the info session PowerPoint

advertisement

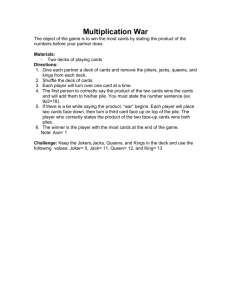

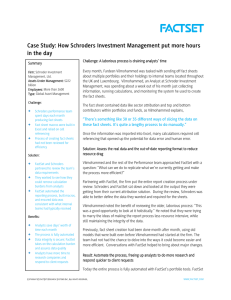

Stock Pitch Competition Info Session Agenda Overview Why Participate? Why Target Corporation? Competition Guidelines Sample Presentation Deck Logistics Q&A Tutorial: Capital IQ & FactSet Overview Sample Deck Logistics Q&A Cap IQ & FactSet Tutorial OVERVIEW First Annual Stock Pitch Competition Work in Teams of 2–4 Analyze the stock of Target Corporation (NYSE: TGT) Preliminary Round: Submit Investment Summary and PowerPoint Deck Final Round: 5 Teams will present their pitch to a panel of Judge Networking with industry professional and UTSC faculty Overview Org. Sample Structure Deck Policies Logistics What’s in it Q&A for you? Cap IQ & Goals/ FactSet Plans Tutorial WHY PARTICIPATE Test your classroom knowledge in a real life application as an Equity Research Analyst Gain insight into one of the most well-know names in the retail sector Put your analytical and presentation skills into practice Take advantage of UTSC’s state-of-the-art Finance Lab and learn how to use Capital IQ and FactSet Earn a cash prize of $400 as a winning team Network with industry professional and UTSC faculty Overview Sample Deck Logistics Policies What’s Q & A in it for you? Cap IQ & Goals/ FactSet Plans Tutorial INTRODUCING: VICTOR KUNTZEVITSKY Victor joined Northland Wealth in August 2012 as an Associate. Northland Wealth Management is a multi-family office providing estate and financial services to 50 families, totaling ~$250M of AUM. His primary role is to support Portfolio Managers with trading and research functions. While at McMaster, Victor was the lead supervisor at the Allen H. Gould Trading Floor and Senior Trader with the McMaster Investment Club. His passion for philanthropy is highlighted as the Founder of ‘Get Swabbed’, an annual bone-marrow drive held in Canadian Universities in partnership with Canadian Blood Services (CBS). Victor is Level II CFA candidate and Level II CAIA candidate. Overview Org. Sample Structure Deck Policies Logistics What’s in it Q&A for you? Cap IQ & Goals/ FactSet Plans Tutorial WHY TARGET CORPORATION One of the top 10 largest retailers in North America Recently entered Canadian market Impacts the livelihood of Canadians and our economy Recent stock performance Overview Overview Org. Sample Sample Structure Deck Deck Policies Logistics Logistics Cap IQ &in it What’s Cap Q & AIQ & FactSet forFactSet you? Tutorial Tutorial Cap IQ & Goals/ Q & A FactSet Plans Q&A Tutorial COMPETITION GUIDELINES Overview Org. Sample Structure Deck Policies Logistics What’s in it Q& A for you? Goals/ Cap IQ & Plans FactSet Tutorial CFA Institute Research Challenge University of Toronto - Scarborough Market Leader - Sustainable Growth - Attractive Valuation TSE: DOL Introduction & Overview ` Market Profile (as of February 8, 2013) Current Price (CAD) 52-week Price Range (CAD) Market Cap (CAD) 58.80 41.50 - 66.30 4.35 B Shares Outstanding 73.35 M Average Volume 354,806 P/E (TTM) 21.45 EPS (TTM) 2.81 Dividend / Yield (%) 0.11 / 0.75 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 $58.80 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Introduction & Overview ` BUY 19% UPSIDE $70 $60 $50 $40 $30 $20 $10 Introduction & Overview ` #1 Dollar Store in Canada with over 700 stores nationwide Introduction & Overview ` Seasonal 14% Consumable 37% General Merchandise 49% Introduction & Overview ` Thousands of products – 7 fixed price points. Sales Distribution Percent of Sales from Items Priced > $1.00 70% Introduce $2.50 & 3.00 price points 49% 50% 51% Q1 - 13 42% 48% Q4 - 12 39% Q3 - 11 40% 40% Q2 - 11 50% Q3 - 12 56% Q2 - 12 Introduce $1.25, $1.50, & $2.00 60% 44% 34% 30% 24% 27% 30% 20% 12% 10% 0% Q2 - 13 Q1 - 12 Q4 - 11 Q1 - 11 Q4 - 10 Q3 - 10 Q2 - 10 Q1 - 10 FY - 09 0% Introduction & Overview ` Global Supplier Network Strong Bargaining Power Price Leadership 50% 40% 45% 40% 30% 20% 10% 10% 5% 0% China North America Europe Other Introduction & Overview ` DOL Sales vs. GDP Growth Competition 18% 16% 14% 12% 10% 8% 6% 4% 2% -2% -4% 2007 Retail Industry 2008 2009 DOL Sales Growth MacroEconomic 2010 2011 GDP Gowth Correlation = -0.57 Introduction & Overview ` MacroEconomic Competition Retail Industry Value ($) Bln Operating Revenues – Chain vs. NonChain Stores $500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 Operating Revenues Total Operating Revenues (Non Chain Stores) Operating Revenues (Chain Stores) Introduction & Overview ` Bargaining Power of Suppliers 4 3 Retail Industry Threat of Substitute products Competitive Rivalry within Industry MacroEconomic Competition 2 1 0 Bargaining Power of Customers Threat of New Entrants Why DOL? ` Market Leader No. of Stores 800 735 700 600 500 400 300 200 124 117 105 100 66 51 0 Dollarama Dollar Store with More Dollar Tree Canada Great Canadian Everything for Buck or Two a Dollar Why DOL? ` Sustainable Growth DOL Revenue Growth - $MM $2,792 12% CAGR $2,528 $2,282 $2,053 FY17 F FY16 F FY15 F FY14 F FY13 F FY12 $1,420 FY11 FY08 $1,089 $1,254 FY10 $972 FY09 $888 FY07 $1,821 $1,603 Why DOL? ` Growth Attractive Valuation Operational Efficiency Target Price 80% FCFF 20% P/E $68.92 $72.18 $55.89 Financials & Valuation ` Contraction Store Expansion Same Store Sales -30% -15% +10% +10% Stable Expansion Financials & Valuation ` FCFF WACC: 8.41% 11.7% CAGR COMPS Cash Flows Sales Store Expansion Increasing SSS Net Profit Margin Growing Margins Economies of Scale 11.9% Financials & Valuation ` FCFF Comps Average Market Cap (B $USD) 7.26 Valuation Ratios P/E Ratio 18.55 EPS Growth 18% PEG Ratio 1.21 P/B Ratio 4.77 P/S Ratio 1.24 EV/EBITDA 9.88 COMPS DOL TSX 4.38 FDO NYSE 7.60 DLTR NASDAQ 8.78 DG NYSE 14.41 NWC - TSX 1.12 21.45 32% 0.79 4.70 2.46 13.51 18.40 14% 1.31 5.54 0.83 8.84 15.52 17% 0.92 7.28 1.26 8.55 15.97 17% 0.94 3.04 0.92 8.94 17.77 9% 2.07 3.31 0.73 9.56 Financials & Valuation ` Income Statement Profit Margin vs. Sales Growth 16% 14% 12% 10% 8% 6% 4% 2% 0% Net Profit Margin Sales Growth Financials & Valuation ` SG&A/Sales and Net Profit Margin 22% 16% 21% 14% 21% 12% 20% 10% 20% 8% 19% 6% 19% 4% 18% 2% 18% 0% 17% -2% SG&A/Sales (%) Net Profit Margin (%) Financials & Valuation ` Balance Sheet Profitability Ratios 25% 22.58% 22.21% 20% 15% 12.76% 10.15% 10% 5% 0% ROA FY2011 ROE Industry Avg 2011 Financials & Valuation ` Turnover Ratios FY 2008 FY 2009 FY 2010 FY 2011 Industry Avg 2011 Total Asset Turnover 0.8x 0.9x 1.1x 1.2x 2.23x Inventory Turnover 2.9x 3x 3.3x 3.2x 6.09x Capital Structure - Debt/Equity 1,600,000 140% 1,400,000 120% 1,200,000 100% 1,000,000 80% 800,000 60% 600,000 40% 400,000 20% 200,000 0 0% Debt Equity Debt/Equity Investment Risks ` Impact • • • • • • • • Strategy Growth Natural Disasters Earnings Manipulation • Distribution Network IT Systems Regulatory Environment Inventory Shrinkage Foreign Exchange • • • Product Safety/• Litigation Product Real Estate Product Real Estate Selection Selection • Safety/Litigation Safety/Litigation Real Estate Selection Merchandise • Merchandise Merchandise/ Ops. Cost Occupancy Cost • Replenishment & Inflation Risk Inflation Risk Merchandise Replenishment Corporate • Retail Competition Governance • Share Repurchase Probability Jan-14 Oct-13 Jul-13 BUY Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 $80 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Conclusion ` $68.92 19% UPSIDE $70 $60 $50 $40 $30 $20 $10 Conclusion ` Market Leader Sustainable Growth Attractive Valuation Recommendation: BUY IMPORTANT DATES Oct. 7th / 8th: Info Sessions Friday, Oct. 11th: Team Registration Deadline Tuesday, Oct. 15th: Investment Summary and Presentation Deck Due at 5:00pm Friday, Oct. 18th: Top 5 Teams Present to Judges Overview Org. Sample Structure Deck Policies Logistics What’s in it Q&A for you? Cap IQ & Goals/ FactSet Plans Tutorial TEAM REGISTRATION Teams of 2–4 Free for Investment Society members, $10 for nonmembers Register your Team at the Investment Society booth in the IC Atrium from 10am–4pm between Tuesday, Oct 8th and Friday, Oct 11th Provide a Team Name, Team Captain, list of members Teams with non-members will be required to pay in order to complete the registration Registration Deadline: Friday, Oct 11th at 4:00pm Overview Org. Sample Structure Deck Policies Logistics What’s in it Q&A for you? Cap IQ & Goals/ FactSet Plans Tutorial PRIZES 1st Place: $400 Cash Prize, Certificate & Reference letter 2nd Place: Certificate & Reference letter 3rd Place: Certificate & Reference letter Networking opportunity for the top 5 Teams Overview Org. Sample Structure Deck Policies Logistics What’s in it Q A for&you? Cap IQ & Goals/ FactSet Plans Tutorial 10 PRESENTATION TIPS 1. Consistent font type and size 2. Professional and concise language 3. Limit the text and use visuals where appropriate in the deck 4. Proofread your deck for grammar and spelling 5. Practice your presentation and be mindful of the timing requirement 6. Ensure the pitch is presented in a logical, well-structured manner 7. Involve all Team members in the presentation and be aware of transitions 8. Ensure Team members know all components of the pitch 9. Project your voice and be confident in your presentation 10. Be prepared to answer additional questions about your investment pitch Overview Org. Sample Structure Deck Policies Logistics What’s in it Q A for&you? Cap IQ & Goals/ FactSet Plans Tutorial GOOD LUCK TO ALL PARTICIPANTS! Overview Org. Sample Structure Deck Policies Logistics What’s in it Q& A for you? Cap IQ & Goals/ FactSet Plans Tutorial FINANCE LAB TUTORIAL Introducing: Stephanie Perpick and Norman Xu Overview Org. Sample Structure Deck Policies Logistics What’s in it Q&A for you? Cap IQ & Goals/ FactSet Plans Tutorial