PDF of Annual report 2002

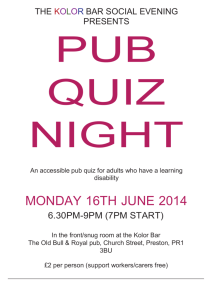

advertisement