Directions Newsletter

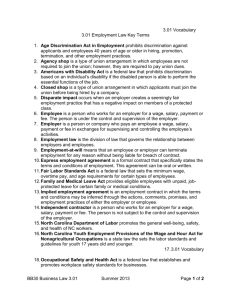

advertisement