The impact of oil in Uganda

advertisement

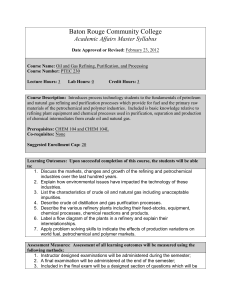

The impact of oil in Uganda Insights from CGE simulations J.-M. Matovu*, K. Pauw+, R. Schweickert&, E. Twimukye*, M. Wiebelt& *Economic Policy Research Center, Uganda +International Food Policy Research Institute, Malawi &Kiel Institute for the World Economy, Germany The Impact of Oil Production on the Agricultural Economy of Uganda Kampala Serena International Conference Centre Kampala, Uganda,November 25, 2011 Recursive-dynamic computable general equilibrium model (DCGE) • Typical neoclassical model (IFPRI) • Calibrated for the year 2007 SAM; no crude oil or oil refining sectors in SAM; production cost information for mining and fuel provide intermediate technology vectors to create negligibly small crude oil and refining sectors • Supply: CES value-added and Leontief intermediates • Income accrues to representative households but microsimulation takes full account of spatial and functional information to calculate FGT (FosterGreer-Thorbecke) poverty rates • Imperfect substitution among goods originating from different geographical areas • Several macro-economic constraints • Dynamic path strongly results from the savings-investment closure rule Analytical framework: general equilibrium effects of oil Source: IFPRI OIL REVENUES Oil fund Government Budget Revenues Expenditures Direct taxes Consumption Factor taxes Transfers (domestic institutions) Value-added taxes Interest payments (domestic debt) Resource rents Interest payments (foreign debt) Import tariffs Savings abroad (FUND) Export taxes Domestic savings Excise taxes Factor income Transfers from abroad Interest income from abroad (FUND) Acticities/Commodities Maize Mining Rice Oil production Other cereals Meat processing Cassava Fish processing Irish potato Other food processing Sweet potato Grain processing Cotton Feed stock Tobacco Beverages & tobacco Oilseeds Textiles & clothing Beans Wood & paper Vegetable (Oil refining) Flowers Petrol & diesel Coffee Other chemicals Tea, cocoa & vanilla Fertilizer Matoke Other manufacturing Fruits & other tree crops Machinery & equipment Cattle & sheep Furniture Other livestock Energy & water Poultry Construction Forestry Trade Fisheries Hotels & catering Transport Communications Banking Real estate Other private services Research & development Public administration Education Health Community services Factors Self-employed labor Unskilled labor Skilled labor Capital Cattle stock Land Oil capital Households Rural farm Rural non-farm Kampala metro Urban farm Urban non-farm Other Actors Government S-I Rest of World Classification in the model Uganda’s economy in 2007 Macro SAM, Uganda 2007 (billions of Ugandan Shillings) Act Activities Fac Househ Gov RoW Inc Tax Fac Tax Imp tariff Ind Tax Total 33595 Commodities 12283 Factors Com SAVINV 33595 4210 18741 2682 3715 5152 46784 21312 21312 Households 21302 12388 -125 Government 33565 1377 Rest of World 7273 2 SAV-INV 8 1046 660 8 1743 Income Tax 694 1219 7283 2191 5152 694 Factor Tax 3785 694 8 8 Import tariff 1046 1046 Indirect Tax 660 660 Total 33595 46784 21312 33565 3785 7283 5152 694 8 1046 660 The DCGE model captures sector detail …in agriculture VAshr PRDshr EMPshr Maize 1.1 0.8 0.9 Rice 0.3 0.2 Other cereals 1.1 Cassava EXPshr 20.0 IMPshr IMP-DEMshr 0.8 21.6 0.2 0.3 26.9 0.8 0.7 2.1 35.5 2.0 1.5 1.0 Irish potato 0.4 0.5 0.3 Sweet potato 1.5 1.2 0.9 Cotton 0.0 0.0 0.0 0.0 100.0 Tobacco 0.7 0.5 0.4 3.8 92.0 Oilseeds 0.6 0.4 0.4 0.2 3.8 0.1 7.3 Beans 2.3 2.0 1.1 4.1 17.4 Vegetable 0.1 0.1 0.1 Flowers 0.3 0.4 0.2 3.9 100.0 0.9 0.4 2.4 0.2 1.2 0.3 0.2 3.8 2.9 22.6 0.8 0.3 1.6 0.1 1.1 0.2 0.2 3.4 2.0 18.1 0.5 0.4 1.2 0.1 1.4 0.3 0.1 9.6 3.3 23.2 7.1 2.8 100.0 100.0 0.2 11.6 5.4 29.2 26.1 16.7 3.5 4.5 Coffee Tea, cocoa & vanilla Matoke Fruits & other tree crops Cattle & sheep Other livestock Poultry Forestry Fisheries TAGR 1.7 EXP-OUTshr …and other sectors of the economy VAshr Mining Oil production Meat processing Fish processing Other food processing Grain processing Feed stock Beverages & tobacco Textiles & clothing Wood & paper Oil refining Petrol & diesel Other chemicals Fertilizer Other manufacturing Machinery & equipment Furniture Energy & water Construction Trade Hotels & catering Transport Communications Banking Real estate Other private services Research & development Public administration Education Health Community services TOTAL-1 TAGR TNAGR TOTAL-2 PRDshr EMPshr EXPshr 0.3 0.1 0.1 0.1 1.5 0.7 0.1 1.5 0.5 0.2 0.0 0.0 0.8 0.0 1.2 0.7 0.4 4.7 14.6 12.2 4.5 4.1 2.1 1.1 9.0 2.2 0.2 0.0 1.0 0.7 4.2 1.6 0.3 3.1 0.7 0.4 0.1 0.1 1.4 0.0 1.7 1.4 0.6 3.3 14.4 12.3 3.6 3.7 2.7 1.1 7.0 1.6 0.2 0.0 0.0 0.1 1.9 0.2 0.1 1.3 0.4 0.1 0.0 0.0 0.4 0.0 0.6 0.5 0.3 2.6 4.7 9.3 2.2 2.2 2.9 3.3 0.2 1.2 0.0 4.2 7.7 1.7 1.4 100.0 22.6 77.4 100.0 0.0 4.4 7.1 2.0 1.3 100.0 18.1 81.9 100.0 0.0 13.2 22.3 3.8 2.4 100.0 23.2 76.8 100.0 0.7 EXP-OUTshr 24.0 0.7 5.6 9.8 IMPshr 0.9 IMP-DEMshr 51.3 5.8 60.0 20.1 0.8 0.6 4.3 1.1 13.7 26.9 21.8 13.1 0.6 1.9 1.4 17.7 1.0 3.7 1.3 6.9 48.6 46.5 0.5 100.0 1.2 6.9 1.5 4.6 8.9 32.4 8.3 9.2 2.0 7.3 29.8 0.4 96.1 57.0 89.1 54.0 86.7 15.1 1.5 4.9 28.9 11.5 0.9 0.6 89.6 34.2 3.7 6.4 20.3 0.4 1.8 64.1 3.1 27.3 0.3 2.3 3.4 32.1 100.0 29.2 70.8 100.0 10.2 16.7 8.7 10.2 100.0 3.5 96.5 100.0 21.7 4.5 24.7 21.7 What the model can and can’t do • Can do: – Capture the impacts of oil revenue on growth, government budget, sectors, trade and income distribution – Analyze trade-offs between spending, saving and any combination of the two – Dynamics: consider any amount of years in a recursive dynamic way • Can’t do: – Inflation analysis – Model does not capture interest rate endogenously – Predict oil price volatility Simulations Business as usual calibrated to reproduce average yearly GDP growth of nearly 6 percent Crude oil exportation versus refining Compare crude oil production and exportation with crude oil refining and exportation: All government revenue are spent in oil fund abroad, isolates the direct and indirect effects of refining vs crude production Spending options Invest 50 percent in oil stabilization fund; withdrawals from oil fund to keep government revenues constant at year 2025 levels, i.e after the ending of peak production years Spend all oil revenues on investment; no oil fund Transferring rents to citizens; no oil fund Oil Revenues (percent of GDP) 9.00 8.00 7.00 6.00 5.00 4.00 3.00 2.00 1.00 0.00 2045 2043 NoFund 2041 2039 2037 StabShare 2035 2033 2031 2029 StabRev 2027 2025 2023 2021 2019 2017 2015 2013 2011 2009 2007 AccuFund Oil Fund (percent of GDP) 120.00 100.00 80.00 60.00 40.00 20.00 AccuFund StabRev StabShare 2045 2043 2041 2039 2037 2035 2033 2031 2029 2027 2025 2023 2021 2019 2017 2015 2013 2011 2009 2007 0.00 Simulation Results INITIAL BASE CRUDE OIL REFINING Absorption 26575.3 5.89800 5.89500 5.88900 Private Consumption 18742.2 6.26000 6.25700 6.25100 5005.7 5.44700 5.44400 5.43700 Fixed Investment Stock Changes 138.4 Gov. Consumtion 2689.0 3.00000 3.00000 3.00000 Exports 3699.2 8.73000 8.72500 8.71600 Imports -7256.9 7.09300 7.08900 7.08200 GDP at Market Prices 23017.6 6.19600 6.19300 6.18700 1703.7 4.35700 4.35700 4.35800 21313.9 6.30200 6.29800 6.29300 Net Indir. Tax GDP at Factor Cost Refining makes no difference to macro result … nor does crude oil production with 100 percent sterilization Low generation of domestic value added Simulation Results INITIAL BASE ABSORP PRVCON FIXINV GOVCON EXPORTS IMPORTS GDPMP 26575.3 18742.2 5005.7 2689.0 3699.2 -7256.9 23017.6 62.9 71.2 49.2 34.4 129.8 76.6 69.4 ABSORP PRVCON FIXINV GOVCON EXPORTS IMPORTS GDPMP 26575.3 18742.2 5005.7 2689.0 3699.2 -7256.9 23017.6 149.9 171.2 116.9 70.2 340.5 194.8 166.3 ABSORP PRVCON FIXINV GOVCON EXPORTS IMPORTS GDPMP 26575.3 18742.2 5005.7 2689.0 3699.2 -7256.9 23017.6 770.6 893.2 635.3 207.5 2288.4 1229.3 869.9 FND100 WTHDRW 2007-17 1.0 1.1 1.0 1.0 1.0 1.4 1.0 1.0 1.7 1.6 1.1 1.2 1.2 1.2 2007-25 1.0 1.1 1.0 1.0 1.0 1.2 1.0 1.0 1.2 1.2 1.0 1.1 1.1 1.1 2007-46 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 FND-100 REDSTR 1.2 1.0 1.9 1.0 1.4 1.3 1.2 1.1 1.2 0.9 1.0 1.4 1.3 1.2 1.1 1.1 1.4 1.0 1.2 1.1 1.1 1.0 1.1 0.7 1.0 1.1 1.1 1.0 1.1 1.1 1.1 1.0 1.1 1.1 1.1 0.9 0.9 0.5 1.0 0.9 0.9 0.9 Agriculture at best not affected but export oriented sectors are hurt Maize Rice Other cereals Cassava Irish potato Sweet potato Cotton Tobacco Oilseeds Beans Vegetable Flowers Coffee Tea, cocoa & vanilla Matoke Fruits & other tree crops Cattle & sheep Other livestock Poultry Forestry Fisheries INITIAL 118.5 12.9 105.6 264.7 55.4 257.1 9.2 0.8 27.3 80.4 55.5 203.6 16.6 17.1 950.5 BASE 56.5 66.3 54.3 68.9 66.2 72.1 56.4 49.4 77.0 79.9 71.1 74.1 95.5 98.1 60.6 FND100 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 WTHDRW 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 FND-100 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 REDSTR 1.0 1.0 1.0 1.0 1.0 1.0 0.9 0.9 1.0 1.0 1.1 0.9 1.0 0.9 1.0 66.9 380.3 63.4 74.3 1151.0 675.8 65.5 59.8 79.3 59.7 63.3 36.8 1.0 1.0 1.0 1.0 0.8 0.7 1.0 1.0 1.0 1.0 0.8 0.6 1.0 1.0 1.0 1.0 0.9 0.6 1.0 1.0 1.0 1.0 1.0 0.8 Nontradables and import substitutes contract relatively INITIAL BASE FND100 WTHDRW FND-100 REDSTR 80.1 30.0 1.0 1.2 1.5 1.0 339.3 57.6 1.0 1.0 1.0 1.0 1403.4 65.0 0.9 0.9 0.9 1.0 Grain processing 550.1 67.6 1.0 1.0 1.0 1.1 Feed stock 101.6 60.0 1.0 1.0 1.0 1.0 1035.6 67.7 1.0 1.0 1.0 1.2 Textiles & clothing 245.1 25.2 1.0 0.9 0.9 1.2 Wood & paper 127.4 26.9 0.6 0.7 0.8 0.5 Petrol & diesel 24.5 35.6 0.9 0.9 0.9 1.1 479.3 38.0 1.1 1.1 1.1 1.2 3.0 28.3 0.9 0.8 0.7 0.7 Other manufacturing 561.5 10.7 1.2 1.8 2.2 1.0 Machinery & equipment 475.5 25.2 1.1 1.4 1.5 0.8 Furniture 186.5 52.3 1.0 1.1 1.3 1.1 Energy & water 1113.1 67.4 1.2 1.2 1.2 1.4 Construction 4842.3 51.2 1.0 1.4 1.7 1.0 Mining Meat processing Other food processing Beverages & tobacco Other chemicals Fertilizer … same holds true for services INITIAL BASE FND-100 REDSTR Trade 4124.2 60.7 1.0 1.0 1.0 1.1 Hotels & catering 1204.1 348.8 0.7 0.5 0.3 0.3 Transport 1253.3 36.6 1.0 1.0 0.9 1.1 Communications 896.6 68.2 1.1 1.1 1.1 1.2 Banking 369.4 72.9 1.2 1.2 1.1 1.1 2337.5 59.2 1.2 1.2 1.2 1.4 534.7 50.1 0.9 0.9 0.9 0.9 2.5 34.4 1.0 1.0 1.0 1.0 Public administration 1476.0 34.4 1.0 1.0 1.0 1.0 Education 2394.5 58.4 0.9 0.9 0.9 1.0 Health 666.9 57.6 1.0 1.0 1.0 1.0 Community services 447.5 69.4 0.9 1.0 1.0 1.1 Real estate Other private services Research & development FND100 WTHDRW No significant contribution to poverty reduction Year 2007 2017 2007 2017 2007 2017 BASE 31.1 18.2 FND100 WTHDRW FND-100 Poverty headcount 31.1 31.1 31.1 18.2 17.9 17.7 REDSTR 31.1 16.0 8.8 4.4 Poverty gap 8.8 8.8 4.4 4.4 8.8 4.3 8.8 3.8 3.6 1.6 Poverty severity 3.6 3.6 1.6 1.6 3.6 1.6 3.6 1.4 … except if oil wealth is distributed to citizens Implications Refining does not create significant domestic labor value added Oil wealth leads to higher growth; is „trade driven“ from the demand side in the case of full sterilization, investment driven if all government oil revenues are invested domestically or abroad, and consumption driven in the case rent distribution …and driven by production of less tradable goods from the supply side Agriculture is largely bypassed: benefits from additional demand but is hurt by lower domestic terms of trade Redistributing rents to citizens accelerates poverty reduction but at the expense of lower investment Simulations neglect productivity effects of private investment and productivity spillovers from provision of public infrastructure