Fidelity Account Change of Registration Instructions

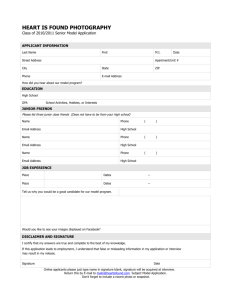

advertisement

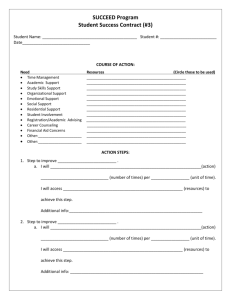

Print Reset Save Fidelity Account Change of Registration Instructions Use this form to change the registration of a nonretirement Fidelity Account.® For registration changes due to the death of an account owner, contact Fidelity to determine if this is the appropriate form. If the Social Security number or tax identification number that the account reports under is not changing, generally the account number may remain the same. If the tax reporting number is changing, a new account will be established. Additional documentation is required if the account ownership changes due to the following: a guardianship/conservator/custodian appointment, termination of a custodial account, or a transfer due to divorce. Read the instructions below as you complete the form. Verify that the registration change you are requesting is available through the use of this form. Return the completed form to the following address: If using a private mail service, send the completed form to the following address: Fidelity Investments Account Reregistration Services P.O. Box 770001 Cincinnati, OH 45277-0039 Fidelity Investments Account Reregistration Services KC1C 100 Crosby Parkway Covington, KY 41015 If you have any questions, visit us at Fidelity.com or call us at 1-800-fidelity. Important Information About Procedures For Opening A New Account To help the government fight money laundering and the funding of terrorism, federal law requires Fidelity to obtain your name, date of birth, address, and a government-issued ID number before opening your account, and to verify the information. In certain circumstances, Fidelity may obtain and verify comparable information for any person authorized to make transactions in an account or beneficial owners of certain entities. Further documentation is required for certain entities, such as trusts, estates, corporations, partnerships, and other organizations. Your account may be restricted or closed if Fidelity cannot obtain and verify this information. Fidelity will not be responsible for any losses or damages (including, but not limited to, lost opportunities) that may result if your account is restricted or closed. Current Customer Information The current account registration information is required. If there are outstanding checks written against the current account, leave sufficient funds in the current account to ensure payment and provide the check numbers of any outstanding checks. 1 NEW ACCOUNT REGISTRATION In order to establish your new account registration, the new owner(s), as well as any current owner(s), must complete the information in this section. • Check the type of new registration that you are requesting. • Provide the name, date of birth, Social Security or Taxpayer ID number, permanent address, mailing address, citizenship, evening phone, daytime phone, e-mail address, employment status, and affiliations of new owner(s) or new joint owner(s). Key items regarding this process: • If you are establishing for a trust, please complete the Beneficial Ownership for Trusts section of this form. • If you are establishing a trust for domestic trusts, please complete the Certification of Trust form. For foreign trusts, include the pages of the trust document that provide the full name of the trust, trust date, name of the trustee(s), and all signatures. Do not include the entire trust document. • If there are more than two owners, attach a separate piece of paper with their names and required information from Section 1. • If the account has been registered as a Transfer on Death (TOD) account, the TOD registration will not carry over to the new registration. A new TOD form needs to be completed. • If reregistering a mySmart Cash Account® with a mySmart Cash Manager® feature, Fidelity may change and/or remove the mySmart Cash Manager feature, and/or eliminate associated Funding Accounts, if the new account registration is not consistent with previous authorizations obtained to establish the mySmart Cash Manager feature on the account. • If the account has unsettled transactions pending at the time Fidelity processes this change of registration, such transactions, when settled, will be reflected in the new registration. As a result, transaction confirmations and account statements reflecting such transactions will be sent to the new owners. Duplicate copies of transaction confirmations and/or account statements originally issued to current owners prior to the registration change may be made available to the new owners upon request. Page 1 of 4 2 Financial Profile for New Registration We are required by the Financial Industry Regulatory Authority (FINRA) and other industry regulators to obtain the information in this section. For joint accounts, provide combined information. For UGMA/UTMA accounts, provide custodian’s information. 3 Account Features for New Registration If you have any features (e.g., checkwriting, electronic funds transfer, Fidelity BillPay® payment service for brokerage customers, etc.) on the current account, and the account number is changing, you must reapply for those features. Please visit Fidelity.com or call us at 1-800-544-6666 to add those features. 4 Beneficial Ownership for Trusts Please complete the information in this section for the grantor and any additional individual(s) named in the trust (other than the grantor or trustee(s)) authorized to make changes to the trustees. 5 Signatures The current owner(s) and new owner(s) must sign this form. Complete the form and review the matrix below: • Determine the type of account that is being transferred • Identify the reason/type of transfer in the first column and follow the requirements indicated in the second column. If your transfer situation is not reflected below, call us for additional instructions. From an Individual Account Reason/Type of Transfer: Required Signatures and Documentation: Trust Account • Current owner must sign in section 5.A., and all trustees must sign in section 5.B. No signature guarantee is required if the current owner is the sole trustee. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • If the current owner is a trustee and there are other trustees, a signature guarantee of the current owner is required if the value of the transfer or reregistration is greater than $100,000. • If the current owner is not a trustee on the new account, a signature guarantee of the current owner is required if the value of the transfer or reregistration is greater than $10,000. Joint Account due to marriage (adding a spouse to your account) • Current owner must sign in section 5.A., and all joint owners must sign in section 5.B. • A signature guarantee of the current owner, or a copy of the marriage certificate, is required if the account being reregistered is greater than $100,000. Joint Account for nonmarital reasons (adding an additional owner, and current owner is not deceased) • Current owner must sign in section 5.A., and all joint owners must sign in section 5.B. • A signature guarantee of the current owner is required if the value of the transfer or reregistration is greater than $100,000. Individual Account (current owner is not deceased) • Current owner must sign in section 5.A., and the new owner must sign in section 5.B. • A signature guarantee of the current owner is required if the value of the transfer or reregistration is greater than $10,000. UGMA/UTMA Account • Current owner must sign in section 5.A. and custodian must sign in section 5.B. No signature guarantee is required if the current owner will be the custodian of the new account. • If the current owner is not the custodian of the new account, a signature guarantee of the current owner is required if the value of the transfer or reregistration is greater than $10,000. Estate or other registration due to the death of the owner • Probated Estate • Personal representative must sign in section 5.A. Include a copy of the court appointment of the decedent’s personal representative, certified by the court within sixty (60) days of the proposed transfer. • Include a copy of the death certificate. • If transferring to an estate registration, a signature guarantee of the personal representative(s) is not required. The personal representative signs in section 5.B. • If transferring to a registration type other than estate, the personal representative’s signature must be guaranteed in section 5.A. if the value of the transfer or reregistration is greater than $10,000. The new owner signs in section 5.B. • If there is more than one personal representative, additional documents may be required. Please call Fidelity for assistance. Estate or other registration due to the death of the owner • Non-Probated Estate • Legal heir must sign in section 5.A. Include a certified copy of the alternative probate document. • Include a copy of the death certificate. • If transferring to legal heir, a signature guarantee of the legal heir is not required. The legal heir signs in section 5.B. • If transferring to a registration type other than to the legal heir, the legal heir’s signature must be guaranteed in section 5.A. if the value of the transfer or reregistration is greater than $10,000. The new owner signs in section 5.B. • If a state tax waiver is required, include a copy of the waiver with this form. Page 2 of 4 From a Joint Account Reason/Type of transfer: Required Signatures and Documentation: Trust Account, and the current joint owners are the sole trustees of the trust • All current owners must sign in sections 5.A. and 5.B. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • No signature guarantee is required. Trust Account, and only one of the current joint owners is a trustee of the trust • All current owners must sign in section 5.A. All trustees of the trust must sign in section 5.B. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • A signature guarantee of the current owners is required in section 5.A. if the value of the transfer or reregistration is greater than $10,000. Trust Account, and the joint owners are trustees of the trust, with one or more new trustees • All current owners must sign in section 5.A. All trustees of the trust must sign in section 5.B. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • A signature guarantee of the current owners is required in section 5.A. if the value of the transfer or reregistration is greater than $100,000. Joint Account in the name of the current owners and new owner(s) • All current owners must sign in section 5.A. The current owners and any new owners must sign in section 5.B. • A signature guarantee of the current owners is required if the value of the reregistration is greater than $100,000. Individual Account, due to divorce or other reasons • All current owners must sign in section 5.A. The individual owner who will retain the account must sign in section 5.B. • A signature guarantee of the current owners is required in section 5.A. if the value of the transfer or reregistration is greater than $10,000. UGMA/UTMA Account, and one of the joint owners is the custodian • All current owners must sign in section 5.A. The custodian must sign in section 5.B. • A signature guarantee of the current owners is required in section 5.A. if the value of the transfer or reregistration is greater than $10,000. A Joint Account in the name of the surviving owner and a new owner(s), due to the death of one of the owners • Surviving owner(s) must sign in section 5.A. The surviving owner(s) and any new owners must sign in section 5.B. • A signature guarantee of the surviving owner(s) is required if the value of the transfer or reregistration is greater than $100,000. • Include a copy of the death certificate. • If a state tax waiver is required, include a copy of the waiver with this form. • For assistance call 1-800-544-0003. Estate or other registration due to the death of one or more of the owners (for Tenants in Common or Community Property registrations) • Probated Estate • Decedent’s personal representative must sign in section 5.A. • Include a copy of the court appointment of the decedent’s personal representative, certified by the court within sixty (60) days of the proposed transfer. • If transferring to an estate registration, a signature guarantee of the personal representative(s) is not required. The personal representative signs in section 5.B. • If transferring the decedent’s portion into a registration type other than estate, the personal representative’s signature must be guaranteed in section 5.A. if the value of the transfer or reregistration is greater than $10,000. The new owner signs in section 5.B. • If a state tax waiver is required, include a copy of the waiver with this form. • For assistance call 1-800-544-0003. From a Custodial Account (UGMA/UTMA) Reason/Type of transfer: Required Signatures and Documentation: Minor is of age • Minor (of age) must complete this form and sign in section 5.B. The custodian must sign in section 5.A. • A signature guarantee of the custodian is required if the account value is greater than $100,000. Custodian is deceased, Minor is 14 years of age or older • The successor custodian must sign this form in sections 5.A. and 5.B. • Provide a notarized letter from the minor appointing the successor custodian, the minor’s birth certificate, and a copy of the custodian’s death certificate. • For assistance call 1-800-544-0003. Custodian is deceased, Minor is under 14 years of age • The successor custodian must complete and sign this form in sections 5.A. and 5.B. A signature guarantee of the successor custodian is required if the value of the transfer or reregistration is greater than $10,000. • Provide the document appointing a successor custodian certified by the court within sixty (60) days of the proposed transfer. If the successor custodian is the parent, the court appointment document is not required. • Include a copy of the death certificate and a copy of the minor’s birth certificate. • For assistance call 1-800-544-0003. Page 3 of 4 From a Custodial Account (UGMA/UTMA) Reason/Type of transfer: Required Signatures and Documentation: Resignation (change) of custodian • Resigning custodian must sign this form in section 5.A. A signature guarantee of the resigning custodian is required if the value of the transfer or reregistration is greater than $10,000. • The successor custodian must complete and sign this form in section 5.B. Minor is deceased • Custodian must complete and sign in section 1 and executor must sign in section 5. A signature guarantee is required if the value of the transfer or reregistration is greater than $10,000. • Include a copy of the death certificate with this form. • Include a copy of the court appointment of the decedent’s personal representative, certified by the court within sixty (60) days of the proposed transfer, or an alternative probate document. • If a state tax waiver is required, include a copy of the waiver with this form. • For assistance call 1-800-544-0003. From a Trust Account Reason/Type of transfer: Required Signatures and Documentation: Adding a new trustee • A current trustee must sign in section 5.A. A signature guarantee of a current trustee is required if the value of the transfer or reregistration is greater than $100,000. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • All trustees of the account must sign in section 5.B. Removing a trustee • A current trustee must sign in section 5.A. A signature guarantee of a current trustee is required if the value of the transfer or reregistration is greater than $10,000. • Complete the Beneficial Ownership for Trusts section. • Include the Certification of Trust with this form if the trust is a domestic trust. • All trustees of the account must sign in section 5.B. Individual Account; sole current trustee is the sole owner of the new account • The trustee must sign in sections 5.A. and 5.B. • No signature guarantee is required. Joint Account; current trustees are the sole owners of the joint account • The trustees must sign in sections 5.A. and 5.B. • No signature guarantee is required. All other trust requests • A current trustee must sign in section 5.A. A signature guarantee of a current trustee is required if the value of the transfer or reregistration is greater than $10,000. • Include the Certification of Trust with this form if the trust is a domestic trust. • Complete the Beneficial Ownership for Trusts section. • All new owners of the account must sign in section 5.B. A signature guarantee is designed to protect you and Fidelity from fraud. You should be able to obtain a signature guarantee from a bank, broker, broker/dealer, credit union (if authorized under state law), securities exchange, or association clearing agency or savings association. A notary public cannot provide a signature guarantee and a notarization cannot be accepted in lieu of a signature guarantee. Retain these instructions and only return the form to complete your transaction. Page 4 of 4 Fidelity Account Change of Registration Form Complete all sections of this form and return all pages of the form. Additional documentation may be required to process the change of registration. Refer to the instructions for requirements. Current Customer Information If the Tax Reporting number is not changing for this account, check this box. Fidelity Account Number Name of Owner/Trustee/Minor Social Security or Taxpayer ID number Name of Co-Owner/Trustee/Custodian Social Security or Taxpayer ID number Daytime phone number Provide the check numbers of any outstanding checks. The entire account will be reregistered, unless you provide a letter of instruction with this form. 1 New Account registration — REQUIRED Note: All addresses are assumed to be the same as the primary owner’s address unless otherwise noted. Individual Trust Custodial (UGMA/UTMA) — Indicate applicable state Estate — Taxpayer ID number (required) Joint Tenants with Rights of Survivorship Community Property Tenants in Common Other (e.g., guardianship) Check here if the Date of Birth, Address, Driver’s License, Phone, or E-mail has changed on the existing account and we will update the account accordingly. Legal Name of Account Owner, Minor, Trustee, or Executor Legal Name of Account Joint Owner, Custodian, Co-Trustee, or Co-Executor Social Security or Taxpayer ID number Social Security or Taxpayer ID number Date of Birth Date of Birth Country of Citizenship: U.S. Other Country of Citizenship: U.S. Other Country of Tax Residence: U.S. Other Country of Tax Residence: U.S. Other (See Government ID box for foreign citizens) (See Government ID box for foreign citizens) E-mail Address E-mail Address U.S. Driver’s License Number (if available) State of Issuance Permanent Address (no P.O. boxes or C/O) — Street City Evening Phone 1.766724.114 StateZip Mailing Address (if different from above) — Street State Zip City Daytime Phone State of Issuance Permanent Address (no P.O. boxes or C/O) — Street State Zip City Mailing Address (if different from above) — Street City U.S. Driver’s License Number (if available) Evening Phone Page 1 of 8 State Zip Daytime Phone 018960401 1 New Account registration — REQUIRED Employment Status Employed (CONTINUed) Employment Status Not Employed Employed Retired Not Employed Retired S elf-Employed and my employment address is the same as my legal address. Self-Employed and I am providing my employment address below. S elf-Employed and my employment address is the same as my legal address. Self-Employed and I am providing my employment address below. Occupation (if retired or not employed, indicate source of income) Occupation (if retired or not employed, indicate source of income) Employer’s Name and Address Employer’s Name and Address City State Zip Affiliations City State Zip Affiliations heck this box if you are affiliated with, or employed by, a stock C exchange or a member firm of an exchange or FINRA, a municipal securities dealer, or Fidelity. If you checked the box, obtain and attach the compliance officer’s letter of approval (“407 letter”) and indicate your company’s name and address below. Failure to include an approval letter may delay the processing of your request. We must tell your employer you have applied for this account. An account approval letter is not required for Fidelity employees. heck this box if you are affiliated with, or employed by, a stock C exchange or a member firm of an exchange or FINRA, a municipal securities dealer, or Fidelity. If you checked the box, obtain and attach the compliance officer’s letter of approval (“407 letter”) and indicate your company’s name and address below. Failure to include an approval letter may delay the processing of your request. We must tell your employer you have applied for this account. An account approval letter is not required for Fidelity employees. Check this box if your affiliation is the same as your employer. (If you checked this box, you are not required to complete the information below.) Check this box if your affiliation is the same as your employer. (If you checked this box, you are not required to complete the information below.) Affiliated Entity Name Affiliated Entity Name Street Street City State Zip City heck this box if you are a control person or affiliate or an immediC ate family/household member of a control person or affiliate of a publicly traded company under SEC Rule 144 (this would include, but is not limited to, a director, 10% shareholder, policy-making officer, and member of the board of directors). Trading Symbol Company Name State Zip heck this box if you are a control person or affiliate or an immediC ate family/household member of a control person or affiliate of a publicly traded company under SEC Rule 144 (this would include, but is not limited to, a director, 10% shareholder, policy-making officer, and member of the board of directors). Trading Symbol Company Name T RUST ACCOUNTS — Complete this section and the Beneficial Ownership for Trusts section. Include the accompanying Certification of Trust form if the trust is a domestic trust.­ Legal Name of Trust as shown on tax return For the Benefit of: SSN or Date of TrustTrust Taxpayer ID number* *Unable to use a decedent’s Social Security number. A Taxpayer ID number is required. 1.766724.114 Page 2 of 8 018960402 TIN 1 New Account registration — REQUIRED UNEXPIRED Government ID (CONTINUed) (foreign trusts ONLY) Identification document must have a reference number. Please attach a photocopy.­ Government-issued identification number Type of document Country of issuance Account Owner UNEXPIRED Government ID Place of birth (foreign citizens ONLY) Identification document must have a reference number and photo. Please attach a photocopy.­ City Immigration status State/Province Permanent resident Country Non-permanent resident Non-resident Check which type of document you are providing: U.S. driver’s license DHS permanent resident card Passport with U.S. visa Employment Authorization Document Passport without U.S. visa Foreign national identity document Document number and country of issuance (Number from the document checked above) Joint Account Owner UNEXPIRED Government ID Place of birth (foreign citizens ONLY) Identification document must have a reference number and photo. Please attach a photocopy.­ City Immigration status State/Province Permanent resident Country Non-permanent resident Non-resident Check which type of document you are providing: U.S. driver’s license DHS permanent resident card Passport with U.S. visa Employment Authorization Document Passport without U.S. visa Foreign national identity document Document number and country of issuance (Number from the document checked above) Duplicate Mailings Check this box if a joint owner has a different address and you would like duplicate copies of the confirmation of the new account profile, confirmation of changes to the investment objectives, and the triannual account profile confirmation sent to that separate address. 1.766724.114 Page 3 of 8 018960403 2 FINANCIAL PROFILE FOR NEW REGISTRATION — REQUIRED We are required to obtain this information for the new registration. If you do not return this page, your request will not be processed. Your Investment Objective You should choose your investments based on your objectives, time frame, and tolerance for market fluctuation. From short-term liquid investments that seek to preserve capital (accepting the lowest returns in exchange for stability) to longer-term investments that seek maximum growth (but can tolerate very wide fluctuations in market values), you can choose an approach that’s best for you. Simply check the box below that most closely matches your investment objective. For joint accounts, please provide c­ ombined information. Check one profile. (Determine your profile using the information below.) Aggressive 1 Short-Term 2 Conservative 6 Balanced 3 Growth 5 Growth SAMPLE PORTFOLIO MIX 100% Asset Class Short-Term 14% Foreign Stocks U.S. Domestic Stocks Bonds 10% 30% 5% 40% 50% 15% 35% 25% 21% 49% 25% 15% 4 Most Aggressive 30% 60% 70% 6% Lower risk Shorter time frame Higher risk Longer time frame Short-Term You seek to preserve your capital and can accept the lowest returns in exchange for price stability. Conservative You seek to minimize fluctuations in market values by taking an income-oriented approach with some potential for capital appreciation (minimum required for writing covered call options). Balanced You seek the potential for capital appreciation and some income and can withstand moderate fluctuations in market value. Growth You have a preference for growth and can withstand significant fluctuations in market value. Aggressive Growth You seek aggressive growth and can tolerate wide fluctuations in market values, especially over the short term. Most Aggressive You seek very aggressive growth and can tolerate very wide fluctuations in market values, especially over the short term (required for options strategies other than writing covered call options). Check one box in each column. Annual Income Estimated Net Worth (from all sources) (excluding residence) Estimated Liquid Net Worth Federal Tax Bracket 1 Under $20,000 1 Under $30,000 1 Under $15,000 1 2 $20,000–$50,000 1 $30,000–$50,000 1 $15,000–$50,000 2 3 $50,001–$100,000 2 $50,001–$100,000 2 $50,001–$100,000 3 4 Over $100,000 3 $100,001–$500,000 3 $100,001–$500,000 4 Over $500,000 4 Over $500,000 <15% 25% >28% Generally, among asset classes, stocks may present more short-term risk and volatility than bonds or short-term instruments but may provide greater potential return over the long term. Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk (as interest rates rise, bond prices usually fall and vice versa) and the risk of default, or the risk that an issuer will be unable to make income or principal payments. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the prices of goods and services, than stocks. Finally, foreign investments, especially those in emerging markets, involve greater risk and may offer greater potential return than U.S. investments. Strategic Advisers, Inc., adjusted its target asset mixes, as of November 2009, to increase the percentage of international equity to 30% of the overall equity portion of each target asset mix. 3 Account Features for New Registration Overdraft Protection and Margin Credit (Sections 1 and 2 must be completed in their entirety.) This borrowing feature allows you to use your eligible securities or mutual funds as collateral for overdraft protection, for the purchase of additional securities, as a low-cost loan alternative, or for debt consolidation. Adding this feature is subject to Fidelity’s approval and may require a review of your credit history. Margin borrowing involves additional risk and is not suitable for all investors. Your signature on this change form acknowledges that you have read the margin agreement section of the Customer Agreement and agree to its terms. 1.766724.114 Page 4 of 8 018960404 3 Account Features for New Registration (continued) Margin Credit is not available on custodial, estate, and other nontrust fiduciary accounts. Check here to be considered for margin borrowing. I f you have any other features (e.g., checkwriting, electronic funds transfer, Fidelity BillPay® payment service for brokerage customers, etc.) on the current account, and the account number is changing, you must reapply for those features. Please visit Fidelity.com or call us at 1-800-544-6666 to add those features. CORE ACCOUNT (CHOOSE ONE) All income from securities (dividends, capital gains, or sale proceeds) is automatically deposited into your core account. Dividends from mutual funds are reinvested in the originating fund. You can elect to change your distributions by phone at 1-800-FIDELITY, or online at Fidelity.com. Select a core position option where all your cash is held and transactions are processed. Availability of core position options may change. Fidelity Municipal Money Market Fund will be your core position if the core position option you selected is unavailable. If Fidelity Municipal Money Market Fund is unavailable, if no core position is selected, or if your initial investment is less than $5,000, a Fidelity taxable interest-bearing cash account will be your core position. You may contact us to change your core position option. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. Fidelity state municipal money market funds Designed to provide income that is free from state and federal income tax for residents of that state. Arizona Connecticut Michigan New York California Massachusetts New Jersey Ohio Pennsylvania Fidelity national municipal money market funds Designed to provide income that is free from federal income tax, but not state income tax. Fidelity Municipal Money Market Fund Fidelity Tax-Free Money Market Fund (This fund will not normally invest in municipal securities whose interest is subject to the Federal Alternative Minimum Tax.) Fidelity taxable interest-bearing position Intended for cash awaiting investment only, not as a long-term investment. Taxable Cash Account Fidelity taxable money market fund Designed to provide income that is generally subject to federal and state taxes. Fidelity Government Money Market Fund 4 Beneficial Ownership for Trusts Please complete the information below for the grantor and any additional individual(s) named in the trust (other than the grantor or trustee(s)) authorized to make changes to the trustees. These individuals will not have any authority to take action on this account. Please make duplicates of this page for additional individuals. GRANTOR Please complete this section for the grantor. If the grantor is deceased, please attest to that by checking here, and complete the name and date of death fields. Full legal name Date of birth (mm/dd/yyyy) Date of death (mm/dd/yyyy) Permanent address Social Security number Country of citizenship U.S. Other(s) 1.766724.114 Page 5 of 8 018960405 4 Beneficial Ownership for Trusts UNEXPIRED GOVERNMENT ID a photocopy.­ Place of birth (foreign citizens ONLY) Identification document must have a reference number and photo. Please attach City Immigration status (continued) State/Province Permanent resident Non-permanent resident Country Non-resident Check which type of document you are providing: U.S. driver’s license DHS permanent resident card Passport without U.S. visa Passport with U.S. visa Employment Authorization Document Foreign national identity document ocument number and country of issuance D (Number from the document checked above) Additional Individual with appoint/remove authority If the name provided below is another trust or an entity, additional information and documentation will be required. Full legal name Date of birth Social Security number (mm/dd/yyyy) Permanent address Country of citizenship U.S. Other(s) UNEXPIRED GOVERNMENT ID Place of birth (foreign citizens ONLY) Identification document must have a reference number and photo. Please attach a photocopy.­ City Immigration status State/Province Permanent resident Non-permanent resident Country Non-resident Check which type of document you are providing: U.S. driver’s license DHS permanent resident card Passport without U.S. visa Employment Authorization Document Foreign national identity document ocument number and country of issuance D 5 Passport with U.S. visa (Number from the document checked above) Signature(s) Current owners must read below, return all pages of the form, and sign in section 5.A. “I” refers to all account owners. Each owner, trustee, custodian, and fiduciary must READ the separate Customer Agreement and SIGN this section in ink. By signing this form, I, the current account owner, request that Fidelity Brokerage Services LLC change the current registration to the new registration as listed in Section 1. I acknow­ledge and understand that by changing the registration, I may be changing the ownership interests and/or removing individuals authorized to transact business or access this account. Upon transfer of assets due to any life event (death, divorce, etc.), and unless otherwise instructed, all dividend/interest income paid to the Transferor (Current Asset Holder) of $100 or less will be systematically allocated to the Transferee (New Asset Holder) receiving the largest share proportion of the account assets. If account is transferred evenly, the dividend/interest income will be systematically allocated to the last transferee paid. If this transfer is due to the death of one or more of the current owners, I certify that all taxes, funeral expenses, debts, and claims against the deceased’s estate have been paid or will be paid by the recipient(s) listed in the New Account Registration section, and no person, firm, association, or corporation other than the recipient(s) listed in the New Account Registration Section has (have) any right, title, claim, equity, or interest in, to, or respecting the estate or the shares to be transferred or the proceeds thereof. 1.766724.114 Page 6 of 8 018960406 5 SignaturE(S) (continued) Authorization: All current account owners listed in Current Customer Information must sign this form and have their signature(s) guaranteed (if required). New owners must read below, return all pages of the form, and sign in section 5.B. “I” refers to all account owners. I hereby request Fidelity Brokerage Services LLC and National Financial Services LLC (collectively “Fidelity” or “you”) to reregister the referenced Fidelity Account to reflect the information provided on this form. I understand that all other information and instructions provided on the original application related to this account remain unchanged and are incorporated hereby. If the new registration is being changed to a Trust or to reflect a change in Trustee, the Trustees hereby certify the following: –Y ou have the authority to accept orders and other instructions relative to the Trust accounts identified herein from those individ­uals or entities listed in Section 1. They may execute any documents on behalf of the Trust which you may require. By signing this form, Trustee hereby certifies that you are authorized to follow the instructions of any Trustee and to deliver funds, securities, or any other assets in the Fidelity Account to any Trustee or on any Trustee’s instructions, including delivering assets to a Trustee personally. Fidelity, in its sole discretion and for its sole protection, may require the written consent of any or all Trustees prior to acting upon the instructions of any Trustee. Applying for a Trust account is also considered to be a statement that all Trustees certify that Fidelity can rely on instructions from any one Trustee to represent the unanimous consent of all Trustees for actions taken on this account. – There are no other Trustees of the Trust other than those listed in Section 1. – S hould only one person execute this agreement, it shall be a representation that the signer is the sole Trustee. – I, as Trustee, have the power under the Trust and applicable law to enter into the transactions and issue the instructions that I make in this account. Such power may include, without limitation, the authority to buy, sell (including short sales), exchange, convert, tender, redeem and withdraw assets (including delivery of securities to and from the account), and to trade securities on margin or otherwise (including the purchase and/or sale of option contracts) for and at the risk of the Trust. I understand that all orders and transactions will be governed by the terms and conditions of all other account agreements applicable to this account. – I, as Trustee, jointly and severally, indemnify you and hold you harmless from any claim, loss, expense or other liability for effecting any transactions, and acting upon any instructions given by a Trustee. I certify that any and all transactions effected and instructions given on this account will be in full com­pliance with the Trust. – I, as Trustee, agree to inform you in writing of any change in the composition of the Trustees, or any other event which could alter the certifications made above. – I, as Trustee, agree that any information I give to Fidelity on this account will be subject to verification, and I authorize you to obtain a credit report about me individually at any time. Upon written request, Fidelity will provide the name and address of the credit reporting agency used. I acknowledge that I have been furnished with the Customer Agreement by Fidelity and that I have read, understood, and agree to be bound by its terms and conditions as are currently in effect and as may be amended from time to time. I am at least 18 years of age and of full legal age in the state in which I reside. I understand that, upon issuer’s request in accordance with applicable rules and regulations, you will supply my name to issuers of any securities held in my account so I might receive any important information regarding them, unless I notify you in writing not to do so. I understand that it is my responsibility to read the prospectus for any mutual fund into which I purchase or exchange. I have received and read the prospectus for the fund in which I am investing, and I agree to the terms of the prospectus. I acknowledge that I have received the description of the Core Account in the Customer Agreement, including Fidelity’s right to change the options available as core positions, and consent to having free credit balances held or invested in the core position indicated above. I consent to have only one copy of Fidelity mutual fund shareholder documents, such as prospectuses and shareholder reports (“Documents”), delivered to me and any other investors sharing my address. My Documents, if held in eligible accounts, will be householded indefinitely; however, I may revoke this consent at any time by contacting Fidelity at 800-544-3018 and I will begin receiving multiple copies within 30 days. As Documents for other investments become available in the future, these Documents may also be householded in accordance with this authorization or any notice or agreement I received or entered into with Fidelity or its service providers. I understand that the Customer Agreement and its enforcement shall be governed by the laws of the Commonwealth of Massachusetts excluding its conflict of laws provisions. It shall cover individually and collectively all accounts which I may open or reopen with Fidelity. It shall inure to the benefit of Fidelity’s successors and assigns, whether by merger, consolidation, or otherwise. Fidelity may transfer my account to your successors and assigns, and this Agreement shall be binding upon my heirs, executors, administrators, successors, and assigns. If I am a U.S. person (including a U.S. permanent resident), I certify under penalties of perjury that: (1) I am a U.S. person (including a U.S. permanent resident) and the Social Security or Taxpayer Identification number provided is correct (or that I am waiting for a number to be issued to me); and (2) I am not subject to backup withholding because: (a) I am exempt from backup withholding; or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding for failure to report all dividend and interest income; or (c) I have been notified by the IRS that I am no longer subject to backup withholding. (Cross out item 2 if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.) If I am not a U.S. person (including a U.S. permanent resident), I am submitting the applicable Form W-8 with this form to certify my foreign status and, if applicable, claim tax treaty benefits. If I have not checked the box for Affiliations, I represent and warrant that I am not affiliated with or employed by a stock exchange or a broker-dealer or I am not a control person or affiliate of a public company under SEC Rule 144 (such as a director, 10% shareholder, or a policy-making officer), or an immediate family or household member of such a person. 1.766724.114 Page 7 of 8 018960407 5 SignaturE(S) (continued) The following clause referring to lending of securities applies only to those accounts eligible and approved for margin. I under­­stand that UGMA/UTMA, estate and other nontrust fiduciary accounts cannot use margin. I hereby authorize Fidelity to lend, hypothecate, or re-hypothecate, separately, or with the property of others, either to yourselves or to others, any property you may be carrying for me on margin. This authori­zation applies to all my accounts you carry and shall remain in force until you receive written notice of revocation. • This account is governed by a predispute arbitration clause, which is located on the last page of the Customer Agreement. I acknowledge receipt of the predispute arbitration clause. • The Internal Revenue Service does not require an account owner to consent to any provision of this document other than the certifications required to avoid backup withholding. Signature and date are required. 5.A. Current Owner Signature Signature of CURRENT OWNER PRINT NAME Date (mm/dd/yyyy) Signature of CO-OWNER PRINT NAME Date (mm/dd/yyyy) SIGNATURE GUARANTEE STAMP (OWNER) SIGNATURE GUARANTEE STAMP (Co-OWNER) 5.B. New Owner Signature Signature of NEW OWNER PRINT NAME Date (mm/dd/yyyy) Signature of CO-OWNER PRINT NAME Date (mm/dd/yyyy) SIGNATURE GUARANTEE STAMP SIGNATURE GUARANTEE STAMP Fidelity Investments is a registered trademark owned by FMR LLC. Accounts are carried with our affiliate, National Financial Services LLC. Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0039. For Fidelity Use Only Cash Rep. Name Margin ATP Account # Assigned Reg. Rep. Signature Approving Manager’s Signature Photo ID Type Corp. ID Date Date Investor Center Number Expiration Date ID Number (Govt. issued only) Second Photo ID Type ID Number (Govt. issued only) Issuance Date Place of Issuance Expiration Date Issuance Date Place of Issuance 465063.6.0COR-APP-SCF-03/12 1.766724.114 Fidelity Brokerage Services LLC, Member NYSE, SIPC 1.766724.114 Page 8 of 8 018960408