APB Statement

advertisement

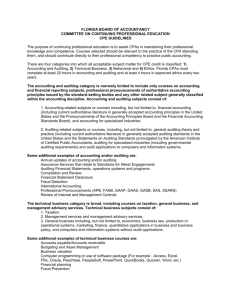

10:21 Page 1 2003 09/04/2003 April sas610 revised cov.qxd APB Statement THE AUDITING PRACTICES BOARD – SCOPE AND AUTHORITY OF PRONOUNCEMENTS (Revised) Further copies, £2.50, post-free, can be obtained from: Croner.CCH Group Ltd, 145 London Road, Kingston upon Thames Surrey KT2 6SR Telephone: 0870 777 2906 Fax: 020 8247 1124 E-mail: tax@croner.cch.co.uk # APB Limited 2003 ISBN 1–84140–378–4 THE AUDITING PRACTICES BOARD SCOPE AND AUTHORITY OF PRONOUNCEMENTS (REVISED) Contents Paragraphs Introduction 1-2 Scope of APB pronouncements 3-9 Authority of APB pronouncements 10-15 Development of APB pronouncements 16-18 International Standards on Auditing 19-20 Pronouncements of predecessor body 21 Scope and Authority of Pronouncements (Revised) INTRODUCTION This Statement, which describes the scope and authority of the Auditing Practices Board’s (APB’s) pronouncements, replaces a previous document of the same title which was issued in May 1993. The revised Statement reflects the position of the APB (and of the Auditing Practices Board Limited) at the date of issue. In January 2003, the Department of Trade and Industry announced changes to the structure of audit regulation in the United Kingdom which will impact the APB and some of the arrangements referred to in this Statement. In particular, it is intended that the Financial Reporting Council will take on the functions of the Accountancy Foundation, and that the APB will assume responsibility for issuing ethical standards concerning the integrity, objectivity and independence of auditors. The APB therefore recognises that this Statement will need to be updated when these proposed changes to audit regulation become effective. 1. The objectives of the Auditing Practices Board Limited, which is a constituent body of the Accountancy Foundation, can be summarised as being: 2. to take the lead in establishing standards of auditing in the United Kingdom and the Republic of Ireland, and thereby provide a framework of practice for the exercise of an auditor’s individual judgment, so as to enhance: - the quality and relevance of auditing services in the public interest, and - public confidence in the auditing process. to contribute to efforts to advance public understanding of the roles and responsibilities of auditors; to take an active role in the development of statutes, regulations and accounting standards which affect the conduct of auditing; and to provide support for international developments in relation to auditing and to have due regard to such developments in its activities. The Auditing Practices Board Limited discharges its responsibilities through a Board (‘the APB’), comprising a mix of individuals who are eligible for appointment as company auditors and those who are not so eligible. Those who are eligible for appointment as company auditors may not exceed 40% of the APB by number. THE AUDITING PRACTICES BOARD 1 Scope and Authority of Pronouncements (Revised) SCOPE OF APB PRONOUNCEMENTS 3. 4. 1 2 3 4 2 The APB publishes Statements of Auditing Standards (SASs) which establish the basic principles and essential procedures with which auditors are required to comply when carrying out: - statutory audits of companies in accordance with the Companies Acts;1 - public sector audits in the UK, including those carried out either on behalf of the national audit agencies or under contract to those agencies, and the audit of central government financial statements in the Republic of Ireland; the national audit agencies in the UK2 and the Comptroller and Auditor General in the Republic of Ireland have adopted SASs as the basis of their approach to the audit of financial statements; - audits of financial statements for entities established under other legislation, for example building societies, credit unions, friendly societies, pension funds, charities and registered social landlords; - other audits performed by audit firms registered with the members of the Consultative Committee of Accountancy Bodies (CCAB)3 unless the nature of the engagement requires the use of other recognised auditing standards (for example International Standards on Auditing (ISAs)); and - other audits where audit firms not registered with members of the CCAB elect, or are required by contract, to perform the work in accordance with UK or Irish auditing standards. SASs contain basic principles and essential procedures (‘Auditing Standards’), which are indicated by bold type4 and with which auditors are required to comply, except where otherwise stated in the SAS concerned, in the conduct of any audit of financial statements. SASs also include explanatory and other material which, rather than being prescriptive, is designed to assist auditors in interpreting and applying Auditing Standards. Each SAS specifies the date from which it becomes effective. Companies Act 1985 in the UK and the Companies Acts 1963–2001 in the Republic of Ireland National audit agencies in the UK are the National Audit Office (for the Comptroller and Auditor General and the Auditor General for Wales), the Audit Commission, Audit Scotland (for the Auditor General for Scotland and the Accounts Commission) and the Northern Ireland Audit Office (for the Comptroller and Auditor General (Northern Ireland)). Members of CCAB are The Institute of Chartered Accountants in England & Wales, The Institute of Chartered Accountants of Scotland, The Institute of Chartered Accountants in Ireland, The Association of Chartered Certified Accountants, The Chartered Institute of Management Accountants and The Chartered Institute of Public Finance and Accountancy. For identification purposes, each Auditing Standard has a unique reference number (for example, SAS 600.1 identifies the first Auditing Standard in SAS 600 ‘Auditors’ reports on financial statements’). THE AUDITING PRACTICES BOARD Scope and Authority of Pronouncements (Revised) 5. The APB also issues non-mandatory guidance in the form of Practice Notes and Bulletins. This guidance is persuasive rather than prescriptive; however it is indicative of good practice and has similar status to the explanatory material in SASs. Practice Notes assist auditors in applying Auditing Standards to particular circumstances and industries and Bulletins provide timely guidance on new or emerging issues. 6. The APB also issues consultative documents, briefing papers and research studies to stimulate public debate and comment. 7. The APB’s remit extends to associated or related review activities including the activities of reporting accountants. The APB’s two principal categories of document in relation to the work of reporting accountants are: - Statements of Investment Circular Reporting Standards (SIRs), and - Bulletins. 8. SIRs adopt the same style and format as SASs: basic principles and essential procedures are set out in bold type and explanatory and other material is provided to assist reporting accountants in interpreting and applying the Standards. 9. The APB will issue standards and guidance for other assurance engagements5 including, for example, review engagements, as practice evolves and when it believes that this is in the public interest. AUTHORITY OF APB PRONOUNCEMENTS 10. In order to be eligible for appointment in Great Britain as auditors of companies, or of any of the other entities which require their auditors to be eligible for appointment as auditors under section 25 of the Companies Act 1989, persons must be registered with a Recognised Supervisory Body (RSB)6 recognised under that Act and must be eligible for appointment under the rules of that RSB. The Companies Act 1989 requires RSBs to have rules and practices as to the technical standards to be applied in company audit 5 6 Not all engagements performed by professional accountants are assurance engagements. The objective of an assurance engagement, as set out in International Standard on Assurance Engagements (ISAE) 100 is: ‘for a professional accountant to evaluate or measure a subject matter that is the responsibility of another party against identified suitable criteria, and to express a conclusion that provides the intended user with a level of assurance about that subject matter’. The Institute of Chartered Accountants in England & Wales, The Institute of Chartered Accountants of Scotland, The Institute of Chartered Accountants in Ireland, the Association of Authorised Public Accountants and The Association of Chartered Certified Accountants are Recognised Supervisory Bodies for the purpose of regulating auditors. In addition to these, the Institute of Certified Public Accountants in Ireland and the Institute of Incorporated Public Accountants are ‘Recognised Bodies’ in the Republic of Ireland. THE AUDITING PRACTICES BOARD 3 Scope and Authority of Pronouncements (Revised) work and as to the manner in which these standards are to be applied in practice.7 RSBs have adopted SASs in order to meet that requirement and each is required to have arrangements in place for the effective monitoring and enforcement of compliance with the Auditing Standards contained within SASs. 11. In the Republic of Ireland legislative requirements concerning qualifications for appointment as auditor and recognition of bodies of accountants are contained in the Companies Act, 1990. This Act requires bodies of accountants to have satisfactory rules and practices as to technical and other standards. The Act also empowers the Minister for Enterprise and Employment to revoke or suspend recognition or authorisation of a body of accountants or individual auditor.8 12. The members of the CCAB have undertaken to adopt Auditing Standards and guidance developed by the APB within three months of promulgation by the APB of such Standards and guidance. In the Republic of Ireland, accountancy bodies which are not members of the CCAB but which are also recognised bodies for the supervision of auditors may choose to require their members to comply with Auditing Standards. 13. Apparent failures by auditors to comply with the Auditing Standards contained within SASs are liable to be investigated by the relevant accountancy body. Auditors who do not comply with Auditing Standards when performing company or other audits make themselves liable to regulatory action which may include the withdrawal of registration and hence of eligibility to perform company audits. 14. All relevant APB pronouncements and in particular Auditing Standards are likely to be taken into account when the adequacy of the work of auditors is being considered in a court of law or in other contested situations. 15. The nature of Auditing Standards issued by the APB requires auditors to exercise professional judgment in applying them, for example in the assessment of materiality and engagement risk. In extremely rare circumstances, it may be necessary to depart from a Standard to achieve the objective of the engagement more effectively. When such a situation arises the auditor documents the reasons and discloses the position (having regard to the guidance in SAS 600 paragraph 26). 7 8 4 In Northern Ireland, equivalent requirements are contained in Part 111 of the Companies (Northern Ireland) Order 1990. In the Republic of Ireland legislative proposals contained in the Companies (Auditing and Accounting) Bill, 2003, will establish a new statutory supervisory body-the Irish Auditing and Accounting Supervisory Authority (IAASA). It is proposed that the functions of IAASA will include a role in cooperating with the auditing profession and other interested parties in developing standards in relation to the independence of auditors and in developing auditing standards and practice notes. THE AUDITING PRACTICES BOARD Scope and Authority of Pronouncements (Revised) DEVELOPMENT OF APB PRONOUNCEMENTS 16. Each year the APB considers its priorities and consults on a proposed work programme with interested parties. 17. Before publishing or amending a SAS, a SIR or a Practice Note the APB will publish an exposure draft on its website. It will also send a copy of the exposure draft to the members of the CCAB and to other interested parties, and allow at least three months for representations to be made on the draft, save where circumstances require a shorter period (which would not be less than two months). Where exposure drafts would cause changes to be made to other previously issued publications, any such consequential changes will also be exposed for comment and published simultaneously. Representations received on exposure drafts will be given full and proper consideration by the APB, and will be available for public inspection. 18. Bulletins and other publications may be developed without the full process of consultation and exposure used for SASs and Practice Notes. However, in the development of such documents, and before publication, the APB will decide the means by which it will obtain external views on them. INTERNATIONAL STANDARDS ON AUDITING 19. The APB supports the International Auditing and Assurance Standards Board (IAASB) of the International Federation of Accountants (IFAC) in its aim of improving the harmonisation of auditing practices throughout the world. SASs are formulated with due regard to the ISAs issued by IAASB. At the time of issue each SAS explains its relationship to the ISA dealing with the same topic. 20. As at the date of issue of this Statement of the Scope and Authority of APB Pronouncements, it is expected that ISAs will be adopted by all member states of the European Union by 2005. Prior to 2005, the APB will decide in consultation with interested parties whether any standards supplementary to ISAs need to be issued for auditors in the United Kingdom and the Republic of Ireland, including auditors working in the public sector, and whether additional guidance is required. PRONOUNCEMENTS OF PREDECESSOR BODY 21. The APB has adopted the Statements of Auditing Standards, Statements of Investment Circular Reporting Standards and the extant Practice Notes and Bulletins issued by its predecessor body the Auditing Practices Board, which was a committee of the CCAB, and these remain in force until withdrawn or replaced. THE AUDITING PRACTICES BOARD 5 NOTICE TO READERS © The Accountancy Foundation Limited This document has been obtained from the website of The Accountancy Foundation Limited and its subsidiary companies (The Review Board Limited, The Auditing Practices Board Limited, The Ethics Standards Board Limited, The Investigation and Discipline Board Limited). Use of the website is subject to the WEBSITE TERMS OF USE, which may be viewed at http://www.accountancyfoundation.com/terms. Readers should be aware that, although The Accountancy Foundation Limited and its subsidiary companies seek to ensure the accuracy of information on the website, no guarantee or warranty is given or implied that such information is free from error or suitable for any given purpose: the published hard copy of the document alone constitutes the definitive text.