Macroeconomics Problem Set 4

advertisement

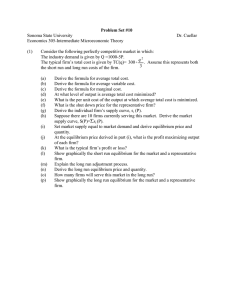

Macroeconomics Problem Set 4 1. The LM-Curve 0.6 ∗V 0.4 , with Y denoting aggregate output, i the Suppose the demand for real money is given by L = Y 100i interest rate and V real wealth. Derive your answers to (a) - (c) analytically. (a) Derive the LM-curve and determine its slope. (b) What happens to the position of the LM-curve if money supply increases by the same amount as bonds supply decreases caused by an expansionary open market operation? The price level P remains constant. (c) What happens to the position of the LM-curve if money supply M increases and the price level P and bonds supply are constant? (d) Compare briefly your results of part (b) and part (c). 2. The IS-LM Modell Consider the following IS-LM model: Y =C+I +G C = 200 + 0.25Y D , Y D = Y − T I = 150 + 0.25Y − 1000i, L = 2Y − 8000i, G = 250, T = 200, M = 1600 and P = 1 (a) Determine the IS-curve and graph it. (b) Determine the LM-curve and graph it. (c) Find the equilibrium interest rate and the equilibrium level of output numerically. (d) Suppose the government increases spending to 400. How much does the IS-curve shift vertically? What are the interest rate and the level of output in the new equilibrium? (e) Set G equal to its initial value of 250. Now suppose that the central bank increases the money supply by 15%. How much does the LM-curve shift vertically? What are the interest rate and the level of output in the new equilibrium? 3. Endogenous Money Supply Suppose the money supply process of the banking system is characterized by the following behavid d oral relationships: Rd = θ(i)Dd , with dθ(i) di < 0 and D = (1 − γ)M , with γ ∈ (0, 1). Furthermore the accounting relationships in the lecture notes on page 27ff apply. (a) How does an expansionary open-market operation work? Explain in words. (b) Suppose that in an economy the monetary base is H = 7.4 ∗ 109 ¤, nominal income and nominal wealth equal $Y = 125 ∗ 109 ¤ and $V = 64 ∗ 109 ¤, respectively. The money demand function is 2 3 1 3 ($V ) given by M d = ($Y )100i . Which ratio γ of their money demand do the people want to hold in currency, if the financial market is in equilibrium with interest rate i = 5% and the reserve ratio 1 follows θ(i) = 200i . (c) Calculate demand for reserves Rd , deposit holding D, currency holding of the non-banking public CU and bonds demand Bd in equilibrium. 1 (d) Suppose that θ is fixed at its initial level instead of θ(i) = 200i . The central bank conducts an 6 open market intervention of size 3.7 ∗ 10 ¤. What happens to the demand of deposits Dd , the currency holding of the non-banking public CU, the demand for reserves Rd and the money supply M1 . 4. The Baumol-Tobin Model of Money Demand Suppose a household earns monthly income of $Y = 250¤, which is automatically deposited in Prof. Dr. Dr. h.c. Gerhard Schwödiauer 1 Summer Term 2009 Macroeconomics Problem Set 4 his bank account. The household earns i = 3% interest on the balance in his bank account. Each withdrawal from the bank account creates a nominal transaction cost of T = 10¤. The household spends all his income at a constant rate on consumption, which can only be bought with cash. (a) Determine the optimal number of money withdrawals from the bank account. (b) Determine the optimal average money holding of this household. (c) Derive the money demand elasticity with respect to income. (d) Derive the money demand elasticity with respect to the interest rate. (e) Assume an income $Y , a positive interest on money Im , interest rate I > Im on security holdings and fixed transaction costs T for every sale of securities. Derive the optimal number n∗ of trips to the bank by maximizing interest income minus transaction costs. Determine the money demand function. Prof. Dr. Dr. h.c. Gerhard Schwödiauer 2 Summer Term 2009