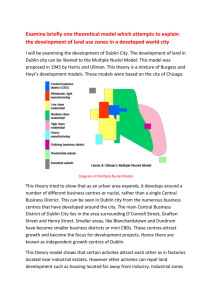

National Statement of Housing Supply and Demand 2014 and

advertisement