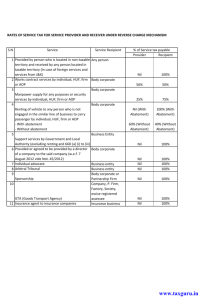

FREQUENTLY ASKED QUESTIONS (FAQ) ON SERVICE TAX

advertisement