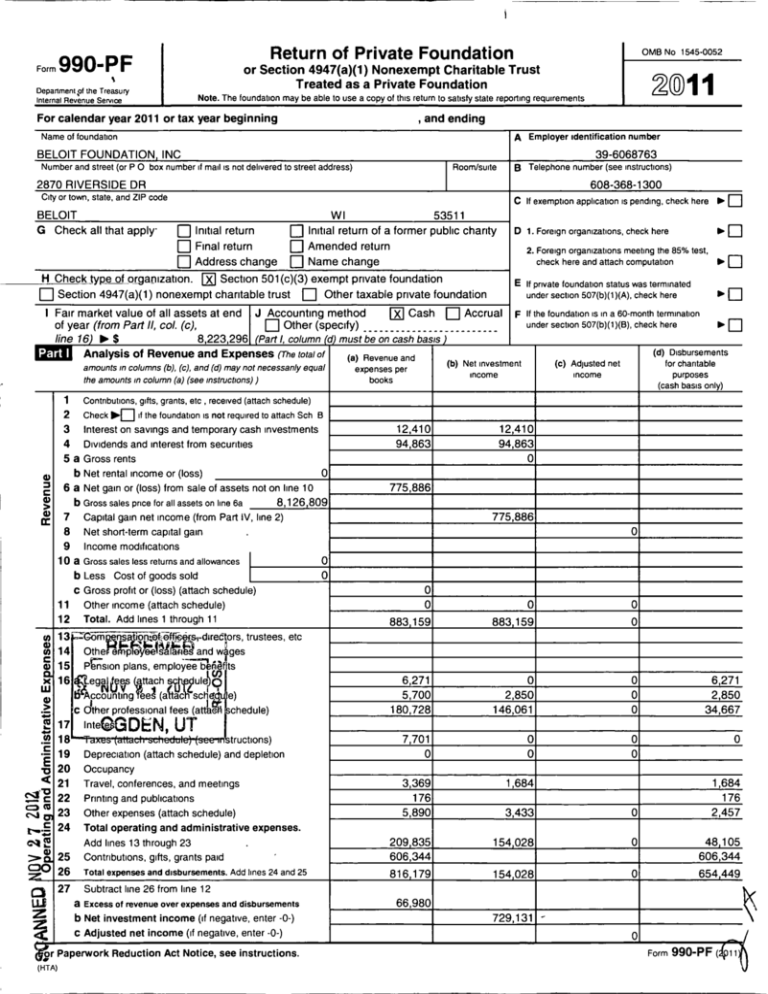

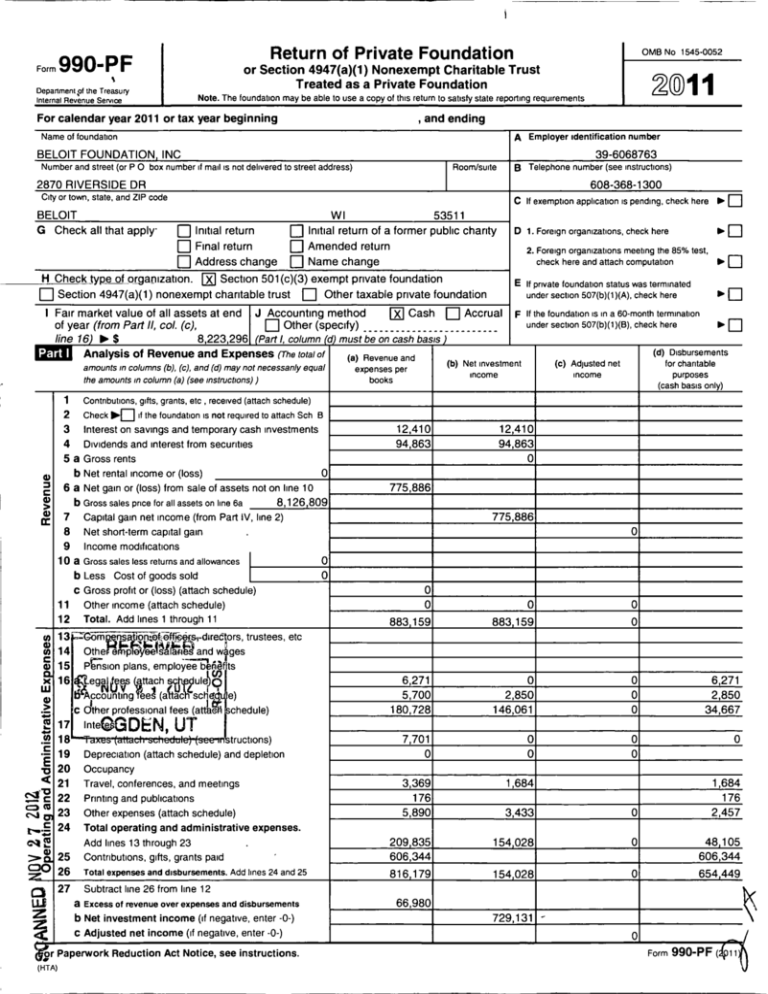

Return of Private Foundation

990-PF

Form

OMB No 1545-0052

or Section 4947( a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

%

Department of the Treasury

For calendar year 2011 or tax year beginning

, and ending

Name of foundation

A Employer identification number

BELOIT FOUNDATION , INC

Number and street (or P 0 box number if mail is not delivered to street address)

39-6068763

B Telephone number (see instructions)

Room/swte

2870 RIVERSIDE DR

608-368-1300

City or town, state, and ZIP code

BELOIT

G Check all that apply'

C If exemption application is pending, check here ^ ❑

❑ Initial return

WI

53511

❑ Initial return of a former public charity

❑ Final return

❑ Amended return

❑ Address change

❑ Name change

D 1. Foreign organizations, check here

0 Section 501 (c)(3) exempt private foundation

Section 4947(a)(1) nonexempt charitable trust ❑ Other taxable private foundation

Fair market value of all assets at end

J Accounting method

of year (from Part ll, col. (c),

line 16) ^ $

8,223,296

1

Contributions, gifts, grants, etc , received (attach schedule)

2

Check

3

4

5 a

b

6 a

b

7

8

9

Interest on savings and temporary cash investments

Dividends and interest from securities

Gross rents

Net rental income or (loss)

0

Net gain or (loss) from sale of assets not on line 10

Gross sales price for all assets on line 6a

8,126,809

Capital gain net income (from Part IV, line 2)

Net short-term capital gain

Income modifications

Cost of goods sold

C Gross profit or (loss) (attach schedule)

11

Other income (attach schedule)

12 Total. Add lines 1 through 11

W 16

CD

>

>1

®

dui Q

'LegW^fee^s ttach

b{Accou^nlting ee (MacCsch2 e)

c Ofther professional fees (attlaeH chedule)

18

19

20

21

22

23

24

tructlons)

Depreciation (attach schedule) and depletion

Occupancy

Travel, conferences, and meetings

Printing and publications

Other expenses (attach schedule)

Total operating and administrative expenses.

25

26

Add lines 13 through 23

Contributions, gifts, grants paid

Total expenses and disbursements . Add lines 24 and 25

27

Subtract line 26 from line 12

UJ

a Excess of revenue over expenses and disbursements

z

b Net investment income (if negative, enter -0-)

c Adjusted net income (if negative, enter -0-)

Qr Paperwork Reduction Act Notice , see instructions .

(HTA)

( a) Revenue and

expenses per

books

^

F If the foundation is in a 60-month termination

under section 507(b)(1)(B), check here

(d) Disbursements

for charitable

purposes

(cash basis only)

(c) Adjusted net

income

(b) Net investment

income

^❑

12,410

94,863

12,410

94,863

0

775,886

775,886

0

0

0

0

0

0

0

883 , 159

883 , 159

0

6,271

5,700

180,728

0

2,850

146,061

0

0

0

6,271

2,850

34,667

7,701

0

0

0

0

0

0

3,369

176

5,890

1,684

Gom

nsaRtion

o -officers, directors, trustees, etc

and w ges

Prnslon plans, employeebn4f is

cc 17 Inte^GDEN, UT

y

=

-0

a

-c

N clit

Eeq

❑ Accrual

if the foundation is not required to attach Sch B

10 a Gross sales less returns and allowances

w 13

a) 14

(D 15

Fx^ Cash

E If private foundation status was terminated

under section 507(b)(1)(A), check here

❑ Other (specify) ------------------------Part 1, column d must be on cash basis

Analysis of Revenue and Expenses (The total of

amounts in columns (b), (c), and (d) may not necessanly equal

the amounts in column (a) (see instructions))

^❑

2. Foreign organizations meeting the 85% test,

check here and attach computation

^❑

H Check ty pe of organization.

b Less

^©1 I

Note . The foundation may be able to use a copy of this return to satisfy state reporting requirements

Internal Revenue Service

1,684

176

2,457

3,433

0

209 , 835

606,344

154 , 028

0

48 , 105

606,344

816 , 179

154 , 028

0

654 , 449

66,980`J\(1

729,131 1 -

0

Form 990-PF 4 i 1

Form 990-PF (2011)

BELOIT FOUNDATION, INC

Balhnce Sheets

Attached schedules and amounts in the description column

Beginning of year

should be for end-of-year amounts only (See instructions)

(a) Book Value

1

Cash-non-interest-bearing

2

Savings and temporary cash investments

3

Accounts receivable

4

5

6

7

^

-^

(b) Book Value

2,714,665

2,714,665

0

0

0

0

0

0

Other notes and loans receivable (attach schedule)

^

0

0

0

0

0

0

0

-----------------0

2;976

0

0

0

6,521,564

533,880

2,837,423

550,291

2,837,423

550,291

307 , 532

307 , 532

307 , 532

1,754,219

1,813,385

1,813,385

0

Less accumulated depreciation (attach schedule)

-----------------------^

______

0

0

0

Other assets (describe ^

Total assets (to be completed by all filers-see the

0

0

0

9 , 470 , 410

8 , 223 , 296

8 , 223 , 296

0

10 a Investments-U S and state government obligations (attach schedule)

b investments-corporate stock (attach schedule)

C Investments-corporate bonds (attach schedule)

Investments-land, buildings, and equipment basis

^ - - _ _ - _ - - - - 307,532

Less accumulated depreciation (attach schedule)

^ ----------------- 0

12

13

Investments-mortgage loans

Investments-other (attach schedule)

14

Land, buildings, and equipment: basis ^

15

16

0

)

instructions Also, see page 1, item I)

J

17

18

19

Accounts payable and accrued expenses

Grants payable

Deferred revenue

20

Loans from officers, directors, trustees, and other disqualified persons

0

21

22

23

Mortgages and other notes payable (attach schedule)

Other liabilities (describe ^ Excise Tax Payable

)

---------------------------Total liabilities (add lines 17 through 22)

0

0

0

201

0

201

9,470,410

8,223,095

9,470,410

8,22 3,095

9 , 470 , 410

8 1 223 , 296

Foundations that follow SFAS 117, check here

and complete lines 24 through 26 and lines 30 and 31.

m

.0

(c) Fair Market Value

350,239

-----------------------------------0

Less allowance for doubtful accounts

^

--------------------Pledges receivable ^ .____________________________________ 0

Less. allowance for doubtful accounts

^

0

--------------------Grants receivable

Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see instructions)

Inventories for sale or use

8

-9-Prepaid-expenses-and-deferred-charg

11

24

Unrestricted

25

26

Temporarily restricted

Permanently restricted

^

.

Foundations that do not follow SFAS 117, check here

and complete lines 27 through 31.

U_

Page 2

0

Less allowance for doubtful accounts ^

cc

39-6068763

End of year

0

27

Capital stock, trust principal, or current funds

y

28

^

N

29

Paid-In or capital surplus, or land, bldg , and equipment fund

Retained earnings, accumulated income, endowment, or other funds .

a

30

Total net assets or fund balances (see instructions)

Z

31

Total liabilities and net assets/fund balances (see

Instructions)

Anal sis of Chan g es in Net Assets or Fund Balances

Total net assets or fund balances at beginning of year-Part II, column (a), line 30 (must agree with

end-of-year figure reported on prior year's return)

. .

.

2 Enter amount from Part I, line 27a

3 Other increases not included in line 2 (itemize) ^

1

1

.

---------------------------------------------------4 Add lines 1, 2, and 3

5 Decreases not included in line 2 (itemize) ^ Change in Unrealized Appreciation _ See Attached 6 Total net assets or fund balances at end of year (line 4 minus line 5)-Part II, column (b), line 30

2

3

9,470,410

66,980

0 -

4

5

9,537,390

1,314,295

6

8 , 223 , 095

Form 990-PF (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC.

Ca ital Gains and Losses for Tax on Investment Income

(b) How acquired

P-Purchase

D-Donation

(a) List and describe the kinds of property sold a , real estate,

()

()

( g

2-story brick warehouse, or common stock, 200 shs MLC Co)

Page 3

39-6068763

(d) Date sold

(mo, day, yr)

(c) Date acquired

()

(mo , day, yr)

la See Attached Statement

b

c

d

e

(e) Gross sales price

a

b

c

d

e

(f) Depreciation allowed

(g) Cost or other basis

(h) Gain or (loss)

(or allowable)

plus expense of sale

(e) plus (t) minus (g)

0

0

0

0

0

0

0

0

0

Complete only for assets showing gain in column ( h) and owned by the foundation on 12/31/69

(1) Adjusted basis

as of 12/31/69

(i) F M V as of 12/31/69

I

a

b

C

d

e

0

0

0

0

^

0

-0

(I) Gains ( Col (h) gain minus

col ( k), but not less than -0-) or

Losses (from col (h))

( k) Excess of col (Q

over col (t), if any

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

If gain, also enter in Part I, line 7

2 Capital gain net income or (net capital loss)

If (loss), enter -0- in Part I, line 7

2

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

If gain, also enter in Part I, line 8, column (c) (see instructions). If (loss), enter -0in Part I, line 8

3

qualification Under Section 4940( e ) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

0

0

0

0

0

775,886

0

If section 4940(d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? ❑ Yes ❑ No

If "Yes," the foundation does not qualify under section 4940(e) Do not complete this part.

1

Enter the aoorooriate amount in each column for each year: see the instructions before maklna any entries.

Base period years

Calendar year ( or tax year be g innin g in )

Adjusted qualifying distributions

2010

2009

2008

2007

2006

8 , 718 , 175

7 , 864 , 597

10 , 088 , 186

12 , 109 , 388

11 , 442 , 117

596 , 170

640 , 160

874 , 629

461 , 740

429 , 272

2 Total of line 1, column (d)

. . . .

. . . .

. . . . .

3 Average distribution ratio for the 5-year base period-divide the total on line 2 by 5, or by

the number of years the foundation has been in existence if less than 5 years . . . . .

4 Enter the net value of noncharitable-use assets for 2011 from Part X, line 5

5 Multiply line 4 by line 3 .

.

.

.

.

.

.

.

.

.

6 Enter 1% of net investment income (1% of Part I, line 27b)

7 Add lines 5 and 6 .

.

.

.

.

.

.

.

.

.

.

.

Distribution

ti ratio

(col ( b ) divided by col ( c ))

Net value of noncharitable-use assets

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0068382

0081398

0086698

0.038131

0.037517

2

0312126

3

0 062425

4

9,058,557

5

565,480

6

7,291

7

572,771

654,449

. . . . . . . . .

8

8 Enter qualifying distributions from Part XII, line 4 . . .

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1 % tax rate. See

the Part VI instructions.

Form 990-PF (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC.

Page 4

39-6068763

Excise Tax Based on Investment Income ( Section 4940(a), 4940( b), 4940(e), or 4948-see instructions)

1 a Exempt operating foundations described in section 4940(d)(2), check here ^

and enter "N/A" on line 1

Date of ruling or determination letter - - - - - - - - - - - - - - - - - (attach copy of letter if necessary-see instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check

here ^ Q and enter 1 % of Part I, line 27b

c All other domestic foundations enter 2% of line 27b Exempt foreign organizations enter 4%

of Part I, line 12, col (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

3 Add lines 1 and 2

. .

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

5 Tax based on investment income . Subtract line 4 from line 3 If zero or less, enter -0. .

6 Credits/Payments

10,000

a 2011 estimated tax payments and 2010 overpayment credited to 2011

6a

b Exempt foreign organizations-tax withheld at source

6b

c Tax paid with application for extension of time to file (Form 8868)

6c

d Backup withholding erroneously withheld

6d

7 Total credits and payments Add lines 6a through 6d

. . . .

8

Enter any penalty for underpayment of estimated tax Check here

fl if Form 2220 is attached

9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed

^

10 Overpayment . If line 7 is more than the total of lines 5 and 8, enter the amount overpaid .

^

^

Refunded ^

11 Enter the amount of line 10 to be Credited to 2012 estimated tax

2 , 709 1

1

7,291

2

3

4

5

0

7,291

7

8

9

10

11

10,000

0

0

2,709

0

7,291

rMAIM Statements Reg ardin g Activities

Yes

1 a During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it

participate or intervene in any political campaign? .

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 19 of the

instructions for definition)'

If the answer is "Yes" to la or lb, attach a detailed description of the activities and copies of any materials

published or distributed by the foundation in connection with the activities

c Did the foundation file Form 1120-POL for this year?

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year

(1) On the foundation ^ $

(2) On foundation managers ^ $

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers ^

$

Has the foundation engaged in any activities that have not previously been reported to the IRS?

2

If "Yes,' attach a detailed description of the activities

Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

3

of incorporation, or bylaws, or other similar instruments? If "Yes,"attach a conformed copy of the changes

4 a Did the foundation have unrelated business gross income of $1,000 or more during the year?

b If "Yes," has it filed a tax return on Form 990-T for this year'? . . . .

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year?

If 'Yes,' attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions

that conflict with the state law remain in the governing instrument? .

. .

7

Did the foundation have at least $5,000 in assets at any time during the year? If 'Yes, 'complete Part 11, col (c), and Part XV

^

8 a Enter the states to which the foundation reports or with which it is registered (see instructions)

WI

--------------------------------------------------------------------------------------------------------b if the answer is "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney

General (or designate) of each state as required by General Instruction G' If "No,"attach explanation

Is the foundation claiming status as a private operating foundation within the meaning of section 49420)(3)

9

or 4942(1)(5) for calendar year 2011 or the taxable year beginning in 2011 (see instructions for Part XIV)? If 'Yes,"

complete Part XIV

10 Did any persons become substantial contributors during the tax year? If "Yes,"attach a schedule listing

their names and addresses

No

1a

X

1b

X

1c

X

2

X

3

4a

4b

5

X

X

N/A

X

6

7

X

X

8b

X

9

10

X

Form 990-PF (2011)

Form 990- PF (2011 )

Page 5

39-6068763

BELOIT FOUNDATION, INC.

Activities (con

11

At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the

meaning of section 512(b)(13)9 If 'Yes," attach schedule (see instructions)

12

Did the foundation make a distribution to a donor advised fund over which the foundation or a disqualified person had

advisory privileges? If 'Yes,' attach statement (see instructions)

Did the foundation comply with the public inspection requirements for its annual returns and exemption application?

13

Website address

X

12

13

X

X

^ N/A

14

The books are in care of ^ GARY G GRABOWSKI--------------------------Telephone no ^ 608-368-1300

53511

Located at ^ 2 870 RIVERSIDE DR. BELOIT WI

ZIP+4 ^ -------------------------------------------------------------------------------------------

15

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041-Check here

and enter the amount of tax-exempt interest received or accrued during the year .

At any time during calendar year 2011, did the foundation have an interest in or a signature or other authority

over a bank, securities, or other financial account in a foreign country?

. . .

16

^

^

El

15

16

Yes

X

No

Yes

No

See the instructions for exceptions and filing requirements for Form TD F 90-22 1 If 'Yes," enter the name of

Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the " Yes" column , unless an exception applies.

la

During the year did the foundation (either directly or indirectly):

(1) Engage in the sale or exchange, or leasing of property with a disqualified person?

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

a disqualified person?

11

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person?

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . .

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person)?

Yes

EX No

Yes

No

Yes

No

^X Yes

No

Yes

No

(6) Agree to pay money or property to a government official? (Exception . Check "No"

if the foundation agreed to make a grant to or to employ the official for a period

after termination of government service, if terminating within 90 days) .

b

C

Yes

No

If any answer is "Yes" to 1 a(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

section 53 4941 (d)-3 or in a current notice regarding disaster assistance (see instructions)?

Organizations relying on a current notice regarding disaster assistance check here

^L

Did the foundation engage in a prior year in any of the acts described in 1 a, other than excepted acts,

that were not corrected before the first day of the tax year beginning in 2011 9

lb

X

1c

X

Taxes on failure to distribute income (section 4942 ) (does not apply for years the foundation was a private

operating foundation defined in section 4942 0)(3) or 4942()(5))

2

a

b

c

3a

b

4a

b

At the end of tax year 2011 , did the foundation have any undistributed income ( lines 6d

and 6e , Part XIII ) for tax year ( s) beginning before 2011 9

Yes

No

If "Yes," list the years ^

20------ , 20------ , 20 ------ , 20

Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets ) to the year's undistributed income? ( If applying section 4942(a)(2)

to all years listed, answer " No" and attach statement-see instructions )

2b

N/A

3b

4a

N/A

If the provisions of section 4942 (a)(2) are being applied to any of the years listed in 2a, list the years here

^

20

20

, 20

, 20

----------------------Did the foundation hold more than a 2% direct or indirect interest in any business

enterprise at any time during the year?

. .

1-1 Yes

If "Yes," did it have excess business holdings in 2011 as a result of (1) any purchase by the foundation

or disqualified persons after May 26 , 1969, (2) the lapse of the 5-year period (or longer period approved

by the Commissioner under section 4943 (c)(7)) to dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine

if the foundation had excess business holdings in 2011)

Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes?

Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable

purpose that had not been removed from j eopardy before the first day of the tax year beginning in 2011 9

No

4b

X

X

Form 990-PF (2011)

Form 990-PF (2011)

'

5a

BELOIT FOUNDATION, INC.

Statements Regardin g Activities for Which Form 4720 Ma y Be Req uired (continued)

During the year did the foundation pay or incur any amount to

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))"

(2) Influence the outcome of any specific public election (see section 4955), or to carry

on, directly or indirectly, any voter registration drive? .

(3) Provide a grant to an individual for travel, study, or other similar purposes?

(4) Provide a grant to an organization other than a charitable, etc , organization described

in section 509(a)(1), (2), or (3), or section 4940(d)(2)9 (see instructions)

i Yes

EX No

Yes

EX No

Li Yes

[X No

E]Yes

EX No

Yes

EX No

(5) Provide for any purpose other than religious, charitable, scientific, literary, or

educational purposes, or for the prevention of cruelty to children or animals?

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in

Regulations section 53 4945 or in a current notice regarding disaster assistance (see instructions)?

Organizations relying on a current notice regarding disaster assistance check here

C If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the

------------ -tax-because-it-maintained expenditure respond llity forthe grant?

If "Yes," attach the statement required by Regulations section 53 4945-5(d)

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay

premiums on a personal benefit contract?

Page 6

39-6068763

5b

N/A

^ El

Yes

No

E]Yes

0 No

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

If 'Yes' to 6b, file Form 8870

X

6b

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction?

b If "Yes,' did the foundation receive any proceeds or have any net income attributable to the transaction?

X No

E]Yes

7b

N/A

Information About Officers, Directors, Trustees, Foundation Managers , Highly Paid Em ployees,

and Contractors

1

List all officers , directors, trustees , foundation managers and their compensat ion (see instructions).

(a) Name and address

(b) Title, and average

hours per week

devoted to position

(c) Compensation

( If not paid, enter

-0

(d) Contributions to

employee benefit plans

and deferred com pensation

(e) Expense account,

other allowances

See Attached Statement

00

10.4 00C7,

0

0

.00

0

0

0

.00

0

0

0

------------------------------------------------------------------------------------------------------------------------------------2 Compensation of five highest-paid employees (other than those included on line 1-see instructions). If none,

enter "NONE."

(b) Title, and average

hours per week

devoted to position

(a) Name and address of each employee paid more than $50,000

(d) Contributions to

employee benefit

plans and deferred

com pensation

(c) Compensation

(e) Expense account,

other allowances

-NONE

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Total number of other employees paid over $50,000

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

^

Form 990-PF (2011)

Form 990-PF (2011)

Page 7

39-6068763

BELOIT FOUNDATION, INC.

Information About Officers , Directors, Trustees , Foundation Managers , Highly Paid Employees,

and Contractors (continued)

3

Five highest -paid independent contractors for professional services (see instructions ). If none, enter "NONE."

(b) Type of service

(a) Name and address of each person paid more than $50,000

(c) Compensation

G. G. GRABOWSKI CPA S.C.

2870 RIVERSIDE DR. , BELOIT WI 53511

104 , 000

ADMINISTRATION

-----------------------------------------------------------------

0

-----------------------------------------------------------------

0

-----------------------------------------------------------------

0

----------------------------------------------------------------0

Summary of Direct Charitable Activities

List the foundation's four largest direct chantable activities during the tax year Include relevant statistical information such as

the number of organizations and other beneficiaries served, conferences convened, research papers produced, etc

Expenses

1 NONE---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------2 --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------3 --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------4

----------------------------------------------------------------------------------------------------Summary of Program - Related Investments (see instructions)

Amount

Describe the two largest program - related investments made by the foundation during the tax year on lines 1 and 2

1

NONE

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2

----------------------------------------------------------------------------------------------------All other program -related investments See instructions

3

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total . Add lines 1 throu g h 3

^

0

0

Form 990-PF (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC.

39-6068763

Page 8

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.)

1

Fair market value of assets not used (or held for use) directly in carrying out charitable, etc.,

purposes

a

Average monthly fair market value of securities

la

8,367,033

b

Average of monthly cash balances

1b

458,472

C

d

Fair market value of all other assets (see instructions)

Total (add lines 1a, b, and c)

11C

Id

371,000

9,196,505

e

2

Reduction claimed for blockage or other factors reported on lines 1 a and

1c (attach detailed explanation)

Acquisition indebtedness applicable to line 1 assets

3

Subtract line 2 from line ld

4

Cash deemed held for charitable activities Enter 1 1/2 % of line 3 (for greater amount, see

.

le

2

3

9,196,505

instru ctions)

4

137,948

5

Net value of noncharitable-use assets . Subtract line 4 from line 3 Enter here and on Part V, line 4

5

9,058,557

6

6

452,928

1

452,928

2c

3

4

7,291

445,637

5

445,637

1

Minimum investment return . Enter 5% of line 5

Distributable Amount (see instructions) (Section 49420)(3) and 0)(5) private operating

foundations and certain foreign organizations check here ^ ❑ and do not complete this part)

Minimum investment return from Part X, line 6

2a

b

C

3

4

Tax on investment income for 2011 from Part VI, line 5

Income tax for 2011. (This does not include the tax from Part VI)

Add lines 2a and 2b .

Distributable amount before adjustments Subtract line 2c from line 1

Recoveries of amounts treated as qualifying distributions

5

Add lines 3 and 4

6

7

Deduction from distributable amount (see instructions)

Distributable amount as adjusted. Subtract line 6 from line 5 Enter here and on Part XIII,

line 1

.

.

.

.

. .

2a

2b

7,291 =

0

.

.

. .

6

7

445,637

Qualifying Distributions (see instructions)

Amounts paid (including administrative expenses) to accomplish charitable, etc , purposes

1

a

Expenses, contributions, gifts, etc -total from Part I, column (d), line 26

b

Program-related investments-total from Part IX-B

Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc ,

purposes

Amounts set aside for specific charitable projects that satisfy the

Suitability test (prior IRS approval required)

Cash distribution test (attach the required schedule)

Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4

Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

income Enter 1% of Part I, line 27b (see instructions)

2

3

a

b

4

5

6

la

.

.

1b

654,449,0

2

3a

3b

4

5

Adjusted qualifying distributions . Subtract line 5 from line 4

6

Note . The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation

qualifies for the section 4940(e) reduction of tax in those years

0

654,449

7,291

647,158

Form 990-PF (2011)

Form 990-PF (2011)

RFI CIIT Fni INI)ATIfN INC;

Page 9

39-6068763

Undistributed Income (see instructions)

1

(a)

Corpus

Distributable amount for 2011 from Part XI,

(b)

Years prior to 2010

(c)

2010

(d)

2011

line 7

2

445 , 637

Undistributed income, if any, as of the end of 2011

a Enter amount for 2010 only

b Total for prior years 20

3

, 20

0

, 20

0

Excess distributions carryover, if any, to 2011

a

b

c

d

e

From

From

From

From

From

2006

2007

2008

2009

2010

429,272

461,740

875,080

640,160

598,194

3,004,446

f Total of lines 3a through e

4-Quahfymg-distributions-for 201-1-f rom Part

t $

XII, line 4

654,449

a Applied to 2010, but not more than line 2a

b Applied to undistributed income of prior years

(Election required-see instructions)

C Treated as distributions out of corpus (Election

0

0

required-see instructions)

d Applied to 2011 distributable amount

0

445,637 -

208,812

e Remaining amount distributed out of corpus

5

Excess distributions carryover applied to 2011

(If an amount appears in column (d), the

same amount must be shown in column (a) )

6

Enter the net total of each column as

indicated below:

0

a Corpus Add lines 3f, 4c, and 4e Subtract line 5

b Prior years' undistributed income Subtract

line 4b from line 2b

C Enter the amount of prior years' undistributed

0

3,213,258

0

income for which a notice of deficiency has

been issued, or on which the section 4942(a)

tax has been previously assessed

d Subtract line 6c from line 6b Taxable

0

amount-see instructions

e Undistributed income for 2010 Subtract line

4a from line 2a Taxable amount-see

0

instructions

f

Undistributed income for 2011 Subtract

7

lines 4d and 5 from line 1 This amount must

be distributed in 2012

Amounts treated as distributions out of

8

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or 4942(g)(3) (see instructions)

Excess distributions carryover from 2006

0

429 , 272 -

not applied on line 5 or line 7 (see instructions)

Excess distributions carryover to 2012.

9

Subtract lines 7 and 8 from line 6a

Analysis of line 9

10

2 , 783 , 986

a Excess from 2007

b Excess from 2008

461,740

875,080

Excess from 2009

640,160

d Excess from 2010

e Excess from 2011

598,194

208,812 ,

c

Form 990-PF (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC.

Private O eratin Foundations ( see instructions and Part VII-A, q uestion 9 )

1 a If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2011, enter the date of the ruling

.

39-6068763

^

❑ 4942(j)(3) or

b Check box to indicate whether the foundation is a private operating fou ndation described in section

2 a Enter the lesser of the adjusted net

Tax year

Prior 3 years

income f rom P ar t I or th e minimum

2011

(b)

2010

(c) 2009

(a)

investment return from Part X for each

year listed

b 85% of line 2a

c Qualifying distributions from Part XII,

line 4 for each year listed

3

(e) Total

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Complete 3a, b, or c for the

alternative test relied upon

a "Assets" alternative test-enter

(1) Value of all assets

(2) Value of assets qualifying

under section 4942())(3)(B)(i)

b "Endowment" alternative test-enter 2/3

of minimum investment return shown in

Part X, line 6 for each year listed

❑ 49420)(5)

(d) 2008

d Amounts included in line 2c not used directly

for active conduct of exempt activities

e Qualifying distributions made directly

fo r active conduct of exempt activities

Subtract line 2d from line 2c

Page 10

0

0

0

0

0

0

0

c "Support" alternative test-enter

(1) Total support other than gross

investment income (interest,

dividends, rents, payments

on securities loans (section

512(a)(5)), or royalties)

0

(2) Support from general public

and 5 or more exempt

organizations as provided in

section 4942())(3)(B)(ui)

0

(3) Largest amount of support

from an exempt organization

0

(4) Gross investment income

0

Supplementary Information (Complete this part only if the foundation had $5 , 000 or more in

assets at any time during the year-see instructions.)

1

Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only if they have contributed more than $5,000) (See section 507(d)(2) )

NONE

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the

ownership of a partnership or other entity) of which the foundation has a 10% or greater interest

NONE

Information Regarding Contribution , Grant , Gift, Loan , Scholarship , etc., Programs:

2

Check here

^ ❑ if the foundation only makes contributions to preselected charitable organizations and does not accept

unsolicited requests for funds If the foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under

other conditions, complete items 2a, b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed

GARY G. GRABOWSKI- EXECUTIVE DIRECTOR- 2870 RIVERSIDE DR BELOIT WI 53511 608-368-1300

b The form in which applications should be submitted and information and materials they should include.

LETTER BRIEFLY DESCRIBING PROJECT, PURPOSE AND REQUESTING AN APPLICATION

c Any submission deadlines

NONE

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors

SUPPORT ONLY FOR THE BELOIT, WI STATELINE AREA; NON-OPERATIONAL FUNDING

Form 990-PF (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC.

JQM Supplementary Information (continued)

3

39-6068763

Page 11

Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

Foundation

status of

recipient

Paid during the year

a

BELOIT COLLEGE

700 COLLEGE STREET

BELOIT W 153511

BELOIT COLLEGE

700 COLLEGE STREET

BELOIT W 153511

BELOIT HEALTH SYSTEM FOUNDATION, INC.

1 969 W H ART ROAD

BELOIT W 153511

BELOIT JANESVILLE SYMPHONY ORCHESTRA

520 E GRAND AVE.

BELOIT WI 53511

BELOIT PUBLIC LIBRARY

605 ECLIPSE BOULEVARD

BELOIT WI 53511

CARITAS

2840 PRAIRIE AVE

BELOIT W 153511

COMMUNITY ACTION, INC.

200 W. MILWAUKEE STREET

JANESVILLE WI 53548

COMMUNITY HEALTH SYSTEMS

690 THIRD STREET, SUITE 200

BELOIT WI 53511

FAMILY SERVICES OF SO WI & NO IL

423 BLUFF STREET

BELOIT WI 53511

FAMILY SERVICES OF SO WI & NO IL

423 BLUFF STREET

BELOIT WI 53511

FRIENDS OF RIVERFRONT

1003 PLEASANT STREET

Total . . See Attached Statement . . . . . .

Approved for future payment

b

FAMILY SERVICES OF SO WI & NO IL

423 BLUFF STREET

BELOIT WI 53511

GREATER BELOIT ECONOMIC DEVELOPMENT CC

500 PUBLIC AVE

BELOIT W 153511

RETIRED SENIOR VOLUNTEER PROGRAM

2433 S. RIVERSIDE DR

BELOIT WI 53511

ROSECRANCE FOUNDATION

1012 N. MULFORD ROAD

ROCKFORD IL 61107

BELOIT JANESVILLE SYMPHONY ORCHESTRA

520 E. GRAND AVE.

BELOIT WI 53511

CARITAS

2840 PRAIRIE AVE.

BELOIT W 153511

. .

Total . . See Attached Statement . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

Amount

PUBLIC

CHARITY

CENTER FOR THE

SCIENCES

PUBLIC

CHARITY

INTERNATIONAL

SCHOLARSHIPS

12,000

PUBLIC

CHARITY

EMERGENCY ROOM

RENOVATION

50,000

PUBLIC

CHARITY

PROGRAM SUPPORT

10,000

PUBLIC

CHARITY

CAPITAL CAMPAIGN

50,000

PUBLIC

CHARITY

RENOVATION

PROJECT

25,000

PUBLIC

CHARITY

FRESH START

PROGRAM

10,000

PUBLIC

CHARITY

SEAL-A-SMILE

PROGRAM

20,000

PUBLIC

CHARITY

PROGRAM SUPPORT

56,627

PUBLIC

CHARITY

BELOIT DOMESTIC

VIOLENCE CENTER

25,000

PUBLIC

CHARITY

.

Purpose of grant or

contribution

.

.

.

.

GOSPEL ON THE

ROCK - MUSIC AT

HARRY'S PLACE

^ 3a

. . .

. .

100,000

5,000

606,344

PUBLIC

CHARITY

PROGRAM SUPPORT

31,500

PUBLIC

CHARITY

ROCK COUNTY 5 0

PROJECT

16,667

PUBLIC

CHARITY

PROGRAM SUPPORT

5,250

PUBLIC

CHARITY

VETERANS PROGRAM

CAPITAL CAMPAIGN

50,000

PUBLIC

CHARITY

PROGRAM SUPPORT

4,600

PUBLIC

CHARITY

RENOVATION

PROJECT

.

.

.

.

.

25,000

^ 3b

883,517

Form 990-PF (2011)

Form 990-PF (2011)

39-6068763

BELOIT FOUNDATION, INC.

Page 12

Analysis of Income-Producing Activ ities

Enter gross amounts unless otherwise indicated.

1 Program service revenuea

b

c

d

e

f

Unrelated bus iness income

(e)

Excluded by sectio n 512, 513, or 514

(a)

(b)

(c)

(d )

Business code

Amount

Exclusion code

Amount

Related or exempt

function income

(See instructions )

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

g Fees and contracts from government agencies

2 Membership dues and assessments

3 Interest on savings and temporary cash investments

14

12.41 0

4 Dividends and interest from securities

5 Net rental income or (loss) from real estate

a Debt-financed property . .

b Not debt-financed property

6 Net rental income or (loss) from personal property

7 Other investment income

14

94,863

8 Gain or (loss) from sales of assets other than inventory

18

775,886

9 Net income or (loss) from special events

10 Gross profit or (loss) from sales of inventory

11 Other revenue

a

b

c

d

e

12 Subtotal. Add columns (b), (d), and (e)

13 Total. Add line 12, columns (b), (d), and (e)

0

0

0

0

0

0

0

0

0

0

0

883,159

13

0

0

0

0

0

0

883,159

(See worksheet in line 13 instructions to verify calculations )

=

Line No .

y

Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to

the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes) (See instructions )

Form WNU-11`11- (2011)

Form 990-PF (2011)

BELOIT FOUNDATION, INC

39-6068763

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Page 13

Exempt Organizations

Did the organization directly or indirectly engage in any of the following with any other organization described

in section 501(c) of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political

organizations?

Yes No

a Transfers from the reporting foundation to a noncharitable exempt organization of(1) Cash . . . . .

. . . . . . . . . . . . . . .

. . . . . . .

. . . .

1 a(l)

X

(2) Other assets . . . . .

. . . . . . . . . . . . . . . .

. . . . .

1a(2)

X

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization . . .

. . .

. . .

1 b( l )

. . .

X

(2) Purchases of assets from a noncharitable exempt organization

. . . . . . .

X

. . . . .

1b(2 )

(3) Rental of facilities, equipment, or other assets . . . . . . . . . . . . . . . . . . . . . . . .

1b 3

X

(4) Reimbursement arrangements

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b 4

(5) Loans or loan guarantees . . . . . . . .

. . .

. . . . . .

. . .

. . . . . .

1b 5

X

(6)-Performance-of-services or-membershiporfundraisingsolicitations

-1 6 -7C

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees . . . . . . . . . . .

1c

X

d If the answer to any of the above is "Yes," complete the following schedule. Column (b) should always show the fair market

value of the goods, other assets, or services given by the reporting foundation. If the foundation received less than fair market

value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received.

(a) Line no

(b) Amount involved

(c) Name of noncharitable exempt organization

( d) Description of transfers , transactions, and sharing arrangements

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2a Is the foundation directly or indirectly affiliated with or related to one or more tax-exempt organizations

described in section 501 (c) of the Code ( other than section 501 (c)(3)) or in section 527' .

. . . .

b If "Yes ," complete the following schedule.

(a) Name of organization

(b) Type of organization

.

D Yes

(c) Description of relationship

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and compl

Declaration of reparer (o er than taxpayer) is based on all information of which pre arer has an knowledge

Sign

Here

Sign

Paid

Prenarer

re of o cer fJee

Print/Type preparer's name

Date

Preparer's signature

No

39-6068763

BELOIT FOUNDATION, INC

Line 6 (990-PF) - Gain/Loss from Sale of Assets Other Than

Totals

Amount

Long Term CG Distributions

Short Term CG Distributions

Check "X"

If Sale of

ndex Security

escri p tion

1

Publicl y Traded Securities

2

ACL Alternative Fund SAC Llml

EIN 80-0066581

3

4

5

6

7

8

9

10

Detail Available U pon Re q uest

Securities

Other sales

USIP #

urchaser

Check "X" If

Purchaser

Is a

Business

ate

Ac q uired

cquisition

Method

P

P

© 2011 CCH Small Firm Services All rights reserved

ate

Sold

Gross

Sales

Cost, Other

Basis and Ex p enses

0

8, 126,809

ross Sales

C t or

Price

Othe r Basis

8,126,809

7, 318,304

32,619

aluation

Method

0

7 , 350 , 923

Expense

of Sale and

Cost of

Improvements

Net Gain

or Loss

0

775 , 886

e p reciation

et Gain

or Loss

808,505

-32,619

0

0

0

0

0

0

0

39-6068763

BELOIT FOUNDATION, INC

Line 16a (990-PF) - Legal Fees

6271

1

Name of Organization or

Person Providin g Service

FOLEY & LARDNER

Revenue and

Expenses per

Books

6,271

0

Net Investment

Income

2

3

4

5

6

7

8

9

10

© 2011 CCH Small Firm Services All rights reserved.

1

0

6.271

_

Disbursements

for Charitable

Purposes

( Cash Basis Onl y)

6,271

Adjusted Ne

Income

0

BELOIT FOUNDATION, INC

39-6068763

Line 16b (990-PF) - Accountinci Fees

5.700

1

2

3

4

5

6

7

8

9

10

Name of Organization or

Person Providin g Service

Financial Statement Review

Revenue and

Expenses per

Books

5 ,700

2. 850

Net Investment

Income

2 ,850

© 2011 CCH Small Firm Services All rights reserved

1

Adjusted Net

Income

0

2.850

Disbursements

for Charitable

Purposes

( Cash Basis Onl y)

2,850

EIN: 39-6068763

The Beloit Foundation, Inc.

Attachment to FORM 990-PF

2011 TAX YEAR

PART I, Line 16c

Other Professional Fees:

Col.

(a)

Col.

(b)

Morgan Stanley/Smith Barney, Investment Management

Custodian, Trading & Transfer Fees

ACL

$

1,814

1,814

ACL - Schedule K-1 Other Deductions

11,275

11,275

Calamos

8,120

8,120

Lord Abbett

12,118

12,118

MDT

10,458

10,458

MDT-SC

5 ,297----5-,297

Mesirow

-310

-310

Paulson Investmets

-861

-861

Sands

17,326

17,326

Templeton Foreign

10,884

10,884

UBP Investment

607

607

G. G. Grabowski, CPA, PC - Administration

104,000

69,333

$ 180,728 , 146,061

PART I, Line 23

Other Expenses:

Aldrich House Insurance - Used for

charitable purposes

Association of Small Foundation Membership

Directors & Officers Liability Insurance

Investment Property Maintenance

Miscellaneous Expense

Col.

(a)

$

Col .

(b)

1,230

695

1,250

1,200

1,515

5,890 -

347

625

1,200

1,261

3,433 -

Col.

(c)

Col.

(d)

N/A

N/A

N/A

N/A

N/A

-N/A

N/A

N/A

N/A

N/A

N/A

N/A

0

0

0

0

0

0

Col.

(c)

0

0

0

0

0

34,667

34,667

Col.

(d)

N/A

1,230

N/A

N/A

N/A

N/A

348

625

0

254

2,457 -

0 -

39-6068763

BELOIT FOUNDATION, INC

Line 18 (990-PF) - Taxes

7.701

Descri ption

1

2

3

4

5

6

Excise Tax

Revenue

and Expenses

p er Books

Net Investment

Income

7,701

7

8

9

10

© 2011 CCH Small Firm Services. All rights reserved

Adjusted

Net Income

Disbursements

for Charitable

Purposes

EIN: 36-6068763

THE BELOIT FOUNDATION, INC.

Tax Year 2011

Attachment to Form 990-PF

Part II, Line 1 Ob - Corporate Stocks

Calamos Investments

Lord Abbett

MDT SCC

Sands Large Cap Growth

Templeton Foreign

Total Corporate Stocks

$

193,760.48

633,667.00

578,848.76

1,026,014.90

405,132.01

2,837,423.15

$

550,290.68

Page 45

$

454,720.00

956,036.00

277,049.00

125,580.00

1,813,385.00

Page 46

$

Page

Page

Page

Page

Page

2

12

25

28

34

Part II, Line 10c - Corporate Bonds

Calamos

Part II, Line 13 - Investments -- Other

ACL Alternative Fund

Mesirow

Paulson

UBP

Total Investments--Other

$

THE BELOIT FOUNDATION, INC

Tax Year 2011

EIN-39 - 6068763

Calamos - Corporate Stocks

Common Stocks

Share

Date

Quanta/

55

Descnpbon

AFFILIATED MANAGERS GROUP

Symbol

AM G

35

acquired

Cost

cost

Current

Current

price

value

04,21:10

$ 4.59140

t 83 48

$95.95

$ 5.27725

10029110

3.06600

87.60

95.95

3 358.25

7,667.40

86 .082

90

8,635.60

300

AUTODESK INC

ADSK

09113111

8.14440

27 148

30.33

9,099.00

116

BAKER HUGHES INC

BHI

05101;11

8.326 . 69

72.406

4864

6.593.60

BARRICK GOLD CORP CAD

ABX

07;21111

8.436.11

49624

45.25

7.692.50

08115,11

3.026.09

50434

45.25

2.715.00

11,462.20

48838

170

60

230

10.40750

500

DELL INC

DELL

07, 29111

8.171 .30

16342

14.63

7,315.00

146

DOVER CORP

DOV

10114,'11

7,723 .99

53 .268

5805

8,417.26

155

EATON CORP

ETN

04.'21,10

6,044.54

38997

43.53

6.747 15

43.53

6.964.80

30.33

13.71196

7,582.50

160

10;07 11

6.372.02

3982S

39.418

26.106

EBAYINC

EB AY

04,21,10

12,416.56

6.52653

FRANKLIN RESOURCES INC

BEN

04,121,10

7,642.70

96.06

6,243.90

FREEPORT MCMORAN COPPER & GOLD

CL B

FCX

08,11,11

7.84958

46174

36.79

6.25430

08116111

3.686.78

46084

3679

2.943.20

11,63636

46.146

MEAD JOHNSON NUTRITION CO

MJN

316

250

86

170

30

250

55

55

11758

9,19750

08,,08111

3.64160

66.21

68.73

3.780.15

080601

3.77846

68.699

6873

3.780.15

7,560.30

7.42006

67.465

MSFT

08(23: 10

7,310.88

24.369

OXY

ORCL

08111 11

3 7,607.77

12;21,10

4.146,74

31.898

25.65

3.33450

135

03104, 11

4.45203

32.978

2565

3.462.75

135

0116,11

4.08753

30.278

2565

3.462.75

12,686.30

31.716

110

300

90

130

MICROSOFT CORP

OCCIDENTAL PETROLEUM CORP-DEL

ORACLE CORP

400

QC OM

$8453

2596

7,788.00

$ 93.70

* 8,433.00

10.260.00

04,21:10

3,81240

42.36

54.70

4.92300

70

01,10111

3.639.80

51.997

54.70

3.829.00

75

03116111

3.943.81

52.584

5470

4.102.50

11,396.07

48.494

7.709. 64

30.233

90

QUALCOMMINC

235

255

SUNCOR ENERGY INC NEW

Su

08i 19111

Total common stocks and options

1143,73&85

1

12,854.50

2883

7,351.65

$14451.16

Prefered Stocks

Quantity

Descnpton

Symbol

BG EPF

Date

acquired

Cost

Share

cost

Current

puce

Current

value

0211;11

$ 3.930.19

$ 100774

$ 92.50

$ 3.607.50

02,15:11

204.97

102.484

92.50

185.00

02116.11

1.143.12

103.92

92.50

1.01750

5

02' 17,11

51984

103967

92.50

462.50

1

03/01111

10473

104.732

9250

92.50

8.643.74

102.902

AMGZO 11;23110

4,074.69

47937

44125

3,750.63

AATRL

6,199.51

38.514

3950

6,332.60

39

2

11

BUNGE LTD CV

PFD

Rated BB

26

84

85

r

AFFILIATED MANAGERS GROUP CV

PFD

7 ,770.00

Rated BB

135

AMG CAPITAL TR PFD CONY

05,04, 10

Rated BB

APA PRD 07123110

15.29767

51856

5428

16.012 60

0& 19111

1.592.71

54.921

5428

1.574.12

11

08(24111

615.37

55.943

54.28

59708

5

08130111

287.44

57.487

5428

27140

597.08

295

299

APACHE CORPORATION 6% MAND

COW PFD

09/02111

APA PRD 09108111

625.90

56.90

$ 630.06

$ 57.278

5-128

$54.28

09109/11

387.77

55.395

5428

379.96

5

09109111

278.55

55.71

54.28

271.40

3

09114' 11

164.75

54.915

54.28

16284

11

09116111

623.88

56,716

5428

59708

12

09119111

668.42

55.702

54.28

661.36

21,172.62

52.931

03103`11

5.872.34

83.89

61.74

4.321.80

03,,3/11

2.968.45

84.812

61.74

2.160.90

8,840. 79

84.198

7,779.09

50.187

11

11

7

APACHE CORPORATION 6% MAND

COW PFD

400

70

35

tOb

165

METLIFE INC COMMON EQUITY UTS

SNR UNSEC 5%

ML U

Rated BBB

NEXTERA ENERGY INC

NEEEU

1a,27,'10

1597 08

21,712.00

8,482.70

5330

8,261.50

DTD 09121,2010

MTY 09;01;2013

$ 66,71034

Totaf preferred ttoaks

$ 68,x.33

$ 193,760.48

Total Corporate Stocks

2

THE BELOIT FOUNDATION, INC

Tax Year 2011

EIN 39-6068763

Lord Abbett - Corporate Stocks

Quantity

Descnpbon

Symbol

Date

acquired

Cost

Share

cost

Current

price

135.712

$ 45 01

Current

value

29

COVIDIEN PLC

COV

0225,09

$ 1,035.66

54

AT&T INC

T

05.25, 10

1289.68

23.382

30.24

1632.96

167

06;11:10

4.22144

25.278

3024

5.050.08

62

08115,11

1.78134

28 739

30.24

1.87488

60

08;22j 11

1.714 55

28.575

30.24

1.814.40

123

09120411

3.558.13

28.927

3024

3.719.52

189

09,2211

525736

27.816

30 24

5.715.36

17.823.00

27.211

28.27

3,081.43

655

109

28

ADOBE SYSTEMS INC IDE)

01. 19! 11

3.71875

34117

ANADARKO PETROLEUM CORP

APC

06,2110

1.14376

40.848

76.33

2137.24

02,117,11

7.81652

78.165

76.33

7 633.00

8.96028

70.002

128

APACHE CORP

APA

06,01110

35296

39

111 10110

27

011"1111

ARCHER-DANIELS- MIDLAND CO

AD M

87

9058

4.29365

110.093

90.58

3.532.62

3.392.43

125.645

9058

2.445.66

8,039 04

114.843

12111;09

1,89159

30.508

28.60

1.773.20

1215109

2,69137

30.935

28.60

2.488.20

116

BAC

826

6,340.60

4,261.40

4.58296

30.758

1.306.81

11.266

556

644.96

01,04,' 11

11.74902

14.224

556

4.592.56

13,066 83

13.86

942

ABX

362.32

11'29110

149

BANK OF AMERICA CORP

9,770.24

88.24

70

b2

19.807.20

ADBE

100

4

* 1,306.29

6,237.52

06121110

312.39

44627

4525

316.75

48

091301 10

2-20670

45.972

45.25

2.172.00

47

09! 19111

2,54169

54.078

45.25

6,060. 78

49. 816

1201;11

920.78

32.885

3524

986.72

65

12;02;11

2.14474

32.996

35.24

2.29060

55

1206;11

1.828.53

33.246

35.24

1.938.20

32

114,11

1.07210

33506

1524

1.12768

26

12301 11

919.27

35.356

35.24

916.24

8,886.64

33 .425

08;19,10

954.13

32.901

42.00

1.218.00

091410

2-20797

35047

42.00

2.646.00

7

BARRICK GOLD CORP CAD

102

28

BRISTOL MY_RS SQUIBB CO

BMY

206

29

63

CIGNA CORP

Cl

3

2.126.75

4,816.50

7,269.44

THE BELOIT FOUNDATION, INC.

Tax Year 2011

E I N: 39-6068763

Lord Abbett - Corporate Stocks

)uantiti

72

DescnpUon

CIGNA CORP

Symbol

CI

Date

acquired

11;05,10

$ 2 676.34

6.83864

164

4

Cost

CVS CAREMARK CORP

CVS

Share

cost

Current

price

$ 37 172

$ 42.00

36.601

Current

value

$ 3.024.00

6,888.00

09102:11

14340

35.85

4078

163.12

35.614

40.78

2.976.94

2.773.04

73

09106111

2.59984

68

091091 11

2.48577

36.556

4078

24

09,12' 11

87120

36 299

4078

978.72

39

11,,25/11

1.443.90

37 023

40.78

1.590.42

7 ,644 11

36 . 27

1.972.53

25.617

3264

2.513.28

1.62725

34.622

32 64

1.534.08

208

77

47

CARNIVAL CORP

(PAIRED STOCK)

CCL

CATERPILLAR INC

CAT

06130,09

06:07 10

8,482.24

4.047.36

3,599 78

2903

05113,109

1.45502

36.375

9060

3.624.00

64

06130,109

2.120.16

33.132

9060

5.798.40

24

1001,10

1.87644

78 185

90.60

2.174.40

5.461.92

42.593

124

40

128

11.696.80

09:18.09

1.02195

72.996

106.40

1.489.60

22

10101.09

1.525.59

69.344

10640

2.34080

49

01, 25110

3.649.56

74.48

106.40

5.213.60

83

05!06/ 10

6.61485

79.697

106.40

8.831.20

48

06/08;10

3.39320

70.691

106.40

5.107.20

13

10, 13,10

1.08909

83.776

106.40

14

CHEVRON CORP

CVX

1.383.20

24.386 60

17 ,294.24

76 521

11,18/11

1.46978

18.604

18.08

1.428.32

84

11,2501

1.484 12

17 668

18.08

1.518.72

67

11,29111

1.197 12

17867

18.08

1211.36

1,171.89

18 .901

18.08

1.120.96

6 , 32291

18 . 229

1207,09

2.41660

42.396

62.35

3.553.95

06,04,110

1.570.47

39.077

62 35

1.995.20

3.987 .07

44 799

229

79

CISCO SYS INC

CSC O

12!07: 11

62

292

57

CLIFFS NATURAL RESOURCES

CLF

32

89

CL

08,20110

7597

29

08123110

22

04,,07.11

26

0& 10111

1

COLGATE PALMOLIVE CO

78

4

6.27936

5,549.16

92.39

75.97

92.39

220223

75.939

92.39

2.679 31

1.79181

81.445

92.39

2032.58

2.12176

81.721

92.39

2.402 14

6,194 .77

7942

7,206.42

THE BELOIT FOUNDATION, INC.

Tax Year 2011

EIN:39 - 6068763

Lord Abbett - Corporate Stocks

Quantity

96

Description

COMCAST CORP CL A

Symbol

Date

acquired

Cost

Share

cost

Current

puce

CM CSA 0&30110

1 694 57

f 17.651

$ 23.71

09130' 10

3.695 76

17.853

23.71

6,39033

17.79

207

303

Current

value

$2.77616

4.907.97

7,184.13

373

CORNING INC

GLW

12 21110

7,185 . 40

19.21

12.98

4,841.64

120

DELTA AIR LINES INC

DAL

01113,09

1. 32019

11.001

8.09

97080

01115; 09

563.60

10.437

8. 09

43686

c54

(NEW)

1,407.68

1.883.79

10 826

71

DEVON ENERGY CORP NEW

DVN

11;1210

5,124.71

72.179

62. 00

4,402.00

88

WALT DISNEY CO

DIS

0214,311

3.80407

43.228

3750

3.300.00

90

02' 2--V1 1

3.765.50

41.838

37.50

3.375.00

110

05'.11,111

4.602 92

41844

3750

4.12500

12 , 172.49

42 . 266

174

288

616.95

21.274

2876

83404

28

10101,09

69919

24.97

2876

80528

29

DOW

10,80000

08:27 09

DOW CHEMICAL CO

104

10122,109

2.63303

25.317

2876

2991.04

100

10:28109

2.45745

24.574

2876

2.876.00

101

12'08;10

3.40450

33.707

2876

2904.76

67

EMC CORP-MASS

EMC

173

27 . 103

1.207 53

18.022

21.54

1.443.18

12-11110

3.921.58

22.668

21 54

3.726.42

5,129.11

21 . 371

1.925.97

42.799

4353

1958.85

43.53

4.178.88

240

45

EATON CORP

ETN

10.411.12

9,811 12

03/29:10

362

0610.'08

5,169.60

2.23690

23.301

4.182 87

29 624

0206;08

2.35902

16.269

26.57

3.852.65

237

11,19;09

2.287.57

9.652

26.57

6297.09

133

1203. 09

1.26871

9 539

2657

3. 533.81

12129;08

96

141

145

EL PASO CORP

EP

6,915.30

11.486

01103,11

5.634.49

57.494

4659

4.565.82

0209111

3.53661

60.976

4659

2.702.22

616

98

EMERSON ELECTRIC CO

EMR

58

6,137.73

13,683.66

9,171.10

58.789

1214,09

5.637.07

69.603

84.76

6.86556

27

03116, 10

1.78992

66.303

84.76

2.288.52

32

04,2710

2238.05

69.949

84.76

2712.32

156

81

EXXON MOBIL CORP

XOM

5

7168.04

THE BELOIT FOUNDATION, INC

Tax Year 2011

EIN 39 - 6068763

Lord Abbett - Corporate Stocks

Share

Date

Quantity

42

Descnpton

EXXON MOBIL CORP

Symbol

XO M

acquired

04, 29110

182

Cost

$2.89153

12 558 57

cost

$68.856

Current

Current

price

value

$ 8476

$3%992

16 426 32

68992

379

FORD MOTOR COMPANY

F

1231,09

3.778 . 37

9969

1076

4,078.04

276

GENERAL ELECTRIC CO

GE

03;23,11

5.39122

19 533

17 91

4.943.16

403

06r 24,' 11

7.285.47

18.078

17 91

7217 73

73

11,29t 11

1.095.27

15.003

17 91

13,771.96

18.314

752

02103,09

49852

83.086

90.43

54258

0209:09

2.71985

97 137

9043

2.532.04

34

07,28,10

5.01748

147 572

9043

3.07462

10

08116,10

1.47473

147 472

90 43

904 30

17

08:31,10

2.32029

136.487

9043

1.53731

10

09120;10

1.50389

150.388

9043

90430

13,634 76

128. 902

6

GOLDMAN SACHS GROUP INC

1.30743

13.488.32

GS

28

105

HSN INC

HSNI

1216.09

5394

17.981

45

1217.09

807.72

21

12. 18:09

374.61

104

0131,10

86

05,20+ 10

10

9,486.15

36.26

108.78

17 949

36.26

1631 70

17838

36.26

76146

3.11392

29.941

3626

3.771.04

2.124 47

24.703

36.26

3.118.36

06118,10

24298

24.298

3626

362 60

25

06,2110

605 53

24 221

3626

906.50

18

06, 24410

43357

24.087

36.26

652.68

35

08; 31<' 10

914.20

26.12

3626

3

347

8.670.94

24 988

1.26910

12,582.22

78

HALLIBURTON CO HOLDINGS CO

HAL

09:09: 09

1,969 .20

25.246

34 51

2,891.78

61

HERTZ GLOBAL HOLDINGS INC

HTZ

0225.09

197.3D

3234

11.72

71492

480

0226,09

1.565.81

3 262

11.72

5.625.60

125

05120Y 10

1294 18

10353

11.72

1.46500

30

05120110

310.60

10353

1172

351.60

290

09130110

3,05915

10.548

11.72

986

42

8.427.04

HESS CORP

HES

06;0209

2.68271

63.374

5680

53.993

5690

852.00

5396

5630

1.420.00

15

09:08,10

809.91

25

09:09 10

1.34900

6

3. 398.80

11,666.92

6.518

2.385.60

THE BELOIT FOUNDATION, INC

Tax Year 2011

EIN 39-6068763

Lord Abbett - Corporate Stocks

Quantity

Descnpbon

Symbol

6

HESS CORP

HES

Date

acquired

11,09110

88

Cost

$ 418.06

Share

cost

Current

puce

$ 69679

11 56.80

5 ,269. 70

69. 769

Current

value

$340.80

4. 998A0 _

0109/11

60365

46.434

25.76

334.88

69

11;07. 11

1.880.58

27.253

2576

1.777 44

52

11; 25,11

1.330.01

25.577

25.76

1.339.52

39

110111

1.10125

28 237

2576

4.916.39

28 . 413

13

HEWL"cTT PACKARD CO

HP Q

173

1.00464

4,466.48

01,29110

713.43

29.726

37 64

903.36

16

02101110

48046

30 028

37.64

60224

85

06130110

3.14447

36.993

3764

3.199.40

17

07x01;10

3764

24

HYATT HOTELS CORP CL A

H

142

INT C

62499

36.764

4.963 . 35

34 963

639.88

6,344.88

1011 10,,11

1.69002

22.838

2425

1.794.50

95

101, 14,11

2.21551

23.321

2425

2.303.75

103

1017:11

2.40149

23.315

24.25

2-49775

74

INTEL CORP

8,696.00

8.307.02

23 . 188

241

INTERNATIONAL PAPER CO

IP

09:23x10

6,07106

21041

2960

7,133.60

220

JPMORGAN CHASE & CO

JPM

272

06111,08

8.28330

37.651

3325

7.31500

72

06/ 20, 08

2.807.65

38.995

33.25

2.394.00

88

111

09115108

11.54121

40.241

33.25

2.926.00

12'01:08

3.21901

2900

33.25

3.690.75

130

09:22110

5.18744

39.91)3

33.25

4.322.50

112

11:2210

4.332.03

38.678

3325

27 ,370.64

733

JNJ

3.724.00

24.37226

37 . 341

11;11,10

127.51

63.755

6558

131.16

118

04,'28,' 11

7.716.34

65.392

6558

7.738.44

85

06,01;11

5.704.57