Do you have an 'R – Biz' Strategy for your Company?

advertisement

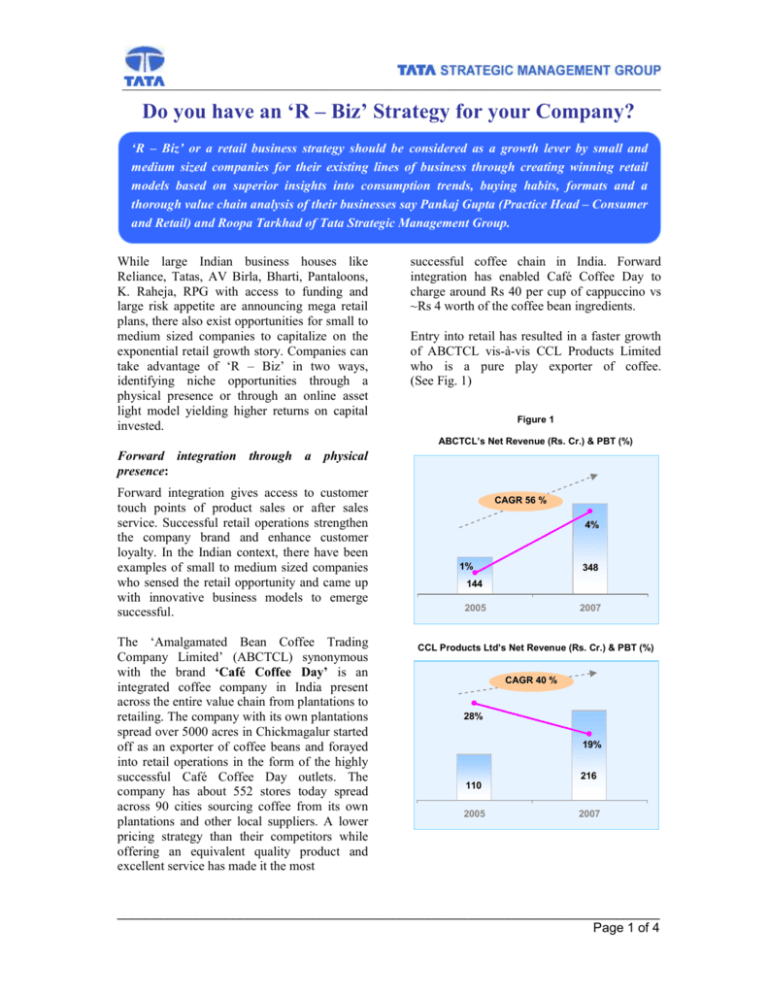

____________________________________________________________________________ Do you have an ‘R – Biz’ Strategy for your Company? ‘R – Biz’ or a retail business strategy should be considered as a growth lever by small and medium sized companies for their existing lines of business through creating winning retail models based on superior insights into consumption trends, buying habits, formats and a thorough value chain analysis of their businesses say Pankaj Gupta (Practice Head – Consumer and Retail) and Roopa Tarkhad of Tata Strategic Management Group. While large Indian business houses like Reliance, Tatas, AV Birla, Bharti, Pantaloons, K. Raheja, RPG with access to funding and large risk appetite are announcing mega retail plans, there also exist opportunities for small to medium sized companies to capitalize on the exponential retail growth story. Companies can take advantage of ‘R – Biz’ in two ways, identifying niche opportunities through a physical presence or through an online asset light model yielding higher returns on capital invested. successful coffee chain in India. Forward integration has enabled Café Coffee Day to charge around Rs 40 per cup of cappuccino vs ~Rs 4 worth of the coffee bean ingredients. Entry into retail has resulted in a faster growth of ABCTCL vis-à-vis CCL Products Limited who is a pure play exporter of coffee. (See Fig. 1) Figure 1 ABCTCL’s Net Revenue (Rs. Cr.) & PBT (%) Forward integration through a physical presence: Forward integration gives access to customer touch points of product sales or after sales service. Successful retail operations strengthen the company brand and enhance customer loyalty. In the Indian context, there have been examples of small to medium sized companies who sensed the retail opportunity and came up with innovative business models to emerge successful. The ‘Amalgamated Bean Coffee Trading Company Limited’ (ABCTCL) synonymous with the brand ‘Café Coffee Day’ is an integrated coffee company in India present across the entire value chain from plantations to retailing. The company with its own plantations spread over 5000 acres in Chickmagalur started off as an exporter of coffee beans and forayed into retail operations in the form of the highly successful Café Coffee Day outlets. The company has about 552 stores today spread across 90 cities sourcing coffee from its own plantations and other local suppliers. A lower pricing strategy than their competitors while offering an equivalent quality product and excellent service has made it the most CAGR 56 % 4% 1% 348 144 2005 2007 CCL Products Ltd’s Net Revenue (Rs. Cr.) & PBT (%) CAGR 40 % 28% 19% 216 110 2005 2007 ___________________________________________________________________________ Page 1 of 4 ____________________________________________________________________________ Kitchen appliances maker, TTK Prestige operates ‘Smart Kitchen’ showrooms across India. The company has expanded from having 50 outlets in 27 cities in 2004-05 to about 200 outlets in 100 cities in 2006-07. The `Smart Kitchen' is a one-stop shop for the entire range of `Prestige' kitchenware. Besides bringing all the innovative/latest products from the `Prestige' staple to the consumers, these showrooms presenting the ambience of a live kitchen with plush interiors also help in channelising TTK's new customer care tools such as `Prestige Privilege Club' (a loyalty programme) and `Prestige Kitchen Care' (the service-at-customers' door-step programme). ‘Namdhari Fresh’ is the retail venture from the Namdhari Group, which is the largest indigenous manufacturer of hybrid seeds. The unique value proposition of ‘Namdhari Fresh’ is the supply of quality produce majority of which is grown organically by them. The freshness is achieved through use of superior cold storage systems and maintaining temperatures of about 10 degrees in the room and the rack where the vegetables are placed for sale. A superior quality value proposition has helped Namdhari Fresh in commanding a price premium for its fruits and vegetables than the regular markets. Koutons is a leading apparel manufacturing company which forward integrated into retail under the ‘Koutons’ and ‘Charlie Outlaw’ brands through a network of 1147 exclusive brand outlets. The company started as an apparel manufacturing unit in 1993 and started retailing through their exclusive stores only in 2002. While, the majority of the apparel manufacturers cum retailers in India operate through a combination of retailing through exclusive outlets, national chain stores and multi brand outlets, Koutons operates only through exclusive branded outlets. This has enabled them to focus their strategies and efforts towards quality maintenance and customer satisfaction without any channel conflict. Koutons has grown faster than Zodiac Clothing Company which retails mainly through Multi Branded Outlets. (See Fig. 2) Figure 2 Koutons’ Net Revenue (Rs. Cr.) & PBT (%) 13% CAGR 91 % 2% 402 16 2005 2007 Zodiac Clothing Co.’s Net Revenue (Rs. Cr.) & PBT (%) CAGR 25% 12% 9% 203 66 2005 2007 Internationally, one of the best examples of forward integration into retail is the Apple store. Apple has built stores that offer a unique customer experience through an innovative use of store design. The layout simulates the usage environment at a customer’s home and office with fewer than 20 products on sale. Apple has done away with checkout counters and replaced them with payments made through wireless credit–card readers carried by mobile salespeople. There is a strong service element within the store as well. Every store has a ‘Genius Bar’ where trained and highly qualified personnel share insights, technical advice and technical support on different products. All these activities have resulted in the Apple Stores grossing maximum annual sales per square feet in comparison to other retail stores like Best Buy, Circuit City etc. ‘Forward integration into retail through a physical store presence helps companies in commanding higher value for their products and faster growth. A strong service orientation through the physical store format helps in building customer loyalty and brand value.’ ___________________________________________________________________________ Page 2 of 4 ____________________________________________________________________________ Innovative use of the online retail model: Global Examples In the US, online retailing has been adopted by an entire spectrum of categories involving low to medium customer involvement like travel, books, event tickets and even high involvement categories like jewellery, accessories etc. Through this format, companies can lower costs on real estate rentals, inventory as well as overheads to offer a price sensitive value proposition to customers seeking alternate points of purchases. To achieve this requires a thorough understanding of customer needs, their relative importance and an in-depth knowledge of the value chain to bring in supply chain efficiencies. This format also brings in the added advantage of convenience at points of purchase and delivery. Expedia is the leading online travel agent in the US having ~5% share of the overall $247 Bn US travel market in 2007. Expedia has developed a niche for itself in the leisure segment of the market by offering customized vacations to price sensitive customers at cheaper rates than traditional travel agents. This is on account of strategic tie – ups with suppliers and leveraging economies of scale. Little or no ownership of inventory (reliance on strategic alliances/networks) and minimal physical presence have resulted in the achievement of EBIDTA margins of ~ 25% which are way above the industry average of ~ 10-15%. Online models have also been successful in categories like jewellery requiring high customer involvement and where a physical store model would have seemed indispensable. Blue Nile with revenue of $319 Mn in 2007 is a leading online seller of jewellery in the US. Blue Nile has adopted a virtual model in which it does not put any of its capital at risk by carrying little inventory. It provides a shop window for suppliers and simply takes a cut when a transaction occurs. This model enables it to sell at 30-40% below the price of a traditional jewellery store and 50% below the high – ends shops. The key features of Blue Nile are its focus on consumer education via online tools like guides to diamond grading on its site. Most of the diamonds sold on the site come with Gemological Institute of America (GIA) or the American Gem Society Laboratories (AGSL) certifications and a 30 day return policy. An innovative business model has enabled Blue Nile to be among the top ten specialty jewellery retailers in the US confounding predictions that luxury and e-commerce would never mix. ‘An online format being asset light helps in generating higher returns on capital employed. Significant savings in cost on real estate rentals and inventory have helped online companies in adopting a low cost value proposition. Also offering the advantage of convenience at points of purchase and sale has resulted in the growth of market share of online companies.’ The use of technology would be a key driver in online retailing for certain product categories. For example Amazon, a leading online retailer of books has launched a new service that allows customers to buy products and compare prices through their mobile phones in addition to the internet. Opportunities for Indian companies Going forward, in India, a seamless play of a physical retail store and an online format aided by technology drivers like mobile phones etc could help companies in creating unique retail models which could help in reaching out to a wider customer base in a shorter time and at lower costs. Companies in India should consider ‘R – Biz’ as a growth lever to their existing lines of business through either a physical store or an online format. Ample niche organized retailing opportunities will exist for companies to target. Developing unique ‘R – Biz’ value propositions in the retailing model is imperative to capture the opportunity gaps in organized retailing. ___________________________________________________________________________ Page 3 of 4 Business Portfolio Review Competitive & Growth Strategy, Country/India Entry Strategy Business Due Diligence and Valuation for M&A Strategy Managing Organization Change Formulation Aligning Organization to Business Strategy Integrated Cost Reduction Marketing & Supply Chain Optimization Performance & Talent Management Business Process Improvement / Outsourcing Organization Competitiveness Effectiveness Enhancement Business Analytics Quantitative Modeling Algorithm Design Optimization Rules Nirmal, 18th Floor, Nariman Point, Mumbai - 400021, India Tel 91-22-6637 6789 Fax 91-22-6637 6600 URL: www.tsmg.com e-mail: info@tsmg.com Tata Strategic Management Group. No part of it may be circulated or reproduced for distribution without prior written approval from Tata Strategic Management Group.