aPPenDiX - Calidad Pascual

advertisement

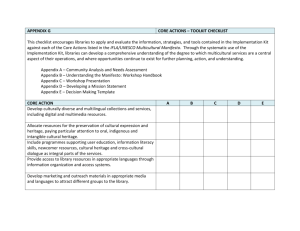

Creating SHARED VALUE REPORT 2014 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INDEX INCREASE REDUCE PRINT INDEX 1 - Message from the President 03 2 - Executive summary 2014 04 3 - Our business model 05 4 - Innovation and quality in our value chain 08 5 - How do we communicate with our stakeholders? 16 6 - How do we create value with our stakeholders? 20 6.1 - Supply chain 6.2 - Production and logistics 6.3 - Merchandising 6.4 -Consumer products 6.5 - Ethical management and corporate governance Appendix: about this report 20 23 26 28 30 35 02 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX Message from the President INCREASE REDUCE PRINT 01 Message from the President Most companies seek value creation as an ultimate goal, but the ones that truly stand out are those which pursue value generation shared with all their stakeholders. Believing firmly in this vision and maintaining this commitment over time, despite complex scenarios, is a difficult task only achievable through a continuous process of listening and learning. Learning from our mistakes and adapting strategies to the social reality is part of our commitment to the community. Calidad Pascual´s project has risen on this premise and, loyal to it, we continue working, integrating new views to lead the food sector on the basis of innovation and quality. To do this, we have deepened our corporate strategy and renewed our branding, CALIDAD PASCUAL, putting the emphasis on what matters to consumers: enjoying healthy and quality products that meet their needs. In 2014 we have laid the ground for a company focused on creating shared value, based on excellence in management and dialogue with all our stakeholders. We now have a new way to understand businesses, focused on our people, ethically creating and sharing economic, labor, environmental and social value. As a consequence, we have taken important steps in developing our vision, mission, values, policies and strategies, both within the organization and with our partners, but also all along our supply chain. We have also extended the collaboration with our financial partners in order to guarantee a solvent and solid company with a capacity to grow in the forthcoming years. In 2015 we will take another step toward fulfilling our business model, with which we hope to make progress in all our areas of business, both in national and international markets. Moreover, the company has initiated a process of reviewing its strategy, which will involve establishing our goals in line with the business plan. Developing new dairy and healthy product categories, growing through innovation and enhancing our distribution potential will become some of our main objectives. Internationalization is another big challenge, all this while maintaining an excellent level of management throughout the value chain. It is therefore our goal to achieve the objectives while complying with the company´s mandate. In other words, to make it clear who we are and who we want to be: your family company, with a consolidated and differentiating set of values, and a leader in the food sector. Tomás Pascual Gómez-Cuétara 03 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX EXECUTIVE SUMMARY 2014 INCREASE REDUCE PRINT 02 Executive summary 2014 READY TO TAKE OFF The year 2014 has witnessed a Spanish food sector still suffering from a trend of weak consumption, albeit in an economic environment that is slowly recovering, where consumers are beginning to regain confidence. Despite these constraints, our company´s financial results respond to the implementation of the roadmap marked by the Strategic Plan Horizonte2015. In 2014 Calidad Pascual achieved a turnover of 720.4 million euros, 2.2% higher than the previous year, with an EBITDA of 73.6 million euros, 7.5% higher than 2013. We have therefore rejoined the path of growth for the first time in recent years, in a market still penalized by the financial crisis, a trend that we expect to consolidate during 2015. This will be the final year of our current business plan and we are working on the strategy for the next five years This will be the final year of our current business plan and the turning point for our future strategy. Looking back, we have made enormous progress, making the necessary adjustments in order to obtain optimal financial indicators. We are ready to take off. diabetics in a joint venture with pharmaceutical company Esteve has also been a significant development in this area. In addition to the preexisting partnerships, our distribution company Qualianza has reached a major agreement in 2014 with the Garavilla group for the distribution of the Conservas Isabel. Besides the remodeling of the business in the national market, we have continued to grow in the area of internationalization, re-launching our range of yogurts for exportation with a new recipe, image and packaging. Furthermore, the company has carried out an analysis of its international investments to bring them in line with its strategic priorities; this analysis led to the rethinking of the cycle of investments in Venezuela. In the local market, Calidad Pascual has continued in 2014 to focus on healthy food products through its main brands: Leche Pascual, Bezoya, Bifrutas, Vivesoy and Mocay Caffé, always focusing on improving consumers’ quality of life. Achieving these important economic goals would not have been possible without the new shared value creation approach and the integrated management of our impacts, which has been an impetus for the whole organization to work with our stakeholders in mind. As proof, indicators such as those measuring customer satisfaction have shown better results both among small and large-scale retail customers, as well as in our hotel business customers. We have also boosted our partnerships, joining forces with our partners to multiply value, with Unilever for the production of Flora dairy drinks and with Idilia Foods to develop Cola Cao and Okey smoothies, initiating in 2014 production in the Aranda de Duero complex. The launch of the DiaBalance range for This approach, backed by our corporate commitments, has allowed us to keep our employment rates as well as to invest in our staff, particularly in the areas of safety and excellence, helping to achieve a better work-life balance. Also noteworthy are the improvements in the working environment survey, “Great Place to Work”, with 85% participation and a score of 70 points. Finally, we must underline the results in the prevention of occupational risks, with a reduction of around 40% in the accident frequency rate. With regard to environmental matters, we continue developing our Pascal Environmental Impact Management Plan with remarkable progress on matters such as the management of the corporate carbon footprint, energy and water consumption or the generation of waste. But none of these achievements would have been possible without the huge commitment and professional and human talent of our people, the people of Calidad Pascual. More than 2,000 men and women that truly make our motto a reality everyday: “You are our reason for being”. We are satisfied with these results in all areas and we believe that in 2014 we have built a more solid company, with a greater capacity for growth based on innovation and quality and, above all, a greater capacity for creating shared value for all of our stakeholders. Ignacio García-Cano CEO of Calidad Pascual 04 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX OUR BUSINESS MODEL INCREASE REDUCE PRINT 03 Our business model: All our policies and strategies have been developed in order to achieve our vision and mission, staying true to our values Vision Mission Values Commitment to complying (doing the right thing): Corporate Responsibility and Good Governance Policy Policies How we work Commitment to creating value: Stakeholder relationship policy Shared Value Management with Stakeholders policy Commitment to excellent management: Excellence and Quality Policy Strategies Strategic lines and strategic plans • What do we have to do to get what we want? • Achieve our goals while meeting our commitments • Achieve our mission and vision 05 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX OUR BUSINESS MODEL INCREASE REDUCE PRINT Our Vision We want to be your company, both family-run and global, a leader in social matters and in quality nutrition. Our Mission We are a family company, with a set of consolidated and differentiating values and a leader in the nutrition sector. We are committed to satisfying consumers’ needs, offering them health, nutrition, quality of life and wellbeing and to being an ally for customers. Basing our development on diversification and independence, we are market leaders with innovative and quality products and services. We have a continued and collective commitment to achieving excellence in management. In this way, we will win the loyalty of our consumers, customers and collaborators. Also, we want to be a company that continues to progress, which transcends and creates value continually and results in an ethical and sustainable manner. 06 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX OUR BUSINESS MODEL INCREASE REDUCE PRINT 07 Our Values We are a family that integrated its values into the business model of its company, which allows us to move towards our goals without losing sight of our identity. Integrity We are committed to being honest, congruent, responsible and to act with integrity in all our areas of operation and all our relationships with our stakeholders. Innovation Quality Proximity We connect with our consumers, customers, employers, stockholders, suppliers and society in general through equality, empathy, mutual respect, trust and humility. We seek excellence and to create added value which make us different through the talent and effort that all of us dedicate for the daily improvement of our products, services and management procedures. We dream of a better future and for this reason we put all our effort and the necessary recourses into providing new and efficient solutions for the current and future needs of our stakeholders. Passion We believe in a culture of responsibility and we are convinced that success comes through motivation, commitment, engagement and enthusiasm that everyone in the organization shows. We have a continuous commitment so that these values are transferred to all our people and collaborators and are reflected in their tasks and their daily behavior. To this end, we have a Code of Conduct and the behaviors associated with these values have been developed. 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR VALUE CHAIN INCREASE 04 Innovation and Quality in our value chain Consumption Supply Livestock Logistics to factories Production Delivery to points of sale Distribution and sale WATER Agriculture Energy Calidad Pascual’s value chain Calidad Pascual’s value chain is more than a sequence of production processes. Through it, we communicate with the stakeholders, we identify risks and opportunities, and we start projects which allow us to meet our commitments and achieve our goals, and each stakeholder, their goals. It is for this reason that our value chain is a chain for the creation of shared value in which we reflect some of the most prominent projects in 2014. REDUCE PRINT 08 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT Most prominent projects in 2014 Engagement with our livestock breeders. More than 90% of them have been with us for more than 15 years. In 2014 we have worked together in efficiency programs which have improved our economic profitability and quality with less environment impact With our suppliers People management is based on Pascual values, leadership and skills models. We have the awards “equality in the workplace” and “family responsible company” We work with our suppliers, verifying their management systems, infrastructure, health and safety, food safety, environment and corporate social responsibility We continue with the Food Security Program with our livestock breeders We review the perception of our employees with surveys and we give variable remuneration based on the fulfillment of the actions plans designed for the improvement of working environment All the staff that have variable remuneration packages have incentives for the improvement of the company’s environmental impacts With our team With the public Business value Value with society Life-cycle assessment by product family We calculate our corporate carbon footprint We design products adapted to special needs (lactose, sugar, without frozen supply chain…) Our range of yogurts has involved the launching of 13 innovative products (7 in the international area) Value with the environment Integration of our values into the business model allows us to guarantee an ethical and responsible management We have launched to market 15 innovative products with the DiaBalance initiative, besides our new Bifrutas Caribe and white chocolate smoothie Value with employees According to the results of working environment surveys, we have implemented more than 50 actions plans in each work center and department, with a more than 95% of them being fulfilled We have the largest fleet of sustainable commercial vehicles in Europe RAP Movement (reduce, save, protect) for the prevention of food waste Ethical value and Good governance 09 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT Key figures The key figures and indicators that provide an understanding of how Pascual creates shared value across its whole value chain. 3,716 Suppliers 441 million euros generated in supply chain 2,367 Employees 720.4 26 761 116,000 Million euros turnover Vehicles with 5-star Ecostars certification Present in 62 Countries Business value Our corporative carbon footprint is 0.034 kilograms of carbon dioxide equivalent per kilogram of product* 73.6 Million euros EBITDA Value with society Value with the environment Value with employees Ethical value and Good governance *Scope 1 and 2. More info about the scope of emissions inventory in the GRI Contents section in the appendix: About this report Since 2010, we have considerably reduced the intensity per kilogram/ liter packaged of our consumer products: - Electric energy: 20.7% - Primary energy: 18.2% -Water: 21.4% 373 Dealers 29.3 Million consumers Million euros of international sales Points of sales (POS) 2.36% Workforce rotation Structuring of corporate compliance processes 880,000 Euros of innovation investment Integration of reporting channels in a single OPEN CHANNEL 19.9 Million kilometers traveled 10 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT Shared economic value In 2014 we improved our financial results, sharing a part of them with society and reinvesting another part, in a firm move to establish a sustainable model with our collaborators. Financing: Internal capital: 256.3 million euros Stabilization of the financial debt Financial net debt: 248.9 million euros Contribution to society in taxes: 104.5 million euros Economic value generated Turnover: 720.4 million euros Other key figures: EBITDA/Sales: 10.2% EBIT: 7.1 million euros EBITDA: 73.6 million euros International turnover: 26 million euros Economic value distributed: 99.1 million euros in employee benefits 557.5 million euros to suppliers Investment: Innovation: 0.88 million euros Economic value retained: Training: 0.4 million euros Depreciation and amortization: 27.3 million euros 18.2 million euros in tax on earnings 26.9 million euros in finance costs 2.4 million euros in community investments Reinvesting of the funds generated 11 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT Presence in Spain 06 Cantabria Vizcaya Asturias D Navarra A Coruña industrial plants in Spain Guipúzcoa E Girona Burgos Pontevedra A A Valladolid Aranda de Duero (2 plants) B (Burgos) Barcelona Zaragoza Tarragona C Castellón Madrid Islas Baleares Valencia Alicante B D Ortigosa del Monte Pamplona (Navarra) (Segovia) Córdoba Sevilla Murcia Granada Almería Málaga Cádiz Canarias C Trescasas (Segovia) E Santa Cruz de Tenerife Gurb (Barcelona) Las Palmas Headquarters of Calidad Pascual, since the beginning in 1969, Ctra. Palencia s/n – 09400 Aranda de Duero (Burgos) Central offices of Calidad Pascual, Avenida de Manoteras, 24 – 28050 Madrid Main activity: preparation, packaging, distribution and sale, among others, of dairy and related products with the Pascual brand, Bezoya mineral water, Vivesoy vegetable drinks, Bifrutas and Mocay Caffè 27 trade delegations through Qualianza, our distribution company 373 dealers 12 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT Brands and products We invest in quality and innovation, to develop products which respond to our customers’ different health and nutrition needs. BEZOYA Pascual dairy products Diversia and others BIFRUTAS 365 million euros 106 million euros 71 million euros 52.3% 15.2% 10.2% VIVESOY 43 million euros 36 million euros 6.2% 5.1% Mocay Caffè Egg products 32 million euros 31 million euros 4.6% 4.4% 2% YOGURES y POSTRES 14 million euros 13 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE REDUCE PRINT 14 International dimension We operate in 62 Russia Iceland Poland countries Belgium Slovakia Albania Turkey Portugal International sales: 26 million euros * Morocco Agreement with La Liga of professional football for the promotion of health, nutrition and sport in 26 countries. Libya Cuba Guatemala El Salvador Dominican Republic Honduras Haiti Antilles Venezuela Barbados Tobago Panama Ecuador Malta Suriname Cyprus Lebanon Kuwait China Pakistán Jordan Qatar Hong Kong UAE Mali Mauritania Cape Verde Chad Senegal Sudan Ghana Djibouti Nigeria Guinea Bissau Guinea Conakry Cameroon Equatorial Guinea Ethiopia Côte d’Ivoire Republic of the Congo Gabon São Tomé and Príncipe Taiwan Philippines Vietnam Maldivas Seychelles Angola Mayotte We have launched products exclusively for international markets. Mozambique Chile *Includes commercial products (does not include semi-industrial goods). Does not include sales to UK. N. Caledonia 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX INNOVATION AND QUALITY IN OUR Value CHAIN INCREASE Partnerships with other organizations are an essential part of our shared value model Patrocinador del Equipo Olímpico Español *In the Associations section in the appendix: About this report, we disclose all of the associations in which we participate. REDUCE PRINT 15 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we communicate with our stakeholders? INCREASE REDUCE PRINT 05 How do we communicate with our stakeholders? We identify our stakeholders and established mechanisms for dialogue with each of them, gathering information on their needs and expectations. The result of this process, together with the risks and opportunities review in the business model and the value chain, has allowed us to identify our material matters and integrate them into our corporate strategy. Identifying our stakeholders and the segments that make them up: • • • • • • Consumers Customers Employees Suppliers Society Capital Dialog channel selection Dialog channels with our stakeholders. Risks and opportunities review in the business model and the value chain Starting the dialogue and identifying the needs and expectations What are the matters that are important to them? We understand that the participation of the stakeholders in the decisionmaking process is a key element in the creation of shared value. 16 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we communicate with our stakeholders? • Performance Management System for all employees • Workplace atmosphere survey (Great Place to Work) • MERCO Personas Report • Satisfaction survey for FRC measures (Family Responsible Company) • Internal meetings • Open channel • Committees (Business, Health and Safety, etc.) • Cuentalonet Intranet • Internal review • Internal policies and standards • Code of Conduct • Corporate Website • Report of Creation of Shared Value • Open doors • Satisfaction surveys • Comunicaciones corporativas • Welcoming for new hires • Meetings with the owners • Measurement of training effectiveness and satisfaction • Board Meetings • Report of Creation of Shared Value • MERCO Report INCREASE • RepTrak® Pulse Spain Study • Corporate Website • Reputation Institute Customers Suppliers • Responsible Purchasing Protocol • Approval questionnaire • Evaluation questionnaire • Satisfaction surveys • Ad-hoc meetings • More than 2000 farm visits each year • Internal policies and standards • Code of Conduct • Corporate Website • Report on Creation of Shared Value • Corporate communications • Internal audits Consumers Society • Report on Creation of Shared Value • MERCO Report • Code of Conduct • Corporate Website • Volunteering PRINT • Code of Conduct Capital Employees REDUCE • Visits to industrial facilities • Customer Service Centre • Retailer satisfaction survey (Advantage Group) • Hotel industry survey panel (AECOC) • Business Review (retailers) • KAM (large clients) • On-going online sales • Route customer satisfaction barometer • Regional Director Delegations • Network Sales Staff • Customer Service Centre • Corporate Website • Code of Conduct • Report of Creation of Shared Value • Satisfaction surveys • MERCO Report • Ongoing RepTrak® Pulse Spain Study • Reputation Institute • Customer Service Centre • Market studies • Marketing analysis focused on specific groups • Havas Group study on CR • Corporate Website • Report on Creation of Shared Value • Code of Conduct • Social networks • Satisfaction surveys 17 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we communicate with our stakeholders? INCREASE REDUCE PRINT From listening to our stakeholders, what are the matters that are important for Pascual? •Last year we developed a materiality analysis to identify the key issues for our stakeholders that allow us to identify the priorities with regards to the company’s creation of shared value. 1st Grade 2nd Grade •This analysis has been carried out based on the shared value creation model, a strategic approach adopted by Pascual to guarantee a sustainable development model. •The preparation of this report and the strategic axes of our shared value creation model both respond to the matters that are relevant for the company and that play a part in the decisions of the stakeholders and in the company’s capacity to respond to their expectations. 6 Stakeholders criteria •As we can see in the chart, the analysis allows us to identify 4 grades of priority, assessing jointly the criteria of the stakeholders and Pascual. 1 2 3 4 5 6 5 13 9 7 8 4 14 12 10 11 3 16 15 2 1 1 2 3 4 5 Calidad Pascual criteria 6 3rd Grade 4th Grade 18 01. 02. 03. 04. 05. 06. APPENDIX How do we communicate with our stakeholders? From listening to our stakeholders, what are the matters that are important for Pascual? Nº Shared value creation topics 1 Comply with Calidad Pascual’s mission 2 Transparent management with values 3 Brand of prestige for quality and innovation 4 Products adapted to the consumer in health and nutrition 5 Innovation in the business and new products 6 Responsible model of people management 7 Sustainable economic and financial management 8 Ethical and responsible management along the whole of the value chain 9 Efficiency in the management of renewable and non-renewable resources 10 Pascual culture of partnerships and innovation 11 Guarantee of compliance with commercial commitments 12 Identification and management of risks and opportunities 13 Excellence of Pascual employees 14 Fluid, open and regular communication 15 Transparency in financial and non-financial management 16 Encouraging staff development and people’s wellbeing CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 19 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? How do we create value with our stakeholders? (6.1) Supply chain CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 20 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures Our programs and controls guarantee the best quality and a responsible and sustainable behavior from our suppliers, which moreover have our support for improving their performance in all areas. Safety guarantee program, with audit or verification of 100% of farmers validated according to UNE EN 45011: - External certificate in quality - External certificate in food safety 100% of the milk sourced certified 82 farms and 105.2 million liters of milk in production efficiency programs that have yielded: -Higher profitability for the farmer - Lower environmental impact -Higher guarantee of quality 470 farm suppliers in Spain 89% of spending on local suppliers of milk Business value Value with society Value with the environment Drawing up of a manual for environmental best practices in the production of milk Value with employees Milk mineral water 420 million liters of milk collected Continuous daily quality checks of sources 467 million liters of bottled water More than 132 million euros for suppliers of milk PLS label (Sustainable dairy products) of the Ministry of Agriculture, Food and Environment. 21 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures 11,207 kilograms of coffee from fair trade 4.9 million kilograms of soy 2.9 million kilograms of coffee Water consumption reduction programs Inclusion of environmental criteria for selection of suppliers Support for the program “Non-transgenic Spanish soy” Our supplies generate a total of 2,665 jobs 5.9 million euros for coffee suppliers Business value Value with society Value with the environment Value with employees 5 coffee suppliers SOY COFFEE Optimization of mineral compost used in the cultivation of soy 100% of strategic suppliers aligned with our policy of responsible purchasing GLOBAL 3.1 million euros for soy suppliers 658 million tetra brik packages certificated with the FSC label, which guarantees that the paper comes from sustainably managed forests 100% of contracts with approved suppliers 85% of our suppliers participate in the responsible suppliers program 22 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? How do we create value with our stakeholders? (6.2) Productions AND logistics CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 23 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures Our production and logistics, in addition to achieving the maximum standards of quality and efficiency, responds to responsible management of our employees and of the natural and social environment. ISO 9001 of quality and 22000 of food safety 100% of employees covered by collective agreements and with company benefits Emissions in short and long distance logistics of 66,273 tons of carbon dioxide equivalent Emissions in production of 44,272 tons of carbon dioxide equivalent (related to energy consumption) 10,282 visitors to factories Business value Value with society Value with the environment Value with employees Note: In the Certifications section in the appendix: About this report, we disclose the work centers that have the different certifications. Environment impact management plan Ecostars certification, for the environmentally efficient and sustainable management of our fleet of transportation vehicles Weight reduction in packages: 1,026,137 kilograms of materials avoided 6 industrial plants 70 points in the internal working environment survey, Great Place to Work Sustainable mobility plan Absenteeism rate of 3,01%, reducing the figure for 2013 100% of workers represented in the health and safety committee 1,206 million packages Wastewater treatment: performance of treatment facilities above 96% Performance management system for all the staff 1st food company to distribute with electric vehicles ISO 14001 of environmental management 275 trucks each day and 11.8 million kilometers in long distance 43 million euros generated in activities of logistics to factories We are subjected to the strictest quality and food safety controls: FSSC 22000, BRC, IFS and SQMS 90% of contracts are permanent 40% of our employees enjoy flexible hours programs HALAL label in our products 24 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures 1,235 jobs generated in production 99% of the energy acquired has a guarantee of renewable origin certified by the Comision Nacional de los Mercados y la Competencia 11.69 hours and 185 euros in training per worker Business value Value with society Value with the environment Value with employees 0.82 kilograms of waste sent to landfill per 1,000 kilograms/liters packaged 2.44% of people with disabilities in the workforce, improving on the 2013 rate 225 participants in corporate volunteer programs, taking part in 25 activities in collaboration with 11 work centers * (Accidents/number of hours worked) x1,000,000 OHSAS 18001 for the management of health and safety in work Pascual Contigo project, which includes measures relating to reconciliation, non-discrimination and equality of opportunities, integration of people with disabilities and social benefits offered to employees 588 jobs generated in logistics to factories Optimized long distance transportation fleet Consumption of 2.2 liters of water per kilogram/liter packaged Accident frequency ratio of 5.35*, reducing this index by about 40% and without serious accidents in 2014 Electric vehicles and trucks and powered by natural gas and liquefied petroleum gas 30% of women in the workforce Family responsible company indicator: 75, with 92% of actions carried out Primary energy consumption of 184 kilowatts/hour per 1,000 kilograms/liters packaged 7.12 points in the annual logistics management survey for transportation suppliers 92% of the actions included in the Director Training Plan have been carried out 94% of all waste generated is valorized 45% of key positions covered by internal promotion Consumption of 92.3 kilowatts/hour of electric energy per 1,000 kilograms/ liter packaged 25 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? How do we create value with our stakeholders? (6.3) MerchandisinG CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 26 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures The mutual collaboration model which we built with our customers based on innovation and establishing partnerships allows us to develop strategies for the creation of together. Through Qualianza, one of the leading Spanish companies in secondary distribution, we supply the hotel and traditional nutrition sectors 303 million euros invoiced in secondary distribution 8.60 out of 10 in the survey of secondary distribution clients Business value Value with society Value with the environment Training given to distributors in new legislative developments related to food safety, 24 hours to more than 50 people Value with employees Incorporation of the 100% electric vehicle for the distribution in cities 1,025 people dedicated to commercial tasks 715 jobs generated in delivery to points of sale (or outlets) 44 million euros generated in deliveries to points of sale (or outlets) Participation in more efficient distribution initiatives in urban centers 354 million euros invoiced in organized distribution 276 trucks each day and 8.1 million kilometers in distribution routes 72% of incidents with clients resolved on time 1,206 customer complaints, 100% dealt with and resolved DOI business intelligence portal Level of service and satisfaction of 97.41% (joint for all channels) 9th position in the Advantage Group ranking of organized distribution, improving 3 places compared with the prior year 11th place in the AECOC client satisfaction study of the organized hotel sector 27 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? How do we create value with our stakeholders? (6.4) Consumer products CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 28 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Key figures We adapt to the needs of each consumer, with a commitment to innovation and quality of our products. Speakers at food safety conferences: 1st European Food Safety Summit of Paris, organized by EuropeanVoice 13 product categories Through DiaBalance we offer products aimed at making life easier for people with diabetes Training in the management of allergies in the industrial complex of Aranda, 45 hours to 200 people Chef Millesime sponsor NAOS strategy for nutrition, physical activity and obesity prevention Business value Value with society Value with the environment Value with employees Leading position in the market shares of our brands: - LECHE PASCUAL: 12.3% - BEZOYA: 12.9% - VIVESOY: 29.3% - BIFRUTAS: 37.6% Tomás Pascual Sanz institute for nutrition and health Present in 52% of homes 1.1 million kilograms of products donated to 23 food banks 29 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? How do we create value with our stakeholders? (6.5) Ethical management AND good governance CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 30 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE Pascual Business Corporation Holding company of food and non-food companies, whose share capital belongs 100% to the Pascual Gómez-Cuétara family. Investee companies International National (100%) (100%) (50%) (100%) (100%) PASCUAL AGROPECUARIO (100%) TEGESTACIN (50%) (25%) (5%) 52 We have climbed positions compared with last year in the Merco ranking of responsible companies with the best corporate governance, reaching 26th place. PRINT 31 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INCREASE REDUCE PRINT Governance bodies in the Pascual Business Corporation 43% Pilar Gómez-Cuétara Fernández PRESIDENT Tomás F. Pascual Gómez-Cuétara PRESIDENT Joaquín Moya-Angeler Cabrera VICE-PRESIDENT Joaquín Moya-Angeler Cabrera VICE-PRESIDENT Tomás F. Pascual Gómez-Cuétara CEO THE PASCUAL BUSINESS CORPORATION, S.L. BOARD Pilar Pascual Gómez-Cuétara BOARD MEMBER Borja Pascual Gómez-Cuétara BOARD MEMBER César Bardají Vivancos BOARD MEMBER THE CALIDAD PASCUAL, S.A.U. BOARD Antonio Castañeda Camarero NON-MEMBER VICE-SECRETARY Antonio Castañeda Camarero NON-MEMBER VICE-SECRETARY D. Joaquín Moya-Angeler Cabrera PRESIDENT Joaquín Uriach Torelló PRESIDENT Cesar Bardají Vivancos NON-EXECUTIVE MEMBER Sonia Pascual Gómez-Cuétara NON-EXECUTIVE MEMBER D. Konstantin Sajonia-Coburgo y Gómez-Acebo NON-EXECUTIVE MEMBER Laura González Molero VOCAL Antonio Castañeda Camarero SECRETARY Antonio Castañeda Camarero SECRETARY 17% OF THE CALIDAD PASCUAL, S.A.U. GOVERNANCE BODY MEMBERS ARE WOMEN Borja Pascual Gómez-Cuétara BOARD MEMBER AND SECRETARY Sonia Pascual Gómez-Cuétara BOARD MEMBER AND SECRETARY APPOINTMENTS, COMPENSATION AND PERSONNEL COMMITTEE Juan José Pérez Cuesta BOARD MEMBER Laura González Molero BOARD MEMBER Joaquín Uriach Torello BOARD MEMBER AUDITING AND GOOD GOVERNANCE COMMITTEE OF THE PASCUAL BUSINESS CORPORATION S.L. GOVERNANCE BODY MEMBERS ARE WOMEN EFFICIENCY INDICATORS FOR INTERNAL AUDITS Compliance with the Audit Plan: 104 % Percentage of expenses audited: 84 % QUALITATIVE INDICATORS Internal Customer Satisfaction Survey: 8,21/10 Auditing Report to Management: Auditing and Good Governance Committee Our governance bodies include both independent and shareholder members 32 01. 02. 03. 04. 05. 06. APPENDIX How do we create value with our stakeholders? Commitments and policies The application of the corporate values to our mission makes us practice our activity according to the most demanding quality, ethical and responsibility criteria. For this we have developed policies which govern our behavior, as well as having taken on a series of external commitments, guaranteeing understanding with our stakeholders and the satisfaction of their needs, as well as cooperation in the development of the communities that surround us. In 2014 we have approved the corporative policies, implementing our open channel and updating the crisis management procedures for the main risks. CREATING SHARED VALUE REPORT 2014 INCREASE REDUCE PRINT 33 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX How do we create value with our stakeholders? INTEREST GROUPSGRUPO DE INTERÉS CONSUMERS CUSTOMERS EMPLOYEES COMMITTMENTS INCREASE REDUCE MANAGEMENT POLICIES AND TOOLS • Quality • Food safety • Transparent information on the company and its products • Compliance with information and product labelling requirements • Excellence in Management Area • Certified Quality Management Systems (ISO 9001) • Certified Food Safety Systems (ISO 22000, FSSC 22000, BRC, IFS) • Halal • Working Group on Advertising and Labelling Validation and Communication • Quality • Food safety • Innovation • EFQM Business Excellence Model (450-500 points in 2014) • Certified Quality Management Systems (ISO 9001) • Certified Food Safety Management Systems • (ISO 22000, FSSC 22000, BRC, IFS) • McDonald’s, Supplier Quality Management System • Halal • Conciliation • Satisfaction • Occupational health and safety • Talent and leadership model • Labour Market Impact Management Area • Certified Health and Safety System (OHSAS 18001) • Great Place to Work • Certified Family-Responsible Company (EFR) • Code of Conduct and Open Channel • Prevention and Action Protocol for sexual harassment in the workplace • Innovation and improvement • Loyalty • Support for quality • Payment guarantee • Purchasing Management Policy • Standard for supplier contracting and relations • Code of Ethics for supplier relations • Minimum entry requirements for suppliers SOCIETY • The Global Compact • Nutrition, physical activity, and obesity prevention • Self-monitoring of advertising • Prevention of food waste • Social Impact Management Area • Launching of Healthy Pascual • Certified environmental systems (ISO 14001) • Carbon footprint calculation Capital • Compliance with commitments acquired • Sustainable economic-financial management • Efficiency in management of working capital • Management of risks and opportunities • Corporate Responsibility and Good Governance Policy • Ethical Management and Compliance Area • Corporate Internal Auditing • Management Control Area ALL INTEREST GROUPS • Dialoguing with and listening to the interest groups • Excellence • Policy on Creation of Shared Value • Channels for dialogue with Interest Groups • EFQM Business Excellence Model (450-500 points in 2014) SUPPLIERS PRINT 34 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE PRINT APPENDIX: ABOUT THIS REPORT FRAMEWORK AND CRITERIA FOR THE DEVELOPMENT OF THIS REPORT 36 GRI CONTENTS 37 IIRC CONTENTS 43 GLOBAL COMPACT CONTENTS 44 SUPPLEMENTARY INFORMATION: ASSOCIATIONS IN WHICH WE PARTICIPATE 45 SUPPLEMENTARY INFORMATION: CERTIFICATIONS 46 35 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE FRAMEWORK AND CRITERIA FOR THE DEVELOPMENT OF THIS REPORT REPORTING PERIOD January – December 2014 SCOPE AND BOUNDARY During 2014 there were no significant changes in the scope and boundary applied in the report. This report has been drafted based on GRI G4 standard and it reflects our sustainability performance in a reasonable and balanced manner. PRINCIPLES FOR DEFINING REPORT CONTENT PRINCIPLES FOR DEFINING REPORT QUALITY • Stakeholder inclusiveness • Sustainability context • Materiality • Completeness • Balance • Accuracy • Timeliness • Comparability • Clarity • Reliability This report is in accordance with the reporting framework guidelines laid down by the International Integrated Reporting Council (IIRC). INTEGRATED REPORTING • Strategic focus and future orientation • Connectivity of information • Stakeholder relationships • Materiality • Conciseness • Reliability and completeness • Consistency and comparability PRINT 36 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE GRI CONTENTS INDICATOR PAGES COMMENTS GENERAL STANDARD DISCLOSURES STRATEGY AND ANALYSIS G4-1 – Statement from the most senior decision-maker. G4-2 – Key impacts, risks, and opportunities. 3 3, 16-34 ORGANIZATIONAL PROFILE G4-3 – Name of the organization. G4-4 – Primary brands, products, and services. G4-5 – Location of the organization’s headquarters. G4-6 – Number of countries where the organization operates, and names of countries where either the organization has significant operations or that are specifically relevant to the sustainability topics covered in the report. G4-7 – Nature of ownership and legal form. G4-8 – Markets served. G4-9 –Scale of the organization (employees , operations , sales, capitalization and quantity of products or services provided). 12 12, 13 12 14 31 13, 14, 27, 29 10, 11, 13 Turnover 2014: € 714,5 million Own resources 2014: € 270.4 million Net financial debt 2014: € 249 million 2013: : € 705 million 2012: € 724 million 2013: : € 271 million 2012: € 269 million 2013: € 273 million 2012: € 289 million G4-10 – Number of employees by employment contract and gender. 10, 24, 25 Employees 2014: 2.166 Permanent employees 2014: 90% 2013: 2.215 2012: 2.272 2013: 95.4% 2012: 93% G4-11 – Percentage of total employees covered by collective bargaining agreements. 24 G4-12 – Description of supply chain. 10, 21, 22 G4-13 – Significant changes during the reporting period regarding the organization’s size, structure, ownership, 4 or its supply chain. G4-14 – Precautionary principle. 34 G4-15 – Externally developed principles or initiatives to which the organisation subscribes or which it endorses 15, 34, 46 G4-16 – Principal associations to which the organisation belongs. 15, 45 IDENTIFIED MATERIAL ASPECTS AND BOUNDARIES G4-17 – Entities included in the organization. 31 G4-18 – Process for defining the report content and the aspect boundaries. 36 G4-19 – Material aspects identified. 16-19 16-19 G4-20 –Aspect boundary within the organisation. PRINT 37 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE INDICATOR PAGES G4-21 –Aspect boundary outside the organisation. G4-22 –Restatements of information provided in previous reports. G4-23 –Significant changes from previous reporting periods in the scope and aspect boundaries. STAKEHOLDER ENGAGEMENT G4-24 –Stakeholders. G4-25 – Basis for identification and selection of stakeholders. G4-26 –Approaches to stakeholder engagement. G4-27 – Key topics and concerns that have been raised through stakeholder engagement. REPORT PROFILE G4-28 –Reporting period. COMMENTS Not apply. 36 17 16, 17 17 16-19 G4-29 – Date of most recent previous report. G4-30 –Reporting cycle. G4-31 – Provide the contact point for questions regarding the report or its contents. 37 GOVERNANCE G4-34 –Governance structure. G4-37 – Processes for consultation between stakeholders and the highest governance body. ETHICS AND INTEGRITY G4-56 –Organization’s values, principles, standards and norms of behavior such as codes of conduct and codes of ethics. SPECIFIC STANDARD DISCLOSURES CATEGORY: ECONOMIC G4-EC1 –Direct economic value generated and distributed. G4-EC9 –Proportion of spending on local suppliers at significant locations of operation. PRINT 16-19 36 G4-32 – GRI Content Index. G4-33 – External assurance for the report. REDUCE 31, 32 17 7, 33, 34 11 21 The emissions inventory reported was made in 2014. June 2014. Annual. Corporate Responsibility and Communication Division. In accordance-core option. Not external assurance. 38 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 Appendix About this report INCREASE INDICATOR PAGES REDUCE PRINT COMMENTS CATEGORY: ENVIRONMENTAL G4-EN3 – Energy consumption within the organisation. G4-EN5 – Energy intensity. G4-EN6 –Reduction of energy consumption. G4-EN8 –Total water withdrawal . 25 Total energy consumption in factories. Electrical energy: 101,6 million kWh. Primary energy: 102 million kWh. 25 10, 24, 25 25 Total water consumption in factories: 2.464.874 m3 G4-EN15 – Direct greenhouse gas (GHG) emissions (Scope 1).* 9,162 t CO2eq. G4-EN16 – Energy indirect greenhouse gas (GHG) emissions (Scope 2).* 23,800 t CO2eq. G4-EN17 – Other indirect greenhouse gas (GHG) emissions (Scope 3).** 118,505 t CO2eq. G4-EN18 – Greenhouse gas (GHG) emissions intensity.* G4-EN23 – Total weight of waste by type and disposal method. G4-EN27 – Extent of impact mitigation of environmental impacts of products and services.. 10 Scopes 1 and 2. Calculated in 2014. 25 Hazardous waste: 50,040 kg (0,045 kg/ 1000 product litre/kg) Non-hazardous waste: 16,964.377 kg (15.41 kg/ 1000 product litre/ kg), being sent for recovery 94% of them. 20-25 There have not been sanctions for noncompliance with environmental laws and regulations. G4-EN29 – Monetary value of significant fines and total number of non-monetary sanctions for non-compliance with environmental laws and regulations. G4-EN30 –Significant environmental impacts of transporting products and other goods and materials for the organization’s operations, and transporting members of the workforce. G4-EN32 – Percentage of new suppliers that were screened using environmental criteria. 24, 25, 27 21, 22 * We have developed our emissions inventory for 2013 during 2014, which is reported on the table and it is the latest available. It has been developed in accordance with the ISO 14064-1: 2006 Greenhouse gases and recommendations of the GHG Protocol. The scope includes five industrial plants (Aranda de Duero, Gurb, Bezoya Ortigosa and Trescasas and Mocay), headquarters and 27 trade delegations. **The Scope 3 includes: -Fuel and energy related activities in the value chain. - Business trips. - Commuting (employees). - Lease of assets upstream. -Transport and distribution downstream. 39 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE INDICATOR PAGES REDUCE PRINT COMMENTS CATEGORY: SOCIAL. LABOR PRACTICES AND DECENT WORK G4-LA1 – Employee turnover. G4-LA2 – Benefits provided to full-time employees. G4-LA4 – Minimum notice periods regarding operational changes, including whether these are specified in collective agreements. G4-LA5 – Percentage of total workforce represented in formal joint management–worker health and safety committees that help monitor and advise on occupational health and safety programs. G4-LA6 –Type of injury and rates of injury, occupational diseases, lost days, and absenteeism, and total number of work related fatalities. 10 24, 25 According to the applicable law. 24 24, 25 No workers with high incidence or high risk of diseases related to their occupation. G4-LA7 – Workers with high incidence or high risk of diseases related to their occupation. G4-LA9 –Average hours of training per year per employee. G4-LA11 – Percentage of employees receiving regular performance and career development reviews. G4-LA12 – Composition of governance bodies and breakdown of employees by gender. G4-LA14 – Percentage of suppliers that were screened using labor practices criteria. G4-LA15 –Significant actual and potential negative impacts for labor practices in the supply chain. CATEGORY: SOCIAL. HUMAN RIGHTS G4-HR1 – Total number and percentage of significant investment agreements and contracts that include human rights clauses or that underwent human rights screening G4-HR5 – Child Labour. G4-HR6 – Compulsory Labor. 25 24 25, 32 9, 21, 22 21, 22 Every significant investments are subjected to screening on human rights. Compliance with Spanish law guarantees the right performance for this indicator. Compliance with Spanish law guarantees the right performance for this indicator. 40 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INDICATOR INCREASE PAGES It has not been identified significant transactions with negative impacts on local communities. CNMC made a sanction proposal in 2015 for supposed anticompetitive practices related to purchase of milk occurred in previous years. At the date of this report, it is under appeal and there is not a final decision. Legal actions for anti-competitive behavior, anti-trust, and monopoly practices. G4-SO9 – Percentage of new suppliers that were screened using criteria for impacts on society. G4-S10 – Significant actual and potential negative impacts on society in the supply chain and actions taken. COMMENTS 9, 24, 25, 29 G4-SO2 –Operations with significant actual or potential negative impacts on local communities. G4-SO7– PRINT Every significant operations are subjected to screening on human rights. G4-HR9 –Total number and percentage of operations that have been subject to human rights reviews or impact assessments. CATEGORY: SOCIAL. SOCIETY G4-SO1 – Percentage of operations with implemented local community engagement, impact assessments, and development programs. REDUCE 9, 21, 22 9, 21, 22 41 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE INDICATOR PAGES REDUCE PRINT COMMENTS CATEGORY: SOCIAL. PRODUCT RESPONSIBILITY G4-PR1 – – Percentage of significant product and service categories for which health and safety impacts are assessed for improvement. G4-PR3 – Type of product and service information required by the organization’s procedures for product and service information and labeling, and percentage of significant product and service categories subject to such information requirements. G4-PR5 – Results of surveys measuring customer satisfaction. 29 24, 34, 46 27 G4-PR7 – Total number of incidents of non-compliance with regulations and voluntary codes concerning marketing communications, including advertising, promotion, and sponsorship. We are members of the SelfRegulation of Commercial Communication Association and we have our own Monitoring Committee. It has not been happened noncompliances in this area in 2014. Another company made a claim in the scope of the Self-Regulation of Commercial Communication Association which is being evaluated by the Disciplinary Matters Commission. G4-PR9 – Monetary value of significant fines for non-compliance with laws and regulations concerning the provision and use of products and services. Our fleet distribution has received 30 penalties for noncompliance of road transport legislation in 2014 (€ 10.072), the main reason was the overloading. INDICADORES ESPECÍFICOS DEL SUPLEMENTO SECTORIAL “FOOD PROCESSING” FP1 – Suppliers compliant with company’s sourcing policy. 9, 21, 22 FP5 – Production manufactured in sites certified by an independent third party according to internationally 24, 46 recognized food safety management system standards. Food and healthy habits and healthy lifestyles - Initiatives to promote healthy lifestyles and nutritious, balanced and 29 accessible nutrition. 42 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE PRINT IIRC CONTENTS CONTENTS PAGES General description 8-15 Mission, Vision and Values 5-7 Composition of the supply chain 21, 22 Ownership structure 31 Main magnitudes 9-11 Governance and decision-making processes 32 Corporate Governance 31-34 Creating Shared Value 8-11, 20-34 Stakeholders 16-17 Materiality 18-19 Products and results 10, 11, 13, 20-29 Description and identification of the main risks and opportunities, and performance about them 3, 16-19 Strategic planning 3-5, 18-19 Commitment to stakeholders 34 Performance Key Performance Indicators 9-14, 20-34 Outlook Challenges and objetives 3 Basis of preparation and presentation Framework and criteria for the development of this report 36 Organizational overview and external environment Governance Business model Risks and opportunities Strategy and resource allocation 43 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE PRINT GLOBAL COMPACT CONTENTS Theme The Ten Principles of the UN Global Compact GRI indicators reported for each principle Principle 1. Businesses should support and respect the protection of internationally proclaimed human rights; and G4-HR9, G4-SO1, G4-SO2 Principle 2. make sure that they are not complicit in human rights abuses G4-HR1 Principle 3. Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining; G4-11, G4-LA4 Principle 4. the elimination of all forms of forced and compulsory labour; G4-HR6 Principle 5. the effective abolition of child labour; and G4-HR5 Principle 6. the elimination of discrimination in respect of employment and occupation. G4-10, G4-LA1, G4-LA9, G4-LA11, G4-LA12 Principle 7 Businesses should support a precautionary approach to environmental challenges; G4-EN3, G4-EN8, G4-EN15, G4-EN16, G4-EN17, G4-EN27 Principle 8. undertake initiatives to promote greater environmental responsibility; and G4-EN3, G4-EN5, G4-EN6, G4-EN8, G4-EN15,G4-EN16, G4-EN17, G4-EN18 , G4-EN23, G4-EN27, G4-EN29, G4-EN30, G4-EN32 Principle 9. encourage the development and diffusion of environmentally friendly technologies. G4-EN6, G4-EN27 Principle 10. Businesses should work against corruption in all its forms, including extortion and bribery. G4-56 Human Rights Labour Environment Anti-Corruption 44 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE PRINT SUPPLEMENTARY INFORMATION: ASSOCIATIONS IN WHICH WE PARTICIPATE ADFO CET, S.L. (Centro especial de empleo de la Associació de Disminuïts Físics d’Osona) Calidalia Federación Española de Hostelería Casino de Madrid Federación Española del Café AECOC (Asociación Española de Codificación Comercial) Centro Español de Logística FENIL (Federación Nacional de Industrias Lácteas) AFOTUR (Asociación Fomento Turismo Ribereño) Agrupació De Sords De Vic i Comarca AME (Asociación Multisectorial de Empresas de Alimentación y Bebidas) CEOE (Confederación Española de Organizaciones Empresariales) Círculo de Confianza (Nueva Economía Fórum) FIAB (Federación Española de Industrias de Alimentación y Bebidas) Círculo Empresarios Forética Club Financiero Génova Fundación EXECyL (Fundación para la Excelencia Empresarial de Castilla y León) ANEABE (Asociación Nacional de Empresas de Aguas de Bebida Envasada) Club Siglo XXI ASEMAR (Asociación de Empresarios de Aranda y la Ribera) Confederación de Organizaciones Empresariales de Castilla y León ASEPRHU (Asociación Española de Productores de Huevos) Dircom (Asociación de Directivos de Comunicación) Asociación de Cocineros y Reposteros Ecoembes Asociación de Empresas Lácteas de Galicia Empresa Familiar Castilla-León Asociación de Industrias de Alimentación de Aragón ENSA (European Natural Soy and Plant Based Manufacturers Organisation) Instituto de Auditores Externos de España Asociación Española de Ciencia Avícola Escuela Superior de Hostelería y Turismo de Madrid Instituto Vasco de Logística European Dairy Farmers Asociación Regional de Industrias Lácteas de Cantabria Sociedad Española de Seguridad Alimentaria Euro-Toques Comunidad Europea de Cocineros Associació Cultural La Creativa Unión de Comerciantes Polivalentes de Mercamadrid Federación Castellano-Leonesa de Industrias Lácteas Asociación para la Innovación en Prevención y Salud Autocontrol de la Publicidad Comunidad de Regantes del Canal de Aranda Fundación Francisco Martínez Benavides Fundación Seres Gremi Indústries Làctiques de Catalunya Halal Food Council Of Europe IESE Business School INOVO (Asociación Española de Industrias de Ovoproductos) Instituto de la Empresa Familiar Promarca 45 01. 02. 03. 04. 05. 06. CREATING SHARED VALUE REPORT 2014 APPENDIX ABOUT THIS REPORT INCREASE REDUCE SUPPLEMENTARY INFORMATION: CERTIFICATIONS ISO 9001 ARTEOVO BARRANCOS BEZOYA I BEZOYA II CAMPORROBLES ARANDA GURB MOCAY MANOTERAS MADRID DELEGATION BARCELONA DELEGATION VALENCIA DELEGATION VALLADOLID DELEGATION OTHER DELEGATIONS LA QUINTA PEACHE MILK SUPPLY ISO 14001 OHSAS 18001 ISO 22000 FSSC 22000 BRC IFS EFR SQMS (Mc Donald’s) HALAL PRINT 46 Calidad Pascual, S.A. Avenida de Manoteras, 24. 28050 Madrid, España