ALTRIA Group - Craig School of Business

advertisement

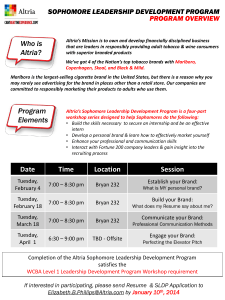

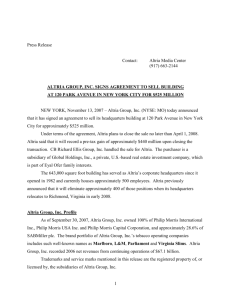

ALTRIA Group (NYSE: MO) Alexander Beck Student Investment Fund (FIN 129) Fall Semester2004 Table of contents 1 Altria - The Company .................................................................................. 3 2 Recent News .................................................................................................. 5 3 The Industries and the competitors............................................................ 6 3.1 Tobacco ................................................................................................... 6 3.1.1 British American Tobacco (NYSE: BTI) ......................................... 6 3.1.2 Reynolds American (NYSE: RAI) .................................................. 7 3.2 Food processing....................................................................................... 7 3.2.1 Kellogg (NYSE: K) .......................................................................... 7 3.2.2 Sara Lee (NYSE: SLE)..................................................................... 8 4 Strengths........................................................................................................ 8 5 Weaknesses.................................................................................................... 9 6 Opportunities ................................................................................................ 9 7 Threats........................................................................................................... 9 8 Valuation ..................................................................................................... 10 9 8.1 PE-multiple............................................................................................ 10 8.2 Dividend Discount Model ..................................................................... 10 8.3 Free Cash Flow to Firm......................................................................... 10 8.4 Chart analysis ........................................................................................ 12 Recommendation ........................................................................................ 13 10 Appendix ..................................................................................................... 13 2 1 Altria - The Company The Altria Group (NYSE: MO) is a holding which emerged out of the restructuring of Philip Moris Companies, which contains of Philip Morris USA Inc. and Philip Moris International Inc., in 1985. During the same year General Foods was acquired for $5.6 billion, to become part of the group. 1988, in the largest non-oil acquisition in U.S. history, Altria Group bought Kraft for $12.9 billion. One year later, in 1989, General Foods and Kraft were combined to Kraft General Foods (owned by 85%), the largest food company in the U.S.. Supplemented by Nabisco Holdings a world leader in cookies, crackers and snacks, along with the selling of Miller Brewing Company to South African Breweries (Altria now owns 36% economic and 24.9% voting interest in this worlds second largest brewing company), Altria became what it is today – a leading consumer products company.1 The company’s leading cigarette brands include Marlboro, Basic and Chesterfield. With a total of 923 billion cigarettes sold in 2003, the company is the world’s largest cigarette manufacturer with a market share of about 15.4%. But the performance of the U.S. and the international segment was quiet different. Mostly due to the fast declining U.S. market (more than 5% from 2002 to 2003 and almost 35% since 19942) PM USA suffered from a decrease of 2.3% in sales and 22.4% in operating income. In contrast to this PM International managed to increase revenue by 1.8% and operating income by 10.9%. However, the most valuable asset of these companies remains the strong brand image besides its market leadership.3 1 www.altria.com www.rjrt.com 3 www.valueline.com 2 3 Kraft, Jacobs, Milka, Oreo and Post are a few examples of the best known brands of Kraft General Foods. After weak a performance in the last few years due to heightened competition and the late reaction to the low-carbohydrate/high protein ideology, Kraft regained market share in 2004. So far, new product introduction and marketing initiatives caused revenue to rise by 4.3% to a total of $32.4, whereas operating income fell by 9%. While profits remain to stay under pressure as a result of high advertising, energy, packaging and commodity costs, product innovation and customization remains key issues for further development.4 Although the name Altria Group officially exists only since January 2003, the history of its subsidiaries reaches as far back as 1767 for Kraft and 1847 for Philip Morris. Today the group has a market capitalization of almost $120 billion, revenue of $88.5 billion and a projected net income for 2004 of about $9.5 billion. Even though MO is selling its products in over 160 countries still 48% of revenues and 54% of operating income are earned in the U.S. market.5 4 5 www.valueline.com www.altria.com 4 2 Recent News - 11-18-2004: Altria upgraded by Prudential and Goldman Sachs6 Prudential revised their expectations for Altria from Neutral to Overweight and Goldman Sachs was in line with that by upgrading the company from In-line to Outperform. - 11-17-2004: Top Judges Have Doubts on Tobacco Penalty7 A U.S. federal court panel on Wednesday expressed scepticism about whether the government had the power to force cigarette makers to pay billions of dollars in past profits as part of its $280 billion racketeering case against the industry. - 11-04-2004: CEO: Altria Preparing to Break Up Company8 “Although the precise timing and chronology of events remain uncertain, I can assure you that we are working on a myriad of activities in anticipation of a potential breakup,” the executive, Louis C. Camilleri said. “Splitting up Altria would be a boon to investors” who hold shares which he described as significantly undervalued. This leaves room for speculations weather only the relative small stake in brewer SABMiller is to be broken away or the most obvious spinoff candidate Kraft Foods. But by speaking of a three-way breakup, Camilleri alluded to other possibilities. Altria could also separate its domestic and international tobacco businesses. The break up is expected to take place in late 2005. - 10-19-2004: Altria Group, Inc. Reports 2004 Third-Quarter Results; Diluted Earnings per Share Up 5.7% to $1.29; Net Earnings Up 6.3% to $2.6 Billion.9 - 08-25-2004: Altria Group, Inc. Increases Quarterly Dividend 7.4% to $0.73 per Share.10 6 finance.yahoo.com www.reuters.com 8 finance.yahoo.com 9 www.altria.com 10 www.altria.com 7 5 3 The Industries and the competitors Since the Altria Group is divided (in terms of revenue) between the tobacco industry (approx. 65%) and the food processing industry (approx. 34%), the following chapter deals with both industries and its specific outlooks and competitors. 3.1 Tobacco Although most companies in this industry recorded solid earnings growth this year, the enthusiasm has been dampened by the start of the U.S. government’s $280 billion racketeering trial. This was probably a key factor why British American Tobacco sold its U.S. subsidiary Brown & Williamson to Reynolds American. The U.S. market is affected by two main players which control together approximately 80% (Philip Morris 50% and Reynolds 30%) of total U.S. shipments. Although Reynolds has good opportunities and a huge savings potential, due to the recent acquisition, to recover market share from MO the two rivals are facing a tough market environment. With a steadily declining tobacco use (2.5% in the first three quarters of 2004) despite massive advertising activity and a strong growth for discount brands the future for the big players in the U.S. doesn’t look bright.11 Further growth is expected to come from the international markets all ahead the Chinese and the African markets. 3.1.1 British American Tobacco (NYSE: BTI) British American Tobacco PLC is the world’s second largest tobacco company, with total sales of 792 billion cigarettes in 200312. Its main brands include GPC, Benson & Hedges, Lucky Strike and Kent. Through the sale of its U.S. subsidiary, Brown & Williamson, to the second largest U.S. cigarette manufacturer, Reynolds, it has now a 42% stake in Reynolds American. With this transaction BTI reacted to its decreasing market share in the U.S. (mainly due to the strength of Philip Morris’ Marlboro brand) and also reduced significantly its exposure to U.S. tobacco litigation. Although British American Tobacco is no direct competitor for Philip Morris in the U.S. anymore, the company continues to be very strong in MO’s foreign markets, especially Australia and Europe where BTI in 2004 has managed to increase sales against the overall 11 12 www.hoovers.com www.bat.com 6 downward trend. It also remains to be a strong competitor in the fight for the huge Chinese market which represents about 30% of total global cigarette sales.13 3.1.2 Reynolds American (NYSE: RAI) After the acquisition of Brown & Williamson, Reynolds American is now the second largest tobacco company with roughly 31% market share. Its main brands are Winston, Camel, Pall Mall, Kool and the discount brand Doral. Reynolds is concentrating on the U.S. market since they sold their international business in 1999. With a now strengthened market share (due to the acquisition and a boost in its premium brands) and estimated cost savings of about $1 billion from the acquisition, the company might now be able to face the competition with MO’s dominating Marlboro brand.14 3.2 Food processing So far 2004 seems to be a predominantly good year for the food business, but going forward the industry continues to face a couple of challenges. Lost bargain power to the major retailers and increasing food ingredients cost describe only two of them. The central issue for the next years seems to keep up with the fast changing consumer preferences. Redesigning, product innovation and branding are likely to be the essential tools to achieve this. It seems that the current low-carbohydrate/high protein craze have surprised some of the industries companies what the example of the struggling American Italian Pasta and Interstate Bakeries shows. Therefore the increasing awareness of health issues, diet philosophies and nutrition facts in the European and North American societies will be the benchmark for this industry.15 3.2.1 Kellogg (NYSE: K) Kellogg is the world’s largest manufacturer of ready to eat cereals. Moreover the company is engaged in the manufacturing of convenience foods, such as cookies, crackers, toaster pastries, cereal bars, frozen waffles and meat alternatives. Like the whole industry Kellogg suffers from high commodity prices. Nevertheless the company has been able to absorb most of these costs by productivity savings and product mix improvements. It also continues to spend much for brand building, which should result in high customer loyalty despite the challenging market conditions.16 13 www.valueline.com www.valueline.com 15 www.hoovers.de 16 www.valueline.com 14 7 3.2.2 Sara Lee (NYSE: SLE) Sara Lee Corp. is a global manufacturer and marketer which consist of five business segments: Meats, Bakery, Beverage, Household Products and Brand Apparel. Well-known brands include Hillshire Farm, Earth Grains, Jimmy Dean and Sara Lee. The company faces some difficulties in its meat division where operating income fell almost 40% although revenues increased by 5%. Nevertheless, recently released products have been selling well and seem to take pressure from this segment. On the other hand the bakery division did surprisingly well with an increase of 60% in operating income although sales barely rose. Altogether Sara Lee, like the other big players in this industry, is likely to continue growing on a moderate pace.17 4 Strengths Size / market leadership: Having two companies, each identified as the leader in its U.S. market segment and the world’s number one and two respectively, Altria Group impresses by its mere size. Provided with enough financial power to face the mature but challenging market the holding adheres its necessary flexibility. Brand loyalty / image: Both, Philip Morris as well as Kraft, are operating for over 150 years. In this time they built up a brand image and loyalty that gives them a cutting edge upon their competitors. The most valuable brand in this group is Philip Morris’ premium cigarette brand Marlboro. Ranking among the ten world’s most valuable brands, Marlboro is worth an estimated fortune of $22 billion. Although well behind the world’s most valuable food brand Kellogg, the Kraft brand is still ranked at position 67 with an estimated value of about $4 billion.18 Earnings / dividend history: Altria is showing a continuous earnings and dividend growth since 1989, when the merger between Kraft and General Foods took place. Being invested in the consumer non cyclical sector Altria seems to be able for further constant improvement. With a current payout-ratio of approximately 60% and a share price around $58 the company provides a 5% dividend yield.19 17 www.valueline.com www.biz-community.com 19 Finance.yahoo.com 18 8 5 Weaknesses Competition: Due to the acquisition of Brown & Williamson by Reynolds, Philip Morris’ main challenger in the U.S. market is regaining strength in an environment that is earmarked by shrinkage. Even if the sales of Kraft seem to grow steadily, it operates in a historically highly competitive market where it is vital to keep up with the overall market trend.20 Limited growth opportunities: Although it seems that there are lots of growth opportunities while there are “only” 650 million smokers worldwide21, expansion seems to be limited. Even the frequently cited Chinese market is unlikely to be a solution, because it is controlled by a state monopoly. More likely the negative attitude towards tobacco products is growing stronger, causing a decrease in smokers as well as increasing taxation should cause smokers to consume fewer cigarettes per person. Earnings trend: The projected earnings estimate of the analyst following the company is declining throughout the last three months. In addition Altria couldn’t manage to announce higher than estimated earnings leaving little space for positive surprise.22 6 Opportunities Company break up: Even if the announcement of Altria’s CEO Louis C. Camilleri on November 4th wasn’t the first time the board mentioned its intension to break up the holding, the share prise rose by 8.5% on that day23. The break up seems to offer opportunities to enhance shareholder value because the sum of its parts seems to be worthier than the company as a whole. Although the precise timing and shape of the break up remains uncertain the market seems to appreciate the notification. 7 Threats Litigations: While the current trials against the U.S. tobacco industry appear to end less expensive for the companies than first assumed, actual und potential litigations are remaining to be the biggest uncertainty. Nevertheless, tobacco litigation is not new. First cases were filed 50 years ago in 1954. Until now only 13 cases went to trail successfully. A milestone was the “Master Settlement Agreement” settled in 1998 committing the industry to pay roughly $22.6 billion the states. 20 www.valueline.com www.who.int 22 finance.yahoo.com 23 www.reuters.com 21 9 Only four states remain to negotiate individual settlements. Unpleasant development comes from growing numbers of cases filed outside the U.S., though they until now have been largely unsuccessful.24, 25 Growing anti-smoking movement: Anti-smoking campaigns, like the “Framework Convention on Tobacco Control” from the World Health Organization, are becoming more and more powerful and have great impact on pricing, advertising and labeling of tobacco products.26 Furthermore, smokers are increasingly banned from public not only in agencies but also in bars, restaurants and even from their own rented apartments. In addition the whole smoking image is rapidly changing from an expression of freedom to an expression of weakness. 8 Valuation 8.1 PE-multiple Altria is currently trading at eleven times earnings. Concerning Valueline.com the historical average is 13 implying a cost of equity of about 7.7% (=1/13). Regarding a current equity risk premium of 5 to 6 percent, an unlevered beta of 0.75 and a risk-free-rate of 4.4%, the CAPM provides a figure between 8.15 and 8.9 percent. This would imply a PE-multiple of about 12. Taking this and the future earnings estimates (appendix no. 6) into account, the projected stock price for 2005 is $62.4 and for 2014 $111. 8.2 Dividend Discount Model Assuming the current earnings pay-out ratio of 60%, the projected earnings growth (appendix no. 6), a discount rate of 8.9% due to the CAPM and an eternal growth rate of 3.5%, the Net Present Value of Altria is about $75. The assumptions made get support by the fact that the terminal value in 2014 calculated by the dividend model hits the estimate projected by the PEmodel. 8.3 Free Cash Flow to Firm To calculate a more accurate intrinsic value of a firm, more and more analyst use and recommend a discounted free cash flow approach. According to the calculation (as can be seen in appendix no. 5) Altria generated a free cash flow of $5.47 billion (all figures are based on Mergent online). Further assumption according 24 www.altria.com www.rjrt.com 26 www.who.int 25 10 to the development of revenues (2007-2009 = $125 billion), the future tax rate and the profit margin were based upon the publications of Valueline and Reuters. Keeping the changes in net working capital and capital expenditures at their current level of 1.99% and 3.54% respectively which are close enough to their 5-year means of 1.90% and 3.39% is as good as any arbitrary assumptions. The only adjustments made are the percentage of depreciation which is consistently projected as 2% of total revenue and the change in other assets which are likely to increase continuously to their historical average of 2.56% and probably further. These expectations are leading to an ongoing moderate increase in revenues, net income and free cash flows which is considered to be fairly realistic for a consumer non-cyclical company. In contrast to this the net profit margin is constantly decreasing which is justified by the prospect that future sales growth is mainly due to further taxation on tobacco which has no impact on profits but increases the revenue. By discounting the projected future cash flows through the weighted average cost of capital (WACC), the net present value of can be derived. The WACC is calculated by taking the 10year treasury yield as the current risk-free-rate, adding the supposed market equity premium times the unlevered beta of Altria and weighting these costs of equity with the costs of debt after tax, according to the current capital structure. The cost of debt is thereby understood as the current yield of a corporate bond issued by Altria with a maturity of close to ten years, multiplied with 1 minus the tax ratio. The last assumption made for the free cash flow valuation is the future growth rate after year ten into infinity. This growth rate is essential to receive the terminal value in year ten derived by the Gordon Growth model. This model calculates, on the basis of year eleven’s free cash flow, the value of all future cash flows from year ten on. This can be done by dividing the cash flow in year eleven by the WACC percentage minus the growth rate. Therefore this growth rate is a very sensible measure while it has huge impact on the terminal value.The long term historical growth rate for the U.S. is around 4.5%. But for mature industries like tobacco and food whose markets are more likely to decline than to expand, a growth rate below average rate of 3.5% seems to be more appropriate. Altogether, the result of this valuation approach under the assumptions made is a present intrinsic value for Altria of $88.14 per share which is above, but not unrealistically far away, from the $75 and $62.4 provided by the previous approaches. 11 8.4 Chart analysis Concerning the technical analysis, both Altria and Kraft Foods have outperformed the S&P500 during the last five and three (IPO in 2001) years respectively. Both stocks are also above their rising 200-day moving average. The overall performance of Kraft Foods so far is a disappointing story. In the last three years the stock price could only increase by 5%. It is also obvious that the top of the gap (1.) from 01/29/2003 at $36.11 is still a big resistance. Also remarkable is that KFT is now moving together with the market for 18 months (since 2.) leaving little fancy for further breakouts. In contrast to this stable movement, the chart of Altria is marked by an outstanding performance, despite the litigation bounces. Now the company is challenging the $60 mark. This is the third attempt to take this resistance and the signs are good that, carried by the good market environment and by some favorable judgments, this attempt is successful. All together the charts look positive for Altria but they also tell how unpredictable the stock movement, due to the litigations, is. 12 9 Recommendation Based on the preceding SWOT-analysis and the valuations I recommend buying Altria Group. For me the stock is currently undervalued partly because of an overreaction of the market concerning the litigations. In addition the chart analysis shows positive patterns which favor a buy at current point in time. Due to the high dividend yield and the average growth expectations the company may attract mainly income orientated investors. But the most likely upcoming break up remains to be the biggest bonus. Nevertheless, after this event investors should reconsider the investment, since I see further sustainable growth potential for the international cigarettes segment only. 10 Appendix Appendix 1: Consolidated statements of earnings Appendix 2: Consolidated balance sheet Appendix 3: Consolidated statements of cash flow Appendix 4: Calculations for FCF analysis and operating figures Appendix 5: FCFF valuation Appendix 6: DCF and P/E-multiple valuation 13