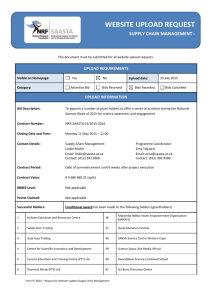

Administrators' Report

advertisement