluminium die-cast components and automotive chains for Hero Honda. Having exited the bicycle

chains and components business in November 2005, it now manufactures only auto components.

The company has a manufacturing facility at Ludhiana, and machining assembly and painting units

at Delhi and Gurgaon. In 2008-09 (refers to financial year, April 1 to March 31), it commissioned a

greenfield manufacturing facility at Haridwar for catering to the requirements of Hero Honda,

besides supplying to Munjal Showa Ltd (Munjal Showa rated ‘AA/Stable/P1+’ by CRISIL) and

Autofit (P) Ltd.

Following the recent family arrangement among the Munjal Family (promoters of the Hero group),

Rockman will continue to be managed by Mr. Suman Kant Munjal, and will be part of the Hero

group led by Mr. Brij Mohan Lall Munjal.

For 2009-10, Rockman reported a profit before tax of Rs.573.3 million (net profit of Rs.115.1

million in 2008-09) on net revenues of Rs.6.5 billion (Rs.3.7 billion).

Rating Rationale

Hero Cycles Limited

Rs.800 Million Cash Credit Limits

Rs.800 Million Letter of Credit Limits*

Rs.800 Million Short-Term Debt Programme

*Interchangeable with bank guarantees.

AA/Stable (Reaffirmed)

P1+ (Reaffirmed)

P1+ (Reaffirmed)

CRISIL’s ratings on Hero Cycles Ltd’s (Hero Cycles’) debt programme and bank facilities continue

to reflect the steady performance of Hero Cycles’ bicycle business, supported by its market leadership

in India, and its strong financial risk profile. The ratings also factor in Hero Cycles’ large liquid

surplus of about Rs.3.0 billion as on March 31, 2010. These rating strengths are partially offset by

the moderate susceptibility of Hero Cycles’ operating profitability to volatility in input prices, and

the company’s significant exposure to group company, Hero Motors Ltd (Hero Motors; rated

‘AA(so)/Stable’ by CRISIL), which is not expected to yield significant returns over the medium term.

Following a recent family arrangement among the Munjals (the promoters of the Hero group), Hero

Cycles is now part of the Om Prakash Munjal group, which also includes Hero Motors, and Munjal

Sales Corporation. Mr. Om Prakash Munjal’s brothers and their sons have stepped down from the

board of Hero Cycles. Besides, the low-profit-generating cold-rolled (CR) division, which was

tempering the overall profitability of Hero Cycles, is now being transferred to a new company

belonging to the Brij Mohan Lall Munjal group. In addition, the Mangli unit of Hero Cycles,

where the company manufactures specialty bicycles and e-bikes, will also be hived off to a newly

formed company, which will be part of Dayanand Munjal group. Also, Hero Cycles has transferred

its ownership in Munjal group companies (barring Hero Motors), to the members of the Munjal

family, including its 8-per-cent ownership in Hero Honda Motors Ltd (HHML; rated

‘AAA/FAAA/Stable/P1+’).

CRISIL believes that the aforementioned restructuring of business divisions will impact Hero Cycles’

revenues in 2010-11 (refers to the financial year, April 1 to March 31). However, Hero Cycles’

overall profitability will improve as its low-margin CR division will be hived off. Also, a large part of

the debt on its balance sheet, which pertained to the CR division, will move to the new company,

thereby lowering Hero Cycles’ gearing and strengthening its debt protection metrics. On the other

hand, Hero Cycles will no longer benefit from the steady cash flows generated from its 8-per-cent

ownership in HHML; the impact of this will be partially offset by the treasury income which will be

generated from Hero Cycles’ large liquid surpluses.

Hero Cycles is the leader in both the standard and special bicycle markets in India, with an overall

market share of about 40 per cent. A nationwide distribution network and the strategic location of its

plants near vendors support its operations, and permits competitive pricing of its bicycles. The

bicycle division registered a healthy growth in revenues in 2009-10, supported by a strong focus on

special bicycles and improvement in realisations. Hero Cycles’ financial risk profile remains healthy,

supported by a comfortable capital structure and strong debt protection metrics. Hero Cycles’

financial flexibility is supported by its large liquid surplus, invested largely in mutual funds.

However, Hero Cycles’ operating profitability, which improved to over 10.9 per cent in 2009-10

from 7.7 per cent in 2008-09, remains moderately vulnerable to movements in prices of iron and

steel, the key inputs involved in the manufacture of bicycles. Also, Hero Cycles’ support to weak

group associate, Hero Motors, in which it holds about 40 per cent stake, remained high, at around

Rs.2.4 billion as on June 30, 2010. Hero Motors has reported losses for the past three years, and is

not expected to break-even at the net level in the medium term, resulting in negligible returns for

Hero Cycles, and also tempering its return on capital employed.

Outlook: Stable

CRISIL believes that Hero Cycles’ business and financial risk profiles will benefit from the proposed

transfer of the low-margin and working-capital-intensive CR division. Hero Cycles’ liquidity is likely

to remain robust, supported by steady cash flows from the bicycle business and sizeable investments

in mutual funds, which will also help offset the impact of Hero Cycles’ exposure to the loss-making

Hero Motors. The outlook may be revised to ‘Positive’ if Hero Cycles gradually reduces its exposure

to Hero Motors, and maintains strong business performance. Conversely, more-than-expected

support provided to Hero Motors or significant deterioration in business performance may lead to a

revision in the outlook to ‘Negative’.

About the Company

Incorporated in 1956, Hero Cycles is the largest cycle manufacturer in the world. Hero Cycles has a

manufacturing capacity of 5.5 million bicycles per year, with facilities at Ludhiana (Punjab). It also

manufacturers automotive rims and components. The company is closely held by the Om Prakash

Munjal family.

For 2009-10, Hero Cycles reported a profit after tax of Rs.3.0 billion (Rs.0.58 billion for 2008-09)

on net revenues of Rs.17.0 billion (Rs.14.9 billion).

Rating Rationale

Hero Motors Limited

Rs.400 Million Non Convertible Debenture Issue*

AA (so)/Stable (Reaffirmed)

Rs.100 Million Non Convertible Debenture Issue*

AA (so)/Stable (Reaffirmed)

*Backed by unconditional and irrevocable corporate guarantees from Hero Cycles Ltd

CRISIL’s rating on Hero Motors Ltd’s (Hero Motors’) non-convertible debenture issues continues

reflect the unconditional and irrevocable guarantees that Hero Motors has received for its

aforementioned debt programmes from its group company, Hero Cycles Ltd (Hero Cycles, rated

‘AA/Stable/P1+’ by CRISIL). The guarantees cover the principal and interest obligations on the

aforementioned debenture programmes. The ratings are supported by a payment mechanism to

ensure the timely fulfilment of the debt obligations on the rated instruments. Thus, the ratings also

reflect the credit strength of the guarantor, Hero Cycles.

For arriving at its rating, CRISIL has combined the business and financial risk profiles of Hero

Motors and its 66.67 per cent subsidiary, Munjal Kiriu Industries Pvt Ltd (Munjal Kiriu).

Outlook: Stable

The rating outlook on Hero Motors is based on CRISIL’s rating on the guarantor, Hero Cycles.

About the Company

Hero Motors, incorporated in 1998, is part of the O P Munjal group, whose flagship company is

Hero Cycles. Hero Motors supplies automotive components to India’s largest motorcycle

manufacturer, Hero Honda Motors Ltd (rated ‘AAA/FAAA/Stable/P1+’), and exports engine

components to Bombardier Rotax, Austria. Hero Cycles owns nearly 41 per cent of Hero Motors.

During 2007-08 (refers to financial year, April 1 to March 31), Hero Motors signed a joint venture

(JV) and technical collaboration agreement with Sumitomo Corporation, and Kiriu Corporation,

Japan (Kiriu). In the same year, Hero Motors sold 33.4 per cent stake in its ferrous casting unit at

Manesar to Sumitomo Corporation and Kiriu. The JV, Munjal Kiriu, manufactures automotive

components, particularly disc brakes, drums, and knuckles. In August 2008, Hero Motors acquired

an assembly facility in Halol, Gujarat, from Delphi Corporation for making chassis systems (rear

axles assembly and front corner modules) for General Motors India Ltd. Hero Motors set up another

unit for chassis assembly in Talegaon, Maharashtra, and hived off its entire chassis system division

into a separate company, Hero Motors Chassis Systems Pvt Ltd (HMCSPL), in 2008-09. In

February 2010, Hero Motors entered into a JV with ZF India Pvt Ltd, wherein 50 per cent stake in

HMCSPL was transferred to ZF India Pvt Ltd, after which HMCSPL was renamed ZF Hero Chassis

Systems Pvt Ltd.

For 2009-10, Hero Motors (consolidated with Munjal Kiriu) reported a net loss of Rs.175.80 million

(Rs.275.40 million for the previous year) on net sales of Rs.2.81 billion (Rs.2.19 billion).

Rating Rationale

Munjal Showa Limited

Rs.667.6 Million (JPY1754.5 Million) LongAA/Stable (Reaffirmed)

Term Loans

Rs.21.9 Million (JPY42.9 Million) Long-Term

AA/Stable (Withdrawn)

Buyers Credit

Rs.150.0 Million Cash Credit *

AA/Stable (Reaffirmed)

Rs.470.0 Million Letter of Credit **

P1+ (Reaffirmed)

Rs.22.5 Million Bank Guarantee

P1+ (Reaffirmed)

Rs.60.0 Million Commercial Paper Programme

P1+ (Reaffirmed)

*Interchangeable with bank overdraft.

**Interchangeable with short-term loan up to Rs.50 million.

CRISIL’s ratings on Munjal Showa Ltd’s (Munjal Showa’s) commercial paper programme and bank

facilities continue to reflect the company’s healthy operating efficiencies, its continuing business

linkages with Hero Honda Motors Ltd (HHML, rated ‘AAA/FAAA/Stable/P1+’ by CRISIL), and its

comfortable financial risk profile. These rating strengths are partially offset by the company’s limited

segment and geographic diversification, which leads to low bargaining power with, and pricing

pressure from, original equipment manufacturers. CRISIL has also withdrawn its rating on Munjal

Showa’s long-term buyer’s credit facility as the same has been completely repaid.

Outlook: Stable

CRISIL believes that Munjal Showa will maintain its comfortable business and financial risk profiles

over the medium term. The outlook may be revised to ‘Positive’ if the company further diversifies its

customer profile, and maintains its financial risk profile. Conversely, the outlook may be revised to

‘Negative’ in case of sluggish revenue growth, decline in profitability or higher-than-anticipated debtfunded capital expenditure, impacting the company’s overall credit risk profile.

About the Company

Munjal Showa was promoted by the erstwhile Hero group in 1987, in technical and financial

collaboration with Showa Corporation of Japan. Following the family arrangement among the

Munjals, Munjal Showa will continue to be managed by Mr. Yogesh Munjal, representing the

Satyanand Munjal group. Presently, the holding company of Mr. Yogesh Munjal and Showa

Corporation have equity holdings of 39 per cent and 26 per cent, respectively, in Munjal Showa,

while public shareholding and institutional holdings are about 22 per cent and 13 per cent,

respectively. There is no impact on Munjal Showa’s business operations and its supply arrangement

with HHML, following the family arrangement among the Munjals.

Munjal Showa manufactures front forks and shock absorbers for two-wheelers, and struts and

window balancers for four-wheelers. HHML, India’s largest two-wheeler manufacturer, accounted

for about 77 per cent of the company’s revenues in 2009-10 (refers to financial year, April 1 to

March 31), with the remainder coming from Maruti Suzuki India Ltd (‘AAA/Stable/P1+’), Honda

Motorcycle & Scooter India (Pvt) Ltd, and Honda SIEL Cars India Ltd.

Munjal Showa reported a net profit of Rs.246.1 million on net revenues of Rs.9.9 billion in 2009-10,

compared with a net profit of Rs.206.9 million on net revenues of Rs.8.3 billion in 2008-09.

Rating Rationale

Highway Industries Ltd

Rs.298.9 Million Long-Term Loan*

Rs.36.7 Million Long-Term Loans

Rs.150.0 Million Cash Credit

Rs.7.5 Million Bank Guarantee

AA-/Stable (Reaffirmed)

AA-/Stable (Withdrawn)

AA-/Stable (Reaffirmed)

P1+ (Reaffirmed)

CRISIL’s ratings on the bank loan facilities of Highway Industries Ltd (HIL) continue to reflect the

company’s healthy operating efficiencies, its continuing business linkages with Hero Honda Motors

Ltd (HHML, rated ‘AAA/FAAA/Stable/P1+’ by CRISIL), and its comfortable financial risk profile.

These rating strengths are partially offset by HIL’s exposure to pricing pressures from original

equipment manufacturers (OEMs), and the limited customer and segmental diversification in its

revenue profile. CRISIL has also withdrawn its rating on the company’s Rs 36.7 million long-term

loans as the same has been completely repaid.

Outlook: Stable

CRISIL expects HIL to diversify its business risk profile through increased focus on exports, even as

demand from HHML is expected to remain steady. The company is also expected to maintain its

comfortable financial risk profile over the medium term, supported by steady cash generation and

moderate capital spending. Higher-than-anticipated debt-funded capital or a steep decline in business

levels and operating profitability could result in the outlook being revised to ‘Negative’. Conversely,

the outlook could be revised to ‘Positive’ if HIL reports higher-than-expected growth in business,

including through higher exports, strengthening its financial risk profile significantly.

About the Company

HIL was set up in 1971 by the Munjals of the erstwhile Hero group to manufacture free-wheels for

bicycles manufactured by Hero Cycles Ltd (rated ‘AA/Stable/P1+’). Subsequently, the company also

set up a unit in Ludhiana to manufacture special purpose machines for the erstwhile Hero group

companies. In 1986, HIL set up a unit at Gurgaon to manufacture aluminium die-cast components

to meet the requirements of HHML. However, HIL ran its Gurgaon and Ludhiana units as separate

divisions. In the interest of operational and management convenience, HIL demerged its Gurgaon

unit in April 1999 into a new company, Sunbeam Auto Pvt. Ltd (rated ‘AA-/Stable/P1+’).

Subsequently, HIL commenced supply of crankshafts, connecting rods, and kick-starters to HHML.

It also supplies cold and hot forgings, machining, and sub assemblies for two- and three-wheelers. At

present, HIL has three units in Ludhiana. Its major customer is HHML, which contributed 95 per

cent to its revenues in 2009-10 (refers to financial year, April 1 to March 31).

Following the recent family arrangement among the Munjals, HIL will continue to be managed by

Mr. Umesh Munjal, representing the Satyanand Munjal group. Presently, Mr Umesh Munjal holds

the entire equity in HIL through UM holdings, an investment company. CRISIL expects HIL’s

business operations and its supply arrangement with HHML, to remain as earlier, when Sunbeam

was part of the larger Hero group.

For 2009-10, HIL reported a profit after tax (PAT) of Rs.67.3 million (Rs.75.3 million in the

previous year), on net sales of Rs.1.29 billion (Rs.1.13 billion).

Rating Rationale

Sunbeam Auto Pvt. Ltd

Rs.350 Million Cash Credit *

Rs.220 Million Bank Guarantee**

Rs.350 Million Short-Term Debt Programme

AA-/Stable (Reaffirmed)

P1+ ( Reaffirmed)

P1+ ( Reaffirmed)

*Interchangeable with packing credit foreign currency loan; **Interchangeable with letter of credit.

CRISIL’s ratings on Sunbeam Auto Pvt Ltd’s (Sunbeam’s) debt programme and bank facilities

continue to reflect the company’s healthy market position in the domestic aluminium die-cast

component (ADCC) business, derived from its continuing business relationship with India’s leading

two-wheeler manufacturer, Hero Honda Motors Ltd (HHML, rated ‘AAA/FAAA/Stable/P1+’ by

CRISIL), and its comfortable financial risk profile. These rating strengths are partially offset by

Sunbeam’s exposure to the risks related to customer and segmental concentration in its revenue

profile, and pricing pressure from original equipment manufacturers (OEMs).

Outlook: Stable

CRISIL believes that Sunbeam will maintain its business risk profile because of its association with

HHML, which is expected to continue to post healthy revenue growth over the medium term, and

Sunbeam’s initiatives to diversify its customer base. The outlook may be revised to ‘Positive’ in case

of higher-than-expected improvement in Sunbeam’s business levels and profitability. Conversely, the

outlook may be revised to ‘Negative’ in case of lower-than-anticipated off-take and profitability,

impacting the company’s key debt protection metrics and gearing levels.

About the Company

Sunbeam was incorporated as a subsidiary of Highway Industries Ltd (rated ‘AA-/Stable/P1+’), part

of the erstwhile Hero group. Following the recent family arrangement among the Munjals, Sunbeam

will continue to be managed by Mr. Ashok Munjal, representing the Dayanand Munjal group.

Presently, Mr Ashok Munjal and his wife, Mrs Neelam Munjal, hold the entire equity in Sunbeam

through Munjal Holdings, an investment company of Mr. Ashok Munjal. Even post the family

arrangement, CRISIL expects Sunbeam’s business operations and its supply arrangement with

HHML, to remain as earlier, when Sunbeam was part of the larger Hero group.

Sunbeam’s manufacturing facilities in Gurgaon were set up in 1986 to meet HHML’s ADCC

requirements. The plant has a casting capacity of 41,555 tonnes per annum and is located close to

HHML’s Gurgaon and Dharuhera (Haryana) plants, and Maruti Suzuki India Ltd’s (MSIL’s,

‘AAA/Stable/P1+’) Gurgaon plant. Sunbeam is the principal supplier of ADCCs to HHML and

presently supplies a major portion of HHML’s requirements of crank cases, cylinder heads, brake

levers, clutch levers, cylinder case covers, grips, and holders. Rico Auto Industries Ltd (Rico) and

Rockman Industries Ltd (Rockman; ‘AA-/Stable/P1+’), another Hero group company, are the other

principal suppliers to HHML. Sunbeam, Rico and Rockman supply about one-third each of

HHML’s ADCC requirements. HHML sources a major portion of its ADCC requirements of

Haridwar plant (commissioned in April 2008) largely from Rockman.

Increasing supplies by Rockman has been tempering Sunbeam as well as Rico’s revenue growth. To

counter this, Sunbeam is attempting to increase focus on the export markets and increase the number

of components supplied to the Dharuhera and Gurgaon facilities of HHML. Sunbeam also has a

technical tie-up with Honda Foundry, Japan, to manufacture pistons for HHML. For 2009-10

(refers to financial year, April 1 to March 31), Sunbeam reported a profit after tax of Rs.129.6

million (Rs.66.1 million in the previous year) on net sales of Rs.7.49 billion (Rs.7.80 billion).

Rating Rationale

Hero Exports

Rs.160 Million Cash Credit Limit

BBB+/Stable (Reaffirmed)

Rs.45 Million Proposed Long-Term bank loan

BBB+/Stable (Reaffirmed)

facility

Rs.655 Million Export packing Credit^

P2 (Reaffirmed)

Rs.150 Million Bill Discounting facility

P2 (Reaffirmed)

Rs.160 Million Letter of Credit*

P2 (Reaffirmed)

Rs.10 Million Bank Guarantee

P2 (Reaffirmed)

*Interchangeable with bank guarantee of upto Rs.10 million

^Interchangeable with bill discounting facility of Rs.150 million and letter of credit facility of Rs.100

million

CRISIL ratings on the bank facilities of Hero Exports continue to reflect Hero Exports’ moderate

business risk profile, marked by strong business linkages with Hero Cycles Ltd (Hero Cycles, rated

‘AA/Stable/P1+‘by CRISIL) and average but improving financial risk profile. These rating strengths

are partially offset by intense competition Hero Exports faces from Chinese players and its

vulnerability to volatility in foreign exchange rates.

Outlook: Stable

CRISIL believes that Hero Exports’ revenues and profitability will improve gradually, supported by

the increase in its order book and better penetration of e-bikes. Hero Exports’ financial risk profile

has benefited from the recent equity infusion from its promoters and is likely to improve further

because of expected improvement in profitability and reduction in derivative-related losses. The

outlook may be revised to ‘Positive’ if Hero Exports’ revenues and profitability improve more than

expected. Conversely, the outlook may be revised to ‘Negative’ in case of sluggish profitability, and if

the firm undertakes larger-than-expected debt-funded capital expenditure programme.

About the Firm

Hero Exports was set up in 1993 as a partnership firm, by the Munjal brothers of the Hero group, as

the export arm of Hero Cycles. Following the recent business re-arrangement among the Munjals,

Hero Exports will continue to be managed by Mr. Vijay Munjal, representing the Dayanand Munjal

group.

Presently, Hero Exports has three partners, Mr Vijay Munjal and his sons, Mr. Naveen Munjal and

Mr. Gaurav Munjal. Hero Exports will continue to be the export arm of Hero Cycles. Apart from

exporting bicycles and bicycle components and spares procured from Hero Cycles, the firm also

manufactures battery-operated bikes and medical equipment.

For 2009-10 (refers to financial year, April 1 to March 31), the firm reported a net loss of Rs.97.1

million on net sales of Rs.1.5 billion, against a net loss of Rs.195.9 million on net sales of Rs.2.1

billion for the previous year.

Disclaimer

CRISIL has taken due care and caution in preparing this report. Information has been obtained by CRISIL from sources

which it considers reliable. However, CRISIL does not guarantee the accuracy, adequacy or completeness of any

information and is not responsible for any errors in transmission and especially states that it has no financial liability

whatsoever to the subscribers/ users/ transmitters/ distributors of this report. No part of this report may be reproduced in

any form or any means without permission of the publisher. Contents may be used by news media with due credit to

CRISIL.

©

CRISIL. All Rights Reserved.

Head Office:

CRISIL House,Central Avenue Road, Hiranandani Business Park,Powai, Mumbai - 400 076

Tel: +91-22- 3342 3000 Fax: +91-22- 3342 3001 www.crisil.com