- CCH Canadian

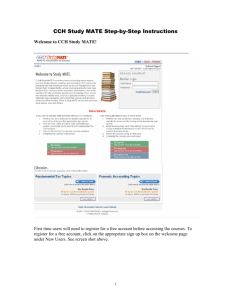

advertisement