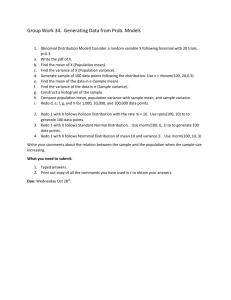

Question 1 - CIA 1192 IV-21 - Manufacturing Input Variances

advertisement