Payment, clearing and settlement systems in Japan (An Excerpt from

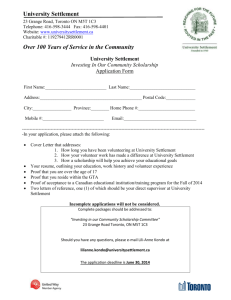

advertisement