Costco Wholesale Corporation (COST)

advertisement

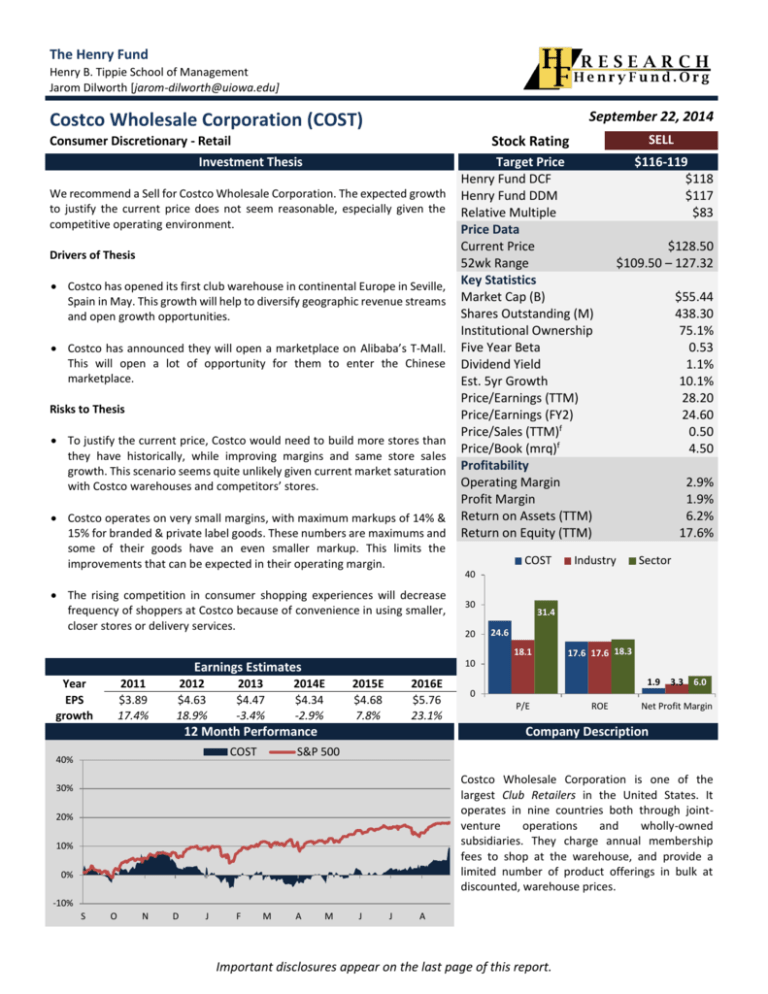

The Henry Fund Henry B. Tippie School of Management Jarom Dilworth [jarom-dilworth@uiowa.edu] September 22, 2014 Costco Wholesale Corporation (COST) Investment Thesis We recommend a Sell for Costco Wholesale Corporation. The expected growth to justify the current price does not seem reasonable, especially given the competitive operating environment. Drivers of Thesis Costco has opened its first club warehouse in continental Europe in Seville, Spain in May. This growth will help to diversify geographic revenue streams and open growth opportunities. Costco has announced they will open a marketplace on Alibaba’s T-Mall. This will open a lot of opportunity for them to enter the Chinese marketplace. Risks to Thesis To justify the current price, Costco would need to build more stores than they have historically, while improving margins and same store sales growth. This scenario seems quite unlikely given current market saturation with Costco warehouses and competitors’ stores. Costco operates on very small margins, with maximum markups of 14% & 15% for branded & private label goods. These numbers are maximums and some of their goods have an even smaller markup. This limits the improvements that can be expected in their operating margin. Target Price Henry Fund DCF Henry Fund DDM Relative Multiple Price Data Current Price 52wk Range Key Statistics Market Cap (B) Shares Outstanding (M) Institutional Ownership Five Year Beta Dividend Yield Est. 5yr Growth Price/Earnings (TTM) Price/Earnings (FY2) Price/Sales (TTM)f Price/Book (mrq)f Profitability Operating Margin Profit Margin Return on Assets (TTM) Return on Equity (TTM) COST 30 Earnings Estimates 10 2012 $4.63 18.9% 2013 $4.47 -3.4% 2014E $4.34 -2.9% 2015E $4.68 7.8% 2016E $5.76 23.1% 12 Month Performance COST 40% $128.50 $109.50 – 127.32 Industry $55.44 438.30 75.1% 0.53 1.1% 10.1% 28.20 24.60 0.50 4.50 2.9% 1.9% 6.2% 17.6% Sector 20 31.4 24.6 18.1 2011 $3.89 17.4% $116-119 $118 $117 $83 40 The rising competition in consumer shopping experiences will decrease frequency of shoppers at Costco because of convenience in using smaller, closer stores or delivery services. Year EPS growth SELL Stock Rating Consumer Discretionary - Retail 17.6 17.6 18.3 1.9 3.3 6.0 0 P/E ROE Net Profit Margin Company Description S&P 500 Costco Wholesale Corporation is one of the largest Club Retailers in the United States. It operates in nine countries both through jointventure operations and wholly-owned subsidiaries. They charge annual membership fees to shop at the warehouse, and provide a limited number of product offerings in bulk at discounted, warehouse prices. 30% 20% 10% 0% -10% S O N D J F M A M J J A Important disclosures appear on the last page of this report. Comparison of size and number of stores in United States. EXECUTIVE SUMMARY We recommend a Sell for Costco. Costco has implemented some good growth strategies recently, including opening stores in continental Europe. Costco has a good management team in place to execute their strategy, but to justify their current stock price, Costco would need to improve New Stores, COGS as a percent of Sales, or Same Store Sales CAGR by more than historical average. There is not a catalyst to justify a strong combination of these changes. Scenario 1 Scenario 2 Scenario 3 Historical New Stores COGS annually percent Sales 25 86.38% 35 86.34% 46 86.54% 25-30 86.54% as CAGR Same of Store Sales 3.46% 2.02% 2.02% 2.02% Costco already operates on a small margin. Because of their corporate policy regarding markups, branded goods cannot have a markup greater than 14% and private label goods cannot have a markup greater than 15%. We do not expect their COGS as a percent of Sales to decrease below 86.3%. Although their maximum markup is 14% for branded goods, they do not always markup their goods the maximum 14%, which keeps the average markup below 14%. Company Description Costco Wholesale Corporation is a wholesale retailer headquartered in Issaquah, WA. As of Aug 31, 2014, Costco operated 653 warehouses in eight countries (United States, Canada, Mexico, United Kingdom, Japan, Korea, Taiwan, & Australia). The company operates an online e-commerce website (www.costco.com) and also receives revenue from membership fees. Approximately 3% of its revenue is generated from online sales, another 1.5-2% is generated through membership fees, and the remaining 95% is generated from in-store sales. The below map illustrates Costco’s locations in the United States. Of total Costco warehouses, 16.7% are located in the state of California, while those same stores provide over 23% of Costco’s revenue. This indicates that the stores in California increase the average revenue per warehouse. Relying on such a concentrated area is a large risk for a big box retailer. Costco is very dependant on the economic and natural environments in California. Costco Locations in Continental United States. COMPANY DESCRIPTION Competitive Landscape Costco is the second largest club warehouse/supercenter in the United States with 17% market share compared with Walmart’s 64%i. Although Walmart has a large market share, Costco has positioned itself to compete in the middle class market. BJ’s is the next largest club warehouse, but it operates exclusively in states located on the Atlantic seaboard. The below table illustrates Costco’s position in the United States compared to its competitors in both number of locations and the average size of warehouses. Sam’s Club has 40% more stores than Costco in the United States. Based on Sales/Sq. Ft., Costco is the category leader. They are able to generate over twice as many sales per square foot as BJ’s Warehouse and nearly twice as many sales per square foot as Sam’s Club. Simplymap.com Products Costco offers a diversified group of products including food, appliances, and electronics among other items. This diversified product list offers its customers an opportunity to streamline their shopping and complete it in one stop. They offer many products from food & grocery to Page 2 appliances & home furnishings. The below chart illustrates their product mix in sales. In fiscal end 2013, the US & Canada represented 88% of net sales. The international expansion will help to diversify revenue streams, especially as 23% of total revenue came from stores in California. This is a risk that we expect to decrease especially as international expansion projects are implemented. The Seattle Times reported that 14,000 new members had signed up for Costco memberships as of May 10. Alibaba T-Mall Data taken from 10-k. With a pretty even distribution between the product lines, Costco has a well-diversified product portfolio amongst its product categories. It also changes products frequently enough to keep customers engaged and returning often to Costco warehouses. Warehouse Costco has a physical retail footprint that is much smaller than that of some competitors. It sells goods in a warehouse format that averages 143,000 square feet in each warehouse. Sam’s Club operates 632 club stores in the United Statesii; whereas, Costco only operates 451 club stores in the United States. Costco still has a strong market share and limits the use of debt in financing its expansion. Costco’s long-term debt is less than 9% of its capital structure, which is comparable to its peer group. RECENT DEVELOPMENTS European Expansion Costco opened its first store in Spain earlier this yeariii. This represents its first footprint on mainland Europe and its plans for a broader global expansion. Half of its expected new stores in 2014 are expected to be outside the United States. We expect this to add more volume to its existing user base in addition to the revenue generated from the new store locations. With Spain still near 25% unemploymentiv and a population that is below replacement ratev, there is a concern about Costco’s growth opportunities as a new entrant as domestic stores such as Zara are closingvi. Costco recently announced it would be entering the Chinese marketplace via Alibaba’s T-Mall.vii In the 30 days since the announcement, COST stock has increased approximately 10% in value from $126 to $139. For Costco to beat the market expectation, they will need to grow their Alibaba to become over 10% of their revenues. We do not feel that they have the potential to reach these numbers. INDUSTRY TRENDS Cybersecurity Given the number of recent cyber attacks, many companies are looking to increase security for data and credit cards. The number of retailers continues to grow; the largest and most publicized was the Target security breach. Other recent attacks include Home Depot, Supervalu, & P.F. Chang’s. This is a growing concern among retailers that they need to provide better data security for their customers. The largest risk for a retailer is reputational risk. As was seen with Target, they lost a lot of faith from consumers due to the credit card breach.viii This has translated into lower revenue for Target as they have lowered guidance twice in the last three months.ix Target revealed the data breach has cost them $148 million, 25% of which was insured.x Excluding the direct costs, they are lowering forward guidance as shoppers are less inclined to shop at Target. Canadian Expansion Ernst & Young has identified Canada as a potential area for expansion for many retailers.xi This may increase the competitive landscape in Canada as American retailers expand into the Canadian marketplace. Chico’s & Nordstrom are among those considering expansion into Page 3 Canada. Canadian expansion is difficult and requires a different strategy than that employed in domestic markets. Target is the most recent American company to have trouble expanding into the Canadian marketplace.xii The Ernst & Young report details some of the different shopping habits that include a lower percentage using coupons, but a higher use of dollar stores and deepdiscount grocery. The report accentuates that Canadians are really looking for a bargain in their shopping. Evolving Shopping Experience The evolving shopping experience is greatly changing the way consumers shop for goods, especially groceries and consumer durables. Two recent developments include Amazon Fresh and Walmart Neighborhood Market. Amazon Fresh is a grocery delivery business that Amazon.com engages in, leveraging its strength in delivering goods. It provides same-day delivery including early morning delivery of groceries.xiii Pilot programs exist in three metropolitan areas: Seattle, Los Angeles, & San Francisco, with an expected expansion to New York City this fall. These metropolitan areas pose the greatest risk to Costco as nearly 25% of its operating revenue is generated from stores in California alone. Because the convenience of having groceries delivered is greater than the convenience of traveling to a club warehouse, this type of shopping poses a risk to Costco as it may encourage shoppers to use the delivery service for many items and reduce the frequency of traveling to a club warehouse. Costco could compete with these type of retailers through an increased web presence and stronger delivery system. Walmart Neighborhood Market is Walmart’s response to the increase in dollar store shopping. This allows Walmart to decrease the square footage in its stores and compete in areas that do not have available real estate for big box retailers. Walmart is expected to add 270-300 Neighborhood Market’s to its footprint this year.xiv After piloting two programs (Neighborhood Market & Walmart Express), Walmart decided to use the Neighborhood Market as its small store brand.xv larger club warehouse locations. Costco mitigates this through the low prices it offers. Consumer Disposable Income The more disposable income that consumers have, the better this industry performs.xvi The trend for the past five years illustrates that consumer disposable income has been steadily increasing. The forecast is for per capita disposable income to continue to increase, which will in turn increase spending at club warehouses like Costco. The below report from IBISWorld illustrates Per capita disposable income change side-by-side with corporate profits for the Club Warehouse industry. Source: Ibisworld.com The below chart from the St. Louis Federal Reserve Database (FRED) illustrates the growth in real disposable personal income on a per capita basis chained in 2009 US dollars. The chart shows the long period of growth during the 1990’s and 2000’s. The growth in real disposable income reversed for a short period during the recent recession, but seems to have started to improve and we expect that real disposable personal income will continue on a sustained growth rate of approximately 2% over the forecast period. The small-store footprint is a risk to Costco as the neighborhood markets will be in areas that may not accommodate a 140,000 square foot club warehouse. This may encourage shoppers to shop in their neighborhoods more regularly and make less frequent shopping trips to Page 4 MARKETS AND COMPETITION Barriers to Entry The club/warehouse retail industry requires moderate capital investment. The size of a warehouse is large and the investment would also require a distribution network and a supplier network that is willing to sell club size products. The broader retail industry does not require as much capital investment and competition is still quite high. Given the recent economic recession, people have been focusing on finding the highest quality at the lowest costxx. These “deal hunters” have found coupons and other ways to save money. Dollar stores have increased their presence significantly over the last five years and have started to take more market share. Source: St. Louis Federal Reserve Gross Margin Gross margin is an area where Costco can significantly affect its net income. Costco has publicly stated that it will not markup private label products by more than 15% of costs and will not markup branded products by more than 14%.xvii This is a relatively low margin as other retailers look to raise prices as often as possible; Costco has strict limitations on its markups. Because of the low markups on its products, Costco’s COGS has averaged between 86-87% as a percent of Sales. At that level, an increase in gross margin by 10 basis points can increase net income by 383 basis points. Recently, the price of poultry has increased and nearly all of Costco’s competitors have raised prices accordingly. However, Costco has maintained its price of rotisserie chicken at $4.99. This has helped to drive volume, but they have been taking very little margin on that product. This is an example of products in which Costco maintains a lower price to help drive volume.xviii The sales are less than .0003% of total revenue, but this shows why Costco will never reach its maximum operating margin and why small improvements are difficult to make. European Retail Environment Retail in Spain was a difficult market in 2013. Much of this was due to rising unemployment and austerity measures by the government to stabilize the economy. In reviewing supermarkets and hypermarkets, Euromonitor International found that supermarkets performed much better than hypermarkets (such as Carrefour) as people wanted to shop closer to home and the smaller supermarkets were seen as more affordable.xix Supplier Power Supplier power in this industry is low. Because of the limited number of products offered at a club warehouse, the club must ensure that they are receiving the best prices on that particular product. Costco is very aggressive on pricing and warns suppilers to not give Costco’s competitors better prices. When one supplier accidentally sent its Walmart invoice to Costco, they saw Walmart was receiving a better price and have not brought that supplier back to Costco.xxi Because Costco only maintains 4,000 SKU’s compared to 100,000 SKU’s at a Walmart, it helps to keep the supplier power low. Toothpaste is a relatively easily replaceable product, so if one supplier does not give the best price, Costco can turn to a different supplier. Peer Comparisons The below chart illustrates the P/E ratio for Costco and some of its competitors. Costco trades at a relatively high P/E ratio compared to its competitors. Although Costco’s P/E ratio decreases in future years, compared to its peer group, it still remains relatively high. Amazon was included as an online retailer, but because it has a negative P/E, we chose to exclude it from any averaging within the peer group. Walmart, Target, & Kroger seemed to be natural peers in their respective spaces. Because Costco has a global footprint and especially because it has entered the continental European market, we felt Carrefour should be included in any peer analysis. Because of Costco’s pharmacy and healthcare related sales, we felt CVS would be a natural inclusion to incorporate data from a drugstore/pharmacy. Excluding Walmart & Amazon, many Page 5 of the peer in the analysis represent a similar market cap to Costco. Costco has a very high P/E ratio compared to its peer group. Its outlook for 2014 is to trade at 28x P/E; whereas, the rest of the peer group is expected to trade a much lower P/E ratios. Company Price WMT $ 76.84 TGT $ 63.81 AMZN $ 331.32 CRRFY $ 6.64 KR $ 52.15 CVS $ 81.37 COST $ 126.50 Source: MSN Money P/E 14 15.2 19.9 (2,208.8) 16.2 15.9 18.1 28.1 Market Cap (billions) 247.618 40.438 153.082 23.827 25.497 94.237 55.444 ECONOMIC OUTLOOK Minimum Wage There has been a lot of regulatory discussion around raising the federal minimum wage. Some states have taken action to increase state minimum wages. Instead of trying to compensate employees through competitive pricing models, Costco compensates employees at a higher rate than competitors. Costco’s hourly employees are compensated on average $20.89/hour.xxii Currently, the federal minimum wage is $7.25/hour. Because Costco compensates its employees at a much higher wage than the laws require, we expect Costco to be more insulated from minimum wage increases than its competitors. A benefit of the higher wages include higher employee retention. Costco has benefited from its investment in its employees by having a lower turnover rate from its competitors.xxiii This lower turnover rate translates into a more productive workforce because less time and money is spent on training and the candidate search process. We do expect if the minimum wage is raised significantly and its competitors react by increasing wages, that Costco may be affected by the increase, which will have an adverse affect on Net Income, the extent would be determined by the wage increase. Sales Per Square Foot Costco is an industry leader in Sales per square foot. They currently have about twice as many sales per square foot as their competitors Sam’s Club & BJ’s Warehouse. For this reason, we do not expect Costco to grow Sales/Sq. Ft. at a greater rate than their historical average. We do expect Costco to continue to grow sales per square foot as their brand awareness improves and more people buy memberships and disposable income increases. CATALYSTS FOR GROWTH Costco’s growth will principally come from new geographic areas. These will most likely include its expansion into Europe. Costco customers typically have a larger disposable incomes, which requires more stable economies. Costco has a lot of opportunities to expand its online presence and increase online sales. Online sales are only 3% of total revenues. Costco will need to invest more in its online infrastructure and marketing to its customers to expand and grow this revenue stream. Online retailing has grown in recent years, especially with retailers such as Amazon Fresh. An increased online presence/delivery system could help Costco to better compete in an online environment. INVESTMENT POSITIVES • Costco has had great success thus far in its international expansion, which includes Canada, Taiwan, and South Korea. These expansions have illustrated its capabilities in understanding the retail environment in a new culture and changes needed to succeed in those different environments. We would expect Costco to continue their successful international expansion as they move into continental Europe. • Costco has continued to perform well and grow through the economic recession, which was something that many peers in the discretionary sector were unable to accomplish. • Costco has begun its expansion project into mainland Europe. Management is pleased with the initial results and expect to increase their footprint in mainland Europe. As European expansion increases, this will diversify their revenue base from the high exposure to the Californian economy. Page 6 INVESTMENT NEGATIVES • To justify the current stock price, Costco would need to improve on two of three variables (Store Growth rate, Operating Margin, or Sales/Sq. Ft.) by more than historical average. • Although Costco does not have major competitors in the club warehouse area, as shopping continues to evolve, Costco will need to develop a stronger online presence and evolving formats to compete with same-day delivery shopping. The smaller-store formats introduced by Walmart may have a negative impact on Costco’s earnings as customers shop at the warehouse less frequently. • Costco is entering Europe, which has a declining population and smaller families. It will be harder to sell warehouse size goods for fewer people in the household; therefore, Costco will need to adjust package sizing to adapt to local preferences. VALUATION Sales growth – In the revenue decomposition, we calculated the revenue per square foot and were able to use a historical average for that growth. We made some assumptions about warehouse growth, that Costco would continue to add approximately 25 stores each year and each warehouse would average to 140,000 square feet. Although Walmart has entered into smaller store formats for some of its urban areas, this strategy does not make sense for Costco to pursue, and we do not feel it will change its format in the near future. COGS – This was a sensitive metric in the Income Statement. Because Costco does not engage in greater than 14% markup on branded products and no larger than 15% for private label goods, as a percentage of sales, this metric could only be less than 86% if Costco began to sell more private label goods than branded goods. The mix becomes important when determining the gross margin. We chose to keep the margin above 86%, assuming that Costco would continue to sell more branded goods than private label goods, and that they would not always be able to secure the maximum markup they expected. There is a strong sensitivity to this number. Small changes in the margin can make drastic changes in the valuation. As was noted above, a 10 basis point change in this metric can change net income by 383 basis points. Beta – For the beta, we used a three-year weekly return taken from Bloomberg. We felt three years would give a better reflection of expected growth during the next five years. A sensitivity analysis on the beta does not change the recommendation to sell this security. Dividend Payout – Costco has a strong history of raising its dividend annually. We expect this trend to continue through the next five years, especially as Costco expands its international footprint. We do expect Costco to raise dividends by approximately 9% annually, given historical trends. Capital Expenditure – We included Costco’s average costs in growing their number of stores by 30 stores each year because this was the assumption we made in the revenue decomposition. Although we expect Costco’s global mix to change going forward as they increase their European footprint, we do not expect that to significantly change the cost structure for new store construction/leases compared to their current mix. Results of models – The different valuation models provided different price targets, but were relatively close to each other. The DCF & DDM provided target prices that were within $2.00 of each other. The DCF & DDM provide the best target prices. Costco currently trades at a higher P/E than its peer group. Part of this higher valuation is due to its ability to continue to grow during the recent economic turmoil. Their growth provided investors with an increased confidence in management to continue to grow their business as they have been able to execute this strategy profitably even during a recession. KEYS TO MONITOR Key considerations include monitoring Costco’s European expansion to evaluate its success. If the European expansion proves to be more successful than domestic stores, the rating on this stock may change. Another consideration is the expected changes in shoppers’ habits. We expect shoppers to migrate to more online delivery systems and less frequent trips to club warehouses due to increased smaller stores in their neighborhoods. If Costco is able to produce a same-day food delivery service or a stronger online presence, they would be more competitive and the rating on this stock may change. Page 7 IMPORTANT DISCLAIMER Henry Fund reports are created by student enrolled in the Applied Securities Management (Henry Fund) program at the University of Iowa’s Tippie School of Management. These reports are intended to provide potential employers and other interested parties an example of the analytical skills, investment knowledge, and communication abilities of Henry Fund students. Henry Fund analysts are not registered investment advisors, brokers or officially xii REFERENCES i Lerman, Sally. 2014. Warehouse Clubs & Supercenters. Ibisworld. ii Walmart 2013 10-k report. iii Gonzalez, A. May 2014. http://seattletimes.com/html/businesstechnology/2023580206 _costcosevillexml.html iv licensed financial professionals. The investment opinion contained in this report does not represent an offer or solicitation to buy or sell any of the aforementioned securities. Unless otherwise noted, facts and figures included in this report are from publicly available sources. This report is not a complete compilation of data, and its accuracy is not guaranteed. From time to time, the University of Iowa, its faculty, staff, students, or the Henry Fund may hold a financial interest in the companies mentioned in this report. International Monetary Fund. 2014. http://www.imf.org/external/pubs/ft/weo/2014/01/pdf/c2.pdf v The Economist. 2012. http://www.economist.com/node/21557774 vi Mallen, P. 2014. International Business Times. http://www.ibtimes.com/its-long-way-recovery-spainsunemployment-rate-remains-26-despite-gdp-growthpredictions-1577504 vii Wang, Y. October 14, 2014. Forbes. Costco Makes China Debut through Alibaba. http://www.forbes.com/sites/ywang/2014/10/14/costcomakes-china-debut-through-alibaba/ viii Notte, J. 2014. TheStreet.com http://www.thestreet.com/story/12890092/1/how-do-homedepot-and-target-save-their-reputations-after-databreach.html ix D’Innocenzio, A. 2014. Los Angeles Daily News. http://www.dailynews.com/business/20140820/targetexpects-to-make-less-money-as-data-breach-fallout-lingers x Sharf, S. 2014. Forbes. http://www.forbes.com/sites/samanthasharf/2014/08/05/targ et-shares-tumble-as-retailer-reveals-cost-of-data-breach/ xi Valerio, D. 2013. Ernst & Young. http://www.ey.com/Publication/vwLUAssets/EY_Canada_Emer ging_Market_Newsletter_US/$FILE/EY-Canada-emergingmarket-newsletter.pdf Austin, I. 2014. New York Times. http://www.nytimes.com/2014/02/25/business/international/t arget-struggles-to-compete-in-canada.html xiii O’Brien, M. 2014. MultiChannel Merchant. http://multichannelmerchant.com/opsandfulfillment/uspshelps-amazonfresh-deliver-groceries-09092014/#_ xiv http://news.walmart.com/newsarchive/2014/02/20/walmart-us-accelerates-small-storegrowth xv Silva, T. 2014. San Antonio Business Journal. http://www.bizjournals.com/sanantonio/news/2014/09/09/wa lmart-express-out-more-neighborhood-market.html xvi Lerman, Sally. 2014. Warehouse Clubs & Supercenters. Ibisworld. xvii Greenhouse, S. 2005. New York Times. http://www.nytimes.com/2005/07/17/business/yourmoney/17 costco.html?pagewanted=all&_r=0 xviii http://seekingalpha.com/article/1737282-costcowholesales-management-discusses-f4q-2013-results-earningscall-transcript xix 2014. http://www.euromonitor.com/retailing-in-spain/report xx Martin, T. 2010. Wall Street Journal. http://online.wsj.com/articles/SB100014240527487036159045 75053413229901660 xxi Greenhouse, S. 2005. New York Times. http://www.nytimes.com/2005/07/17/business/yourmoney/17 costco.html?pagewanted=all&_r=0 xxii Stone, B. 2013. Business Week. http://www.businessweek.com/articles/2013-06-06/costcoceo-craig-jelinek-leads-the-cheapest-happiest-company-in-theworld xxiii O’Donnell, J. and McElhaney, A. 2014. USA Today. http://www.usatoday.com/story/money/business/2014/01/29 /costco-wages-walmart-federal-minimum-wageobama/5029211/ Page 8 COSTCO WHOLESALE CORP Key Assumptions of Valuation Model Ticker Symbol Current Share Price Fiscal Year End COST 140.01 Aug. 31 Pre-Tax Cost of Debt Beta Risk-Free Rate Market Risk-Premium Effective Tax Rate Operating Cash CV Growth CV ROIC WACC 4.22% 0.71 3.14% 4.64% 34.60% 20% 3.20% 10.75% 6.02% COSTCO WHOLESALE CORP Revenue Decomposition Fiscal Years Ending Aug. 31 Membership Membership Growth Membership Revenues Gold Star Growth Gold Star Business Membership Growth Business Membership Business Add-On Additional Cardholders Additional Cardholders Growth Membership Revenues 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 11.1% 2,075 11.1% 25.00 8.6% 6.3 4.0 28.7 8.7% 2,145 10.2% 2,286 6.8% 26.70 1.6% 6.4 3.8 30.1 4.9% 2,217 8.8% 2,487 8.2% 28.9 3.1% 6.6 3.5 32.2 7.0% 2,327 10.2% 2,739 7.4% 31.05 3.4% 6.82 3.5 32.2 5.8% 2,339 10.1% 3,017 7.6% 33.43 3.7% 7.07 3.5 32.2 6.1% 2,353 10.1% 3,321 8.2% 36.19 4.1% 7.36 3.5 32.2 6.5% 2,368 9.9% 3,648 7.7% 38.96 3.2% 7.60 3.5 32.2 6.0% 2,381 9.8% 4,006 7.9% 42.02 3.5% 7.86 3.5 32.2 6.3% 2,396 31.3 33.1 592 82,880 1.17 97,062 11.5% 608 85,120 1.21 102,870 6.0% 634 88,760 1.12 99,381 -3.4% 663 92,820 1.12 104,025 4.7% 688 96,320 1.15 110,286 6.0% 713 99,820 1.17 117,089 6.2% 738 103,320 1.20 124,087 6.0% 763 106,820 1.23 131,282 5.8% 52,871.6 0.9% 3,101.0 0.8% 54,440.8 3.0% 3,107.9 0.2% 55,993.7 2.9% 2,799.5 -9.9% 57,126.8 2.0% 2,746.5 -1.9% 58,869.8 3.1% 2,723.0 -0.9% 61,078.2 3.8% 2,688.7 -1.3% 63,090.0 3.3% 2,665.1 -0.9% 65,380.3 3.6% 2,631.7 -1.3% 3.1% 3,154.68 3.3% 3,288.12 3.2% 3,315.93 3.5% 3,846.38 3.8% 4,434.89 4.1% 5,072.23 4.4% 5,760.16 108,311 9.3% 105,156 -2.9% 110,080 4.7% 117,150 6.4% 124,845 6.6% 132,808 6.4% 141,048 6.2% Total Members Excluding add-ons (millions) Number of open Warehouses # Sq. Feet (thousands) (1) Revenue per Sq. Ft. Total Warehouse Revenue Total Warehouse Revenue Growth Members/Warehouse Members/Warehouse Growth Revenue/Membership Revenue/Membership Growth Online % of Warehouse Sales Online Sales Total Revenue Revenue Growth Rate 99,137 11.5% (1) Assuming 140,000 sq. ft. per warehouse location 35.5 37.8750591 40.5024537 43.5487755 46.5604168 49.8851947 COSTCO WHOLESALE CORP Income Statement (in millions) Fiscal Years Ending Aug. 31 Sales COGS Depreciation & Amortization Expense Gross Income SG&A Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Consolidated Net Income Minority Interest Net Income Net Income available to Common EPS (recurring) Total Shares Outstanding Dividends per Share 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 88,915.0 76,884.0 855.0 11,176.0 8,728.0 2,448.0 60.0 116.0 9.0 2,383.0 841.0 1,542.0 80.0 1,462.0 99,137.0 85,915.0 908.0 12,314.0 9,555.0 2,759.0 103.0 95.0 0.0 2,767.0 1,000.0 1,767.0 58.0 1,709.0 105,156.0 91,002.0 946.0 13,208.0 10,155.0 3,053.0 97.0 99.0 0.0 3,051.0 990.0 2,061.0 22.0 2,039.0 110,080.2 95,087.3 1,060.4 13,932.6 10,620.1 3,312.4 86.7 99.0 0.0 3,300.1 1,141.8 2,158.3 22.0 2,136.3 117,149.6 101,193.8 1,115.3 14,840.4 11,067.9 3,772.6 95.6 99.0 0.0 3,769.1 1,304.1 2,465.0 22.0 2,443.0 124,844.5 107,715.8 1,171.7 15,957.0 11,919.7 4,037.3 93.1 99.0 0.0 4,031.4 1,394.9 2,636.5 22.0 2,614.5 132,807.8 114,586.6 1,240.3 16,981.0 12,680.0 4,301.0 91.8 99.0 0.0 4,293.8 1,485.6 2,808.1 22.0 2,786.1 141,047.8 121,696.0 1,322.3 18,029.5 13,466.7 4,562.8 93.5 99.0 0.0 4,557.2 1,576.8 2,980.4 22.0 2,958.4 1,462.0 3.89 432.35 1.03 1,709.0 4.63 436.84 1.17 2,039.0 4.47 438.58 1.29 2,136.3 4.86 439.99 1.33 2,443.0 5.53 441.40 1.42 2,614.5 5.90 442.81 1.56 2,786.1 6.27 444.22 1.70 2,958.4 6.64 445.63 1.84 COSTCO WHOLESALE CORP Balance Sheet (in millions) Fiscal Years Ending Aug. 31 Assets Cash & Short-Term Investments Short-Term Receivables Inventories Other Current Assets Total Current Assets 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 5,613.00 965.00 6,638.00 490.00 13,706.00 4,854.00 1,026.00 7,096.00 550.00 13,526.00 6,124.00 1,201.00 7,894.00 621.00 15,840.00 8,943.76 1,225.01 8,130.78 611.28 18,910.83 12,384.16 1,290.83 8,610.43 658.94 22,944.36 13,193.88 1,367.56 9,205.15 702.68 24,469.26 17,576.31 1,457.47 9,767.80 750.62 29,552.20 18,075.38 1,565.53 10,429.43 800.13 30,870.46 Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment 18,368.00 5,936.00 12,432.00 19,546.00 6,585.00 12,961.00 21,022.00 7,141.00 13,881.00 22,360.56 8,201.37 14,159.19 23,768.07 9,316.71 14,451.36 25,249.68 10,488.36 14,761.32 26,626.02 11,728.61 14,897.41 28,042.02 13,050.88 14,991.14 Total Investments and Advances Long-Term Note Receivable Intangible Assets Deferred Tax Assets Other Assets Total Assets 0.00 0.00 74.00 232.00 317.00 26,761.00 0.00 225.00 66.00 58.00 304.00 27,140.00 0.00 128.00 63.00 62.00 309.00 30,283.00 109.28 60.00 88.29 383.88 33,711.46 121.19 57.00 110.45 396.41 38,080.77 137.68 54.00 138.05 410.52 39,970.83 175.75 51.00 106.92 429.35 45,212.63 159.97 48.00 119.76 460.68 46,650.01 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities 900.00 6,544.00 335.00 4,271.00 12,050.00 1.00 7,303.00 397.00 4,559.00 12,260.00 4.00 7,872.00 382.00 4,999.00 13,257.00 8,250.02 435.13 5,238.81 13,923.96 1,199.00 8,747.94 456.62 5,564.43 15,967.99 9,282.02 480.79 5,908.88 15,671.69 2,198.00 9,894.01 513.67 6,267.07 18,872.75 10,531.37 541.69 6,689.81 17,762.87 Long-Term Debt Deferred Tax Liabilities Other Liabilities Total Liabilities 1,253.00 387.00 498.00 14,188.00 1,381.00 412.00 569.00 14,622.00 5,190.00 450.00 374.00 19,271.00 5,190.00 404.09 517.37 20,035.42 5,190.00 458.97 590.51 22,207.47 5,190.00 508.77 615.17 21,985.64 5,190.00 533.86 636.53 25,233.14 5,190.00 563.15 649.32 24,165.34 Common Stock & Additional Paid-In Capital4,518.00 Retained Earnings 7,111.00 Other 373.00 Total Shareholders' Equity 12,002.00 Accumulated Minority Interest 571.00 Total Equity 12,573.00 Total Liabilities & Shareholders' Equity 26,761.00 4,371.00 7,834.00 156.00 12,361.00 157.00 12,518.00 27,140.00 4,672.00 6,283.00 -122.00 10,833.00 179.00 11,012.00 30,283.00 5,405.23 7,834.07 167.98 13,407.28 268.76 13,676.04 33,711.46 5,727.59 9,650.29 180.40 15,558.28 315.02 15,873.30 38,080.77 5,849.04 11,574.04 191.62 17,614.69 370.50 17,985.19 39,970.83 5,938.95 13,604.97 133.18 19,677.10 302.38 19,979.48 45,212.63 6,275.20 15,743.43 125.35 22,143.98 340.69 22,484.67 46,650.01 COSTCO WHOLESALE CORP Cash Flow Statement Fiscal Years Ending Aug. 31 Cash from Operating Activities Net Income (loss) Depreciation & Amortization Expense Change in Short-Term Receivables Change in Inventories Change in Other Current Assets Change in ST Debt & Curr. Portion LT Debt Change in Accounts Payable Change in Income Tax Payable Change in Long-Term Notes Receivable Change in Other Current Liabilities Net Cash from Operating Activities 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 1,462 890 (81) (1,000) (53) 874 597 13 54 503 3,259 1,709 649 (61) (458) (60) (899) 759 62 (225) 288 1,764 2,039 556 (175) (798) (71) 3 569 (15) 97 440 2,645 2,136 1,060 (24) (237) 10 (4) 378 53 19 240 3,631 2,443 1,115 (66) (480) (48) 1,199 498 21 (12) 326 4,997 2,615 1,172 (77) (595) (44) (1,199) 534 24 (16) 344 2,758 2,786 1,240 (90) (563) (48) 2,198 612 33 (38) 358 6,489 2,958 1,322 (108) (662) (50) (2,198) 637 28 16 423 2,367 Cash from Investing Activities (Increase) Decrease in Gross PP&E (Increase) Decrease in Total Investments & Advances (Increase) Decrease in Intangible Assets (Increase) Decrease in Deferred Tax Assets (Increase) Decrease in Other Assets Net Cash from Investing Activities (2,008) 357 (3) (222) (16) (1,892) (1,178) 8 174 13 (983) (1,476) 3 (4) (5) (1,482) (1,339) 3 (26) (75) (1,437) (1,408) 3 (22) (13) (1,439) (1,482) 3 (28) (14) (1,520) (1,376) 3 31 (19) (1,361) (1,416) 3 (13) (31) (1,457) (888) 143 61 470 251 (941) (904) 128 25 71 (414) (217) (986) (1,393) 3,809 38 (195) 22 (278) (3,590) (194) (46) 143 90 290 (585) (108) 55 73 46 12 (627) (440) 50 25 55 11 (691) (550) 25 21 (68) (58) (755) (835) 29 13 38 (8) (820) (747) 5,613 (759) 4,854 4,854 1,270 6,124 Cash from Financing Activities Change in Long-Term Debt Change in Deferred Tax Liabilities Change in Other Liabilities Change in Accumulated Minority Interest Change in Other Payment of Dividends Net Cash from Financing Activities Beg Cash Change in Cash End Cash 4,749 864 5,613 6,124 2,820 8,944 8,944 3,440 12,384 12,384 810 13,194 13,194 4,382 17,576 17,576 499 18,075 COSTCO WHOLESALE CORP Common Size Income Statement Fiscal Years Ending Aug. 31 Sales COGS Depreciation & Amortization Expense Gross Income SG&A Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Consolidated Net Income Minority Interest Net Income 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 100.00% 86.47% 0.96% 12.57% 9.82% 2.75% 0.07% 0.13% 0.01% 2.68% 0.95% 1.73% 0.09% 1.64% 100.00% 86.66% 0.92% 12.42% 9.64% 2.78% 0.10% 0.10% 0.00% 2.79% 1.01% 1.78% 0.06% 1.72% 100.00% 86.54% 0.90% 12.56% 9.66% 2.90% 0.09% 0.09% 0.00% 2.90% 0.94% 1.96% 0.02% 1.94% 100.00% 86.38% 0.96% 12.66% 9.65% 3.01% 0.08% 0.12% 0.00% 3.00% 1.04% 1.96% 0.02% 1.94% 100.00% 86.38% 0.95% 12.67% 9.45% 3.22% 0.08% 0.12% 0.00% 3.22% 1.11% 2.10% 0.02% 2.09% 100.00% 86.28% 0.94% 12.78% 9.55% 3.23% 0.07% 0.11% 0.00% 3.23% 1.12% 2.11% 0.02% 2.09% 100.00% 86.28% 0.93% 12.79% 9.55% 3.24% 0.07% 0.11% 0.00% 3.23% 1.12% 2.11% 0.02% 2.10% 100.00% 86.28% 0.94% 12.78% 9.55% 3.23% 0.07% 0.11% 0.00% 3.23% 1.12% 2.11% 0.02% 2.10% COSTCO WHOLESALE CORP Common Size Balance Sheet Fiscal Years Ending Aug. 31 2011 2012 2013 2014E 2015E 2016E 2017E 2018E Assets Cash & Short-Term Investments Short-Term Receivables Inventories Other Current Assets Total Current Assets 6.31% 1.09% 7.47% 0.55% 15.41% 4.90% 1.03% 7.16% 0.55% 13.64% 5.82% 1.14% 7.51% 0.59% 15.06% 8.12% 1.11% 7.39% 0.56% 17.18% 10.57% 1.10% 7.35% 0.56% 19.59% 10.57% 1.10% 7.37% 0.56% 19.60% 13.23% 1.10% 7.35% 0.57% 22.25% 12.82% 1.11% 7.39% 0.57% 21.89% Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment 20.66% 6.68% 13.98% 19.72% 6.64% 13.07% 19.99% 6.79% 13.20% 20.31% 7.45% 12.86% 20.29% 7.95% 12.34% 20.22% 8.40% 11.82% 20.05% 8.83% 11.22% 19.88% 9.25% 10.63% Total Investments and Advances Long-Term Note Receivable Intangible Assets Deferred Tax Assets Other Assets Total Assets 0.00% 0.00% 0.08% 0.26% 0.36% 30.10% 0.00% 0.23% 0.07% 0.06% 0.31% 27.38% 0.00% 0.12% 0.06% 0.06% 0.29% 28.80% 0.18% 0.10% 0.05% 0.08% 0.35% 30.62% 0.13% 0.10% 0.05% 0.09% 0.34% 32.51% 0.06% 0.11% 0.04% 0.11% 0.33% 32.02% 0.07% 0.13% 0.04% 0.08% 0.32% 34.04% 0.09% 0.11% 0.03% 0.08% 0.33% 33.07% Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities 1.01% 7.36% 0.38% 4.80% 13.55% 0.00% 7.37% 0.40% 4.60% 12.37% 0.00% 7.49% 0.36% 4.75% 12.61% 0.00% 7.49% 0.40% 4.76% 12.65% 1.02% 7.47% 0.39% 4.75% 13.63% 0.00% 7.43% 0.39% 4.73% 12.55% 1.66% 7.45% 0.39% 4.72% 14.21% 0.00% 7.47% 0.38% 4.74% 12.59% Long-Term Debt Deferred Tax Liabilities Other Liabilities Total Liabilities 1.41% 0.44% 0.56% 15.96% 1.39% 0.42% 0.57% 14.75% 4.94% 0.43% 0.36% 18.33% 0.00% 0.37% 0.47% 18.20% 0.00% 0.39% 0.50% 18.96% 0.00% 0.41% 0.49% 17.61% 0.00% 0.40% 0.48% 19.00% 0.00% 0.40% 0.46% 17.13% 5.08% Common Stock Par/Carry Value 8.00% Retained Earnings 0.42% Other 13.50% Total Shareholders' Equity 0.64% Accumulated Minority Interest 14.14% Total Equity Total Liabilities & Shareholders' Equity 30.10% 4.41% 7.90% 0.16% 12.47% 0.16% 12.63% 27.38% 4.44% 5.97% -0.12% 10.30% 0.17% 10.47% 28.80% 12.65% 4.71% 0.15% 12.18% 0.24% 12.42% 30.62% 13.63% 4.43% 0.15% 13.28% 0.27% 13.55% 32.51% 12.55% 4.16% 0.15% 14.11% 0.30% 14.41% 32.02% 14.21% 3.91% 0.10% 14.82% 0.23% 15.04% 34.04% 12.59% 3.68% 0.09% 15.70% 0.24% 15.94% 33.07% COSTCO WHOLESALE CORP Value Driver Estimation Fiscal Years Ending Aug. 31 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 88,915 76,884 8,728 855 81 2,529 99,137 85,915 9,555 908 82 2,841 105,156 91,002 10,155 946 79 3,132 110,080 95,087 10,620 1,060 84 3,396 117,150 101,194 11,068 1,115 89 3,861 124,845 107,716 11,920 1,172 94 4,132 132,808 114,587 12,680 1,240 100 4,401 141,048 121,696 13,467 1,322 105 4,668 Less: Adjusted Taxes: Provision for Income Taxes + Tax Shield on Interest Expense + Tax Shield on other pre-Tax income + Tax Shield on Implied Lease Interest Adjusted Taxes 841 40 18 28 927 1,000 33 36 28 1,097 990 34 34 27 1,085 1,142 34 30 29 1,235 1,304 34 33 31 1,402 1,395 34 32 33 1,494 1,486 34 32 34 1,586 1,577 34 32 36 1,680 Plus: Change in Deferred Tax (DT) Liabilites Current year DT Liabilities - Current year DT Long-Term Assets Net DT Liabilites for Current year 387 232 155 412 58 354 450 62 388 404 88 316 459 110 349 509 138 371 534 107 427 563 120 443 Prior year DT Liabilities - Prior year DT Long-Term Assets Net DT Liabilites for Prior year 244 10 234 387 232 155 412 58 354 450 62 388 404 88 316 459 110 349 509 138 371 534 107 427 Net Change in DT Liab (current - prior) (79) 199 34 (72) 33 22 56 16 NOPLAT Computation: EBITA: Net Sales - Cost of Products Sold - Operating Expenses - Depreciation & Amortization + Implied Interest on Operating Leases EBITA NOPLAT: EBITA - Adjusted Taxes + Change$in DT 1,523.35 $ 1,943.29 $ 2,080.60 $ 2,088.84 $ 2,491.99 $ 2,659.97 $ 2,870.68 $ 3,004.40 Invested Capital Computation Operating Current Assets: Normal Cash (lesser of actual or %) Accounts Receivable, Net Inventory Other Current Assets Operating Current Assets 5,613 965 6,638 490 13,706 4,854 1,026 7,096 550 13,526 6,124 1,201 7,894 621 15,840 8,944 1,225 8,131 611 18,911 12,384 1,291 8,610 659 22,944 13,194 1,368 9,205 703 24,469 17,576 1,457 9,768 751 29,552 18,075 1,566 10,429 800 30,870 Operating Current Liabilities: ST Debt & Curr. Portion LT Debt Accounts Payable Income Taxes Payable Other Current Liabilities Operating Current Liabilities 900 6,544 335 4,271 12,050 1 7,303 397 4,559 12,260 4 7,872 382 4,999 13,257 8,250 435 5,239 13,924 1,199 8,748 457 5,564 15,968 9,282 481 5,909 15,672 2,198 9,894 514 6,267 18,873 10,531 542 6,690 17,763 1,656 1,266 2,583 4,987 6,976 8,798 10,679 13,108 12,432 12,961 13,881 14,159 14,451 14,761 14,897 14,991 1,924 1,948 1,862 1,981 2,105 2,237 2,358 2,484 16,012 16,175 18,326 21,127 23,533 25,795 27,935 30,583 Net Operating Working Capital Plus: Net PPE Plus: PV of Operating Leases Invested Capital: ROIC (NOPLAT/Beg IC) EP (Beg IC * (ROIC - WACC)) FCF (NOPLAT - (End IC - Beg IC)) 10.4% 642 134 12.1% 979 1,780 12.9% 1,106 (70) 11.4% 985 (712) 11.8% 1,219 86 11.3% 1,242 398 11.1% 1,317 731 10.8% 1,321 357 COSTCO WHOLESALE CORP Weighted Average Cost of Capital (WACC) Estimation Yield on publicly traded debt (Kd) Tax Rate After tax Kd Risk Free Rate Market Risk Premium Beta Cost of Equity (KE) Market Value of Debt Market Value of Equity Debt/(Debt+Equity) Equity/(Debt+Equity) WACC 4.22% Taken from FINRA market data (Used WMT as comp for 30 year) 34.60% 2.76% 3.14% 4.64% 1928-2013 geometric average risk premium 0.71 Taken from Bloomberg on Sept 5, 2014 6.44% 7,056 55,668 11.2% 88.8% 6.02% COSTCO WHOLESALE CORP Discounted Cash Flow (DCF) and Economic Profit (EP) Valuation Models Key Inputs: CV Growth CV ROIC WACC Cost of Equity Beta COGS Margin New Stores Opened Sales/Square Ft. Fiscal Years Ending Aug. 31 3.20% 10.75% 6.02% 6.44% 0.71 86.38% 25 1.15 2014E 2015E 2016E 2017E 2018E 2,089 (712) 2,492 86 2,660 398 2,871 731 3,004 (671) 59,442 493 Plus: Other Non-operating assets 59,935 Vfirm Less: Non-Operating Liabilities & LT Debt 6,111 1,862 Less: PV Operating Leases Less: ESOP 194 Vequity 51,767 # Shares 440 P0 $ 117.66 Partial-year adjustment $ 119.17 76 334 578 23,533 11.8% 1,219 25,795 11.3% 1,242 27,935 11.1% 1,317 1,085 1,042 1,042 DCF Model NOPLAT FCF CV DCF Voper 74,714 59,125 EP Model Invested Capital ROIC EP CV PV of EP discounted by WACC Sum of PV (EP) Plus: Beginning Invested Capital Voper 21,127 11.4% 985 929 41,116 18,326 59,442 Plus: Other Non-operating assets 493 Vfirm 59,935 Less: Non-Operating Liabilities & LT Debt 6,111 Less: PV Operating Leases 1,862 Less: ESOP 194 Vequity 51,767 # Shares 440 P0 $ 117.66 Partial-year adjustment $ 119.17 30,583 10.8% 46,779 37,019 Sensitivity Tables WACC $ 119.17 5.00% 5.25% 5.50% 5.75% 6.00% 6.25% 6.50% 6.75% CV Growth 2.00% 126.41 116.36 107.88 100.62 94.34 88.86 84.03 79.74 2.25% 135.62 123.75 113.86 105.52 98.38 92.20 86.81 82.06 2.50% 146.67 132.48 120.85 111.17 102.99 95.99 89.94 84.65 2.75% 160.17 142.95 129.11 117.76 108.31 100.32 93.49 87.58 3.00% 177.05 155.75 139.02 125.56 114.52 105.32 97.54 90.89 3.25% 198.75 171.75 151.13 134.91 121.86 111.15 102.22 94.67 3.50% 227.69 192.33 166.27 146.34 130.67 118.05 107.68 99.04 3.75% 268.20 219.76 185.73 160.63 141.43 126.32 114.13 104.13 0.70 95.08 99.16 103.84 109.24 115.54 122.99 131.95 142.91 0.75 88.77 92.27 96.25 100.80 106.06 112.22 119.52 128.33 0.80 83.07 86.07 89.46 93.32 97.74 102.86 108.87 116.02 0.85 77.87 80.46 83.36 86.64 90.37 94.66 99.64 105.50 0.90 73.13 75.36 77.85 80.65 83.81 87.41 91.57 96.40 0.95 68.78 70.71 72.85 75.24 77.92 80.97 84.44 88.45 1.00 64.78 66.44 68.28 70.33 72.61 75.19 78.11 81.45 Beta $ 119.17 2.00% CV Growth 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% COGS Margin COGS Margin 0.65 102.07 106.87 112.39 118.83 126.43 135.53 146.62 160.46 $ 119.17 85.8% 86.0% 86.2% 86.4% 86.6% 86.8% 87.0% 87.2% Cost of Equity 6.00% 179.28 166.82 154.37 141.92 129.47 117.01 104.56 92.11 6.25% 161.46 150.13 138.81 127.49 116.16 104.84 93.52 82.19 6.50% 146.39 136.02 125.66 115.29 104.92 94.55 84.18 73.81 6.75% 133.49 123.94 114.39 104.84 95.29 85.74 76.19 66.64 7.00% 122.32 113.48 104.64 95.79 86.95 78.11 69.26 60.42 7.25% 112.56 104.34 96.11 87.89 79.66 71.44 63.21 54.99 $ 119.17 85.8% 86.0% 86.2% 86.4% 86.6% 86.8% 87.0% 87.2% Sales per Square Foot 1.03 1.09 130.51 140.20 120.95 130.12 111.39 120.05 101.83 109.97 92.26 99.89 82.70 89.82 73.14 79.74 63.58 69.67 1.15 149.88 139.29 128.70 118.11 107.53 96.94 86.35 75.76 1.21 159.57 148.47 137.36 126.26 115.16 104.05 92.95 81.85 1.27 169.26 157.64 146.02 134.40 122.79 111.17 99.55 87.93 1.33 178.94 166.81 154.68 142.55 130.42 118.29 106.15 94.02 COSTCO WHOLESALE CORP Dividend Discount Model (DDM) or Fundamental P/E Valuation Model 1 2014E Fiscal Years Ending Aug. 31 EPS $ Key Assumptions CV growth CV ROE Cost of Equity Intrinsic Value Partial-year adjustment 5.53 $ 3 2016E 5.90 $ 4 2017E 2018E 6.27 $ 6.64 3.20% 13.16% 6.44% Future Cash Flows P/E Multiple (CV Year) EPS (CV Year) Future Stock Price Dividends Per Share Future Cash Flows Discounted Cash Flows Discounted CF Stock Price 4.86 $ 2 2015E 23.37 $ 6.64 $ 155.14 1.33 $ 1.25 $ $ 126.00 $ 127.62 1.42 1.25 $ 1.56 1.7 1.29 $ 1.32 $ 120.87 COSTCO WHOLESALE CORP Relative Valuation Models Ticker WMT TGT AMZN CRRFY KR CVS Company WAL-MART STORES Inc TARGET CORPORATION AMAZON.COM INC Carrefour S.A. KROGER COMPANY CVS HEALTH CORPORATION $ $ $ $ $ $ Price 84.99 72.50 326.54 6.17 58.49 89.59 COST COSTCO WHOLESALE CORP $ 140.01 Implied Value: Relative P/E (EPS14) Relative P/E (EPS15) PEG Ratio (EPS14) PEG Ratio (EPS15) $ $ $ $ EPS 2014E $5.04 $3.20 ($0.15) $0.41 $3.28 $4.49 EPS 2015E $5.47 $3.78 $1.82 $0.48 $3.64 $5.08 Average $4.86 $5.53 89.68 89.97 234.23 236.26 P/E 14 16.9 22.7 (2,176.9) 15.0 17.8 20.0 18.5 28.8 P/E 15 15.5 19.2 179.4 12.9 16.1 17.6 16.3 25.3 Est. 5yr Gr. 7.6 10.7 45.4 16.1 9.6 13.8 28.1 PEG 14 2.22 2.12 (47.95) 0.93 1.86 1.45 1.7 1.0 PEG 15 2.04 1.79 3.95 0.80 1.67 1.28 1.5 0.9 COSTCO WHOLESALE CORP Key Management Ratios Fiscal Years Ending Aug. 31 2011 2012 2013 Liquidity Ratios Current Ratio (CA/CL) Cash Ratio ((Cash+ST Inv.)/CL) Quick Ratio ((CA-Cash)/CL) 1.14 0.47 0.67 1.10 0.40 0.71 96.18 3.52 14.49 0.06 Activity or Asset-Management Ratios Receivables turnover (Sales/Avg. A/R) Asset turnover (Sales/Avg. TA) Inventory turnover (Sales/Avg. Inventory) Working Capital/Total Assets [(CA-CL)/TA] Financial Leverage Ratios Leverage (Assets/Equity) Financial Leverage (ROE/ROA) Profitability Ratios Return on Equity (Net Income/Equity) Return on Assets (Net Income/Assets) Gross Margin (Gross Profit/Sales) Net Profit Margin (Net Income/Sales) Payout Policy Ratios Payout Ratio (Div per share/EPS) 2014E 2015E 2016E 2017E 2018E 1.19 0.46 0.73 1.36 0.64 0.72 1.44 0.78 0.66 1.56 0.84 0.72 1.57 0.93 0.63 1.74 1.02 0.72 99.59 3.68 14.44 0.05 94.44 3.66 14.03 0.09 90.75 3.44 13.74 0.15 93.13 3.26 14.00 0.18 93.93 3.20 14.02 0.22 94.02 3.12 14.00 0.24 93.32 3.07 13.97 0.28 2.13 2.13 2.17 2.17 2.75 2.75 2.47 2.47 2.40 2.40 2.22 2.22 2.26 2.26 2.07 2.07 11.6% 5.5% 12.6% 1.6% 13.7% 6.3% 12.4% 1.7% 18.5% 6.7% 12.6% 1.9% 15.6% 6.3% 12.7% 1.9% 15.4% 6.4% 12.7% 2.1% 14.5% 6.5% 12.8% 2.1% 13.9% 6.2% 12.8% 2.1% 13.2% 6.3% 12.8% 2.1% 0.26 0.25 0.29 0.27 0.26 0.26 0.27 0.28