suppose <

advertisement

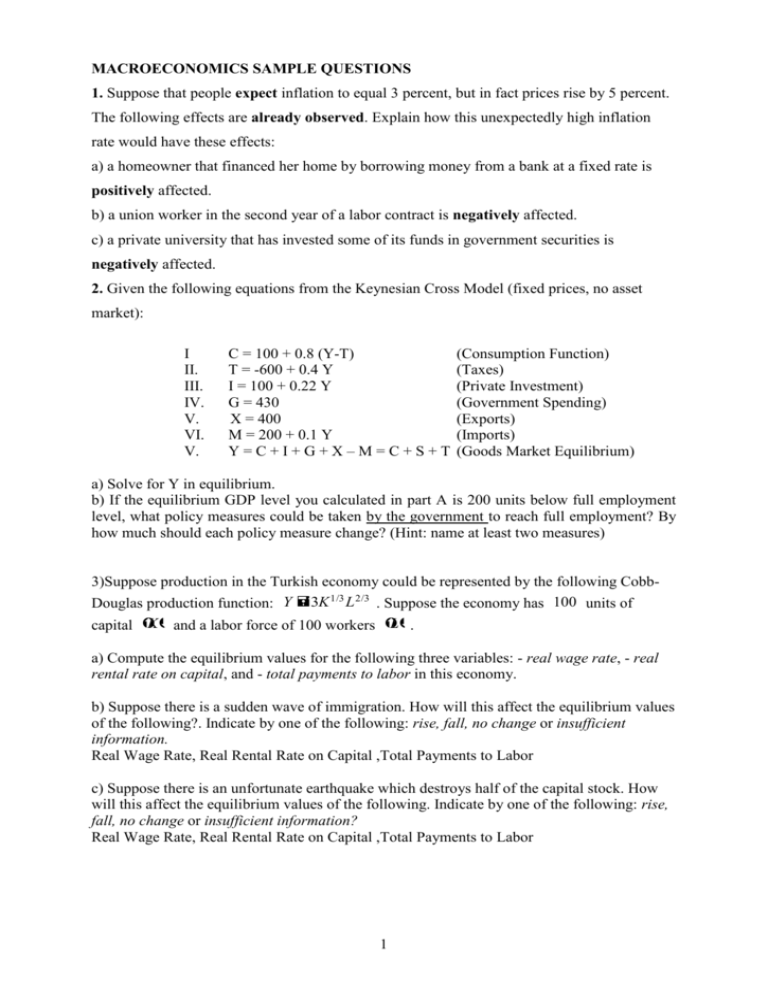

MACROECONOMICS SAMPLE QUESTIONS 1. Suppose that people expect inflation to equal 3 percent, but in fact prices rise by 5 percent. The following effects are already observed. Explain how this unexpectedly high inflation rate would have these effects: a) a homeowner that financed her home by borrowing money from a bank at a fixed rate is positively affected. b) a union worker in the second year of a labor contract is negatively affected. c) a private university that has invested some of its funds in government securities is negatively affected. 2. Given the following equations from the Keynesian Cross Model (fixed prices, no asset market): I II. III. IV. V. VI. V. C = 100 + 0.8 (Y-T) T = -600 + 0.4 Y I = 100 + 0.22 Y G = 430 X = 400 M = 200 + 0.1 Y Y=C+I+G+X–M=C+S+T (Consumption Function) (Taxes) (Private Investment) (Government Spending) (Exports) (Imports) (Goods Market Equilibrium) a) Solve for Y in equilibrium. b) If the equilibrium GDP level you calculated in part A is 200 units below full employment level, what policy measures could be taken by the government to reach full employment? By how much should each policy measure change? (Hint: name at least two measures) 3)Suppose production in the Turkish economy could be represented by the following CobbDouglas production function: Y 3K 1/3 L 2/3 . Suppose the economy has 100 units of K and a labor force of 100 workers L. capital a) Compute the equilibrium values for the following three variables: - real wage rate, - real rental rate on capital, and - total payments to labor in this economy. b) Suppose there is a sudden wave of immigration. How will this affect the equilibrium values of the following?. Indicate by one of the following: rise, fall, no change or insufficient information. Real Wage Rate, Real Rental Rate on Capital ,Total Payments to Labor c) Suppose there is an unfortunate earthquake which destroys half of the capital stock. How will this affect the equilibrium values of the following. Indicate by one of the following: rise, fall, no change or insufficient information? Real Wage Rate, Real Rental Rate on Capital ,Total Payments to Labor 1 MICROECONOMICS SAMPLE QUESTIONS 1. Suppose that a firm operates in a perfectly competitive market and produces two products. Due to perfect competition, prices of both commodities are exogenous. The firm’s revenue (TR) function is given as: T R = 12Q1 + 18Q2 , where the prices of product 1 and 2 are 12 and 18, respectively. The firm’s cost function is T C = 2Q12 + Q1Q2 + 2Q22 . a) Find the necessary conditions for profit maximization. b) What are the profit maximizing levels of outputs for these two products? What is the profit level at these output levels? 2. Suppose that a consumer has the choice of consuming two goods, x and y. The prices of these goods are market-determined with Px = 4, Py = 6 . The consumer chooses how much of x and y to consume to maximize his utility described by the function U = (x + 2)(y + 1) . The consumer’s purchasing power (budget) is given as 4x + 6y = 130 . a) Write the Lagrangian function for optimization. b) Find the optimal levels of purchase of x and y. 3. The price elasticity of demand measures how much the quantity demanded responds to changes in the price. Demand tends to be more elastic if close substitutes are available, if the good is a luxury rather than a necessity, if the market is narrowly defined, or if buyers have substantial time to react to a price change. Consider the following pairs of goods. For which of the two goods would you expect the demand to be more price elastic? Why? a. water or diamonds b. insulin or medicine for cold c. food in general or breakfast cereal d. gasoline over the course of a week or gasoline over the course of a year e. personal computers or IBM personal computers 4. An individual is currently faced with two portfolios: A and B. In A she will get 100$ with a probability %50 and 25$ with a probability of 50%. In B she will get 125$ with a probability of 50%, 25$ with a probability of 20% and 0 with a probability of 30%. We know that this individual is indifferent between A and B. Now, she is presented two additional portfolios: C and D. In C she will get 100$ with a probability of 50%, 25$ with a probability of 30%, and 0 with a probability of 20%. In D she will get 125$ with a probability of 50%, 100$ with a probability of 20%, and 0 with a probability of 30%. Will she prefer C to D, or D to C, or be indifferent between C and D. Provide an explanation. 5. Below we have five individuals (Veli, Ahmet, Ali, Ayşe, and Fadime) who have ranked their choices over four candidates (A, B, C, and D) who run for the presidency. Veli, for example, prefers B to C, C to D, and D to A. Apply the “Plurality with a Runoff” procedure to the profile to find out which candidate will be the president. This procedure works as follows: In the first round the two candidates who appear the most in the first rank will be selected. Then in the second round these two candidates will run for the presidency and the one with higher votes will get elected. 2 VELİ AHMET ALİ AYŞE FADİME B A B A C C B C B A D C A C B A D D D D A) What is the outcome? B) Assume now that VELİ happens to know the whole society’s profile. Will he tell his true preference ordering, or will he change it? If so, how and why? 6. A monopolist separates its customers into two distinct submarkets by the following own price demand curves: Q1D 30 0.25 P1 and Q2 D 50 0.5 P2 . Assume that the cost of producing the good is the same regardless of the submarket and the total cost is given by TC 40QT , where QT Q1 Q2 . a) Find the profit maximizing levels of output sold in each submarket. Find the respective price levels in both markets. Comparing the price levels what will be your explanation? Calculate the profit levels in both submarkets and find the total profit as a sum of them. b) Suppose that now the firm does not discriminate between the submarkets. Find first the total demand curve, and then get the inverse demand as a function of quantity. Find the profit maximizing output and price levels. Calculate the profit level and compare it with the one in part (a), what is your conclusion? 3