corporate & commercial insight july 2008

advertisement

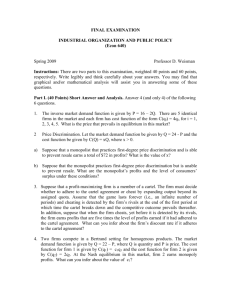

corporate & commercial insight july 2008 Change in the law relating to the meaning of ‘consequential loss’ The recent Victorian Court of Appeal decision in Environmental Systems Pty Ltd v Peerless Holdings Pty Ltd has seen a change to the law concerning the meaning of the phrase ‘consequential loss’ in contracts. · where losses arise naturally, according Background · where losses were contemplated by In 1997, Peerless Holdings Pty Ltd (Peerless) entered into a contract with Environmental Systems Pty Ltd (Environmental Systems) to acquire a system for reducing odour emissions. The system did not function as required under the agreement, and as a result Peerless brought proceedings against Environmental Systems. Significantly, the contract between the parties contained the following exclusion clause: “As a matter of policy, Environmental Systems does not accept liquidated damages or consequential loss…” Previous legal position Australian courts have previously used the principle outlined in the United Kingdom case of Hadley v Baxendale that loss could be recovered under 2 limbs, namely to the usual course of things, as a result of the breach; or the parties, at the time that the parties made the contract, as being the probable result of the breach. It has previously been accepted that the phrase ‘consequential loss’ in exclusion clauses fell within the second limb of the rule stated above. Consequently, the courts have in the past ruled that a mere reference to ‘consequential loss’ in an exclusion clause was not sufficient to exclude liability for loss such as profits lost or expenses incurred through breach of the contract. Current legal position The decision of the Victorian Court of Appeal in Environmental Systems appears to have changed this previous authority. The final judgement contends that the term ‘consequential loss’ should be given its ‘ordinary natural meaning’ and that the ‘true distinction is between ‘normal loss’, which is loss that every plaintiff in a like situation will suffer, and ‘consequential losses’, which are anything beyond the normal measure, such as profits lost or expenses incurred through breach.’ As a result, the court held that because previously awarded costs were beyond the ‘normal’ losses, they were ‘consequential losses’, and as such fell within the scope of the exclusion clause in the contract. What this decision means This decision means that, in general, an exclusion of consequential loss will be interpreted to exclude all losses beyond the normal measure (including lost profits) unless the contract indicates the parties intended the loss to be construed as ‘normal loss’. As a result it remains good practice to define precisely what is meant by ‘consequential loss’ when used in an exclusion clause. Breach of Contract - Intermediate terms The recent High Court case of Koompahtoo Local Aboriginal Land Council v Sanpine Pty Ltd is significant in establishing which categories of contractual obligations, if breached, could entitle the other party to terminate the contract. Particularly relevant is the confirmation that a contract may be repudiated by the breach of an “intermediate” term. Background Sanpine Pty Ltd (Sanpine) entered into a joint venture agreement with Koompahtoo Local Aboriginal Land Council (Koompahtoo). Under the terms of the agreement, the aboriginal land council contributed the land to be developed whilst Sanpine Pty Ltd provided the expertise. Ultimately however, the joint venture failed and an administrator was appointed on behalf of Koompahtoo. In the course of the administrator’s enquiries, attempts were made to obtain financial information from Sanpine relating to the position of the joint venture, an account of which they were required to maintain under the terms of the agreement. It turned out that proper bookkeeping and financial records had never been kept. The 2 administrator endeavoured to terminate the agreement by alleging Sanpine had breached its obligations. Essentially the issue before the court was whether the term breached constituted an “essential term of the contract” (giving rise to a right to terminate), an “intermediate” term (also potentially giving rise to a right to terminate) or neither. The decision of the High Court of Australia The High Court upheld Koompahtoo’s right to terminate the contract, ruling that certain breaches of the agreement on the part of Sanpine had been established. The majority held that an "intermediate" term will have been breached where default in respect of a non-essential term is so significant as to go "to the root of the contract". Whether a breach goes "to the root of the contract" is said to depend upon "the nature of the contract and the relationship it creates, the nature of the term, the kind and degree of the breach, and the consequences of the breach" as well as whether or not damages would provide appropriate relief in the circumstances. The court held that Sanpine had committed sufficiently serious breaches of intermediate terms that went to the “root of the contract”, depriving Koompahtoo substantially of the whole benefit of the agreement. What this means This case affirms that a contract may be repudiated by the breach of an “intermediate” term. It was not until this decision that the Australian High Court had confirmed the Australian common law position in this regard. Repudiation of contract and the contractual effect of correspondence between parties The recent decision of Jobern Pty Ltd v BreakFree Resorts (Victoria) Pty Ltd in the Federal Court offers valuable instruction to parties to a ‘Heads of Agreement’ (HOA) when negotiating the more precise terms of a transaction, namely that they must appreciate the potentially binding effect of their correspondence. Background In 2004, Jobern Pty Ltd, trading as Latitude Development Group, entered into a HOA with BreakFree Resorts (Victoria) Pty Ltd, concerning the development and construction of the Erskine Resort development in Lorne, Victoria. Following a break down in negotiations, BreakFree purported to terminate the HOA by relying on the non-satisfaction of a condition precedent to performance contained in the heads of agreement. In response, Latitude argued that BreakFree’s conduct amounted to a repudiation of the HOA and sued for damages alleging breach of contract. Latitude contended that following a series of email and telephone communications, the parties had ultimately reached a point where the condition precedent had been mutually abandoned. Decision of the Federal Court In determining contractual intention the courts adopt an objective approach. In his assessment of Latitude’s submission, Justice Gordon commented that “the only objective characterisation of the exchanges is that they record the mutual giving up of the capacity to terminate for the failure to satisfy the deposits condition precedent”. The Court agreed that BreakFree’s purported termination of the HOA did amount to a repudiation for which Latitude was entitled to an award of damages. Implications Preliminary contracts such as HOA are commonly used during the process of negotiating a more formal contract, where certain specific terms have been discussed and agreed to, but may be subject to further agreement of more complete terms in the future. Depending on the precise terms of a HOA it may create a legally binding arrangement between the parties. From a practical perspective, this decision is an important reminder that correspondence between parties can have significant contractual implications, particularly when following a negotiated and binding HOA. The courts will consider the objective intention of each party as evidenced by all relevant events and communications. 3 New Draft Merger Guidelines 2008 The ACCC has issued its Draft Merger Guidelines 2008 (Guidelines) for public deliberation. They are intended to replace the original Merger Guidelines published in 1999. The Guidelines are intended to provide an explanation of the framework the ACCC will apply when assessing whether a merger or proposed merger constitutes a substantial lessening of competition, for the purposes of section 50 of the Trade Practices Act 1974 (Cth) (TPA). The Merger Guidelines are not law, but offer useful guidance as to how the ACCC will consider merger applications under section 50 of the TPA. Key changes The most important changes under the new Guidelines include: · the removal of the “safe harbour” thresholds · introduction of new thresholds for the voluntary notification of mergers to the ACCC · application of a stricter policy regarding divestiture undertakings · use of internal company documents in the assessment of the likely competitive impact of a merger Replacement of the ‘safe harbour’ thresholds The 1999 Guidelines set out “safe harbour” thresholds to assist parties when deciding whether a merger was likely to be reviewed by the ACCC. If a proposed merger fell within the scope of a pre-determined “safe harbour” it would generally be unlikely to necessitate any further investigation. In the proposed new Guidelines, the ACCC has abolished these “safe harbours” in favour of new market concentration indicators. They will now measure market concentration by reference to market shares, firm concentration ratios and the Herfindahl – Hirschman Index (HHI). Voluntary notification thresholds Currently, there is no compulsory notification requirement for mergers in Australia under the TPA. However, the new Guidelines propose to introduce new thresholds for the voluntary notification of proposed mergers to the ACCC should any one of the following criteria apply: · the merged firm would operate in at least one market that is concentrated on the basis of a HHI calculation; or · a substantial number of customers consider the products of the merger parties to be particularly close substitutes such that the merger parties represent customers’ first and second choices; or · the target firm has shown a recent rapid increase in market share, has driven innovation or has tended to charge lower prices than its competitors in one or more markets in which the merged firm would operate; or · the merged firm would have a significantly higher market share than any of its rivals in one or more markets; or · the ACCC has indicated to a firm or industry that notification of proposed mergers in a specific industry would be advisable, given past history in that industry or the level of acquisitive authority. Divestiture process Divestiture undertakings are the most common form of structural remedy accepted by the ACCC. As outlined in the proposed Guidelines, a divestiture seeks to remedy the competitive detriments of a merger by either creating a new source of competition or strengthening an existing source of competition. The draft Guidelines make clear that the ACCC prefers all divestiture undertakings to occur on or before the completion of a merger. Examination of internal company documents The Guidelines make clear that the ACCC intends to increase merger inspection by utilising internal company documents, such as board papers, internal plans, financial accounts and independent audit reports amongst other things, to help determine whether merged parties would otherwise be likely to be effective competitors in the future. Conclusion The Draft Guidelines offer a welcome update to the 1999 Guidelines. We shall wait to see whether any submissions presented to the ACCC translate into further changes to the Draft Guidelines. 4 Criminalising cartel conduct The new Labor government has acted swiftly in an endeavour to fulfil its election promise to criminalise cartel conduct by releasing for public comment the exposure draft of the Trade Practices Amendment (Cartel Conduct and Other Measures) Bill 2008. The Bill seeks to create a new criminal regime in addition to redefining the current civil liability provisions relating to cartel conduct under the Trade Practices Act 1974 (Cth) (TPA). If the proposed legislation is enacted Australian cartel law will be bought into line with jurisdictions such as the United States and the United Kingdom where cartel conduct is already criminalised. The new regime – key elements The Bill proposes a dual criminal and civil liability regime relating to cartel conduct. The new provisions will operate in conjunction with the current prohibition on collective boycotts known as the ‘exclusionary provisions’ under section 4D of the TPA. The proposed legislation will create an offence to make or give effect to a contract, arrangement or understanding (CAU) that contains a “cartel provision”. The term “cartel provision” is extensively defined under the Bill but in simple terms is a provision which has the purpose, effect or likely effect of: · fixing prices for the supply, re-supply or purchase of goods or services; · restricting or limiting production of goods or capacity to supply goods or services; · allocating customers, suppliers and geographical areas in connection with the supply or purchase of goods or services; or · bid-rigging, by parties that are, or are likely to be, in competition with each other. The concept of “dishonesty” is the prime means of differentiating between the criminal and civil regimes relating to cartel conduct. That is, the Bill seeks to impose a criminal offence if a CAU containing a cartel provision is made with the intention of dishonestly obtaining a benefit. conduct. However, individuals who are convicted under the criminal provisions are also liable to face up to 5 years imprisonment. The criminal cartel offences and civil penalty prohibitions would apply to corporations as well as individuals who engage in the proscribed conduct. Further, a word of warning for related body corporates of companies that enter into CAUs containing cartel provisions - they will be deemed to be a party to the CAU. A draft memorandum of understanding (MOU) between the ACCC and the Commonwealth Director of Public Prosecutions (DPP) was released alongside the Bill. The MOU sets out the policy for enforcement of the new offences and the roles of, and the relationship between, the ACCC and DPP. The ACCC will be responsible for investigating and gathering evidence of any alleged criminal cartel conduct while the DPP will be responsible for prosecuting the new criminal cartel offences. The ACCC will continue to prosecute the civil cartel offences. Defences and penalties The proposed criminal and civil offences will not apply to cartel provisions that are subject to the collective bargaining notification regime or authorisation process, nor to CAUs between related bodies corporate. The Bill also creates a defence to the civil penalty provisions for joint ventures that do not substantially lessen competition. Curiously, this defence is not mirrored for the criminal offences. Under the Bill, corporations found liable under the criminal or civil regimes will be subject to a fine. The fine will not exceed the greater of $10 million, 3 times the value of the benefit from the cartel or, where the value of the benefit cannot be determined, 10% of the annual turnover of the Australian corporate group. It is unclear why the maximum fines for the civil penalties are the same as those for criminal cartel conduct. A more illogical feature of the Bill is a maximum fine for individuals convicted of contravening the criminal cartel offences of $220,000 - less than half the maximum pecuniary penalty of $500,000 for the contravention of the civil penalty prohibitions. This is inconsistent with the Government and the ACCC’s purported views that criminal cartel conduct offences are more serious than other cartel or anti-competitive Investigation and prosecution of the proposed new offences Where to from here? While the long-awaited release of the Bill indicates that the new Government is committed to taking cartel conduct seriously, there is room for improvement. The Government has expressed an intention to legislate the Bill this year but commentators concerned with its perceived shortcomings have stressed the importance of the Government considering submissions closely and not acting hastily in its legislative response. If the Bill is legislated, the changes to the TPA will be complex and far-reaching with cartel conduct being defined in more specific ways than under the existing legislation. 5 Variation of Class Order [CO 98/1418] ASIC has issued Class Order [CO 08/11]: Variation of Class Order CO 98/1418. This Class Order makes minor variations to ASIC Class Order [CO 98/1418] of the Corporations Act 2001, which gives financial reporting relief to wholly-owned subsidiaries, by removing some requirements which are considered to impose compliance burdens on group entities seeking to rely on the relief. Relief under Class Order 98/1418 Under Class Order [CO 98/1418], certain wholly-owned subsidiaries may be relieved from the requirement to prepare and lodge audited financial statements under Chapter 2M of the Corporations Act 2001, where they enter into deeds of cross guarantee with their parent entity and meet certain other conditions. The main changes The main changes to [CO 98/1418] effected by [CO 08/11] are: · the removal of the requirement for a 3 year compliance history with the financial reporting requirements of the Corporations Act 2001 · replacement of the requirement to lodge an annual notice concerning use of the class order with a requirement to lodge a notice when the relief is first applied or the group holding entity changes, and another notice when the company ceases to apply the relief · reduction of the matters which must be addressed in the certificate required under [CO 98/1418] · removal of the requirement for a statutory declaration when first entering into a deed of cross guarantee · removal of the requirement to lodge solvency statements by directors and simplification of the signing requirements for those statements These changes were effective from 31 March 2008, and will ultimately make it quicker and easier for groups to access this relief. key contacts melbourne Michael Linehan Partner t +61 (0)3 9321 9807 e michael.linehan@holdingredlich.com.au Daniel Marks Partner t +61 (0)3 9321 9992 e daniel.marks@holdingredlich.com.au sydney David Walker Partner t +61 (0)2 8083 0446 e david.walker@holdingredlich.com.au Ian Robertson Partner t +61 (0)2 8083 0401 e ian.robertson@holdingredlich.com.au brisbane David Purvis Partner t +61 (0)7 3135 0682 e david.purvis@holdingredlich.com.au disclaimer The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.