Harvesting risk premium in equity investing

advertisement

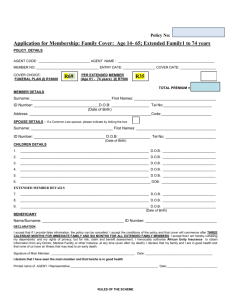

Harvesting risk premium in equity investing Active Management Harvesting risk premiums is a common investment strategy in fixed income or foreign exchange investing. In equity investing it is still rather new, but promising. Dr. Klaus Teloeken is CIO Systematic Equity at Allianz Global Investors. Basu, S. (1977) Investment Performance of Common Stocks in Relation to their Price-Earnings Ratios, Journal of Finance 1 Rolf W. Banz (1981), The Relationship Between Market Value and Return of Common Stocks, Journal of Financial Economics 2 3 Jegadeesh, N. and Titman (1993), Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency, Journal of Finance For institutional investors, harvesting risk premiums is a common investment strategy. In asset classes like fixed income or currencies, it is straightforward for investors to think of investing in terms of harvesting risk premiums like the term premium or the credit premium in fixed income, or the carry premium in “FX” (foreign exchange) trading. Fixed income investors extend the duration of portfolios to capture the term premium in fixed income, or add to corporates and high yields to earn the credit premium. FX investors exploit the FX carry premium by going long in high-yielding currencies, and shorting low-yielding currencies. In all these examples, investors take extra risks (duration risk, credit risk, currency risk) and expect to be compensated for this extra risk by means of an extra return potential – the risk premium. For equity investors, however, thinking in terms of equity risk premiums is still rather new. But risk premiums also exist here. Examples include the value premium, the small cap premium or the momen- tum premium. Value stocks, e. g. stocks with a low price / book-ratio, are usually more risky, as value stocks are typically less profitable, more leveraged and more cyclical than other stocks. The existence of all these risk premiums is well documented in the academic literature. For instance, Basu (1977)1 discovered that stock with a low Price / Earnings ratio led stocks with a higher Price / Earnings ratio on the NYSE. Banz (1981)2 described the size effect – small cap stocks outperform large cap names. Titman (1993)3 found the momentum anomaly – stocks that led the market over the last six to twelve months have a tendency to continue to lead markets. The existence of these risk premiums is documented for all major investment regions, and over extended time spans. And, based on our experience, there are not too many patterns in investing that are as persistent as these risk premiums. Therefore, it does make sense to explicitly build a portfolio around the idea of harvesting these equity risk premiums. Understand. Act. Focus: Harvesting risk premium in equity investing Implicitly, the performance of equity managers is to a large extent explained by their exposures to a few equity risk premiums anyway – and this is true irrespective of whether the manager is aware of this investment style exposure or not. Chart 1: Where do active returns come from? Empirical evidence Active return decomposition of global equity managers 1990 – 2013 2.5 % Residual 2.0 % Value 1.5 % Active Returns = Momentum 1.0 % 0.5 % Revisions 0.0 % Growth Size Quality – 0.5 % Risk Source: Allianz Global Investors, 31 July 2013 As the above performance decomposition based on Mercer’s GIMD database shows, investment style risk premiums are main drivers of active equity returns. Index providers have reacted, and have recently launched a whole series of indices that target these risk premiums – under a variety of different labels like smart beta indices, alternative beta indices or risk premium indices. As we are proponents of the idea of harvesting risk premiums, we think these indices are a good start. But we think investors can do better when it comes to harvesting individual risk premiums than just buying individual smart beta indices. Typical smart beta indices are not designed to harvest the equity risk premiums in the most efficient way for a client portfolio, but are more designed as an easy-to-grasp index methodology. For example, simple value indices like the Research Affiliates Fundamental Indices (RAFI) or the MSCI value weighted indices are biased towards companies in financial disarray, but the value premium can be earned more efficiently by avoiding these companies. Minimum volatility indices like the MSCI minimum volatility index, while targeting the low volatility premium, leave the exposure to other risk premiums like value or momentum largely unmanaged, which can result in adverse exposures to these risk factors. These examples demonstrate that, while smart beta investing is a good starting point, investors can do better in terms of capturing individual risk premiums like value or low volatility. And investors can also do better in terms of capturing multiple risk premiums than just buying a multiple of smart beta indices. The reason is that just buying a multiple of smart beta indices often leads to insufficient diversi­ fication. However, diversification across multiple risk premiums is warranted. Many risk factors like value or momentum have been very successful over the longer term, but have also experienced significant short-term drawdowns. For example, the value investor had to endure a sharp decline in the run-up to the TMT (technology, media and telecommunications) bubble, or as the financial crisis unfolded in 2007. Similarly, the momentum investor suffered from a painful setback after the burst of the TMT bubble, or during the market recovery in 2009. A diversified blend of the value and momentum investment styles has earned the risk premiums attached to these investment styles in a much more stable way than each of the individual investment styles. 2 Focus: Harvesting risk premium in equity investing Chart 2: Investment style diversification is key to stable performance Hypothetical example: Relative performance of investment styles for a global universe exposures are unmanaged. This makes correlations between smart beta indices rather unstable, and hence renders an efficient diversification impossible. For example, the correlation between the MSCI risk premium indices for value and momentum shifts over time. Most of the time, like today, the correlation of relative returns is negative, hence there can be a substantial diversification advantage from blending value with momentum. 120 % 100 % 80 % 60 % 40 % 20 % 0% 89 91 93 95 97 99 01 03 05 07 09 11 13 Momentum Diversified Style Mix Value Source: Allianz Global Investors Hypothetical example: Dec 1989 – Dec 2013 Historic simulation: Monthly rebalancing, performance after transaction costs. Assumptions of the historic simulation: The chart above represents the relative performance of hypothetical portfolios with the investment styles noted above using the success factors described on the investment style pages in this presentation. Performance results for hypothetical portfolios have certain inherent limitations. The results do not reflect the results of trading in actual accounts or the material economic and market factors that could impact an investment manager’s decision-making process. The performance figures are before taxes and after transactions costs of 50bps, dividends are reinvested. The model portfolio comprises approx. 150 stocks, all overweighs in the portfolio are of equal size, underweights relative to the benchmark are restricted to 1 %. No constraints are in place with respect to sector or country deviations from the benchmark. The strategy is rebalanced semi-annually, on average 50 % half turn portfolio changes p.a. The relative performance of the strategy is shown relative to a global investment universe that represents the liquid investment opportunities over time. The performance of this investment universe may differ from the performance of a benchmark like the MSCI World. Unless otherwise noted, performance results and valuation presented are in U.S. Dollars. The chart above is for illustration only. There is no guarantee that these investment strategies and processes will be effective under all market conditions and investors should evaluate their ability to invest for a long-term based on their individual risk profile especially during periods of downturn in the market. There is no assurance that a portfolio will match the profits or losses shown, or that the portfolio will be able to achieve the results of these hypothetical portfolios. Diversification is key The chart underpins the fact that harvesting risk premiums diversification across multiple risk factors has been key to stable performance. But investors can do better in terms of diversification across multiple risk factors than just buying a multiple of smart beta indices. Typical smart beta indices have varying exposures to risk factors – to the targeted risk factors, and also to non-targeted risk factors where However, in prolonged cyclical value rallies like the one from 2003 to 2007, value and momentum typically go hand in hand, and hence there is no diversification advantage left from blending value with momentum. But diversification was badly needed at the end of the value rally in 2008, as both value and momentum stocks tanked as the global economy grinded to a halt after the Lehman collapse. However, for investors in these two MSCI risk premium indices there was nothing that could be done to restore diversification; investors just had to accept the loss of diversification. Smart beta indices like the MSCI risk premium indices are simply not designed with a view to a diversified combination with other smart beta indices, but are designed as stand-alone products. A portfolio manager in an integrated portfolio solution, though, can provide the proper diversification across multiple risk premiums by structuring the individual risk premium portfolios with a view towards the subsequent diversification across multiple risk premiums. To do so, the portfolio manager should manage the composition of the individual risk premium port­ folios in a way that allows stable mutual correlations, and hence effective diversification. For example, if the correlations between value and momentum are becoming too high the portfolio manager will: • put more weight on those value stocks that are not also momentum stocks • put more weight on those valuation criteria that will have a lower correlation with momentum factors to effectively restore diversification between value and momentum. In addition to this, an integrated portfolio solution not only achieves the proper diversification across 3 Focus: Harvesting risk premium in equity investing multiple risk premiums, but also allows the successful mitigation of exposures to unwanted risk factors like macro-economic or interest rate sensitivities that stand in the way of harvesting the risk premiums in a stable way, i. e., largely independent from the economic or market environment. Smart beta investing, harvesting equity risk premiums and beyond An active equity management approach built around the idea of harvesting smart betas – or investment style risk premiums – in a disciplined, systematic approach can go further. • First, seek to capture the risk premiums attached to investment styles like value and momentum. • In a second layer, seek to generate additional alpha within the investment style framework based on bottom-up company research. Understand. Act. • Harvesting risk premiums can be a successful investment strategy across asset classes • This concept has also been well-rewarded in equity markets • Index providers have started to offer a variety of risk premium strategies under labels like smart beta, alternative beta or risk premium indices • These smart beta indices are an easy-to-grasp index methodology, but in our view they fail to efficiently earn the risk premiums of investment styles in a stable way • Strategies can go further by looking to harvest investment style risk premiums in a stable way across time These two layers can be combined with a diligent portfolio construction that implements a diversified investment style mix. In doing so, in addition to harvesting investment style risk premiums, proper diversification across risk premiums can be sought. Chart 3: Investment approach: Harvesting risk premium in equity investing Investment style research to earn the smart beta risk premiums of investment styles ↓ Harvesting risk premium in equity investing ↓ Global company research to generate stock selection alpha within investment styles Imprint Allianz Global Investors Europe GmbH Bockenheimer Landstr. 42 – 44 60323 Frankfurt am Main Global Capital Markets & Thematic Research Hans-Jörg Naumer (hjn), Stefan Scheurer (st), Ann-Katrin Petersen (akp) Data origin – if not otherwise noted: Thomson Financial Datastream. Calendar date of data – if not otherwise noted: April 2014 Source: Allianz Global Investors Investing involves risk. Diversification does not ensure a profit or protect against loss in declining markets. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This material is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission (SEC); Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt fur Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; and Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator; Allianz Global Investors Korea Ltd., licensed by the Korea Financial Services Commission; and Allianz Global Investors Taiwan 4 Ltd., licensed by Financial Supervisory Commission in Taiwan. WP-17-0215