Page 1 of 9

Gleim / Flesher CMA Review

15th Edition, 1st Printing

Part 1 Updates

Available December, 2010

NOTE: Text that should be deleted from the outline is displayed as struck through with a red

background. New text is shown in courier font with a green background.

Study Unit 7 – Cost and Variance Measures

Top of page 333: This presents the mix and yield variances in a more useful format.

7.5 MIX AND YIELD VARIANCES

1. In some production processes, inputs are substitutable, e.g., a baker of pecan pies may use

pecans from Florida rather than from Georgia as market conditions shift.

a. The use of substitutable ingredients allows the quantity/efficiency variance for both direct

materials and direct labor to be broken down into two components, a mix variance and a

yield variance.

2. To enable the calculation of the mix and yield variances, the weighted-average expected price

(WAEP) and weighted-average standard price (WASP) must be derived.

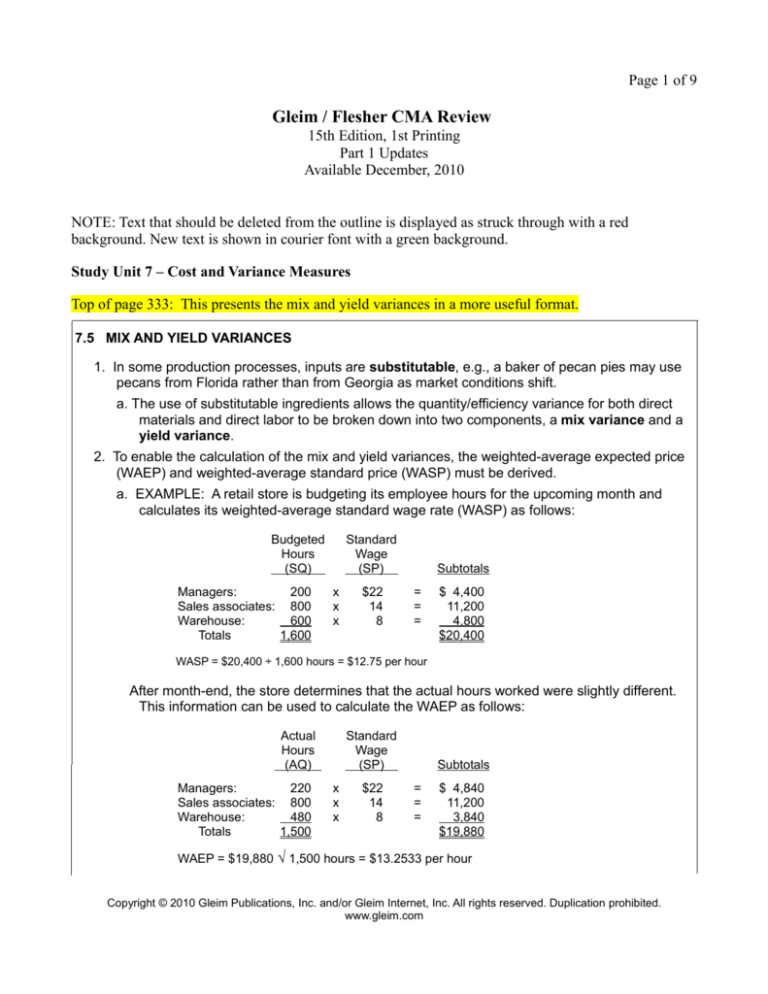

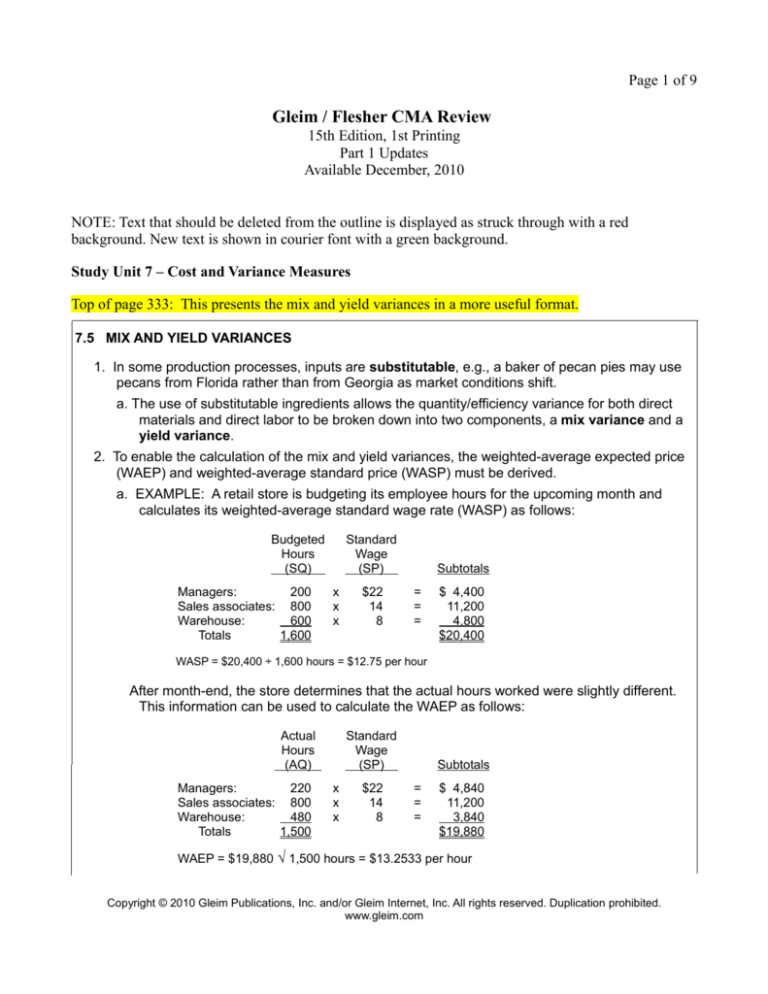

a. EXAMPLE: A retail store is budgeting its employee hours for the upcoming month and

calculates its weighted-average standard wage rate (WASP) as follows:

Budgeted

Hours

(SQ)

Managers:

200

Sales associates: 800

Warehouse:

600

Totals

1,600

Standard

Wage

(SP)

x

x

x

$22

14

8

Subtotals

=

=

=

$ 4,400

11,200

4,800

$20,400

WASP = $20,400 ÷ 1,600 hours = $12.75 per hour

After month-end, the store determines that the actual hours worked were slightly different.

This information can be used to calculate the WAEP as follows:

Actual

Hours

(AQ)

Managers:

220

Sales associates: 800

Warehouse:

480

Totals

1,500

Standard

Wage

(SP)

x

x

x

$22

14

8

Subtotals

=

=

=

$ 4,840

11,200

3,840

$19,880

WAEP = $19,880 ÷ 1,500 hours = $13.2533 per hour

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com

Page 2 of 9

3. The mix variance measures the relative usage of higher-priced vs. lower-priced inputs in the

production process.

Mix variance = ATQ × (WASP – WAEP)

a. EXAMPLE: The store calculates its labor mix variance as follows:

Labor mix variance =

=

=

=

ATQ × (WASP – WAEP)

1,500 hours × ($12.75 – $13.2533)

1,500 hours × –$0.5033

$755 unfavorable

This unfavorable variance resulted from the more expensive managers working more hours

and the less expensive warehouse employees working fewer hours than were budgeted.

4. The yield variance measures how efficiently the actual mix of inputs was used to produce the

given level of output.

Yield variance = (STQ – ATQ) × WASP

a. EXAMPLE: The store calculates its labor yield variance as follows:

Labor yield variance =

=

=

=

(STQ – ATQ) × WASP

(1,600 hours – 1,500 hours) × $12.75

100 hours × $12.75

$1,275 favorable

This favorable variance resulted from the store using fewer hours than budgeted to achieve

its output for the month. The sum of the mix and yield variances is the efficiency variance

($755 U + $1,275 F = $520 F).

5. The same formulas can be applied to the mix and yield variances for direct materials.

Middle of page 342: This brings the Core Concepts in line with the mix and yield variance formulas.

Mix and Yield Variances

■ The quantity variance for materials and the efficiency variance for labor can be further

subdivided into mix and yield variances:

Mix variance = AQ × (A% – S%) × SP ATQ × (WASP - WAEP)

Yield variance = (SQ × S% × SP) – (AQ × A% × SP) (STQ - ATQ) × WASP

Beginning on the top of page 357: The following six pages replace the pages currently in your book.

The solutions for these questions employ easier formulas for the mix and yield variances.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com

357

SU 7: Cost and Variance Measures

7.5 Mix and Yield Variances

Questions 42 and 43 are based on the following information.

Mack Fuels produces a gasoline additive. The standard

costs and input for a 500-liter batch of the additive are

presented below.

Chemical

Echol

Protex

Benz

CT-40

Totals

Standard

Input Quantity

in Liters

200

100

250

50

600

Standard

Cost

per Liter

$.200

.425

.150

.300

Total Cost

$ 40.00

42.50

37.50

15.00

$135.00

42. What is Mack’s direct materials mix variance for

this operation?

A. $294.00 favorable.

B. $388.50 favorable.

C. $94.50 unfavorable.

D. $94.50 favorable.

The quantities purchased and used during the current period

are shown below. A total of 140 batches were made during

the current period.

Chemical

Echol

Protex

Benz

CT-40

Totals

Quantity

Purchased

(Liters)

25,000

13,000

40,000

7,500

85,500

Total

Purchase

Price

$ 5,365

6,240

5,840

2,220

$19,665

Quantity

Used

(Liters)

26,600

12,880

37,800

7,140

84,420

Answer (B) is correct. (Publisher, adapted)

REQUIRED: The direct materials mix variance.

DISCUSSION: To enable the calculation of the mix

variance, the weighted-average expected price (WAEP) and

weighted-average standard price (WASP) must be derived.

Mack can calculate its WAEP and WASP for the month as

follows:

Middle

Chemical

AQ

SP

Budget

Echol

26,600 × $0.200 = $ 5,320

Protex

12,880 × 0.425 =

5,474

Benz

37,800 × 0.150 =

5,670

CT-40

7,140 × 0.300 =

2,142

Totals

84,420

$ 18,606

Divided by: total liters

÷ 84,420

WAEP per liter

$0.22040

To calculate WASP, the total standard quantity of each input

must first be derived: Echol (200 liters × 140 batches = 28,000

total), Protex (100 liters × 140 batches = 14,000 total), Benz

(250 liters × 140 batches = 35,000 total), and CT-40 (50 liters ×

140 batches = 7,000 total).

Static

Chemical

SQ

SP

Budget

Echol

28,000 × $0.200 = $ 5,600

Protex

14,000 × 0.425 =

5,950

Benz

35,000 × 0.150 =

5,250

CT-40

7,000 × 0.300 =

2,100

Totals

84,000

$ 18,900

Divided by: total liters

÷ 84,000

WASP per liter

$0.22500

The mix variance can now be calculated:

Materials mix variance =

=

=

=

ATQ × (WASP – WAEP)

84,420 liters × ($0.22500 – $0.22040)

84,420 liters × –$0.0046

$388.50 favorable

Answer (A) is incorrect. The quantity variance is $294.00

favorable. Answer (C) is incorrect. The yield variance is $94.50

unfavorable. Answer (D) is incorrect. The yield variance

reversed is $94.50 favorable.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

358

SU 7: Cost and Variance Measures

43. What is Mack’s direct materials yield variance for

this operation?

A. $294.00 favorable.

B. $388.50 favorable.

C. $94.50 unfavorable.

D. $388.50 unfavorable.

Answer (C) is correct. (Publisher, adapted)

REQUIRED: The direct materials yield variance.

DISCUSSION: To enable the calculation of the yield

variance, the weighted-average standard price (WASP) must be

derived. Mack can calculate its WASP for the month as follows:

Static

Chemical

SQ

SP

Budget

Echol

28,000 × $0.200 = $ 5,600

Protex

14,000 × 0.425 =

5,950

Benz

35,000 × 0.150 =

5,250

CT-40

7,000 × 0.300 =

2,100

Totals

84,000

$ 18,900

Divided by: total liters

÷ 84,000

WASP per liter

$0.22500

The yield variance can now be calculated:

Materials yield variance =

=

=

=

(STQ – ATQ) × WASP

(84,000 liters – 84,420 liters) × $0.22500)

–420 liters × $0.22500

$94.50 unfavorable

Answer (A) is incorrect. The quantity variance is $294.50

unfavorable. Answer (B) is incorrect. The mix variance is

$388.50 favorable. Answer (D) is incorrect. The mix variance

reversed is $388.50 unfavorable.

44. The efficiency variance for either direct labor or

materials can be divided into

A. Spending variance and yield variance.

B. Yield variance and price variance.

C. Volume variance and mix variance.

D. Yield variance and mix variance.

45. A materials or labor mix variance equals

A. The actual total quantity of inputs times the

difference between the weighted-average

budgeted price for inputs and the weightedaverage expected price for inputs.

B. The actual total quantity of inputs times the

difference between the weighted-average

budgeted price for inputs and the weightedaverage actual price for inputs.

C. The budgeted total quantity of inputs times the

difference between the weighted-average

budgeted price for inputs and the weightedaverage expected price for inputs.

Answer (D) is correct. (CMA, adapted)

REQUIRED: The components into which a direct labor or

materials efficiency variance can be divided.

DISCUSSION: A direct labor or materials efficiency variance

is calculated by multiplying the difference between standard and

actual usage times the standard cost per unit of input. The

efficiency variances can be divided into yield and mix variances.

Mix and yield variances are calculated only when the production

process involves combining several materials or classes of labor

in varying proportions (when substitutions are allowable in

combining resources).

Answer (A) is incorrect. A spending variance is not the same

as an efficiency variance. Answer (B) is incorrect. A price

variance is not the same as an efficiency variance. Answer (C) is

incorrect. A volume variance is based on fixed costs, and an

efficiency variance is based on variable costs.

Answer (A) is correct. (Publisher, adapted)

REQUIRED: The definition of the materials mix variance.

DISCUSSION: Mix and yield variances are the components

of the usage (quantity or efficiency) variance. Mix and yield

variances can only be calculated when inputs are substitutable.

The mix variance isolates the effects of changes in the mix of

inputs used. The mix variance equals actual total quantity (ATQ)

times the weighted-average standard price (WASP) minus the

weighted-average expected price (WAEP).

Answer (B) is incorrect. The weighted-average actual price

is not used in calculating the mix variance. Answer (C) is

incorrect. The budgeted total quantity of inputs is used in

calculating the yield variance but not the mix variance.

Answer (D) is incorrect. The weighted-average actual price is not

used in calculating the mix variance.

D. The actual total quantity of inputs times the

difference between the weighted-average

actual price for inputs and the weightedaverage expected price for inputs.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

359

SU 7: Cost and Variance Measures

Questions 46 through 48 are based on the following information. Mountain View Hospital (MVH) has adopted a standard

cost accounting system for evaluation and control of nursing labor. Diagnosis Related Groups (DRGs), instituted by the

U.S. government for health insurance reimbursement, are used as the output measure in the standard cost system. A

DRG is a patient classification scheme in which hospitals are regarded as multiproduct firms with inpatient treatment

procedures related to the numbers and types of patient ailments treated. MVH has developed standard nursing times for

the treatment of each DRG classification, and nursing labor hours are assumed to vary with the number of DRGs treated

within a time period. The nursing unit on the fourth floor treats patients with four DRG classifications. The unit is staffed

with registered nurses (RNs), licensed practical nurses (LPNs), and aides. The standard nursing hours and salary rates

and actual numbers of patients for the month of May were as follows:

DRG

Classification

1

2

3

4

No. of

Patients

250

90

240

140

Standard Hours per DRG

RN

LPN

Aide

6

4

5

26

16

10

10

5

4

12

7

10

Total Standard Hours

RN

LPN

Aide

1,500

1,000

1,250

2,340

1,440

900

2,400

1,200

960

1,680

980

1,400

7,920

4,620

4,510

Standard Hourly Rates

RN

$12.00

LPN

8.00

Aide

6.00

The results of operations during May for the fourth floor nursing unit are presented below:

Actual hours

Actual salary

Actual hourly rate

RN

8,150

$100,245

$12.30

LPN

4,300

$35,260

$8.20

Aide

4,400

$25,300

$5.75

Because MVH does not have data to calculate variances by DRG, it uses a flexible budgeting approach to calculate labor

variances for each reporting period by labor classification (RN, LPN, Aide). Labor mix and labor yield variances are also

calculated because one labor input can be substituted for another. The variances are used by nursing supervisors and

hospital administration to evaluate the performance of nurses.

46. What is the direct labor static budget variance?

A. $2,205 favorable.

B. $2,205 unfavorable.

C. $1,745 favorable.

D. $1,745 unfavorable.

Answer (D) is correct. (Publisher, adapted)

REQUIRED: The total flexible budget variance.

DISCUSSION: The static budget variance (i.e., the total

variance to be explained) is the difference between the standard

cost of labor and the actual cost of labor. Based on the standard

hours and rates given, the standard cost of labor is $159,060

[(7,920 RN × $12.00) + (4,620 LPN × $8.00) + (4,510 Aide ×

$6.00)]. The actual cost of labor is $160,805 ($100,245 RN +

$35,260 LPN + $25,300 Aide). The static budget variance is thus

$1,745 unfavorable ($159,060 standard – $160,805 actual).

Answer (A) is incorrect. Reversing the order of subtraction

for the labor rate variance results in $2,205 favorable.

Answer (B) is incorrect. The labor rate variance is $2,205

unfavorable. Answer (C) is incorrect. Reversing the order of

subtraction results in $1,745 favorable.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

360

SU 7: Cost and Variance Measures

47. What is the labor mix variance?

A. $460 unfavorable.

B. $460 favorable.

C. $1,406 unfavorable.

D. $1,406 favorable.

Answer (C) is correct. (Publisher, adapted)

REQUIRED: The labor mix variance.

DISCUSSION: To enable the calculation of the mix

variance, the weighted-average expected price (WAEP) and

weighted-average standard price (WASP) must be derived.

Mountain View can calculate its WAEP and WASP for the month

as follows:

Labor

Class

AQ

SP

RN

8,150

× $12.00

LPN

4,300

×

8.00

Aide

4,400

×

6.00

Totals

16,850

Divided by: total hours

WAEP per hour

Labor

Class

SQ

SP

RN

7,920

× $12.00

LPN

4,620

×

8.00

Aide

4,510

×

6.00

Totals

17,050

Divided by: total hours

WASP per hour

=

=

=

=

=

=

Middle

Budget

$ 97,800

34,400

26,400

$158,600

÷ 16,850

$9.41246

Static

Budget

$ 95,040

36,960

27,060

$159,060

÷ 17,050

$9.32903

The mix variance can now be calculated:

Labor mix variance =

=

=

=

ATQ × (WASP – WAEP)

16,850 hours × ($9.32903 – $9.41246)

16,850 hours × –$0.08343

$1,406 unfavorable

Answer (A) is incorrect. The labor efficiency variance is

$460 favorable. Answer (B) is incorrect. The labor efficiency

variance is $460 favorable. Answer (D) is incorrect. The

variance was unfavorable.

48. What is the labor yield variance?

A. $1,866 unfavorable.

B. $1,866 favorable.

C. $1,406 unfavorable.

D. $1,406 favorable.

Answer (B) is correct. (Publisher, adapted)

REQUIRED: The labor yield variance.

DISCUSSION: To enable the calculation of the yield

variance, the weighted-average standard price (WASP) must be

derived. Mountain View can calculate its WASP for the month as

follows:

Labor

Class

SQ

RN

7,920

×

LPN

4,620

×

Aide

4,510

×

Totals

17,050

Divided by: total hours

WASP per hour

SP

$12.00

8.00

6.00

=

=

=

Static

Budget

$ 95,040

36,960

27,060

$159,060

÷ 17,050

$9.32903

The yield variance can now be calculated:

Labor yield variance =

=

=

=

(STQ – ATQ) × WASP

(17,050 hours – 16,850 hours) × $9.32903

200 hours × $9.32903

$1,866 favorable

Answer (A) is incorrect. The yield variance is favorable.

Answer (C) is incorrect. The labor mix variance is $1,406

favorable. Answer (D) is incorrect. The labor mix variance is

$1,406 favorable.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

361

SU 7: Cost and Variance Measures

Questions 49 and 50 are based on the following

information. Tamsin Company’s standard direct

labor rates in effect for the fiscal year ending June

30 and standard hours allowed for the output in

April are as follows:

Labor class III

Labor class II

Labor class I

Standard DL

Rate per Hour

$8.00

7.00

5.00

Standard DLH

Allowed for Output

500

500

500

The wage rates for each labor class increased

January 1 under the terms of a new union contract.

The standard wage rates were not revised. The

actual direct labor hours (DLH) and the actual direct

labor rates for April were as follows:

Labor class III

Labor class II

Labor class I

Actual Rate

$8.50

7.50

5.40

Actual DLH

550

650

375

49. What is the direct labor yield variance (rounded)

for Tamsin?

A. $500 unfavorable.

B. $325 unfavorable.

C. $825 unfavorable.

D. $325 favorable.

Answer (A) is correct. (Publisher, adapted)

REQUIRED: The direct labor yield variance for April.

DISCUSSION: To enable the calculation of the yield

variance, the weighted-average standard price (WASP) must be

derived. Tamsin can calculate its WASP for the month as

follows:

Labor

Class

SQ

III

500

×

II

500

×

I

500

×

Totals 1,500

Divided by: total hours

WASP per hour

SP

$8.00

7.00

5.00

=

=

=

Static

Budget

$ 4,000

3,500

2,500

$ 10,000

÷ 1,500

$6.66667

The yield variance can now be calculated:

Labor yield variance =

=

=

=

(STQ – ATQ) × WASP

(1,500 hours – 1,575 hours) × $6.66667

–75 hours × $6.66667

$500 unfavorable

Answer (B) is incorrect. The direct labor mix variance is

$325 unfavorable. Answer (C) is incorrect. The direct labor

efficiency variance is $825 unfavorable. Answer (D) is incorrect.

Reversing the order of subtraction for the mix variance results in

$325 favorable.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

362

SU 7: Cost and Variance Measures

50. What is the direct labor mix variance (rounded)

for Tamsin?

A. $500 unfavorable.

B. $325 unfavorable.

C. $325 favorable.

D. $500 favorable.

Answer (B) is correct. (Publisher, adapted)

REQUIRED: The direct labor mix variance for April.

DISCUSSION: To enable the calculation of the mix

variance, the weighted-average expected price (WAEP) and

weighted-average standard price (WASP) must be derived.

Tamsin can calculate its WAEP and WASP for the month as

follows:

Labor

Class

AQ

III

550

×

II

650

×

I

375

×

Totals 1,575

Divided by: total hours

WAEP per hour

Labor

Class

SQ

III

500

×

II

500

×

I

500

×

Totals 1,500

Divided by: total hours

WASP per hour

SP

$8.00

7.00

5.00

SP

$8.00

7.00

5.00

=

=

=

=

=

=

Middle

Budget

$ 4,400

4,550

1,875

$ 10,825

÷ 1,575

$6.87302

Static

Budget

$ 4,000

3,500

2,500

$ 10,000

÷ 1,500

$6.66667

The mix variance can now be calculated:

Labor mix variance =

=

=

=

ATQ × (WASP – WAEP)

1,575 hours × ($6.66667 – $6.87302)

1,575 hours × –$0.20635

$325 unfavorable

Answer (A) is incorrect. The yield variance is $500

unfavorable. Answer (C) is incorrect. The mix variance is $325

unfavorable. Answer (D) is incorrect. Reversing the order of

subtraction for the yield variance results in $500 favorable.

51. A materials or labor yield variance equals

A. The difference between the standard total

quantity of inputs and the actual total quantity

of inputs times the weighted-average expected

price for inputs.

B. The actual total quantity of inputs times the

difference between the weighted-average

budgeted price for inputs and the weightedaverage expected price for inputs.

C. The difference between the standard total

quantity of inputs and the actual total quantity

of inputs times the weighted-average actual

price for inputs.

Answer (D) is correct. (Publisher, adapted)

REQUIRED: The definition of materials yield variance.

DISCUSSION: Mix and yield variances are the components

of the usage (quantity or efficiency) variance. Mix and yield

variances can only be calculated when inputs are substitutable.

The yield variance measures how efficiently the actual mix of

inputs was used to produce the given output. The yield variance

equals standard total quantity (STQ) minus the actual total

quantity (ATQ) times the weighted-average standard price

(WASP).

Answer (A) is incorrect. The weighted-average expected

price for inputs is used in calculating the mix variance but not the

yield variance. Answer (B) is incorrect. This is the formula for

the mix variance. Answer (C) is incorrect. The weightedaverage actual price for inputs is not used in calculating the mix

and yield variances.

D. The difference between the standard total

quantity of inputs and the actual total quantity

of inputs times the weighted-average budgeted

price for inputs.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Page 9 of 9

Top of page 378: This corrects a typo; Unfavorable should be Favorable.

Essay Questions 1, 2 — Unofficial Answers

1. Total direct materials variance:

Static budget (SQ × SP): 4,000 bottles × $13.00

Less: actual cost

Static budget variance

= $ 52,000

(51,710)

$ 290 U F

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com