3 The Benazir Income Support Programme and the Zakat

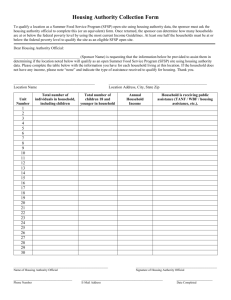

advertisement