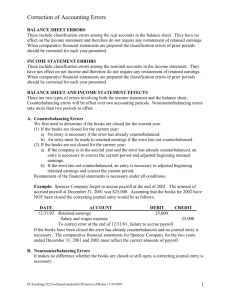

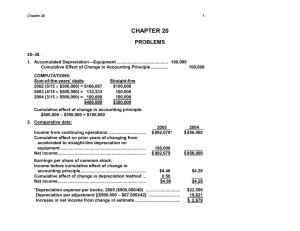

CHAPTER 22 Accounting Changes and Error Analysis

advertisement