DOES MORE CONSERVATIVE REVENUE RECOGNITION

advertisement

DOES MORE CONSERVATIVE REVENUE RECOGNITION IMPROVE THE

INFORMATIVENESS OF EARNINGS?

Clayton L. Forester

Carlson School of Management, The University of Minnesota

claytonf@umn.edu

July 2008

I am grateful to my dissertation committee, Paul Hribar, Daniel Collins, Haidan Li, Jon Garfinkel,

and Gene Savin for their guidance and comments. I also appreciate helpful discussions and

suggestions from Brad Badertscher, John McInnis, Huishan Wan, Shibin Xie and Rong Zhao as

well as workshop participants at The University of Iowa, The University of Alberta, and The

University of Minnesota. Data is available from public sources.

DOES MORE CONSERVATIVE REVENUE RECOGNITION IMPROVE THE

INFORMATIVENESS OF EARNINGS?

Abstract

Watts (2003a) and Watts and LaFond (2007) provide evidence that more conservative

earnings serve an informational role in equity valuation. My study tests this assertion

using a sample of treatment firms that changed their revenue recognition policies to meet

the requirements of a more conservative reporting regime. I find that more conservative

revenues are more informative with respect to future cash flows and that expense

manipulations do not increase to counteract the effects on earnings of more conservative

revenue recognition. My results provide evidence of an initial decline in earnings

informativeness when more conservative practices are followed but that this decline in

informativeness is temporary. My results provide important evidence for the Financial

Accounting Standards Board who are currently considering two revenue recognition

models that differ with respect to their degrees of conservatism envisioned.

1

I. INTRODUCTION

This paper investigates the effect of conservative revenue recognition practices on

the informativeness of earnings with respect to future operating cash flows. I test the

informational role of more conservative revenue recognition using a sample of firms

whose reporting environment changed so as to require these firms to report more

conservatively.

Watts (2003a) analyzes conservatism in financial reporting and discusses the

reasons why conservatism arose in financial reporting and why it flourishes. Watts

(2003a) argues that conservatism not only serves as a natural contracting mechanism but

that “conservative accounting performance measures such as earnings also fulfill an

important role in providing information for investors”(page 214). LaFond and Watts

(2007) provide empirical evidence that conservatism serves an informational role by

reducing information asymmetry through limiting the manger’s ability to manipulate

financial reports. My paper uses a unique time frame surrounding the issuance of Staff

Accounting Bulletin No. 101 (SAB 101) to study a shift in revenue reporting

conservatism from a regime of less conservative reporting to one of increased

conservatism.

My study uses a natural experimental setting to investigate the informational role

of conservatism by studying how the informativeness of earnings is affected when a

regime shift occurs from one of less conservatism to one of more conservatism. This

study also disaggregates earnings into cash flows and the major components of accruals

to determine the source of the change in earnings’ informativeness with respect to future

cash flows for firms affected by SAB 101. Barth, Cram and Nelson (2001) demonstrate

2

that disaggregating earnings into cash flows and the major components of accruals

significantly enhances earnings’ predictive ability with respect to one period ahead

operating cash flows.

Altamuro, et al. (2005) consider two competing hypotheses – the earnings

informativeness hypothesis and the earnings management hypothesis – and find that

earnings are less managed but also less informative using their post-SAB 101 period. I

posit and find that the results of Altamuro, et al. (2005) are biased toward the finding of a

decrease in informativeness of earnings with respect to future operating cash flows in

their post-SAB 101 period. Altamuro, et al. (2005) use a relatively short post-adoption

period in the quarters immediately after adoption. This does not allow sufficient time for

previously recognized revenues that were required to be deferred by SAB 101 to re-enter

the earnings stream and creates a temporary disturbance in the earnings – cash flow

relationship.

I consider a sample of firms that were required to adopt more conservative

revenue recognition practices due to the issuance of SAB 101 (treatment firms) along

with a matched sample of firms whose revenue recognition practices did not change as a

result of SAB 101 (control firms). First, I test the relation between earnings and future

cash flows and find that this measure of earnings informativeness – the ability of earnings

to map into future cash flows – decreases in the transitional period immediately following

the increase in conservatism. This result is consistent with Altamuro, et al. (2005). Next,

I decompose earnings into current period cash flows and accruals components and

demonstrate how these components’ relations with future cash flows are affected by SAB

101 adoption. I find that the predictive ability of treatment firms’ earnings components

3

with respect to future operating cash flows declines post-SAB 101. While I do not find a

significant decline in the relation between the change in receivables and future cash flows,

there is a significant decline in the relation between the “other accruals” component of

earnings and future cash flows. Since the other accruals component contains the change

in deferred revenues, this decline provides evidence that the decline in earnings

informativeness documented in Altamuro, et al. (2005) is due to the deferral of revenues.

The decomposition results suggest that the decline in earnings informativeness for

treatment firms may be due to the disruption in the accruals brought about by the deferral

of revenue in the year of adoption of SAB 101 recognition rules. To test this hypothesis,

I reconsider whether the more conservative recognition practices recommended in SAB

101 continue to be less predictive of future operating cash flows over a longer post-SAB

101 period. Contrary to the findings in Altamuro, et al. (2005), over the longer horizon, I

find that earnings’ informativeness with respect to future cash flows actually improves in

the post-SAB 101 period. That is, earnings and the accrual components of earnings do a

better job of predicting future cash flows under the more conservative SAB 101 rules

than under the pre-SAB 101 reporting climate when firms practiced more aggressive

revenue recognition.

Further, I show that the amount of the improvement is significantly related to the

magnitude of the initial deferral required by the cumulative effect adjustment due to SAB

101 adoption. This result suggests that firms that were required to defer a large amount

of pre-SAB 101 revenues in the year of adoption will likely find a portion of these

revenues coming back into earnings in the transitional post-SAB 101 period. This reentry into earnings of revenues previously deferred as part of the cumulative effect

4

adjustment creates a disruption of the earnings – cash flow relation in the transitional

post-SAB 101 period. The significant relation between the size of the cumulative effect

adjustment (the deferral) and the change in earnings informativeness from the transitional

post-adoption period to the longer post-adoption period provides evidence of the

temporary decrease in informativeness of earnings being a result of large deferred

revenues re-entering the earnings stream.

Finally, based on Jensen’s (2005) argument that overvalued firms may be

motivated to engage in long-run value-destroying activities such as benchmark beating in

the near term, I demonstrate that benchmark beating behavior for three quarterly earnings

benchmarks (levels, changes, and analyst forecast errors) decline in the post-adoption

period for SAB 101 firms and I show that this decline is significantly greater for the

treatment firms than for the control firms. This provides evidence that these firms may

have been using aggressive revenue recognition practices to meet or beat benchmarks

with an eye to maintaining potentially overvalued equity.

Gaining a better understanding of the findings of how a change in conservatism

affects the informativeness of firms’ reported earnings is important for at least three

reasons. First, the SEC’s move to issue SAB 101 was a heavily contested regulatory

event. On the one hand, the SEC argued that SAB 101 did nothing more than provide

guidance on their interpretation of current GAAP regarding revenue recognition and was

not “new regulation” for revenue recognition. However, many firms were required to

change their revenue recognition practices in light of the issuance of SAB 101. So, for

these firms, it was tantamount to new regulation that required more conservative revenue

recognition. Second, the Financial Accounting Standards Board (FASB) is undertaking a

5

project on revenue recognition guidance that will better align with the financial statement

elements project in which it is currently involved. 1 Preliminary discussions by the FASB

suggests it is considering a less conservative approach to revenue recognition than that

embodied in SAB 101. My study’s results cast doubt on the appropriateness of moving

revenue recognition standards in that direction. I find that the more conservative SAB

101 revenue recognition policies have reduced benchmark beating (often cited as being

related to earnings management) and have increased the informativeness of earnings.

This study provides evidence on unintended consequences of financial reporting

regulation. SAB 101 was intended to more clearly communicate acceptable revenue

recognition practices in order to prevent abusive revenue recognition by firms. At the

same time, however, it may have temporarily reduced the informativeness of earnings

with respect to future cash flows in the adoption period.

This paper enhances our understanding of how regulation affects the users of

financial statements. Beatty (2007) provides a review of the literature concerning how

changes in regulation affect the behavior of management and points out the relative lack

of evidence concerning the impact of regulatory changes on social welfare. If investors

benefit from more informative earnings and an enhanced ability to predict future

operating cash flows, then my findings suggest that investors may be better off as a result

of SAB 101’s requirement for more conservative revenue recognition.

1

The FASB stated recently during a board meeting that they would be “remiss” not to address this issue of

revenue recognition. The FASB states that the reasons for reconsidering revenue recognition criteria are:

(1) there is a gap between broad conceptual guidance and detailed authoritative literature; (2) there are

flaws in the conceptual guidance provided in the FASB’s Concepts Statement No. 6; and (3) the issues of

revenue recognition are intimately tied to liability recognition issues currently under consideration by the

FASB. This paper will provide information useful to this process.

6

Finally, this paper informs the literature on conservatism by using the SAB 101

setting to compare the more aggressive revenue recognition practices of the pre-adoption

period with the more conservative revenue recognition practices subsequent to adoption.

LaFond and Watts (2006) argue that information asymmetry between informed and

uninformed equity investors generates a demand for conservatism in financial statements.

My results show that more conservative revenue recognition practices recommended in

SAB 101 create earnings that are more informative with respect to future operating cash

flows and, arguably, more useful to equity investors attempting to assess the timing,

amounts, and uncertainty of future cash flows. Consistent with the implications of

LaFond and Watts (2007), my study provides evidence that conservative revenue

recognition improves financial statement usefulness. Watts (2003b) calls for empirical

studies that focus on how GAAP changes affect conservatism and my study provides an

ideal setting to consider how a regulatory change such as SAB 101 affects the usefulness

of reported earnings numbers that are specifically made more conservative.

The remainder of the paper is organized as follows. Section II provides

background information on SAB 101 and the response of businesses and the Financial

Accounting Standards Board (FASB) and develops the hypotheses. Section III discusses

the sample selection and descriptive statistics. Section IV presents the empirical tests and

results. Finally, Section V provides a conclusion and discusses the implications of the

empirical results.

7

II. BACKGROUND AND HYPOTHESES DEVELOPMENT

Staff Accounting Bulletin (SAB) 101 was introduced by the Securities and

Exchange Commission (SEC) in response to a growing concern over firms’ use of

accelerated revenue techniques to manipulate earnings. The SEC claimed that by

accelerating revenues, firms were potentially inflating results in a way that was

misleading to investors and other users of the financial reports. Concern for these types

of abuses formed the central criticism aimed at financial reporting by Arthur Levitt in his

Numbers Game speech in 1998. 2

SAB 101 spells out the basic criteria for revenue recognition. At the time of its

introduction, there were two opposing views on the implications of this bulletin. Firms

argued that this was tantamount to a new revenue recognition standard while others

(including the SEC) maintained that this bulletin merely reiterated the current existing

requirements in GAAP. Specifically, SAB 101 requires that the following criteria be met

before revenue can be recognized: (1) Persuasive evidence of an arrangement between

buyer and seller; (2) delivery has occurred or services have been rendered; (3) the seller’s

price to the buyer is fixed or determinable; and (4) collectability is reasonably assured.

While these requirements seem to be a reiteration of the FASB’s revenue

recognition guidance in its Concepts Statement No. 6, SAB 101 went further, providing

additional guidance on more complex recognition issues related to the following: (1)

timing of approval for sales agreements; (2) side arrangements to the master contract; (3)

consignment arrangements; (4) criteria for delivery; (5) layaway programs; (6)

nonrefundable up-front fees; (7) cancellation provisions; and others.

At the time that SAB 101 was first introduced (implementation began with fiscal

year 2000 for most firms), the businesses most affected by this new guidance were not in

2

Readers can find copies of this September 28, 1998 speech through the SEC’s website at

http://www.sec.gov/news/speech/speecharchive/1998/spch220.txt

8

favor of its implementation. As one example, firms with revenues whose recognition

relied on customer acceptance under SAB 101guidance argued that this would create a

shift of power within the supply chain and would adversely affect their profit margins and

credit terms with customers.

In contrast to the more conservative approach to revenue recognition embodied in

SAB 101, the FASB appears to be moving toward a less conservative or more neutral

approach as part of its Conceptual Framework Project. 3 Specifically, the FASB is

considering two revenue recognition models – the Measurement Model (formerly the Fair

Value Model) and the Allocation Model (formerly the Customer Consideration Model).

At a joint meeting with the International Accounting Standards Board (IASB) on October

22, 2007, the two bodies discussed these models. Both models are based on revenue

recognition being linked to contractual rights arising from a revenue arrangement. The

Measurement Model recognizes revenues as obligations are satisfied and allows for some

revenue (and profit) to be recognized at contract inception. The Allocation Model

recognizes revenues as performance obligations are satisfied and does not allow

recognition of revenues or profits at contract inception. It appears then that the

Measurement Model is less conservative than the Allocation Model in terms of when

initial revenues may be recognized.

The FASB, along with the IASB, is currently considering these two models and it

is unclear which model the resulting revenue recognition pronouncement will favor.

However, during a May 11, 2005 board meeting, the FASB “…affirmed its past decision

to develop a standard for revenue recognition based on recognized changes in assets and

liabilities…that would not be overridden by additional recognition criteria such as

realization and completion of the earnings process….” (FASB, board meeting minutes

from May 11, 2005). In addition, the FASB seems poised to eliminate conservatism as a

3

Readers can find details on the FASB’s Conceptual Framework Project on their website at

http://www.fasb.org/project/conceptual_framework.shtml

9

desirable qualitative characteristic of accounting information. At a May 2, 2007 board

meeting to discuss the FASB’s Conceptual Framework project, the staff recommended

that the board affirm its decision to exclude conservatism as a component of faithful

representation because it is incompatible with neutrality. This explicit move away from

conservatism by the FASB diverges from the conservative reporting requirements of

SAB 101. In this paper, I consider the relative usefulness of revenue accruals in

predicting future cash flows to provide evidence of importance to this issue currently

under consideration by the FASB and the IASB.

Watts (2003a) argues that conservatism not only serves as a natural contracting

mechanism but that “conservative accounting performance measures such as earnings

also fulfill an important role in providing information for investors”(Watts, 2003a, page

214). LaFond and Watts (2007) provide empirical evidence that conservatism provides

an informational role by reducing information asymmetry through limiting the manger’s

ability to manipulate financial reports. In contrast to this view, Altamuro, et al. (2005)

show a decline in earnings informativeness with respect to future cash flows from the less

conservative pre-SAB 101 era to the more conservative post-SAB 101 era. The

seemingly contradictory evidence in Altamuro, et al. (2005) and Watts (2003a) and Watts

and LaFond (2007) brings into question whether more conservative accounting is more

informative or whether more conservative reporting decreases earnings informativeness.

I posit that the decline in earnings informativeness with respect to future cash

flows documented by Altamuro, et al. (2005) is temporary and mechanical in nature.

When firms adopted SAB 101, the adoption was treated as a change in accounting policy

by the affected firms. 4 APB No. 20 requires that this change be reflected as a cumulative

effect adjustment to earnings in the period of adoption. In most cases, this created

deferred revenue and a one-time charge to earnings for the difference between revenues

4

The pre-SAB 101 period is 1997 – 1999; the year of adoption is 2000; the transitional post-SAB 101

period is 2001, and the post-transitional period is 2002 – 2003.

10

under the more aggressive pre-SAB 101 approach versus the more conservative postSAB 101 approach. In the transitional year following adoption of SAB 101, it is likely

that for firms with an operating cycle less than one year, this deferral was recognized in

revenues. I posit that the recognition of the previously deferred revenues along with

revenues initiated in the transitional period immediately after adoption likely created a

temporary distortion in the earnings-cash flow relation that manifest itself in earnings

showing less predictive ability with respect to future cash flows. This result is interpreted

by Altamuro, et al. (2005) as evidence that the more conservative approaches to revenue

recognition embraced by SAB 101 are less informative than the more liberal approaches

followed in the pre-SAB 101 era. If this decline in earnings informativeness is

mechanical and temporary in nature as I posit, then the effect should be more

concentrated in the “other” accruals component of earnings because this is where the

change in deferred revenues is found. This leads to the statement of my first two

hypotheses.

Hypothesis 1: The predictive usefulness of earnings with respect to future

operating cash flows from before to after SAB 101 will decline in the transitional period.

Hypothesis 2: The reduction in the predictive usefulness of earnings with respect

to future operating cash flows from before to after SAB 101 is concentrated in the “other”

component of accruals.

The first hypothesis is more of a statement of expected results that confirm the

Altamuro, at al. (2005) finding of a decrease in earnings informativeness with respect to

future cash flows in the transitional period immediately after SAB 101’s adoption. The

second hypothesis provides a basis for testing the potentially mechanical relation between

an unusual change in “other” accruals during the transitional post-SAB 101 period. I

posit that this change in the transitional period is brought about by the recognition of

revenues deferred in the year of adoption. My next hypothesis builds on the first two

hypotheses and speaks more specifically to the temporary nature of the decrease in

11

earnings’ informativeness documented in Altamuro, et al. (2005). Once beyond the

transitional period, I expect an increase in the informativeness of earnings based on the

findings of Watts (2003a) and Watts and LaFond (2007) that document an information

role for conservative reporting.

Hypothesis 3: Beyond the transitional period, the predictive usefulness of

earnings with respect to future cash flows improves relative to the transitional period and

this improvement is concentrated in “other” accruals component of income.

The previous hypotheses have considered primarily the informativeness of overall

earnings with respect to future cash flows and the “other” accruals component of earnings

and its informativeness for future cash flows. I now turn my attention to the expense

components’ informativeness for future cash flows and how this informativeness is

affected by SAB 101. If managers respond to more conservative revenue recognition

guidance brought about with SAB 101 by managing expenses to help meet or beat

benchmarks, then one would expect to see the informativeness of the expense

components of earnings declining in the post-SAB 101 period and no decrease in

benchmark beating. However, if the informativeness of these components with respect to

future cash flows does not decrease with SAB 101 adoption, then it provides some

evidence that firms have not attempted to manage expense accruals to make up for the

more conservative revenue recognition required by SAB 101.

The ability of affected firms 5 to beat benchmarks is shown by Altamuro, et al.

(2005) to decrease in the transitional post-SAB 101 period. Since the more conservative

recognition requirements of SAB 101 place a constraint on firms’ revenue recognition

practices, it similarly might constrain their ability to meet or beat targets of importance to

investors and management. Jensen (2005) discusses how capital market pressure to beat

short term benchmarks is exacerbated by overvaluation of firms’ equity. If a firm’s

5

Affected firms are those that have a cumulative effect adjustment necessitated by SAB 101 adoption.

12

equity is overvalued, then market expectations with respect to earnings benchmarks may

be unreasonably high. Graham, Harvey, Rajgopal (2005) provide evidence that

executives worry about benchmarks and manage earnings to help meet benchmarks.

If expense accruals do not decrease in terms of their informativeness for future

cash flows and if declines in benchmark beating documented by Altamuro, et al. (2005)

are not temporary, then SAB 101 has even greater benefits than a reduction of benchmark

beating through aggressive revenue recognition. Not only would SAB 101 provide more

informative earnings as Watts (2003a) and Watts and LaFond (2007) suggests it should,

but it could also curb potentially value-destroying benchmark beating that can result from

overvaluation of equity. This leads to my final two hypotheses.

Hypothesis 4: Expense accruals’ informativeness with respect to future cash flows

is not expected to decrease in the late post-SAB 101 period.

Hypothesis 5: Benchmark beating will decline in the late post-SAB 101 period

relative to the pre-SAB 101 period.

13

III. SAMPLE SELECTION

SAB No. 101 was adopted by most firms during the 2000 calendar year. 6 The

adoption of SAB 101 resulted in some firms changing their revenue recognition policy.

For those firms who had been using a revenue recognition policy deemed inappropriate

under SAB 101, a cumulative effect adjustment for the effects of adoption of SAB 101

was required (following APB No. 20) in the year of adoption. 7 Using a keyword search

of firms’ 10K filings, I first identify all firms who mention “SAB 101” by itself and in

combination with “cumulative” and “adjustment”. This yields an initial sample of 1,468

firms. Of these firms, 257 report a cumulative effect adjustment to earnings due to SAB

101 adoption. Compustat data is unavailable for 28 of these firms. After eliminating

these firms from the sample, 229 firms remain as the final sample of SAB 101 firms.

Henceforth, I will refer to this as my treatment sample.

The majority of firms that mention SAB 101 and a related cumulative adjustment

do not actually report a cumulative effect adjustment on their income statement. These

firms discuss SAB 101 adoption and state either that (a) the cumulative effect of SAB

101 cannot be estimated or is immaterial or (b) the firm’s revenue recognition policy

requires no change in light of SAB 101. These firms are not included in the treatment

sample. I construct a matched control sample of firms unaffected by SAB 101 as follows.

I first match the SAB 101 firms to other Compustat firms by their two-digit SIC code and

select the firm closest in size (measured by total assets) within that industry. Each

matched firm is allowed to appear only once in the control sample.

6

There were 5 firms that reported a cumulative effect adjustment resulting from SAB No. 101 adoption

during fiscal 1999 and 37 that reported a cumulative effect adjustment in 2001. These firms have not been

included in the sample of SAB 101 firms used in this study so that a single and common year of adoption

can be used in empirical tests. Future analysis may look at the 2001 sample and compare these “late

adopters” with the majority of firms who adopted SAB No. 101 during fiscal 2000.

7

For comparison, this study follows closely the sample selection methods of Altamuro, et al. (2005) in that

firms are considered “affected” by SAB 101 based on whether or not they have a cumulative effect

adjustment related to SAB 101.

14

In constructing the matched control sample of firms that are unaffected by SAB

101, it is important to find firms that have similar revenue streams from similar activities

but did not have to change their reporting in light of SAB 101. While searching 10K

filings to identify SAB 101 firms for the treatment sample, firms were also identified that

did not have a cumulative effect adjustment but could arguably be considered affected by

SAB 101. These firms discussed the importance of SAB 101 not only to their revenue

recognition policies but also to their business practices. Some firms describe the impact

that SAB 101 had on recognition of revenues when such recognition now relies on

acceptance by the customer and how this acceptance has the potential to shift power from

supplier to customer in the supply chain.

Caution was exercised to specifically exclude these firms from the control sample

of unaffected firms. It is possible that firms considered “unaffected” by SAB No. 101

may not have a cumulative effect adjustment to income in the year of adoption because

they lack detailed information to calculate the cumulative effect. For this reason, firms

who mention that they make no cumulative effect adjustment for SAB 101 because they

lack information to calculate the effect have also been excluded from the control sample.

Table 1 provides the industry membership information for SAB 101 firms. The

industry composition of my SAB 101 treatment sample is similar to that in Altamuro, et

al. (2005), which suggests similarity in the sample selection process. Also included in

Table 1 are the industry average cumulative effect adjustments scaled by total market

value (Compustat quarterly data item 199 * data item 25) reported by the SAB 101 firms

along with the overall average. Industry average cumulative effect adjustments range

from 0.5% of total market value (Communications) to 9% of total market value (Air

Transportation) which is likely economically important to these firms. Further

corroboration of the similarity of my sample characteristics with those SAB 101 firms

selected in Altamuro, et al. (2005) is the fact that the overall average cumulative effect

adjustment recorded by firms is 3% of market value in both studies.

15

IV. EMPIRICAL TESTS AND RESULTS

Transitional Post-SAB 101 Earnings Informativeness

This section provides evidence on the first two hypotheses and demonstrates how

the informativeness of earnings with respect to future cash flows is affected by the more

conservative reporting required under SAB 101. To test the first hypothesis that the

predictive usefulness of earnings with respect to future operating cash flows declines in

the transitional post-SAB 101 period relative to the pre-SAB 101 period, I estimate the

following regression for both the treatment and control samples using firm, quarter and

industry fixed effects: 8

LeadCFO( i ,q +t ) = β 0 + β 1 Post + β 2 Earni ,q + β 3 Post * Earni ,q + ε

(1)

where LeadCFO(i ,q +t ) = accumulated cash flow from operations (Compustat data item

108) scaled by end-of period total assets (Compustat data item 44) for firm i in quarters q

+ 1, q + 2, q + 3, and q + 4.

Earni ,q = earnings (Compustat data item 69) for firm i in quarter q scaled by endof-period q total assets (Compustat data item 44).

Post = a dummy variable set equal to one if the observation is from the post-SAB

101 period, 0 otherwise.

Post * Earni ,q = the interaction of Post and Earni ,q (calculated as Post multiplied

by Earni ,q ).

8

The relation between current earnings and future cash flows as a measure of earnings informativeness is

selected as the measure of choice as the main analysis of the paper and extension of Altamuro, et al. (2005).

This choice was made since the major extension in the current paper is to consider the components of

earnings and their relation to future cash flows and how these relations are affected differentially by the

adoption of SAB 101. Announcement day abnormal stock returns’ relation to two measures of earnings

surprises are considered in section 6 of this paper.

16

The model in equation (1) was estimated for the treatment sample and the control

sample in a system of seemingly unrelated regressions. The variable of interest in

equation (1) is Post * Earni ,q . The predicted sign for the coefficient on Post * Earni ,q is

negative for the treatment sample when estimating this specification with data from the

transitional post-SAB 101 period. A negative coefficient on Post * Earni ,q represents a

decline in earnings informativeness with respect to future operating cash flows from the

pre-SAB 101 period to the transitional post-SAB 101 period. Results from the estimation

of equation (1) for a sample period from 1997 to 1999 (pre-SAB 101 period) and 2001

(transitional post-SAB 101 period) are found in the first two columns of Table 2. Panels

A through D in Table 2 present the earnings informativeness results for 1 through 4

subsequent quarters of accumulated cash flows, respectively.

The results in the first column of Table 2 show that in three out of four panels the

coefficient on Post * Earni ,q for the treatment sample is significantly negative and in the

fourth panel it is insignificantly positive. This provides evidence that the earnings

informativeness with respect to future operating cash flows declines in the transitional

post-SAB 101 period for the treatment sample of affected firms. The third column of

Table 2 reports the F-statistics resulting from tests of the differences in coefficients

derived estimating the model as a system of seemingly unrelated regressions. The

significant differences in the Post * Earni ,q coefficients reported in the third column of

Table 2 show that the decline in informativeness is stronger for the treatment firms than

for the control firms in three out of four panels. In panel C, the treatment firms have less

improvement in informativeness than do the treatment firms which is directionally

consistent with the other three panels. These results are consistent overall with the

findings in Altamuro, et al. (2005).

17

Components of Earnings and Future Cash Flows

This section investigates how the various components of earnings relate to future cash

flows. In doing so, I am able to demonstrate how the transitional impact of SAB 101

adoption affected the findings in Altamuro, et al. (2005). I investigate whether the

decline in earnings informativeness for the treatment firms in the transitional post-SAB

101 period is mechanical in nature by decomposing earnings into its cash flow and major

accrual components. As described in Section II, a mechanical decline in earnings

informativeness in the transitional period that is being driven by the large revenue

deferral would manifest itself in a decline in informativeness in the “other” accruals

component of earnings. This is due to the fact that “other” accruals captured in the cash

flow statement data in Compustat includes the change in deferred revenues.

To understand how these components of earnings are related to the decrease in

informativeness of earnings in the transitional post-adoption period found in Table 2, I

decompose earnings into its cash flow and accrual components using data from the cash

flow statement. 9 I then estimate the following regression to test whether the impact of

SAB 101 on treatment firms’ earnings is mechanically related to the deferral of revenues:

LeadCFO(i , q + t ) = β 0 + β 1CFOi , q + β 2 ΔARi , q + β 3 ΔINVi , q + β 4 ΔAPi , q

+ β 5 DEPRi , q + β 6 OTHERi , q + β 7 POST + β 8 POST * CFOi , q

+ β 9 POST * ΔARi , q + β 10 POST * ΔINVi , q + β 11 POST * ΔAPi , q

(2)

+ β 12 POST * DEPRi , q + β 13 POST * OTHERi , q + ε

where LeadCFO(i ,q +t ) = accumulated cash flow from operations (Compustat data item

108) scaled by end-of period total assets (Compustat data item 44) for firm i in quarters q

+ 1, q + 2, q + 3, and q + 4.

9

Compustat data items in the cash flow statement are provided on a cumulative basis. Throughout this

paper, cash flow statement variables have been disaggregated for fiscal quarters two, three and four.

18

CFOi ,q = cash flow from operations (Compustat data item 108) for firm i in

quarter q scaled by end-of-period q total assets (Compustat data item 44).

ΔARi ,q = the change in receivables for firm i from quarter q – 1 to quarter q,

(quarterly Compustat data item 103 from the cash flow statement), scaled by end-ofperiod total assets (Compustat data item 44).

ΔINVi ,q = the change in inventory for firm i from quarter q – 1 to quarter q,

(quarterly Compustat data item 104 from the cash flow statement) , scaled by end-ofperiod total assets (Compustat data item 44).

ΔAPi ,q = the change in accounts payable for firm i from quarter q – 1 to quarter q,

(quarterly Compustat data item 105 from the cash flow statement), scaled by end-ofperiod total assets (Compustat data item 44).

DEPRi ,q = depreciation and amortization for firm i in quarter q (Compustat data

item number 77 from the statement of cash flows), scaled by end-of-period total assets

(Compustat data item 44).

OTHERi ,q = the other component of accruals for firm i in quarter q not included

in specific categories above (calculated as Earni ,q – [ CFOi ,q + ΔARi ,q + ΔINVi ,q - ΔAPi ,q DEPRi ,q ], scaled by end-of-period total assets (Compustat data item 44).

Post = a dummy variable set equal to one if the observation is from the post-SAB

101 period, 0 otherwise.

Post * CFOi ,q = the interaction of Post and CFOi ,q (calculated as Post multiplied

by CFOi ,q ).

POST * ΔARi ,q = the interaction of Post and ΔARi ,q (calculated as Post multiplied

by ΔARi ,q ).

POST * ΔINVi ,q = the interaction of Post and ΔINVi ,q (calculated as Post

multiplied by ΔINVi ,q ).

POST * ΔAPi ,q = the interaction of Post and ΔAPi ,q (calculated as Post multiplied

by ΔAPi ,q ).

19

POST * DEPRi ,q = the interaction of Post and DEPRi ,q (calculated as Post

multiplied by DEPRi ,q ).

POST * OTHERi ,q = the interaction of Post and OTHERi ,q (calculated as Post

multiplied by OTHERi ,q ). 10

If the decline in earnings informativeness documented in the transitional postSAB 101 period is mechanically related to the deferral of revenues as required by SAB

101 adoption, I expect to see a negative coefficient on POST * OTHERi ,q for treatment

firms. Further, I expecte that this coefficient will be more negative for the treatment

firms than for the control firms. Results from the estimation of equation (2) for a sample

period from 1997 to 1999 (pre-SAB 101 period) and 2001 (transitional post-SAB 101

period) are found in the Table 3.

Comparing the pre-adoption period to the transitional SAB 101 adoption period,

the only variable that consistently loses informativeness for future cash flows is the

“other” component of accruals. Across Panels A, B, and C, the coefficient on

POST * OTHERi ,q is significantly negative. Compustat includes changes in deferred

revenues created as a result of SAB 101 adoption in the “other” accruals category. This

indicates that the “other” component of accruals which embeds the deferral adjustments

that most firms made when adopting SAB 101 is the major reason for the drop in

informativeness of earnings, providing support for Hypothesis 2. This result makes sense

if the majority of revenues were revenues received in advance and then deferred as a

result of SAB 101 adoption. 11 In all 4 panels presented, the F-Statistic on the difference

between the coefficient on POST * OTHERi ,q for SAB 101 firms and unaffected firms is

10

SAB 101 adoption created a cumulative effect adjustment for affected firms and, for the vast majority of

affected firms, a deferral of revenues previously recognized as earned that is reflected in the “other” accrual

component in Compustat’s coding of cash flow statements.

11

For the vast majority of firms required to make cumulative effect adjustments for SAB 101 adoption,

revenues received in advance of performance of services or provision of goods was the main reason for the

adjustment. I estimate equation (2) for a sub-sample of firms (183 firms) whose cumulative effect

adjustment clearly related to revenues received in advance and the results are qualitatively similar to those

found in Table 3 with slightly more significant results for the Post*Other variable, as expected.

20

significant, providing further evidence that the other component of earnings is the main

component in which a reduction in informativeness occurs and that this result is stronger

for treatment firms than for control firms. The coefficient on POST * ΔARi ,q is positive

and insignificant in Panels A through C of Table 3 and significantly positive in Panel D.

This suggests there is no change in the relation between accounts receivable and future

cash flows from the pre-SAB 101 period to the transitional post-SAB 101 period.

Similarly, the coefficients on most of the expense accruals do not decrease in

informativeness in the transitional post-adoption period. This provides some evidence

that managers did not use expense manipulations to counteract the impact of more

conservative revenue recognition on their ability to meet benchmarks of importance.

Taken together, the results of this and the previous section provide evidence that the

decrease in earnings’ informativeness during the transitional post-SAB 101 period is

mechanical in nature and related to the deferral of revenues re-entering the earnings

stream and creating a disruption in the earnings – future cash flow relation.

Transitory Nature of Informativeness Results

SAB 101 adoption created a cumulative effect adjustment for affected firms and,

for the vast majority of affected firms, a deferral of revenues previously recognized as

earned that is reflected in the “other” accrual component in Compustat’s coding of cash

flow statements. Accordingly, I posit that the reduction in the informativeness of

earnings due to SAB 101 documented by Altamuro, et al (2005) was temporary. If

treatment firms defer a portion of previously recognized earnings until a period just

shortly after SAB 101 adoption, and related operating cash flows are unaffected, then one

would expect a temporary distortion in the relation between the “other” accrual

component (that contains the adjustment to the deferred revenue) and future operating

cash flows. Whether this reduction is permanent or temporary is an important empirical

21

question. It is important for researchers to recognize that in testing the relative

informativeness of alternative revenue recognition procedures that they conduct their

tests outside of the transitional period in which the initial adoption of the new procedures

affects the various accrual accounts.

To test whether the reduction of earnings informativeness in the post-SAB 101

period is permanent or temporary, I re-estimate equations (1) and (2) using a longer

sample period, including all quarters in the post-SAB 101 period for 2002 and 2003. 12 I

eliminate 2000 as the year of adoption and also eliminate 2001 as it is the year in which

deferrals from 2000 are likely to reverse and, therefore, does not represent an equilibrium

for the “other” accruals in the SAB 101 regime. The post-transitional period of 2002 and

2003 provides us a “cleaner” post-adoption period once the deferrals from the one-time

adjustments have had a chance to completely unwind. The results of these estimations

can be found in Tables D4 and D5.

The results in Table 4 for the post-transitional SAB 101 period exhibit a dramatic

reversal of the results in Table 2 from the transitional post-SAB 101 period. Based on the

post-transitional time period, SAB 101 firms’ earnings informativeness improves

dramatically from the pre-adoption period to the post-transition period. The F-Statistic

for the difference between SAB 101 firms and control firms becomes is significant in all

panels of Table 4. This provides evidence that the improvement for the treatment firms is

greater than that of the control firms, suggesting that SAB 101 has actually improved

earnings’ informativeness with respect to future cash flows through more conservative

revenue recognition.

Additional evidence that firms affected by SAB 101 were not in equilibrium by

the end of the transitional time period is found by considering β 1 + β 2 in Table 4. The

sum of these two coefficients represents the informativeness of cash flows and revenues

12

I have also estimated these regressions including 2001 in the longer post-adoption period. Qualitatively,

the results are similar to those reported.

22

from receivables. This suggests that earnings are not related to future operating cash

flows in the transitional post period. This provides further support for my hypothesis that

the transitional post-adoption period is in disequilibrium with respect to the relation

between earnings and cash flows.

In the post-transitional period, the treatment firms exhibit the expected significant

relation between earnings and future operating cash flows in three out of four panels.

β 1 + β 2 is significant in the post-transitional period and the sum of these coefficients is

significantly larger than in the transitional post-adoption period. These results are

consistent with the decline in informativeness being temporary in nature.

In Table 5, the results for the post-transitional SAB 101 time period demonstrate a

similar reversal relative to the transitional time period results in presented in Table 3. In

the transitional period, the SAB 101 firms exhibit significantly negative coefficients on

the Post*Other variable in three out of four panels, indicating that the “other” component

of accruals (which is where changes in the deferred revenues resides) is where the

reduction in the informativeness of earnings with respect to future cash flows is

concentrated. However, in Table 5, the POST*OTHER variable becomes either positive

and significant (Panels A and B) or insignificantly positive (Panel C) or insignificantly

negative (Panel D). POST*OTHER loses significance in all Panels except B. The

transitional finding of a negative relation between POST * OTHERi ,q and future cash

flows becomes insignificant. This suggests that the relation between other accruals and

future cash flows was temporarily negative and that the difference between treatment and

control samples’ changes was also temporary. Taken together these results support

Hypothesis 3.

Table 5 also presents evidence that supports results in the previous section that

expense accruals do not demonstrate a significant decrease in informativeness in the posttransitional period. This provides support for the idea that the managers have not used

expense accruals manipulation to overcome the limitations of a more conservative

23

revenue recognition regime. This provides support for Hypothesis 4. In a subsequent

section, I will investigate the target beating behavior of the treatment and control firms to

further understand if conservative revenue recognition that resulted from SAB 101

provides a disciplining force to reduce potentially value-destroying benchmark beating

activities.

Magnitude of Deferral

In this section I investigate whether the temporary decline in the predictive

usefulness of earnings and the “other” accrual component with respect to future cash

flows that is exhibited during the transitional SAB 101 period is related to the cumulative

effect adjustment that firms made when they adopted the more conservative revenue

recognition procedures recommended by SAB 101. I split the sample into large and

small cumulative adjustments and I then estimate the following equation to determine

how the size of the SAB 101 cumulative adjustment affected the reversal:

LeadCFO(i ,q +t ) = β 0 + β 1 Late + β 2 Earni ,q + β 3 Size _ Adji ,q +

β 4 Late * Earni ,q + β 5 Size _ Adj * Late * Earni ,q + ε

(3)

where LeadCFO(i ,q +t ) = accumulated cash flow from operations (Compustat data item

108) scaled by end-of period total assets (Compustat data item 44) for firm i in quarters q

+ 1, q + 2, q + 3, and q + 4.

Size _ Adji ,q = a dummy variable set to 1 if the observation comes from the

quartile of firms with the highest cumulative effect adjustment (scaled by total market

value) due to SAB 101 adoption and 0 if the observation comes from firms in the smallest

quartile of cumulative effect adjustment.

Late * Earni ,q = the interaction of the dummy variable Late and Earni ,q

24

Size _ Adj * Late * Earni ,q = the interaction of the size of the cumulative effect

adjustment and the change in earnings informativeness from the early post period to the

later post period.

Late = a dummy variable set equal to one if the observation is from the posttransitional SAB 101 period, 0 if the observation is from the transitional SAB 101 period.

The results from estimating equation (3) are presented in Table 6. The positive

and significant coefficient on Size _ Adj * Late * Earni ,q provides additional corroborating

evidence that the decrease in the informativeness of earnings with respect to future cash

flows documented in Table 3 in the transitional SAB 101 period was temporary. Since

the magnitude of the deferral of revenues (as measured by the cumulative effect

adjustment) is positively correlated with the shift from earnings being less informative in

the transitional SAB 101 period to earnings being more informative in the posttransitional period, this provides corroborative evidence that the decrease in earnings’

informativeness reported by Altamuro, et al (2005) was temporary in nature and tied to

the mechanics of the deferral of revenues.

Benchmark Beating Analysis

The previous sections have provided evidence of the temporary decline in

earnings informativeness in the transitional SAB 101 period followed by an increase in

earnings informativeness in the post-transitional period. In addition, I show that this

result is likely driven by “other” accruals component of earnings and that expense

accruals have not decreased in terms of there predictive usefulness with respect to future

operating cash flows. Jensen (2005) posits that managers of overvalued firms may

manipulate earnings in order to meet or beat important benchmarks. This behavior (along

with other short-sighted activities) on the part of managers can have real value destroying

implications for firms. SAB 101 created a regime in which revenue recognition is more

25

conservative. In the previous sections, I find that greater conservatism in revenue

recognition does not appear to have motivated managers to manipulate expense accruals.

This is evidenced by no significant decline in informativeness of expense accruals with

respect to future cash flows with the adoption of SAB 101 reporting.

I now perform test my final hypothesis concerning the benchmark beating

activities of firms and how those activities are affected by more conservative revenue

recognition required by SAB 101. I use three benchmarks shown in prior literature to be

important to managers – zero quarterly earnings, zero seasonally adjusted quarterly

earnings changes, and consensus analyst quarterly earnings forecasts.13 The pre-SAB

101 period includes all quarters for 1997, 1998 and 1999. I test to see if benchmark

beating declines with the introduction of SAB 101 using two different post-SAB 101

periods as I have done in the previous empirical tests of this section. For both the

treatment firms and the control firms, histograms of quarterly earnings (Compustat data

item 69) scaled by end-of period total assets (Compustat data item 44), the seasonally

adjusted change in quarterly earnings scaled by end-of-period total assets, and quarterly

analyst forecast errors are created for the pre-SAB 101 period as well as the post-SAB

101 period.

I construct histograms for quarterly earnings levels and seasonally adjusted

changes in quarterly earnings (both scaled by end of period total assets). Bin widths for

the distributions are 0.75 percent. For the earnings level histogram, I construct a variable,

Earn_Diff, which is measured according to Burgstahler and Dichev (1997) as the

difference between the actual number of firms in each distribution bin and the expected

number of firms in each bin. The expected number of firms in each bin is calculated as

the mean number of firms in the two adjacent bins. A similar variable,

13

Burgstahler and Dichev (1997) and Brown and Caylor (2005) document the importance of these three

benchmarks. Additionally, Graham, Harvey, and Rajgopal (2005) report survey evidence that benchmarks

are important to managers.

26

Earn_Change_Diff, is constructed for the histograms for the seasonally adjusted change

in earnings. Also, Forecast_Error_Diff is constructed for the histograms of analyst

quarterly earnings forecast errors in a similar manner. Analyst forecast errors are

computed as the difference between I/B/E/S actual quarterly earnings per share minus the

median of the most recent (prior to the quarterly earnings announcement date) consensus

forecast. The difference between the actual number of firms in a bin and the expected

number of firms (average of adjacent bins) is Forecast_Error_Diff. I create the variable

Netbin that is 1 if it is the bin just to the right of the benchmark of interest, -1 if it is in the

bin just to the left of that benchmark, and zero otherwise.

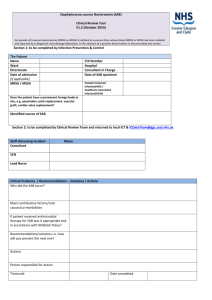

The histogram in Figure 1 is derived from the pre-adoption period for the SAB

101 affected firms. Figure 2 is derived from the post-adoption period. Visually, the

discontinuity around zero earnings seems to have declined following the adoption of SAB

101. Figures E3 and E4 provide a similar comparison for the histograms of the

seasonally adjusted change in quarterly earnings for the SAB 101 firms while Figures E5

and E6 provide a comparison of analysts’ quarterly earnings per share forecast errors

(I/B/E/S actual earnings per share less the most recent consensus forecast of earnings per

share prior to the quarterly earnings announcement date).

To test whether the observed differences are statistically significant, the following

regressions are estimated to determine whether there has been a significant decrease in

the amount of benchmark beating behavior from the pre-SAB 101 period to the post-SAB

101 periods and whether any such change is more significant for SAB 101 firms than for

the sample of unaffected firms:

Earn _ Diff (b ,t ) = β 0 + β1 Post + β 3 Netbin(b,t ) + β 3 Post * Netbin(b,t ) + ε

Earn _ Change _ Diff ( b ,t ) = β 0 + β1 Post + β 2 Netbin( b ,t )

+ β 3 Post * Netbin( b ,t ) + ε

(4)

(5)

27

Forecast _ Error _ Diff (b ,t ) = β 0 + β 1 Post + β 2 Netbin( b ,t )

+ β 3 Post * Netbin(b ,t ) + ε

(6)

where Earn _ Diff (b ,t ) = the difference between the expected number of firms and the

actual number of firms for each bin b in each period t for the histogram of net income

scaled by end-of-period total assets.

Earn _ Change _ Diff (b ,t ) = the difference between the expected number of firms

and the actual number of firms for each bin b in each period t for the histogram of

seasonally adjusted change in net income.

Forecast _ Error _ Diff (b ,t ) = the difference between the expected number of

firms and the actual number of firms for each bin b in each period t for the histogram of

analysts’ consensus quarterly earnings per share forecasts.

Post = a dummy variable set equal to one if the observation is from the post-SAB

101 period, 0 otherwise.

Netbin(b ,t ) = a dummy variable set equal to 1 if the firm is in the bin just to the

right of the appropriate benchmark (zero earnings, zero change in earnings and 0 and 1

cent per share above analyst forecasts, respectively), -1 if the firm is in the bin just to the

left of the benchmark of interest and 0 otherwise.

Post * Netbin(b ,t ) = the interaction of Post and Netbin(b ,t ) (calculated as Post

multiplied by Netbin(b ,t ) ).

Table 7 presents the results from the estimation of equations (4), (5), and (6) using

the transitional post-adoption period. Panel A presents the results where the benchmark

of interest is zero earnings, Panel B presents the results where the benchmark of interest

is last year’s earnings for the corresponding quarter, and Panel C presents results for the

analyst forecast benchmark.

28

The significantly negative coefficient on Post * Netbin(b ,t ) for the SAB 101 firms

(first column) found in all three panels indicates that the level of unexpected number of

firms around the benchmark of interest declines significantly in the post-SAB 101 period.

This suggests that benchmark beating has declined overall. The F-Statistics in the third

columns of Panels A and B of Table 7 provide evidence that SAB 101’s conservative

reporting requirements curbed benchmark beating around earnings levels and changes

benchmarks. However, Panel C does not provide evidence that the treatment firms

declined more than the control firms with regard to meeting or beating analysts’ quarterly

earnings forecast. It seems that the benchmark beating results are mixed in the

transitional SAB 101 period.

Finally, Table 8 presents the results from the estimation of equations (4), (5), and

(6) using the post-transitional period. Panel A presents the results where the benchmark

of interest is zero earnings, Panel B presents the results where the benchmark of interest

is last year’s earnings for the corresponding quarter, and Panel C presents results for the

analyst forecast benchmark. Overall, the earnings levels and changes benchmarks

provide some evidence of a decrease in benchmark beating for the treatment firms

(relative to the control firms) from the pre-SAB 101 regime to the post-SAB 101 regime.

However, evidence from the analyst forecast benchmark in Panel C is inconsistent with

significantly lower benchmark beating for treatment firms relative to control firms.

One potential issue that might create difficulty interpreting the results observed in

the main tests is the differential incidence of loss firms across samples and time periods.

To test whether loss firms are driving any of my results, I re-estimated the main tests

separately, excluding loss firms from the analysis. Results (not tabled here) of the main

tests for profitable firms only remain qualitatively unchanged and provide confidence that

the changes in the accruals – cash flow relation documented in Tables 2 and 4 are not

driven by losses in the various samples and time periods.

29

Since there are some inconsistencies across quarters in the results prior to this, I estimate

equation (1) again using annual data due to concerns over seasonality. Overall, the annual

estimations (not tabled here) are qualitatively similar to the results in the quarterly

analysis.

Another possible confounding factor in the tests for changes in informativeness of

earnings and its accruals components over time is that the volatility of earnings may be

different across treatment and control samples and between pre-SAB 101 and post-SAB

101 periods. To test for differences in earnings volatility across samples and across time

periods, I calculate mean earnings (cash flows) volatility of quarterly earnings for the preSAB 101 period and post-SAB 101 period for both samples. This was calculated as the

variance of quarterly earnings for the time series pre-SAB 101 and post-SAB 101. Each

firm has 12 quarterly observations in the pre-SAB 101 period and 12 quarterly

observations in the post-SAB 101 period. I perform t-tests and find that neither

differences across time periods nor across samples are significant.

30

V. CONCLUSION

This paper investigates the impact of conservative revenue recognition practices

on the informativeness of earnings with respect to future operating cash flows. In a prior

paper, Altamuro, et al. (2005) find evidence that more conservative revenue recognition

practices are less informative relative to more aggressive revenue recognition procedures

that firms were using prior to SAB 101. I posit that this finding is due to distortions in

the earnings-cash flow relationship during the SAB 101 transition period over which

Altamuro, et al. (2005) conduct their analysis.

Given the concern over accounting manipulations and scandals related to

aggressive financial reporting and the fact that the FASB is in the beginning stages of

revising revenue recognition criteria in conjunction with its conceptual framework project,

this paper reconsiders the affects of SAB 101 on earnings informativeness and provides

important additional evidence that both complements and extends the results of Altamuro,

et. al (2005).

I find that the decrease in earnings informativeness with respect to future

operating cash flows documented in Altamuro, et al. (2005) appears to be limited to the

period shortly after adoption of SAB 101. This decrease in informativeness reverses

when the informativeness tests are conducted on SAB 101 data from periods beyond the

transitional SAB 101 period (i.e., after 2001 fiscal quarters) leading to an overall increase

in earnings informativeness for the sample of SAB 101 firms. This finding has important

implications for future revenue recognition projects under consideration by the FASB.

My findings suggest that more conservative revenue recognition enhances the predictive

usefulness of earnings and its accrual components with respect to future cash flows.

Moreover, I present findings that the more conservative revenue recognition under SAB

101 reduces management’s benchmark beating behavior. This finding suggests that

31

worries over SAB 101 and its potential to diminish the informativeness of earnings may

not be as serious as previously thought.

LaFond and Watts (2007) provide empirical evidence that conservatism serves an

informational role and reduces information asymmetry between investors. My study,

while not specifically focused on information asymmetry, does provide complementary

evidence that supports LaFond and Watts’ (2007) conjecture. My finding that more

conservative revenues are more informative with respect to future operating cash flows

provides evidence on one of the mechanisms by which investor information asymmetry

may be reduced.

A potential area of future research is to consider how this temporary shift in the

earnings-cash flow relationship in the transitional post-SAB 101 period affected analysts’

forecast accuracy. This area of future research will allow a better understanding of

whether and how analysts anticipated the consequences of SAB 101 for affected firms.

Future work could use analyst forecast dispersion as a measure of information asymmetry

to test for a shift in asymmetry after the imposition of SAB 101.

Additional future research could investigate whether more conservative SAB 101

revenue reporting changed firms’ business models as some claimed it would. Watts

(2003b) calls for empirical studies that focus on how GAAP changes affect conservatism

and how contracting responds to these changes. Critics of SAB 101 argued that these

requirements would place greater power in the hands of the customer in the supply chain.

Since one implication of the more conservative revenue recognition required by SAB 101

was that firms were required to wait for customer approval prior to recognition of

revenues, firms that have a greater concentration of revenues with relatively few

customers might be more affected operationally than would firms that have a wider

customer base. For example, if 90% of a firm’s revenues come from one customer, then

SAB 101 could impact that firm more than a firm with many customers. Of interest

32

would be whether the reduction of informativeness of earnings was concentrated in firms

more likely to lose power in the supply chain as a result of SAB 101.

Additionally, the pre- and post-SAB 101 setting of my study provides a unique

context to test the sensitivity of a growing array of firm-specific measures of accounting

conservatism that have recently been proposed. Khan and Watts (2007) propose the

C_Score to be used in event studies and other contexts. Since SAB 101 reduces the

manager’s flexibility in choosing when to recognize revenues, it provides an ideal setting

in which to test the sensitivity of the C_Score measure to real changes in the

conservatism of a firm’s reported earnings.

33

Table1: Average industry cumulative adjustment scaled by market value of equity

Industry

Pharmaceuticals and Chemicals

Machinery

Electrical

Measuring Instruments

Transportation By Air

Communications

Miscellaneous Retail

Holding Companies

Computer and Business Services

Educational Ser SAB

101vices

Management Services

All Other Industries

Total

Number

of

Firms

48

28

8

35

5

8

10

6

24

SIC

Code

28

35

36

38

45

48

59

67

73

Cumulative

Adjustment

0.026

0.034

0.020

0.036

0.091

0.005

0.024

0.010

0.038

82

87

0.008

0.076

5

8

44

0.031

229

Note: Industries with at least companies of membership were considered in the

classifications in this table based on 2-digit SIC membership codes. The

cumulative adjustment reported is the average scaled cumulative effect adjustment

reported by the firms in the industry. The adjustment was scaled by the market

value of equity at the end of fiscal year 2000.

34

Table 2: Changes in Earnings Informativeness from Pre-SAB 101 Period (1997 – 1999)

to the Transitional SAB 101 Period (2001)

Panel A: Cash flows for quarter q+1

Variable

Intercept

Post

Earn

Post*Earn

β1 + β 2

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

Unaffected

Firms

Coefficients

(t-statistics)

0.002*

(1.85)

0.004**

(2.02)

0.199***

(27.98)

-0.128***

(-5.57)

-0.012

(-0.42)

3,370

0.003**

(2.14)

0.006**

(2.32)

0.376***

(41.34)

-0.096***

(-5.81)

-0.051***

(-1.92)

3,370

0.12

F-Statistic for

Difference in

Coefficients

0.88

1.03

697.69***

3.89**

0.23

Panel B: Cash flows for accumulated to quarter q+2

Variable

Intercept

Post

Earn

Post*Earn

β1 + β 2

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

0.002

(0.97)

0.007**

(2.20)

0.288***

(23.40)

-0.108***

(-3.93)

-0.042

(-0.89)

3,370

0.50

Unaffected

Firms

Coefficients

(t-statistics)

0.003

(1.37)

0.013***

(3.12)

0.599***

(38.46)

-0.050

(-1.44)

0.175***

(5.03)

3,370

0.62

F-Statistic for

Difference in

Coefficients

0.70

3.63*

764.07***

5.30**

35

Table 2. Continued

Panel C: Cash flows accumulated to quarter q+3

Variable

Intercept

Post

Earn

Post*Earn

β1 + β 2

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

Unaffected

Firms

Coefficients

(t-statistics)

0.001

(0.08)

0.012***

(2.59)

0.001

(0.45)

0.021***

(3.32)

0.380***

(3.51)

0.021

(0.47)

0.049

(0.80)

3,370

0.810**

(35.31)

0.189***

(3.34)

0.178 ***

(2.93)

3,370

0.57

F-Statistic for

Difference in

Coefficients

0.14

3.27*

640.13***

16.14***

0.61

Panel D: Cash flows accumulated to quarter q+4

Variable

Intercept

Post

Earn

Post*Earn

β1 + β 2

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

0.001

(0.20)

0.010**

(1.62)

0.470***

(20.59)

-0.306***

(-2.67)

0.221***

(2.69)

3,370

Unaffected

Firms

Coefficients

(t-statistics)

0.002

(0.50)

0.016

(1.92)

1.023**

(34.73)

- 0.170**

(-2.42)

0.239***

(3.46)

3,370

0.59

0.63

F-Statistic for

Difference in

Coefficients

0.23

0.83

666.39***

6.85**

36

Table 2. Continued

Note: Variables are defined in text.

Note: This table presents regression results using a transitional post-adoption period

consisting of fiscal year 2001.

Note: The dependent variable in panel A is one quarter ahead cash flows from operations.

Note: The dependent variable in panel B is cumulative cash flows from operations for

two quarters ahead.

Note: The dependent variable in panel C is cumulative cash flows from operations for

three quarters ahead.

Note: The dependent variable in panel D is cumulative cash flows from operations for

four quarters ahead.

Note: * Denotes statistical significance at the .10 level, two-tailed t statistics.

Note: ** Denotes statistical significance at the .05 level, two-tailed t statistics.

Note: *** Denotes statistical significance at the 0.01 level, two-tailed t statistics.

Note: Results in the table were obtained using firm, quarter and industry fixed effects.

Also, a system of seemingly unrelated regressions was estimated to determine

differences in coefficients for the variables of interest.

37

Table 3:

Disaggregated Earnings Informativeness – Changes from Pre-SAB 101 Period

(1997 – 1999) to Transitional SAB 101 Period (2001)

Panel A: Cash flows for quarter q+1

Variable

Intercept

Post

CFO i , q

ΔARi ,q

ΔINVi ,q

ΔAPi ,q

DEPRi ,q

OTHERi ,q

POST * CFOi ,q

POST * ΔARi ,q

POST * ΔINVi ,q

POST * ΔAPi ,q

POST * DEPRi ,q

POST * OTHERi ,q

β 6 + β13

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

-0.009

(-0.24)

0.012***

(2.95)

0.097***

(4.68)

0.241***

(7.01)

0.147***

(3.10)

-0.053

(-1.27)

0.042

(0.26)

0.070***

(6.45)

-0.220***

(-4.56)

-0.006

(-0.08)

-0.085

(-0.83)

0.006

(0.06)

0.228

(1.34)

-0.181***

(-3.61)

-0.111***

(2.25)

Unaffected

Firms

Coefficients

(t-statistics)

0.026

(0.76)

0.003

(0.62)

0.162***

(7.60)

0.245***

(6.07)

-0.078*

(-1.53)

-0.469***

(-9.67)

-0.181

(-0.89)

0.012

(0.44)

-0.257***

(-6.10)

-0.053

(-0.66)

0.217**

(1.84)

0.613***

(10.44)

0.283

(1.02)

0.135***

(2.62)

0.147***

(3.16)

2,930

0.43

2,376

0.55

F-Statistic for

Difference in

Coefficients

0.82

0.12

0.93

0.42

0.25

6.53***

11.23***

3.53*

1.12

0.85

4.67**

3.58*

-0.055

14.25***

38

Table 3. Continued

Panel B: Cash flows accumulated to quarter q+2

Variable

Intercept

Post

CFO i , q

ΔARi ,q

ΔINVi ,q

ΔAPi ,q

DEPRi ,q

OTHERi ,q

POST * CFOi ,q

POST * ΔARi ,q

POST * ΔINVi ,q

POST * ΔAPi ,q

POST * DEPRi ,q

POST * OTHERi ,q

β 6 + β13

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

-0.012

(-0.20)

0.020***

(2.99)

0.071**

(2.06)

0.274***

(4.77)

0.172**

(2.18)

-0.100

(-1.46)

0.059

(0.22)

0.075***

(4.14)

-0.141*

(-1.75)

0.012

(0.10)

-0.066

(-0.38)

0.166

(1.01)

0.263

(0.93)

-0.235***

(-2.79)

-0.161***

(-1.94)

Unaffected

Firms

Coefficients

(t-statistics)

0.054

(1.03)

0.004

(0.52)

0.164***

(5.04)

0.332***

(5.39)

-0.005

(-0.06)

-0.525***

(-7.10)

-0.663***

(-2.13)

0.059*

(1.46)

-0.239***

(-3.65)

0.380***

(3.03)

0.330**

(1.81)

0.186***

(2.07)

0.887***

(2.04)

0.157***

(1.96)

0.216***

(2.88)

2,923

0.50

2,362

0.65

F-Statistic for

Difference in

Coefficients

0.49

0.23

0.89

0.72

5.66**

78.36***

789.36***

7.58**

6.12**

48.36***

6.68**

0.89

5.66**

725.36***

39

Table 3. Continued

Panel C: Cash flows accumulated to quarter q+3

Variable

Intercept

Post

CFO i , q

ΔARi ,q

ΔINVi ,q

ΔAPi ,q

DEPRi ,q

OTHERi ,q

POST * CFOi ,q

POST * ΔARi ,q

POST * ΔINVi ,q

POST * ΔAPi ,q

POST * DEPRi ,q

POST * OTHERi ,q

β 6 + β13

Number of Observations

Adjusted R2

SAB 101

Firms

Coefficients

(t-statistics)

0.008

(0.10)

0.029***

(3.20)

-0.044

(-0.96)

0.256***

(3.40)

0.173*

('1.67)

-0.109

(-1.21)

0.639*

(1.81)

0.074***

(3.10)

0.014

(0.13)

0.016

(0.10)

0.343

(1.52)

0.009

(0.05)

0.035

(0.09)

-0.186*

(-1.68)

-0.113

(-1.03)

2,916

0.57

Unaffected

Firms

Coefficients

(t-statistics)

0.109 ***

(2.38)

-0.011

(-1.31)

0.393 ***

(8.89)

0.268 ***

(2.92)

0.315 ***

(2.74)

-0.734 ***

(-6.68)

-1.29 ***

(-3.01)

0.375 ***

(6.39)

-0.196 ***

(-2.76)

0.195

(1.47)

0.130

(0.78)

0.275 ***

(2.20)

1.776 ***

(3.63)

0.135

(1.04)

0.210 ***

(3.54)

2,351

0.63

F-Statistic for

Difference in

Coefficients

365.34***

0.40

365.43***

0.25

544.22***

658.23***

459.34***

455.66***

452.30***

778.23***

262.36***

0.78

456.38***

765.32***

40

Table 3. Continued

Panel D: Cash flows accumulated to quarter q+4

Variable

Intercept

Post

CFO i , q

ΔARi ,q

ΔINVi ,q

ΔAPi ,q

DEPRi ,q

OTHERi ,q

POST * CFOi ,q

POST * ΔARi ,q

POST * ΔINVi ,q

POST * ΔAPi ,q

POST * DEPRi ,q