CPA, CA LEGACY PROFESSIONAL PROGRAM Academic

advertisement

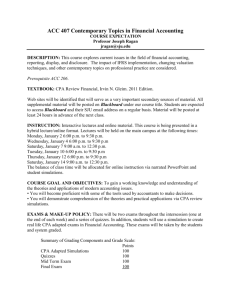

CPA Ontario (The Institute of Chartered Accountants of Ontario) 69 Bloor Street East, Toronto, ON M4W 1B3 Tel: 416.962.1841 Fax: 416.962.8900 Toll Free: 1.800.387.0735 www.cpaontario.ca CPA, CA LEGACY PROFESSIONAL PROGRAM Academic Qualification Requirements Chartered Professional Accountancy is a dynamic profession. Its education requirements are geared to meet the increasing demand for the many services that CPAs provide now and in the future. Entry Routes to Becoming a CPA, CA The main entry route to becoming a CPA, CA is a bachelor degree. Details on the several possible entry routes to CPA, CA qualification are provided CPA Ontario’s Regulation 6-4; Student Registration. Degree Requirement The core academic qualification requirement consists of a 4-year, 120-academic-credit-hour university degree in any discipline from any recognized degree-granting institutions, nationally and internationally; relevant experience gained during co-op work terms may qualify as prescribed practical experience, but not as academic requirement. 51-Credit-Hour Requirement Students are required to successfully complete CPA Ontario-prescribed degree-credit courses that cover all of the topics in The Chartered Professional Accountant Competency Map that are tested on the Common Final Evaluation (CFE). This requirement may be fulfilled as part of the required degree or as post-degree diplomas. CPA Ontario-accredited university programs and streams offer CPA Ontario-prescribed courses that have been approved as meeting the 51-credit-hour requirement as a whole. Students whose curriculum departs from the approved courses listed in the accredited programs/streams may have to meet the 51credit-hour requirements of the non-accredited programs/streams. Most of Ontario degree-granting institutions offer all or most of CPA Ontario-prescribed courses in their business degree programs and so do many out-of-province degree-granting institutions. International degree-granting institutions also offer courses that may be recognized toward the 51-credit-hour requirement. Bridging to the CFE Students who meet the registration requirements of Regulation 6-4; Student Registration and the 51credit-hour requirements are eligible to enrol in Path B (CPA, CA) of CPA Path Decision Tree. Students who meet the registration requirements of Regulation 6-1; Student Registration and the 51credit-hour requirements are eligible to enrol in Path C (CPA) of the CPA Path Decision Tree. May 27, 2014 Page 1 CPA Ontario (The Institute of Chartered Accountants of Ontario) 69 Bloor Street East, Toronto, ON M4W 1B3 Tel: 416.962.1841 Fax: 416.962.8900 Toll Free: 1.800.387.0735 www.cpaontario.ca The specific areas of coverage are: COMPETENCY AREA Financial Accounting (Introductory, Intermediate, and Advanced) Cost and Management Accounting Advanced Accounting Elective (Financial, Managerial or Capstone) Auditing (Introductory, Advanced and EDP) Canadian Taxation (Personal and Corporate) Management/Business Information Systems Finance Economics (Micro and Macro) Canadian Business Law Total CREDIT-HOURS REQUIRED 15 6 3 9 6 3 3 3 3 51 Computer Requirement Regulation 6-4; Student Registration s. 2.4 requires that a student have access to a computer that meets the minimum configuration requirements as set out by CPA Ontario from time to time. The current computer requirements are as follows: • • • • Computer capable of running Folioviews 4.5 software to access the CICA Handbook and related infobases; Access to the Internet; Acrobat Reader 5.0 (minimum); and A valid e-mail address. May 27, 2014 Page 2 McMaster University DeGroote School of Business CPA Ontario’s CA Legacy Qualification Program Degree Program: MBA Academic Credit-Hour Equivalence Students enrolling or currently enrolled in a program leading to the qualifying four-year-120-academic-credithour degree and the CA Legacy 51-Credit-Hour requirement will be provided bridging options to the new CPA Qualification Program. Academic Years: 60 2013-15 Total CA Legacy Credits Offered: 51 Description and notes Detailed eligibility requirements for these options are available on the CPA Professional Education Program (PEP) under the CPA Path Decision Tree link. Includes MBA Co-op degree program. COM 4AH3/BUS&COM 501 is only creditable to students who complete all of the undergraduate courses listed below. Co-op or internship credits do not count toward the required 120 academic credit-hours. Accredited Stream - The Accredited Stream is comprised of all the courses in the MBA program, some additional Master level courses and the courses for Professional Designation (BUS&COM [B&C] series), as listed below. Students who hold a recognized bachelor degree and graduate from this MBA program, inclusive of all the courses listed below with an average GPA of “B–” have fulfilled CPA Ontario’s University Degree and Credit-Hour requirements. Courses offered at other campuses and institutions will be reviewed by CPA Ontario on a case-by-case basis. Post-Diploma Degrees are subject to specific recognition criteria pursuant to Regulation 6-4, among which, the conferral of a two-year or a three-year diploma. CA Legacy Credits are granted based on course content, not on course code. Subject to change without notice. Financial Accounting (15 credit hrs) Introductory Financial Accounting BUSA 600 3 Intermediate – Assets + Revenues BUSA 701 3 Intermediate – Liabilities + Equity BUSA 702 3 Advanced – InterCo Investment +Forex +NFP BUSA 703 3 Advanced – Accounting Theory BUSA 717 3 Cost/Managerial Accounting 1 BUSA 610 3 Intermediate – Cost/Managerial Accounting BUSA 721 3 1 (6 credit hrs) Capstone COM 4AG3 / B&C 500 3 Financial Statement Analysis COM 4AJ3 / B&C 503 or BUSA 750 3 Only 3 credit hours are available to students who do not graduate from this stream with all the courses listed above. June 9, 2014 Auditing Advanced Auditing 2 Business/Management Information Systems Taxation (6 credit hrs) Introductory – Cost/Managerial Accounting Advanced Accounting Elective Assurance + IT (6 + 3) 3 COM 4AH3 2 / B&C 501 3 BUSA 723 3 (6 credit hrs) BUSA 730 3 Taxation – Corporate BUSA 733 3 Corporate Finance & Financial Management Non- Core 2 BUSA 745 Taxation – Personal Finance 1 (9 credit hrs) (3 credit hrs) BUSF 600 3 (6 credit hrs) Micro and Macro Economics BUSE 600 3 Canadian Business Law BUSP 722 3 COM 4AH3/BUS&COM 501 is not creditable to students who do not graduate from this stream with all the courses listed above. CPA Ontario Page 1 University of Waterloo School of Accounting and Finance CPA Ontario’s CA Legacy Qualification Program Degree Program: MAcc Academic Credit-Hour Equivalence Students enrolling or currently enrolled in a program leading to the qualifying four-year-120-academic-credithour degree and the CA Legacy 51-Credit-Hour requirement will be provided bridging options to the new CPA Qualification Program. Academic Years: 120 2013-15 Total CA Legacy Credits Offered: 39 + 12 Description and notes Detailed eligibility requirements for these options are available on the CPA Professional Education Program (PEP) under the CPA Path Decision Tree link. Accredited Stream – The Master of Accounting (MAcc) is the only Accredited Program that offers CPA Ontario’s Professional CA Legacy Program; it is comprised of the BAFM courses (or equivalent), the MAcc courses for the CPA, CA designation, and other courses. Co-op or internship credits do not count toward the required 120 academic credit-hours. Students who graduate from the MAcc degree program have fulfilled CPA Ontario’s University Degree and Credit-Hour requirements, the Core Knowledge Examination and the School of Accountancy; they are eligible to write the Uniform Evaluation (UFE) or the Common Final Evaluation (CFE) immediately following graduation. Courses offered at other campuses and institutions will be reviewed by CPA Ontario on a case-by-case basis. Post-Diploma Degrees are subject to specific recognition criteria pursuant to Regulation 6-4, among which, the conferral of a two-year or a three-year diploma. CA Legacy Credits are granted based on course content, not on course code. Subject to change without notice. Financial Accounting Introductory Financial Accounting (15 credit hrs) (12 credit hrs) Auditing AFM 451 3 Intermediate – Assets + Revenues AFM 291 3 Advanced Auditing ACC 650 3 Intermediate – Liabilities + Equity AFM 391 3 EDP Auditing ACC 621 3 Advanced – InterCo Investment +Forex +NFP AFM 491 3 Business/Management Information Systems 3 Advanced – Accounting Theory AFM 401 3 AFM 341 or CS 330 Advanced – Issues in External Reporting ACC 611 3 Cost/Managerial Accounting Taxation (6 credit hrs) AFM 362 + AFM 363 3 AFM 461 3 AFM 102 3 Taxation – Corporate Intermediate – Cost/Managerial Accounting AFM 481 3 Finance Capstone – Issues in Accounting Practice Corporate Finance & Financial Management 2 (3 credit hrs) ACC 610 3 (3 credit hrs) AFM 273 + AFM 274 Non- Core AFM 101, while a mandatory course in the many programs offered by University of Waterloo, does not receive CPA Ontario credit hours. Micro and Macro Economics Canadian Business Law 2 May 27, 2014 (6 credit hrs) Taxation – Personal Introductory – Cost/Managerial Accounting Advanced Accounting Elective 1 Assurance + IT (9 + 3) 1 3 (6 credit hrs) ECON 101 + ECON 102 3 AFM 231 or COMM 231 3 BMath CPA, CA students complete AFM 272 and AFM 372. CPA Ontario Page 1 University of Toronto Erindale Campus Institute for Management & Innovation CPA Ontario’s CA Legacy Qualification Program Degree Program: MMPA Academic Credit-Hour Equivalence Students enrolling or currently enrolled in a program leading to the qualifying four-year-120-academic-credithour degree and the CA Legacy 51-Credit-Hour requirement will be provided bridging options to the new CPA Qualification Program. Academic Years: 103.5 2013-15 Total CA Legacy Credits Offered: 51 Description and notes Detailed eligibility requirements for these options are available on the CPA Professional Education Program (PEP) under the CPA Path Decision Tree link. The MMPA degree program is a Co-op degree program. Accredited Program - Students who graduate from this degree program with the courses listed below and an average GPA of "B" in the entire program have fulfilled the CPA Ontario’s Credit-Hour requirement. Co-op or internship credits do not count toward the required 120 academic credit-hours. Courses offered at other campuses and institutions will be reviewed by CPA Ontario on a case-by-case basis. Post-Diploma Degrees are subject to specific recognition criteria pursuant to Regulation 6-4, among which, the conferral of a two-year or a three-year diploma. CA Legacy Credits are granted based on course content, not on course code. Subject to change without notice. Financial Accounting (15 credit hrs) Assurance + IT (9 + 3) (12 credit hrs) Introductory Financial Accounting MGT 1221 6 Auditing MGT 1323 3 Intermediate – Assets + Revenues MGT 2250 3 Advanced Auditing MGT 2225 3 Intermediate – Liabilities + Equity MGT 2251 3 EDP Auditing MGT 2224 3 Advanced – InterCo Investment +Forex +NFP MGT 2205 3 Business/Management Information Systems MGT1272 3 Advanced – Accounting Theory MGT 2280 Cost/Managerial Accounting Taxation (6 credit hrs) Taxation – Personal MGT 2206 3 MGT 2207 3 Introductory – Cost/Managerial Accounting MGT 1222 3 Taxation – Corporate Intermediate – Cost/Managerial Accounting MGT 2260 3 Finance Advanced Accounting Elective Management Accounting & Control Systems (3 credit hrs) MGT 2261 3 (6 credit hrs) Corporate Finance & Financial Management Non- Core Micro and Macro Economics Canadian Business Law (3 credit hrs) MGT 1330 3 (6 credit hrs) MGT 1210 + MGT 1211 3 MGT 2014 3 A number of Reading and Research courses are eligible for credits in certain areas. May 27, 2014 CPA Ontario Page 1 York University Schulich School of Business CPA Ontario’s CA Legacy Qualification Program Degree Program: MBA – CPA, CA Stream Academic Credit-Hour Equivalence Students enrolling or currently enrolled in a program leading to the qualifying four-year-120-academic-credithour degree and the CA Legacy 51-Credit-Hour requirement will be provided bridging options to the new CPA Qualification Program. Academic Years: 60 2013-15 Total CA Legacy Credits Offered: 51 Description and notes Detailed eligibility requirements for these options are available on the CPA Professional Education Program (PEP) under the CPA Path Decision Tree link. Accredited Stream - The Accredited Stream is comprised of all the graduate courses listed below. Students who graduate from this MBA – CPA, CA Stream degree program with an average GPA of “B–” in these courses have fulfilled the CPA Ontario’s Credit-Hour requirements. Co-op or internship credits do not count toward the required 120 academic credit-hours. Courses offered at other campuses and institutions will be reviewed by CPA Ontario on a case-by-case basis. Post-Diploma Degrees are subject to specific recognition criteria pursuant to Regulation 6-4, among which, the conferral of a two-year or a three-year diploma. CA Legacy Credits are granted based on course content, not on course code. Subject to change without notice. Financial Accounting (15 credit hrs) Introductory Financial Accounting ACTG 5100 or INTL 5100 3 Intermediate – Assets + Revenues ACTG 6120 3 Intermediate – Liabilities + Equity ACTG 6140 3 Advanced – InterCo Investment +Forex +NFP ACTG 6160 3 Advanced – Accounting Theory ACTG 6200 3 Cost/Managerial Accounting Introductory – Cost/Managerial Accounting ACTG 5210 + ACTG 6350 3 Intermediate – Cost/Managerial Accounting ACTG 6400 3 Advanced Accounting Elective (one of) 1 (6 credit hrs) 1 (3 credit hrs) Assurance + IT (9 + 3) (12 credit hrs) Auditing ACTG 6600 3 Advanced Auditing ACTG 6610 3 EDP Auditing ACTG 6620 3 OMIS 5110 + OMIS 5210 3 Business/Management Information Systems Taxation (6 credit hrs) Taxation – Personal ACTG 6710 3 Taxation – Corporate ACTG 6720 3 Finance Corporate Finance & Financial Management Non- Core (3 credit hrs) FINE 5200 3 (6 credit hrs) Capstone ACTG 6951 3 Micro and Macro Economics ECON 5100 3 Management Accounting & Control Systems ACTG 6450 3 Canadian Business Law MGMT 6200 3 Financial Statement Analysis ACTG 6250 3 The following courses also qualify as Advanced Accounting Electives: ACTG 6150, and ACTG 6800 June 9, 2014 CPA Ontario Page 1 York University Schulich School of Business CPA Ontario’s CA Legacy Qualification Program Degree Program: MAcc – CPA, CA Stream Academic Credit-Hour Equivalence Students enrolling or currently enrolled in a program leading to the qualifying four-year-120-academic-credithour degree and the CA Legacy 51-Credit-Hour requirement will be provided bridging options to the new CPA Qualification Program. Academic Years: 60 2013-15 Total CA Legacy Credits Offered: 51 Description and notes Detailed eligibility requirements for these options are available on the CPA Professional Education Program (PEP) under the CPA Path Decision Tree link. Accredited Stream - The Accredited Stream is comprised of all the graduate courses listed below. Students who graduate from this MAcc – CPA, CA Stream degree program with an average GPA of “B–” in these courses have fulfilled the CPA Ontario’s Credit-Hour requirement. Co-op or internship credits do not count toward the required 120 academic credit-hours. Courses offered at other campuses and institutions will be reviewed by CPA Ontario on a case-by-case basis. Post-Diploma Degrees are subject to specific recognition criteria pursuant to Regulation 6-4, among which, the conferral of a two-year or a three-year diploma. CA Legacy Credits are granted based on course content, not on course code. Subject to change without notice. Financial Accounting (15 credit hrs) Assurance + IT (9 + 3) (12 credit hrs) Introductory Financial Accounting MACC 5101 3 Auditing ACTG 6600 3 Intermediate – Assets + Revenues ACTG 6120 3 Advanced Auditing ACTG 6610 3 Intermediate – Liabilities + Equity ACTG 6140 3 EDP Auditing ACTG 6620 3 Advanced – InterCo Investment +Forex +NFP ACTG 6160 3 Business/Management Information Systems MACC 5201 + MACC 6201 3 Advanced – Complex Financial Reporting Issues ACTG 6150 3 Taxation Cost/Managerial Accounting (6 credit hrs) Taxation – Personal ACTG 6710 3 ACTG 6720 3 Introductory – Cost/Managerial Accounting MACC 5211 3 Taxation – Corporate Intermediate – Cost/Managerial Accounting ACTG 6450 3 Finance Advanced Accounting Elective (one of) Capstone June 9, 2014 (3 credit hrs) MACC 6301 3 (6 credit hrs) Corporate Finance & Financial Management Non- Core (3 credit hrs) FINE 5200 3 (6 credit hrs) Micro and Macro Economics ECON 5100 3 Canadian Business Law MGMT 6200 3 CPA Ontario Page 1