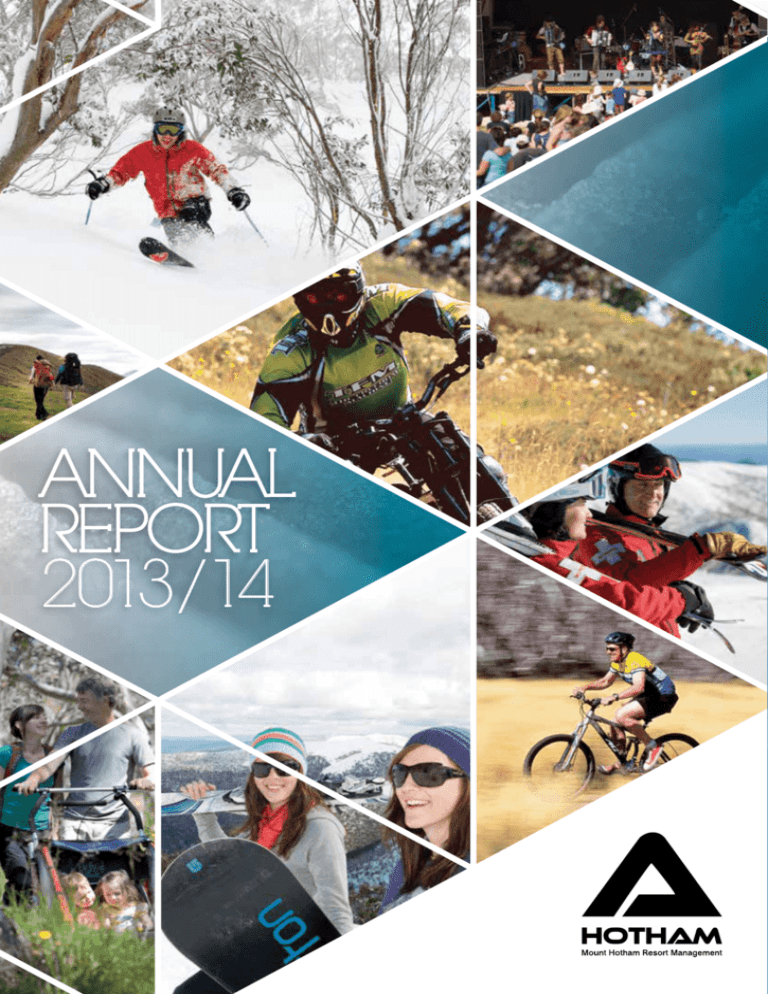

Mt_Hotham_Annual_Report_2013_2014 (6666

advertisement